Most people don't get a premium bill from Medicare because they get their Medicare Part B (Medical Insurance) premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

Full Answer

What happens if I don’t sign up for Medicare Part B?

Most retiree plans (i.e., coverage offered to former employees and their spouses) will inform you that you have to take Part B in order to be covered by the plan. If you don’t sign up for Part B when you first qualify for it, your retiree plan might pay little or nothing toward your health care.

Are You Involved in Medicare Part B billing?

In other words, if you're involved in Medicare Part B billing, you'll have to know the specific rules and regulations that you, as the biller or coder, must follow to make sure your office gets paid by Medicare. It's important to remember that even though Part B is somewhat like a commercial insurance plan, it's still not a 100% coverage plan.

Why don't I get a bill from Medicare?

Most people don't get a bill from Medicare because they get these premiums deducted automatically from their Social Security (or Railroad Retirement Board) benefit.) Your bill pays for next month's coverage (and future months if you get the bill every 3 months).

What are the most common Medicare Part B enrollment mistakes?

Here are Part B enrollment scenarios where people often make mistakes, in order of severity (high to low): Coverage purchased in the individual market (e.g., through HealthCare.gov or a state-based marketplace like Covered California) is usually not available to Medicare beneficiaries.

Will I get a bill for Medicare Part B?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

How often does Medicare bill for Part B?

every 3 monthsA person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month.

How do you qualify for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Does Medicare send you a bill?

Most people don't get a bill from Medicare because they get these premiums deducted automatically from their Social Security (or Railroad Retirement Board) benefit.) Your bill pays for next month's coverage (and future months if you get the bill every 3 months). Your bill lists the dates you're paying for.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I get my Medicare reimbursement?

How to Get Reimbursed From Medicare. To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

How does the Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How much is taken out of Social Security for Medicare Part B?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is Medicare Part B?

Medicare Part B covers most of the services people expect in a health plan – such as outpatient physician visits , mental health services, lab tests, and physical therapy. It’s important to sign up at the correct time for this part of Medicare – because simple enrollment mistakes can result in gaps in coverage and lifelong premium penalties.

How long is the Medicare Part B enrollment period?

If you meet these criteria, you’ll receive an 8-month long special enrollment period (SEP) during which you can enroll in Part B without penalty. The Medicare Part B SEP begins the sooner of when: ...

What is EGWP in Medicare?

Additionally, many employers offer retiree benefits through Employer Group Waiver Plans (EGWPs) – a type of Medicare Advantage plan. You have to be enrolled in Medicare Parts A and B to receive retiree benefits through an EGWP.

How much is the Part B premium for 2020?

The Part B premium in 2020 is $144.60 per month for most people. Consider an individual who qualified for Part B five years ago but didn’t enroll until this year – ...

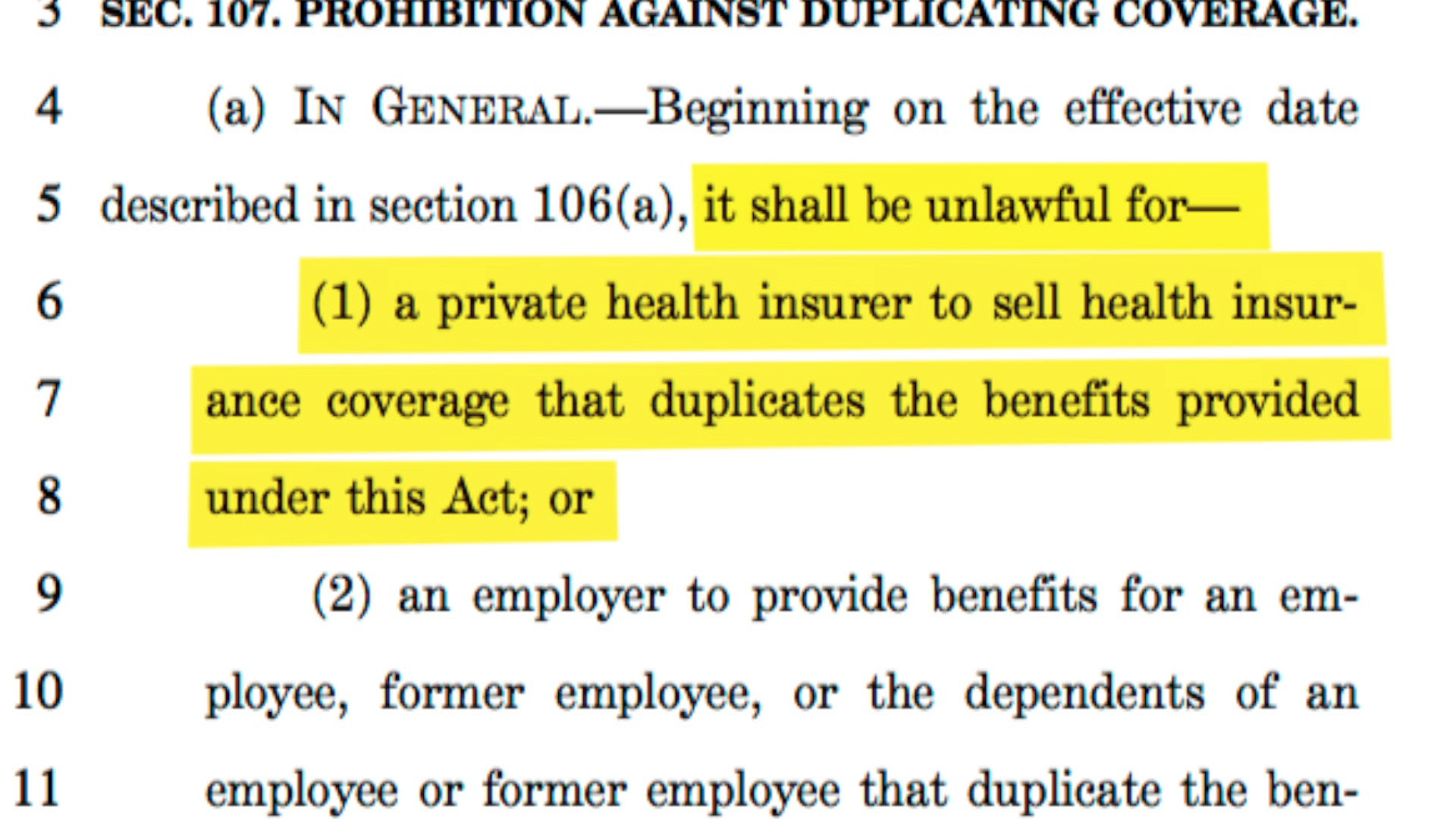

Can Medicare beneficiaries buy individual market policies?

In fact, Medicare beneficiaries are not allowed to purchase individual market policies other than Medigap plans. Many Americans are enrolled in the individual market when they qualify for Medicare – and can keep their individual market plan after becoming Medicare eligible.

Do you have to pay for Medicare if you have an individual market plan?

But once you’re eligible for Medicare, an individual market plan may pay little or nothing toward your care. This is why it’s important to enroll in Medicare (and a Medigap or Medicare Advantage plan) when you’re first eligible for the benefit.

Do large companies have to enroll in Medicare?

Employees of large companies (i.e., usually one with more than 20 employees) do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

Is Medicare correct to sign you up for Part B?

Further, your failure to return that card in a timely fashion does not necessarily mean that Medicare was correct to sign you up for Part B and begin to subtract the monthly premiums for Part B from your Social Security. However, it might have been correct.

Can I get Medicare if I turned 65?

You say you chose not to get Medicare, so I assume you already have turned 65. But if you just turned 65, it’s standard for Social Security to send you notice about Medicare enrollment. Social Security administers many aspects of Medicare including the enrollment process and handling the deduction of Part B premiums from monthly Social Security ...

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does it take for Medicare to pay Part B?

Like other commercial insurances, you should send Medicare Part B claims directly to Medicare for payment, with an expected turnaround of about 30 days. Unlike typical commercial insurance, Medicare can pay either the provider or the patient, depending on the assignment.

What is Medicare Part B for eyeglasses?

Other preventative services are also covered under Medicare Part B: Preventive shots, including the flu shot during flu season, and three Hepatitis B shots, if you're considered at risk.

What is CMS in Medicare?

CMS, the Centers for Medicare and Medicaid Services, governs all parts of Medicare, including Part B. CMS holds a great amount of influence over the way insurance companies pay doctors, as well as the services that doctors provide. This is, in large part, because of Medicare Part B restrictions. Every type of healthcare service eligible ...

Why is Medicare important?

Because Medicare is a service provided for the elderly, disabled, and retired, the patients who are covered by Medicare will usually have limited financial resources . Because of this, it's very important to make sure that your office bills and codes within all Part B guidelines and provides only approved Part B services.

Is it important to understand the limitations of Medicare?

No matter what type of insurance a patient has, it's important to understand the limitations you may have because of their insurance coverage. The same goes for Medicare Part B billing. But in this case keeping in mind the rules, regulations, and guidelines is especially relevant.

Is Part B insurance 100% coverage?

It's important to remember that even though Part B is somewhat like a commercial insurance plan, it's still not a 100% coverage plan. Some of the covered services are the following, only when they're considered medically necessary: Laboratory and Pathology services such as blood tests and urinalyses.

Do all medical procedures have to meet the standards of accepted medical practice?

These range from the rule that all medical procedures must meet the standards of currently accepted medical practice, to the way certain claims must be billed for special services. In other words, if you're involved in Medicare Part B billing, you'll have to know the specific rules and regulations that you, as the biller or coder, ...

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Why did my spouse receive a settlement from my employer?

You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy or reorganization. These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

How much is Part B insurance?

That depends. The normal premium for Part B is $148.50, but that is for the “normal” premium. For high-income retirees (and I use the term “high-income” very loosely), that number escalates. It is remarkably easy for federal retirees, especially single retirees, to find themselves in this “high-income” category.

Does Part B replace FEHB?

Part B doesn’t replace the Federal Employees Health Benefits (FEHB), but rather supplements it.

Is Medicare Part B important?

The decision on whether or not to take Medicare Part B is an important one, and your income range should play a role in that decision. IRMAA is just one way that retirees can incur extra, unnecessary costs in retirement. Addressing seemingly little things like IRMAA can help you enjoy a fruitful retirement.