If the plan does not cover a given medication, the beneficiary pays the full cost, and those payments will not apply to the deductible. It’s possible to meet the deductible all at once, over time or maybe never. After meeting the deductible and entering the Initial Coverage payment stage, the plan can charge copayments or coinsurance.

Full Answer

Do Medicare Advantage plans have deductibles?

If you have a Medicare Advantage plan, you don’t have to pay Original Medicare deductibles. But your plan might have its own deductible. With a Medicare Advantage plan, we’ll track all the costs you pay – deductible, copays and coinsurance.

Do copays count toward my deductible?

But in general, you should expect that your copays will not be counted towards your deductible. They will, however, be counted towards your maximum out-of-pocket (unless you have a grandmothered or grandfathered plan that uses different rules for out-of-pocket costs). Copayments add up.

What are the Medicare Part A and Part B deductibles?

Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance. Medicare Part A and Medicare Part B each have their own deductibles and their own rules for how they function. The Medicare Part A deductible in 2021 is $1,484 per benefit period.

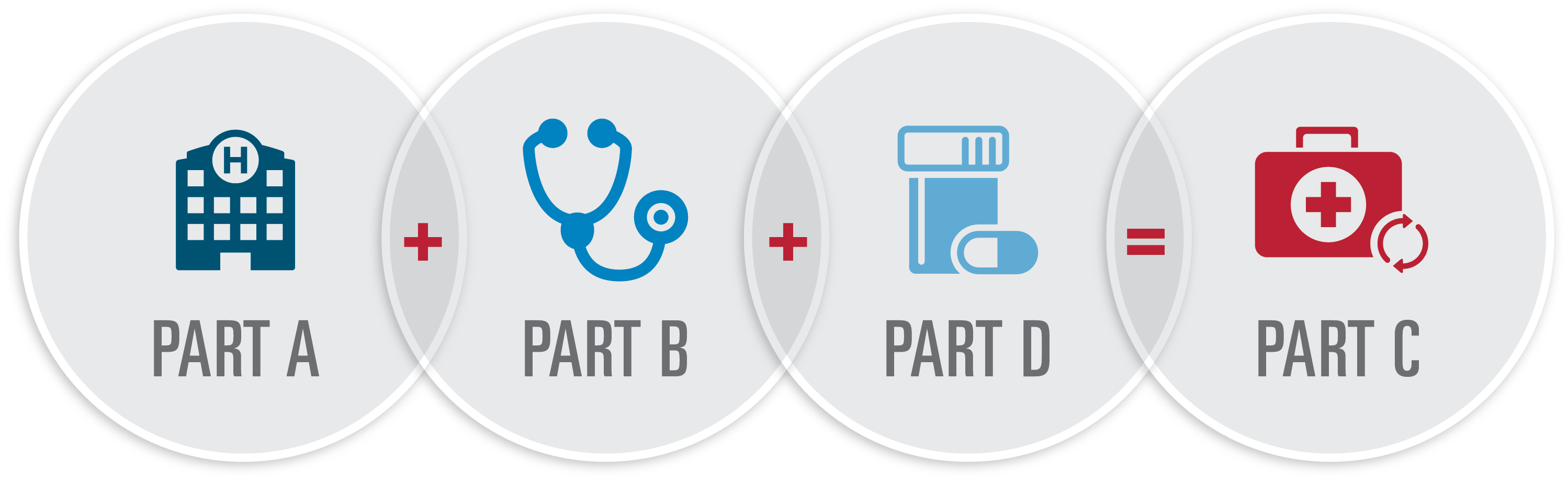

What is a Medicare Advantage plan?

A Medicare Advantage Plan is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D).

How does deductible work with Part D?

“Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in. The Medicare Part D deductible is the amount you most pay for your prescription drugs before your plan begins to pay.

Do copays count towards deductible Medicare?

Copays typically apply to some services while the deductible applies to others. But both are counted towards the plan's maximum out-of-pocket limit, which is the maximum that the person will have to pay for their covered, in-network care during the plan year.

Does Medicare Advantage plans have copays?

Copays and coinsurance Our Medicare Advantage plans use copays for most services. You pay 20 percent coinsurance for most services with Original Medicare.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Does your copay apply to your deductible?

Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. In most cases your copay will not go toward your deductible.

Does copay apply before deductible?

Co-pays and deductibles are both features of most insurance plans. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. Co-pays are typically charged after a deductible has already been met.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the best Part D prescription plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Can I use GoodRx if I have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

How much does a lower tier drug cost?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. level assigned to your drug. Once you and your plan spend $4,130 combined on drugs (including deductible), you’ll pay no more than 25% of the cost for prescription drugs until your out-of-pocket spending is $6,550, under the standard drug benefit.

What is the maximum deductible for Part D?

A deductible is an amount that you must spend each year before your insurance kicks in. If you have a high deductible (the maximum deductible for Part D is $435 in 2020) and do not expect that you will spend more than that amount over the course of the year, it may make sense to use drug coupons instead of your insurance.

How much does Part D cost in 2020?

After spending a certain amount each year (which is $4,020 in 2020), your Part D plan decreases coverage. In 2019, you will pay 25% for brand-name and generic drugs during this time. 4 . To keep costs down, it might be reasonable to use drug coupons during this time.

What is Medicare.gov?

Medicare.gov. Costs in the coverage gap. Congress.gov. S.2553 - A bill to amend title XVIII of the Social Security Act to prohibit Medicare part D plans from restricting pharmacies from informing individuals regarding the prices for certain drugs and biologicals.

How much does Medicare spend on prescription drugs?

on March 06, 2020. Medicare beneficiaries spend a lot on prescription drugs. For instance, medications accounted for $100 billion (14%) of Medicare spending in 2017, which is more than double the $49 billion that was spent in 2007.

Can a pharmacist tell you about less expensive medications?

In the case of a pharmacy gag rule, the pharmacist is not allowed to tell you about less expensive medication options. This is not surprising when you realize that the PBMs are trying to protect their investments. They want you to use the drugs on their formularies so that they can generate the most profit.

Can I use a coupon instead of Medicare?

Using Medicare. It is not always obvious when you should use a drug coupon instead of using Medicare. Since the Centers for Medicare & Medicaid Services (CMS) requires that a pharmacist use your Part D plan unless you specifically say not to, you need to speak with your pharmacist.

Is it illegal to get a discount on Medicare?

It's illegal for pharmaceutical companies to offer discounts for medications that you purchase through Medicare due to the Social Security Amendments of 1972. Included in those amendments is the Anti-Kickback Statute (AKS).

How much will copays be in 2021?

When health insurance deductibles are often measured in thousands of dollars, copayments—the fixed amount (usually in the range of $25 to $75) you owe each time you go to the doctor or fill a prescription—may seem like chump change.

How much is a copayment for diabetes in January?

You see your PCP three times and are prescribed one generic drug and one brand-name drug. Your January copayments are $30 + $30 + $30 + $25 + $45 = $160.

Do ACA plans count copays?

ACA-Compliant Plans Count Copays Toward Your Out-of-Pocket Maximum. Although it's rare to come across a plan that counts copays towards the deductible, all ACA-compliant plans count copays (for services that are considered essential health benefits) towards your annual out-of-pocket maximum, and there's an upper limit in terms ...

Does an endocrinologist have to pay for copay?

But the endocrinologist also orders a series of tests and labs, which aren't covered by the specialist office visit copay, since they're instead counted towards your deductible. You end up paying $240 for the tests, and that counts towards your deductible. In March, you see the endocrinologist twice.

Does Medicare have a cap on out-of-pocket charges?

But Original Medicare —without supplemental coverage—works differently and does not have a cap on out-of-pocket charges. Most people don't end up meeting their maximum out -of-pocket for the year. But if you do, it can be any combination of copays, deductible, and coinsurance that gets you to the limit.

Can copays be counted as deductible?

If it’s still not clear, you may need to call the member number on your health insurance card and ask. But in general, you should expect that your copays will not be counted towards your deductible.

How much is Medicare Part A deductible?

Medicare Part A has a $1,340 deductible each benefit period. Tip: A Medicare Part A benefit period starts when you first go into the hospital or other inpatient facility. It ends when you've been out of the hospital or facility for 60 days in a row.

What is copay in health insurance?

A copay is a fixed amount of money you pay for a certain service. Your health insurance plan pays the rest of the cost. Coinsurance refers to percentages. Our Medicare Advantage plans use copays for most services. You pay 20 percent coinsurance for most services with Original Medicare.

Does Medicare Advantage have an out-of-pocket maximum?

When you reach a certain amount, we pay for most covered services. This is called the out-of-pocket maximum. Original Medicare doesn’t have an out-of-pocket maximum. There's no cap on what you pay out of pocket.

Does Medicare Advantage have a deductible?

Most Medicare Advantage plans have separate medical and pharmacy deductibles. That means that in addition to the $160 medical deductible we used as an example above, you might also have a Part D prescription drug deductible that you’ll need to meet before your plan starts covering your medications.

Do you have to pay coinsurance after you reach your deductible?

After you reach your deductible, you’ll still have to pay any copays or coinsurance. Some services will be covered by your plan before you reach the deductible. Here's an example of how a deductible works. Grace has Medicare Plus Blue SM PPO Essential. This plan has a $160 deductible.

What is a Copay?

A copay, also known as copayment, is the amount you may be required to pay out of pocket as your share of the cost for a medical service or supply. Often copays are associated with doctor visits, speciality visits, or prescription drugs. A copay is usually a fixed amount that is determined by your health coverage plan.

How are Part D Copays Determined?

Since Medicare Part D plans are sold by private insurance companies, they can choose how much to charge for a copayment. Medicare Part D copays can vary between plans, which is why it is important to compare plans before enrolling in prescription drug coverage.

How much does a Medicare Part D Copay Cost?

Again, because Medicare Part D plans are sold by private insurance companies, there is no set standard Medicare Part D copay amount. Part D copay amounts vary between plans, and are usually determined by the type of coverage you receive, the type of plan you choose, and the location in which you live.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).