Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

Does your zip code matter for Medicare Advantage plans?

Apr 01, 2021 · As for Medicare advantage plans, the zip code is what determines what plans are even available; this alters the benefits available to each person greatly! One zip code may offer a plan that another does not, leading your friend in one state to have better benefits than you in another. One zip code may offer $0 PPO plans, and one may not.

Are Medicare premiums the same anywhere in the country?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans …

How do I compare Medicare Part D plans?

Jan 07, 2022 · Zip code does affect which plan options are available to you. For example, Medigap and Medicare Advantage plans will vary in pricing as well as features depending on your location. Additionally, you must live in the plans service area to be eligible for enrollment. Medicare Advantage plans are impacted most by zip code changes.

Are Medicare Advantage plans the same as Original Medicare?

Nov 30, 2021 · Medicare can be broken down into two different plans: Medigap and Medicare Advantage. Medigap, often known as Medicare Supplement, is available to Original Medicare beneficiaries, and it covers ...

What makes you eligible for Medicare?

To qualify to receive Medicare services, you must be aged 65 or older, and you must have been getting disability income from Social Security or the Railroad Retirement Board (RRB) for 24 months.

How can the service vary?

Medicare can be broken down into two different plans: Medigap and Medicare Advantage.

Why is insurance higher in a certain zip code?

Rates may be higher in a certain zip code because car theft is much more likely to happen in that zip code versus another. Or property crimes are significantly higher in one zip code compared to another.

Why are healthcare premiums set by county?

Healthcare premiums are typically set by county to account for a few different geographic factors: The general cost of doing business in an area. Rent as well as wages are higher in urban areas than rural areas, for example, which necessitates higher payments to providers (such as physicians and hospitals) to allow them to operate at a profit.

Why are health insurance premiums going up?

Health care premiums have been going up for decades because of catastrophically failed insurance run health care in the United States. US health insurance companies are solely responsible for the increase in health insurance premiums.

What is the healthcare utilization of the local population?

The healthcare utilization of the local population. A county with an older population, or a more obese population, or a population with a higher incidence of environmentally-linked cancers may incur more healthcare expenses per person.

What are the factors that affect healthcare costs?

The other answers are accurate, but there are several other factors that they did not mention, but are demonstrated, through research, to be significant root causes of differences in healthcare costs. The Dartmouth Atlas Survey, led now by Dr. Elliott Fisher, but led previously by Dr. John Wennberg, has documented wide differences in healthcare costs for Medicare patients among the Medicare Physician Service Areas. There are three primary factors: 1 Differences in healthcare practices, generally driven by the choices made by the leading practitioners in a community; 2 The supply of hospital beds and

Is health care cost determined by where you live?

Continue Reading. Yes and no. The cost of your health care is determined by what region you live in and what the expected costs are for where you live. They are broken down much larger than a simple zip code, but the rural vs. urban does play in a little.

Is health care more expensive than housing?

the cost of care in your area (which is one factor in the cost of living, but it is possible to have housing and groceries be less expensive but health care be more expensive, so the overall cost of living is lower but health care is more expensive) Tons of other factors. Additionally, if your family is changing (getting married or divorced, ...

What are the factors that determine the premiums for Medicare Supplement?

Medicare Supplement insurance plan premiums might depend on a few factors, including: The plan type you choose. The state where the plan is sold. The private insurance company that offers the plan. The plan rating, which may be determined in part by your age. Each plan type offers a different set of basic benefits.

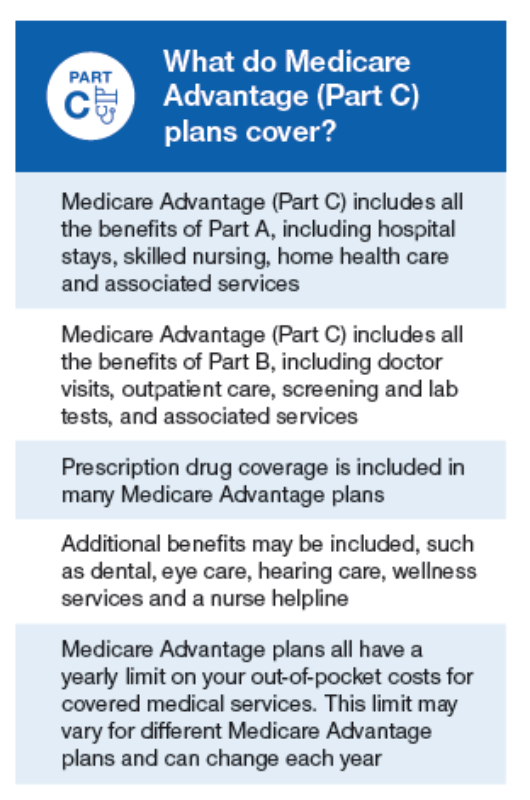

What is Medicare Part C?

Medicare Part C premium. Medicare Part C, also known as Medicare Advantage, is an alternative way to receive your Original Medicare coverage. Private, Medicare-approved health insurance companies offer Medicare Advantage plans. Premiums and other out-of-pocket costs can vary from plan to plan. Some Medicare Advantage plans have monthly premiums as ...

How much is Medicare Part B in 2021?

Medicare Part B premium. The Medicare premium for Part B varies based on your income level, rather than your location. The standard monthly premium is $148.50 in 2021. Your Part B premium may be more if your income is above a certain level. As with Part A, the Part B premium doesn’t change across the states.

What is the original Medicare?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). Many people are automatically enrolled in Original Medicare when they become eligible. Your Original Medicare premiums work like this:

Is Medicare the same anywhere?

Summary: Some Medicare premiums are the same anywhere in the country. Premiums for other types of Medicare coverage may be different depending on: Where you move. What type of Medicare coverage you have. Which Medicare-approved health insurance company offers the plan.

Can you lose Medicare if you move?

Medicare premiums for these plans can also fluctuate between states, depending on the specific plans offered in each state. Since these plans typically have a limited service area, you can also lose your coverage if you move.

Does Medicare cover prescription drugs?

Medicare Part D covers prescription drugs, which Original Medicare covers only in certain situations. Medicare premiums for these plans vary from plan to plan and can also change by location. Deductibles, coinsurance, and copayments for these plans can differ as well.

What are the different parts of Medicare?

There are four main “parts” to Medicare. These include Part A and B – which form Original Medicare. There is also Part C, known as Medicare Advantage, and Medicare Part D, which offers prescription drug coverage. Original Medicare is provided by the government to those who are age 65 and over, and who have worked in Medicare-covered employment ...

How long does Medicare cover?

Original Medicare is provided by the government to those who are age 65 and over, and who have worked in Medicare-covered employment for at least 10 years.

Can Medicare Part D be used for prescriptions?

However, for those who opt to also include Medicare Part D for prescription drug coverage, benefits can vary from one plan to another, as well as from state to state. In many instances, the benefits can even differ from one region to another. Likewise, for those who choose to receive their Medicare coverage through a Medicare Advantage plan ...

Does Medicare Advantage plan vary from state to state?

Likewise, for those who choose to receive their Medicare coverage through a Medicare Advantage plan (Medicare Part C), both the cost and availability of plans can vary from one state to another, as well as by the private health insurance company that offers them.

Can you fill gaps in Medicare?

Those who are enrolled in Original Medicare, may choose to fill in some of the coverage “gaps” with a Medicare Supplement insurance plan . These policies, oftentimes referred to as “Medigap” insurance, can provide coverage for some or all of Medicare’s deductibles, co-insurance, and / or co-payments that are required by enrollees ...

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.