Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What happened to Medicare Cost plans?

Dec 03, 2019 · Starting on January 1, 2019, the federal government eliminated Medicare Cost Plans from counties where two or more Medicare Advantage plans were competing the year before. However, that was the case only if those plans met certain enrollment thresholds.

What happens when there are limited Medicare Advantage options?

MACRA (1) delays the non-renewal requirement for cost plans affected by the competition requirements by two years to CY 2019 and revises how enrollment of competing MA plans is calculated for the purpose of meeting the competition requirements; (2) permits cost plans to transition to MA by CY 2019; and (3) allows organizations to deem their cost enrollees into …

What is a Medicare cost plan?

But there were far fewer Medicare cost plan enrollees as of 2019, due to the implementation of the Medicare Advantage competition clause. According to a Kaiser Family Foundation analysis, the total number of cost plan enrollees dropped to about 200,000 people as of 2019.

Why are Medicare Advantage insurance premiums so low?

Nov 12, 2021 · Medicare Advantage, on the other hand, has a narrow network of providers but it can offer supplemental benefits that Original Medicare does not offer. These plans can also include Part D coverage. Cost-wise, you will still pay Part B premiums but you will also be responsible for any premiums, deductibles, copays, or coinsurance your plan requires.

Why do some Medicare plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.Oct 6, 2021

What is the difference between a Medicare Advantage plan and a cost plan?

What are Medicare limitations?

Why are Medicare Advantage plans so much cheaper?

Is Medica Prime Solution A Medicare Advantage plan?

What is included in a cost plan?

Is there a max out of pocket for Medicare?

In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

Do Medicare Advantage plans have a lifetime limit?

Can Medicare run out?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Does getting a Medicare Advantage plan make you lose original Medicare?

Is Medicare Advantage too good to be true?

What is cost contract?

A Cost Contract provides the full Medicare benefit package. Payment is based on the reasonable cost of providing services. Beneficiaries are not restricted to the HMO or CMP to receive covered Medicare services, i.e. services may be received through non-HMO/CMP sources and are reimbursed by Medicare intermediaries and carriers.

What is the Medicare Access and CHIP Reauthorization Act of 2015?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) amends the cost plan competition requirements specified in section 1876 (h) (5) (C) of the Social Security Act (the Act).

What is Medicare cost plan?

What is a Medicare cost plan? A Medicare cost plan is similar to a Medicare Advantage plan in that enrollees have access to a network of doctors and hospitals, and may have additional benefits beyond what’s provided by Original Medicare.

How many people are on Medicare in 2019?

According to a Kaiser Family Foundation analysis, the total number of cost plan enrollees dropped to about 200,000 people as of 2019.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

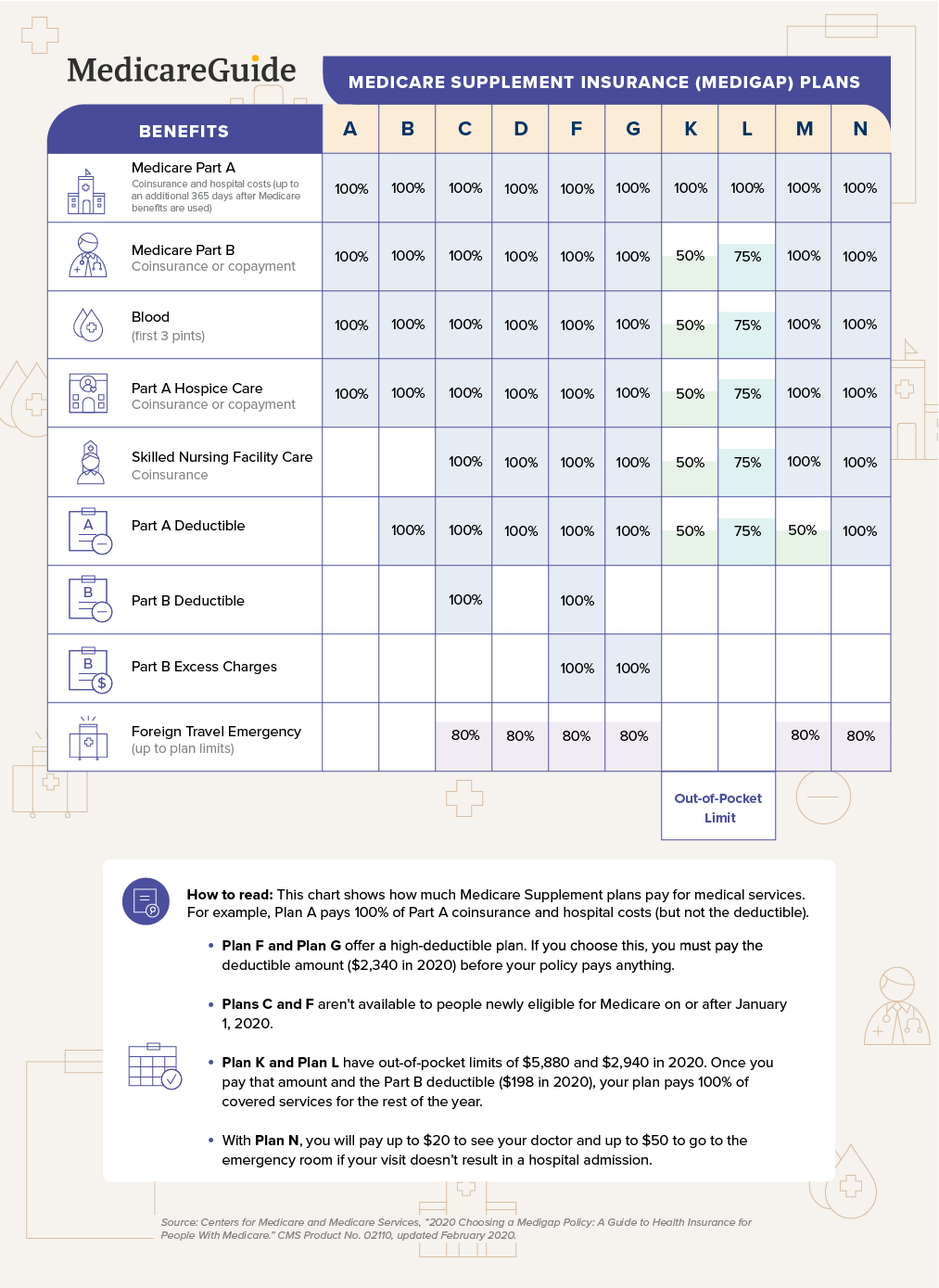

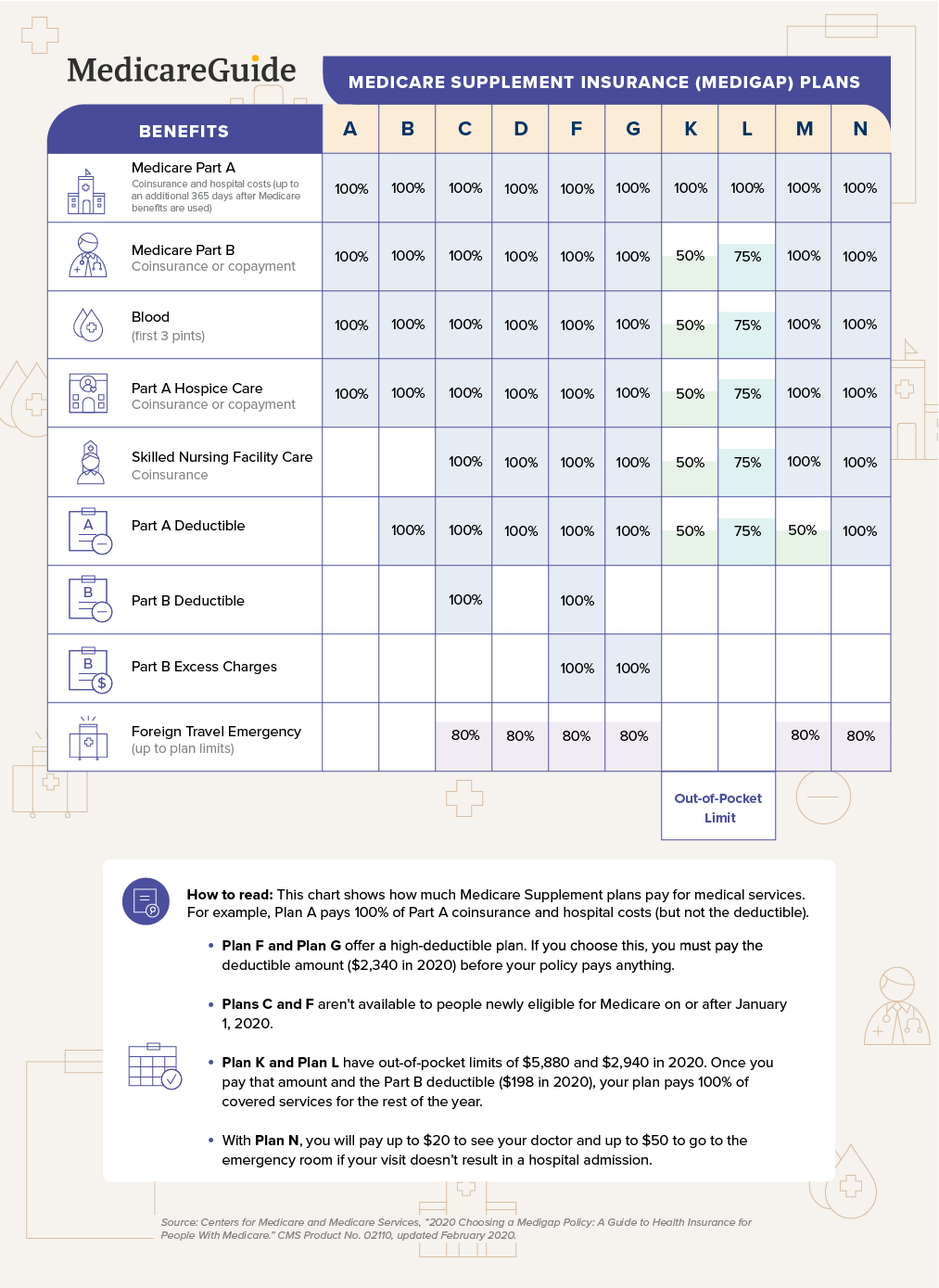

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Cost Plan?

Medicare Cost Plans are sometimes described as a type of Medicare Advantage plan. There are four key differences, however, that distinguish a Medicare Cost Plan from a Medicare Advantage plan:

What is the number to call to compare Medicare Advantage plans?

Would you rather have a Medicare Advantage plan instead of a Medicare Cost plan? You can learn more and compare Medicare Advantage plans that are available where you live by calling a licensed insurance agent at#N#1-800-557-6059#N#1-800-557-6059 TTY Users: 711.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Why Are Medicare Cost Plans not Renewing?

The short story is that Cost Plan contracts will not be renewed in areas that have at least two competing Medicare Advantage plans that meet certain enrollment requirements. If your organization has decided to convert your plan to Medicare Advantage, it can continue as a Cost Plan until the end of 2018.

What Are the Options for Employer- or Union-Sponsored Cost Plans?

If you purchase your Cost Plan from your workplace or union, your plan may simply change to a similar Medicare Advantage plan. Also, you can disenroll from your Cost Plan at any time to return to Original Medicare.

Are Insurance Companies Offering Alternatives to Medicare Cost Plans?

Many of the country’s leading insurance companies are expanding their options in areas that currently have Medicare Cost Plans. During this year’s annual enrollment period, you’ll likely see additional Medicare plans from existing companies and offerings for plans from companies that are new to your area.

Switching to a Medicare Supplement Plan

If you’re an individual who chose a Medicare Cost Plan so that your coverage is easily portable when traveling to other states, your best choice may be to switch to one of the Medicare Supplement plans, also known as Medigap plans, that can also fully protect you when you’re out of your coverage area.

Switching to a Medicare Advantage Plan

Cost-conscious individuals with a Cost Plan may benefit by considering a Medicare Advantage Plan, also known as Medicare Part C. It includes all the benefits of Original Medicare and can also include extra features such as emergency care, wellness programs, Medicare Part D, as well as other benefits.

HealthMarkets Can Make Your Medicare Cost Plan Switch Easy

HealthMarkets offers Medicare Advantage, Medicare Part D, and Medigap plans, and we know how to help you choose the best option. We have licensed agents ready to talk to you at (800) 488-7621. You can also find a local agent online. If you’re ready to find the right Medicare Advantage or Medicare Supplement plan that fits your needs, call today!

What is Medicare Advantage Plan?

With Medicare Advantage, you’ll get your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) through a private company and not through Original Medicare.

Does Medicare cover hospital care?

Medicare Advantage covers both hospital care (Part A) and medical care (Part B). Some types of Medicare Cost Plans only cover medical care while hospital care is covered through Original Medicare Part A. If you have this type of Medicare Cost Plan and don’t have Medicare Part A, you may not be covered for hospital care.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans also often provide coverage for Medicare Part D, prescription drugs, which Original Medicare usually doesn’t cover.

Does Medicare cover vision?

The availability of Medicare Cost Plans depends on the insurance companies offering them, not on Medicare. Medicare Cost Plans may offer coverage for prescription drugs and other benefits, such as hearing and vision coverage not usually provided by Original Medicare.

Is Medicare Part A or B?

Medicare Part A and Part B are also called Original Medicare. However, Original Medicare is not the only way to receive your Medicare benefits. Medicare Advantage plans and Medicare Cost plans are alternative ways to receive your Medicare benefits. Original Medicare is administered by the government, while Medicare Advantage plans ...