Why would you want a Medicare Advantage plan?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.Oct 12, 2021

Why is Medicare Advantage so popular?

This is because Medicare Advantage offers more services and flexibility than traditional Medicare plans. It's still lower under MA plans to pay premiums, co-payments and deductibles even if you just have traditional Medicare.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What percent of seniors choose Medicare Advantage?

Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation.Nov 15, 2021

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Do Medicare Advantage plan premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Does a Medicare Advantage plan replace Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

Why Choose a Cigna Medicare Advantage Plan?

Cigna-HealthSpring is a global health service company that offers several Medicare Advantage plans, including HMO and HMO-SNP plans that offer plenty of benefits.

Medicare Advantage Options Under Cigna

There are several different types of Medicare Advantage plans under Cigna. The primary types of Medicare Advantage include:

Costs of Cigna Medicare Advantage Plans

Each Medicare Advantage plan has a different cost structure. Cigna is ahead of the curve when it comes to offering $0 premium plans. The vast majority (89%) of Cigna Medicare Advantage plans are offered with no premium. Make sure to compare each plan to determine if the benefits and costs are a good fit for your situation.

When will Medicare be available in 2020?

November 23, 2020. If you are new to Medicare, it is easy to become overwhelmed by the different options. Understanding the difference between Original Medicare and Medicare Advantage is essential. The New Hanover Health Advantage (NHHA) team wants you to have all the information you need to help you or your loved ones choose the right coverage.

What is Medicare Advantage Plan?

Medicare Advantage plans, also called Medicare Part C, are provided by licensed insurance companies and provide all the benefits of Original Medicine (Part A and Part B) along with additional bundled benefits, usually including a prescription drug plan.

What is Medicare Part A?

Original Medicare is offered by the federal government and includes two parts: • Part A – which includes coverage for inpatient hospital care, skilled nursing facility care, hospice care and home health.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

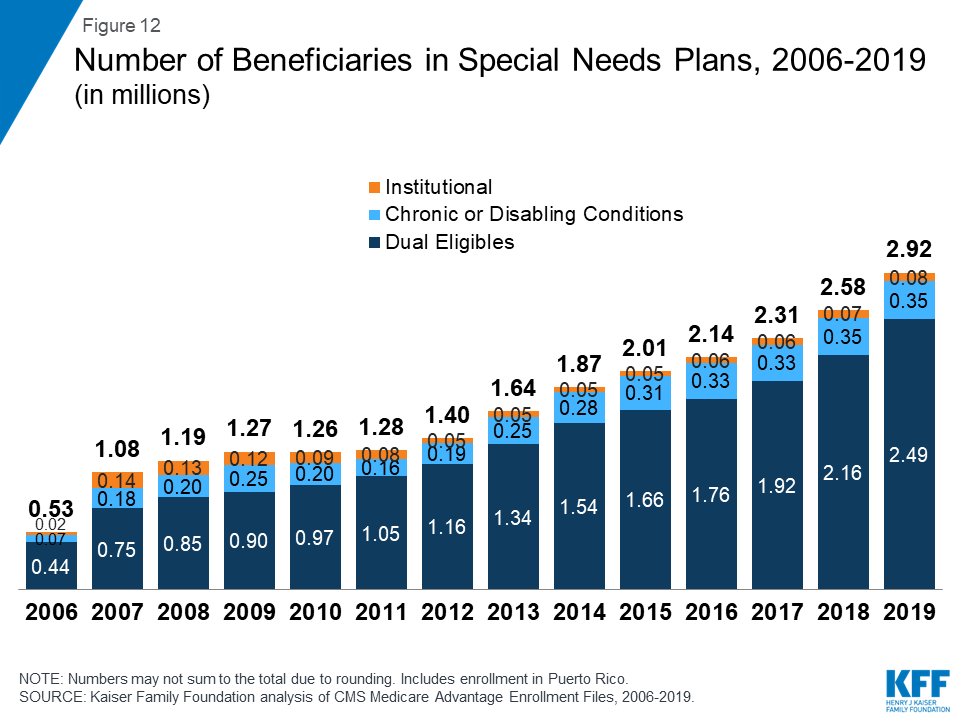

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Why A Medicare Advantage Plan Could Be The Right Choice For You

When it comes time to choose your Medicare health plan, you’ll basically have three options: 1) Rely on Original Medicare alone — health insurance from the federal government; or 2) Supplement Original Medicare with a Medicare Supplement plan; or 3) Get affordable, all-in-one coverage from a Medicare Advantage plan, like Johns Hopkins Advantage MD.

Relying On Original Medicare Alone Puts Your Savings At Risk

Quick Fact: Medicare pays just 80% of the costs for covered medical expenses — you pay the rest.

The Affordable Solution? All-In-One Coverage From A Medicare Advantage Plan

Quick Fact: Over 17 million Americans choose Medicare Advantage plans for savings and convenience.

HOW TO FIND PLANS

If you’re planning to enroll in Medicare Advantage, it’s important to find a plan that’s right for you. You may prefer to pay a high premium and have more comprehensive coverage, or a low premium and have higher out-of-pocket expenses. If you take any prescription drugs, you’ll need to make sure they’re included in the plan you sign up for.

CHANGES TO MEDICARE ADVANTAGE PLANS IN 2020

Many people choose a Medicare Advantage plan when they first become eligible for Medicare at age 65. If you haven’t signed up yet, or want to change your plan, you’ll have to wait for an Open Enrollment Period. These typically run from October 15th through December 7th and from January 1st through March 31st each year.

OVERVIEWS OF PLANS

There are a lot of factors that go into choosing a Medicare Advantage plan, so let’s look at a few different plans to get an idea of your options. Remember, you can find plans that have premiums as low as $0, but you’ll want to look for hidden out-of-pocket costs.

CONCLUSION

Medicare Advantage plans offer a range of coverage options. If you’re in good health but want vision or dental coverage, then you may choose a different plan than someone who needs medical supplies or hearing aids.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

Does Medicare Advantage have a deductible?

Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

What is Pro 8?

Pro 8: ESRD coverage. Medicare Advantage plans can now accept you if you’re a Medicare beneficiary under age 65 who has ESRD (end-stage renal disease, a type of kidney failure).

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

What is Medicare Advantage?

Medicare Advantage is private healthcare offered by companies like BlueCross BlueShield, UnitedHealthcare, and AARP (just to name a few). MA plans are able to offer extra benefits and even $0 premium plans because the federal government subsidizes it.

What is the difference between Medicare Advantage and Medicare Advantage?

It also failed to highlight the clear difference between Medicare and Medicare Advantage, which is the networks! Medicare gives you access to any provider that accepts Medicare assignment. Medicare Advantage limits your access to a network of providers in a specific area.

How much does Medicare cost in MA?

Many MA plans have $0 premium, while Medicare Supplements routinely cost $100-$125 per month in premium. The Plan Finder tool is hyper-focused on premium, and there are a lot of non-monetary components that the Plan Finder fails to highlight.

Is Medicare Advantage managed care?

Medicare Advantage Is Managed Care. We know that CMS pays private insurance companies a monthly fee for each individual they insure. That’s how these private companies can offer extra benefits and even $0 premium in many cases. However, another way MA plans can offer more benefits for $0 premium is because it’s managed care.

Does Medicare cover over 65?

Original Medicare has figured out that healthcare for a person over 65 costs them a certain dollar amount. They figure if they pay a private insurance company a little less, they’re saving money.

How many people are covered by Medicare Advantage?

Medicare Advantage is a public-private partnership that provides more than 24 million beneficiaries – over one third of the Medicare population – with affordable, high-quality, and convenient health care that protects against unforeseen medical costs, coordinates care for those with chronic illnesses, and reduces hospital readmissions to keep beneficiaries as healthy as possible.

How much does Medicare cost for a 72 year old?

UnitedHealth Group research shows annual health care costs for a 72-year-old beneficiary of average health in Medicare Advantage ($3,632) are as much as 39% less than for a comparable beneficiary in Medicare Fee-For-Service.