Are Medicare Cost plans being eliminated?

As of January 1, 2019, Medicare Cost Plans will be eliminated by the federal government from counties where two or more Medicare Advantage plans are competing. This is known as the two-plan test.

When do Medicare Cost plans go away in Minnesota?

They’re offered by private insurance companies to consumers in 15 states and the District of Columbia. About 535,000 Cost Plan enrollees, with more than 400,000 living in Minnesota, will be affected when the plans go away at the end of 2018. Why Are Medicare Cost Plans not Renewing?

What happens to Medicare Cost plans in 2019?

As of January 1, 2019, Medicare Cost Plans will be eliminated by the federal government from counties where two or more Medicare Advantage plans are competing. This is known as the two-plan test. If you live in a county that has less than two competing Medicare Advantage plans, you might be able to keep your Cost Plan.

What is a Medicare cost plan?

Cost Plans have been available since the 1970’s and are often thought of as a cross between a Medigap and Medicare Advantage plan. Medicare Cost plans are like Medicare Advantage plans in a few ways.

Why do some Medicare plans have no premium?

$0 Medicare Advantage plans aren't totally free Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

What is the difference between a Medicare Advantage plan and a cost plan?

Like Medicare Advantage plans, Medicare cost plans are offered by private companies and may also include extra coverage. However, unlike Medicare Advantage plans, a Medicare cost plan doesn't replace your original Medicare coverage. Instead, it offers other benefits in addition to those of original Medicare.

Do Medicare Advantage plans have no out-of-pocket costs?

So what's the catch? Of course, no Medicare Advantage plan is really $0 cost. You may still pay deductibles and copays for covered services and you'll still have to pay the Part B premium. But depending on your own personal healthcare needs, a Medicare Advantage plan may be worth it for the added benefits.

Are Medicare Advantage plans phased out?

In a word—no, Medicare isn't going away any time soon, and Medicare Advantage plans aren't being phased out. The Medicare Advantage (Part C) program is administered through Medicare-approved private insurance companies.

Do Medicare cost plans have copays?

A Medicare Advantage (Part C) plan is offered by private companies. It is an alternative to original Medicare Part A and Part B, and may offer additional benefits. In addition to plan premiums, a person will have to cover copays and deductibles. Costs may vary among plans.

Can you have a cost plan and Part D?

You can join a separate Medicare drug plan or you can get drug coverage from the Cost Plan (if offered). Even if the Cost Plan offers drug coverage, you can choose to get drug coverage from a separate Medicare drug plan. You can add or drop Medicare drug coverage only at certain times.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the disadvantages of Medicare?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

How many states offer Medicare Cost Plans?

Without further delay, the changes to Medicare Cost Plans will finally go into effect as of January 2019. Currently, 15 U.S. states have counties that offer Medicare Cost Plans. The states are: Arizona. California.

What state has the two plan test?

You will be notified in the mail, if you haven’t already, whether you are losing your Cost Plan or not. The state that will make the most adjustments is Minnesota.

How is a cost plan similar to a Medigap plan?

In contrast, they are similar to Medigap plans in the way they work with Original Medicare. For instance, when you seek medical help outside of your network, a Cost Plan works like a Medigap plan in the way that Original Medicare will be in charge of your coverage.

What is Medicare Cost Plan?

What Are Medicare Cost Plans? Private insurance companies offer Medicare Cost Plans in the same way that Medicare Advantage plans are offered. Cost Plans have been available since the 1970’s and are often thought of as a cross between a Medigap and Medicare Advantage plan.

When does Medigap end?

This Period begins November 2 nd and ends March 4 th of 2019.

When do you have to change your insurance plan?

Normally, the AEP begins October 15 th and ends December 7 th, but because of the special circumstances this year, this window of time will be extended until February 28 th, 2019 for people who are losing their Cost Plan.

Which states have eliminated Medicare Advantage plans?

Nebraska. North Dakota. New York. South Dakota. Texas. Virginia. Wisconsin. Washington DC. As of January 1, 2019, Medicare Cost Plans will be eliminated by the federal government from counties where two or more Medicare Advantage plans are competing.

What is cost contract?

A Cost Contract provides the full Medicare benefit package. Payment is based on the reasonable cost of providing services. Beneficiaries are not restricted to the HMO or CMP to receive covered Medicare services, i.e. services may be received through non-HMO/CMP sources and are reimbursed by Medicare intermediaries and carriers.

What is the Medicare Access and CHIP Reauthorization Act of 2015?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) amends the cost plan competition requirements specified in section 1876 (h) (5) (C) of the Social Security Act (the Act).

When do transition plans have to notify CMS?

Plans are responsible for following all contracting, enrollment, and other transition guidance released by CMS. In its initial, December 7, 2015 guidance, CMS specified that transitioning plans must notify CMS by January 31 of the year preceding the last cost contract year. In its May 17, 2017 guidance, CMS revised this date to permit ...

Why Are Medicare Cost Plans not Renewing?

The short story is that Cost Plan contracts will not be renewed in areas that have at least two competing Medicare Advantage plans that meet certain enrollment requirements. If your organization has decided to convert your plan to Medicare Advantage, it can continue as a Cost Plan until the end of 2018.

What Are the Options for Employer- or Union-Sponsored Cost Plans?

If you purchase your Cost Plan from your workplace or union, your plan may simply change to a similar Medicare Advantage plan. Also, you can disenroll from your Cost Plan at any time to return to Original Medicare.

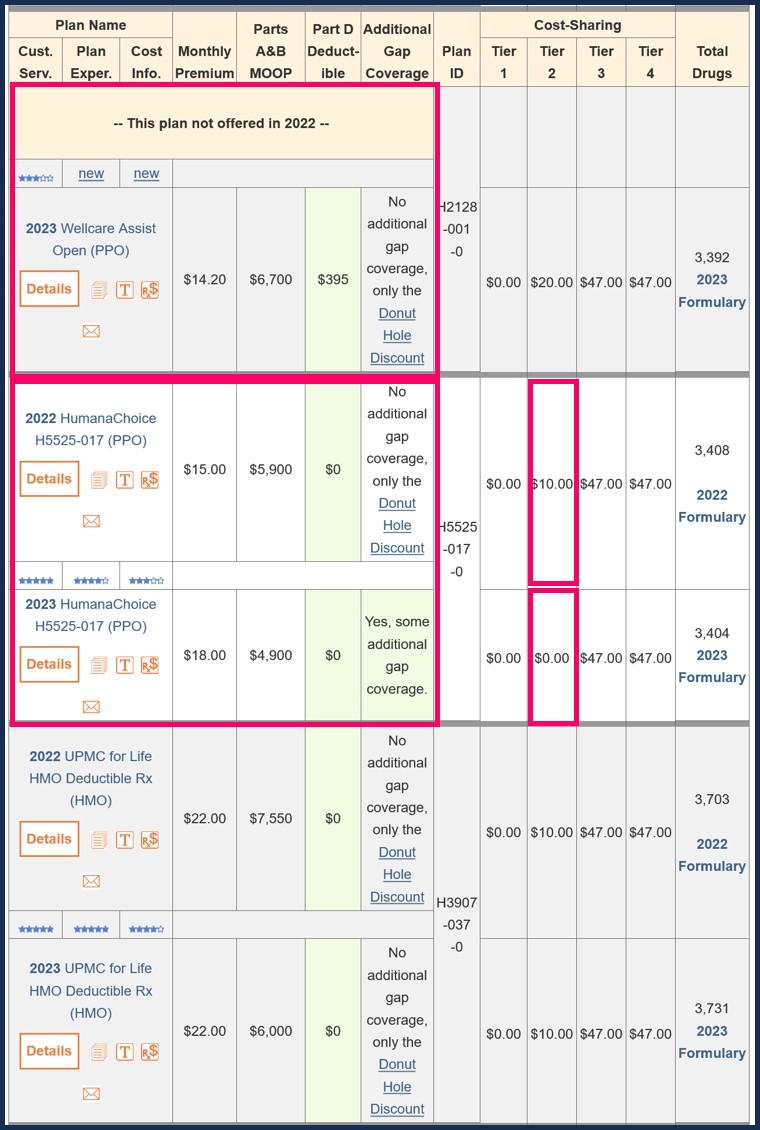

Are Insurance Companies Offering Alternatives to Medicare Cost Plans?

Many of the country’s leading insurance companies are expanding their options in areas that currently have Medicare Cost Plans. During this year’s annual enrollment period, you’ll likely see additional Medicare plans from existing companies and offerings for plans from companies that are new to your area.

Switching to a Medicare Supplement Plan

If you’re an individual who chose a Medicare Cost Plan so that your coverage is easily portable when traveling to other states, your best choice may be to switch to one of the Medicare Supplement plans, also known as Medigap plans, that can also fully protect you when you’re out of your coverage area.

Switching to a Medicare Advantage Plan

Cost-conscious individuals with a Cost Plan may benefit by considering a Medicare Advantage Plan, also known as Medicare Part C. It includes all the benefits of Original Medicare and can also include extra features such as emergency care, wellness programs, Medicare Part D, as well as other benefits.

HealthMarkets Can Make Your Medicare Cost Plan Switch Easy

HealthMarkets offers Medicare Advantage, Medicare Part D, and Medigap plans, and we know how to help you choose the best option. We have licensed agents ready to talk to you at (800) 488-7621. You can also find a local agent online. If you’re ready to find the right Medicare Advantage or Medicare Supplement plan that fits your needs, call today!

What is a plan F?

In reality, it’s a Medicare Supplement Insurance (Medigap) plan. It covers all the coinsurance, copays, and deductibles that would usually be your obligation after original Medicare pays its part. If you have a Plan F, you pay $0 for hospital stays, doctor visits, lab works, and many more. That is why Plan F has been America’s most popular Medigap ...

What plans are available for Medicare after January 1 2020?

For people eligible for Medicare after January 1, 2020, there are other plans available for you. Plans D, G and High-Deductible Plan G (which is a brand new plan option) will still be available to Medicare beneficiaries after January 1, 2020. Among the three, Plan G is the most popular because it’s almost a match in coverage, ...

Which Medicare plan is the most comprehensive?

Among the three, Plan G is the most popular because it’s almost a match in coverage, except for Part B Deductible. Although you must pay the Part B deductible in a Plan G, the premiums can be notably less. After paying the Part B deductible, Plan G works the same as Plan F, making Plan G the most comprehensive plan for newly eligible Medicare ...

When does Medicare Part B deductible take effect?

But hang in there, this will not take effect yet until the 1st of January 2020. So you still have some time. And the good thing is that Medicare Part B doesn’t cover the biggest health care costs under Medicare.

Is Medicare Plan F a Medigap?

That is why Plan F has been America’s most popular Medigap plan for decades. However, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) bill. MACRA stops the sale of Medigap Plans F and C for people who joined Medicare in January 2020 or later. Medicare Plans C and F both cover Part B deductible, ...

When did the standardized plan options start?

From 1990 (when Congress first standardized plan options) to 2010 there are other parts that have been phased out by the legislative (those are Plans E, H, I, and J). The government stresses that if you have a plan that covers everything, you may go more often than necessary.

Can you change your Medicare Supplement Plan without medical underwriting?

That means they can’t say no due to your medical situation. Those states are California, Connecticut, Missouri, New York, and Oregon.

How many QMBs were there in 2016?

In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level. The ’90s.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How to save money on Medicare?

If you’re concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs: 1 Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs. 2 Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. 3 Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare).#N#Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

How much does Medicare Part B coinsurance go up?

Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year. There are a number of contributing factors to why Medicare costs go up each year, such as:

What percentage of Medicare Part B funding came from beneficiaries?

Approximately 27 percent of Medicare Part B funding in 2017 came from beneficiaries’ premiums. Nearly 71 percent of Part B funding in 2017 came from general revenue, which consists mostly of federal income taxes. Increasing the Part B premium by only a small percentage for each beneficiary can raise tens of millions of dollars for ...

How does the population age affect Medicare?

As the population ages, the ratio of employed workers (who support Medicare through taxes) to retirees (who receive the benefits from those taxes) continues to shrink. The cost of health care continues to rise.

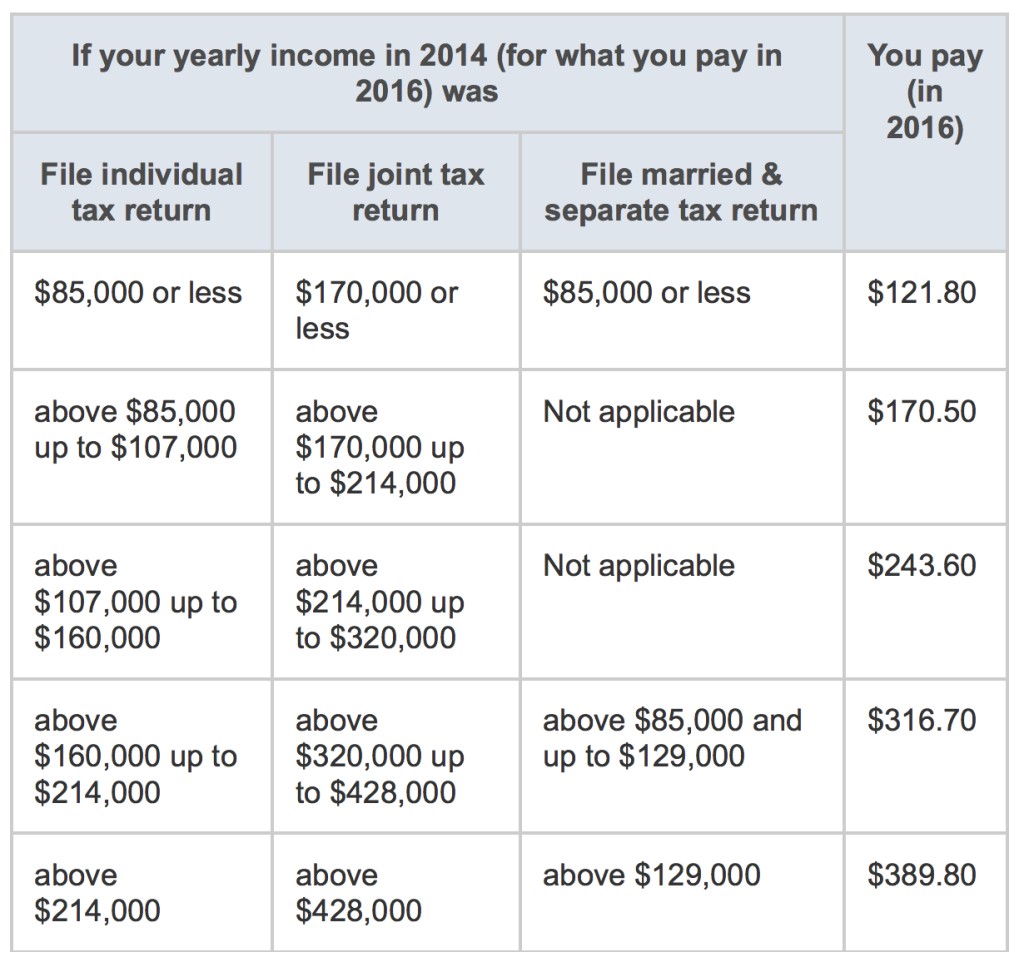

How much is the Part B premium?

The premium went up even more for higher income earners who pay an income-related monthly adjustment amount (IRMAA), with the most expensive Part B premium increasing from $428.60 per month in 2018 to $460.50 per month in 2019.

Does Medicare Advantage cover Part B?

While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare). Most Medicare Advantage plans also offer extra benefits such as dental, ...

Does Medicare Part B go up every year?

Does the Medicare Part B premium go up every year? The Part B premium is hardly the only Medicare cost that will go up every year. The Medicare Part A (hospital insurance) premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.