Those factors included congressional action that lowered the Part B premium in 2021 in exchange for a bump in costs to future premiums, as well as the typical rising costs across the health care industry that result in higher Medicare premiums each year.

Should you decline Medicare Part B?

Jan 28, 2022 · But that uncertainty appears to be moving towards a resolution. Becerra’s directive was in response to Biogen, the company that makes Aduhlem, dropping its cost to $28,200 according to AARP. On top of that price change, Medicare appears to be closing in on a decision to not offer significant coverage for the drug.

How can I reduce my Medicare premiums?

Mar 07, 2022 · And in recent years Part B costs have risen. Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.” 1 . Part B Premiums for 2022 . The standard Part B premium for 2022 is …

How much will you pay for Medicare Part B?

Jan 10, 2022 · By law, CMS is required to set each year's Part B premium at 25% of the estimated costs that will be incurred by that part of the program. So in its calculation for 2022, the agency had to account...

Does Medicaid replace Medicare Part B?

Jan 11, 2022 · This sudden increase in premiums is due to inflation, which is pushing up the price of goods and services following the pandemic. However, there’s a chance that Medicare Part B premiums for 2022 could actually be reduced. It comes after Biogen - the manufacturers of Alzheimer's drug Aduhelm - enacted a 50% price drop on January 1, 2022.

Does Medicare Part B premium change every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Is Medicare Part B premium going down 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.Jan 26, 2022

Are Medicare Part B premiums being reduced?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

Do Medicare premiums decrease with income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How can I lower my Medicare Part B?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.Mar 30, 2022

Why did Part B premium go up?

The increase in the Part B premium was to allow for a “high-cost scenario” of Aduhelm coverage based on assumptions about utilization months before the scheduled announcement of a National Coverage Determination (NCD).Jan 12, 2022

What is the increase in Medicare Part B for 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

Is Medicare Part B premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part B premium based on AGI or taxable income?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

At what income does Medicare premiums increase?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What is the impact of Part B premiums?

A major influence on your Part B premiums is the annual Social Security Cost-of-Living-Adjustment (COLA). The COLA for the upcoming year, which is usually announced in October, accounts for rising, or falling, costs of daily living. Depending on the COLA, Medicare may raise premiums to cover costs.

What happens if you don't sign up for Medicare?

You receive a penalty when you don’t sign up for Medicare during your Initial Enrollment Period and don’t have a qualified group health plan. The penalty increases your premium by 10 percent for each 12-month cycle you’re not enrolled.

How much will the Social Security increase in 2021?

For example, the Social Security Administration announced that the COLA for 2021 was a 1.3 percent increase. As a result, the average retiree receives roughly an extra $20 per month with their Social Security benefit.

Does Medicare Part B change?

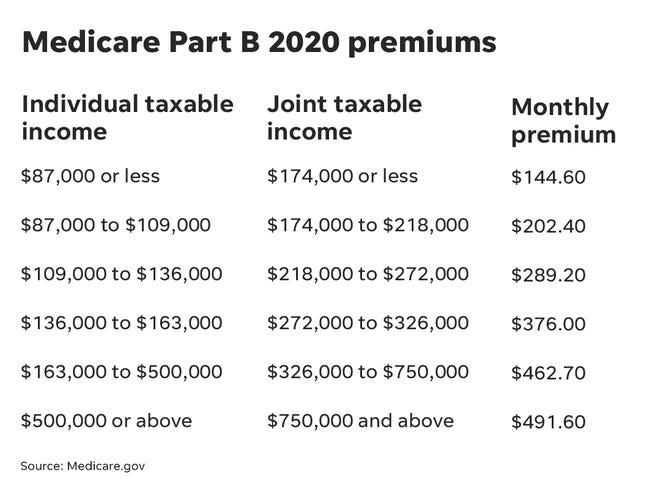

Here’s how your annual income affects your Medicare Part B monthly premiums for 2020.*. Whether it’s through penalties or income, your Medicare premiums may not match someone else’s. Additionally, the cost of Part B may change from year to year. It’s important you understand why the amount you’re paying could change.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Have questions about Medicare premiums?

How is your Medicare B premium set? And how can you lower your Medicare premium if your income declines in retirement? Today the Fearless Advisor explains all!

Your Medicare Part B premiums are based on your income from 2 years back

What I am referring to is how Medicare Part B premiums are determined. Part B is often referred to as “Medical Insurance.” (Please bear with me as there are going to be some acronyms used by the Social Security Administration.) These premiums are determined by your modified adjusted gross income or MAGI from two years ago.

Good news! Yes, you can request a reduction in Medicare Part B Premiums

Now that you are aware that the cost of Part B premiums can increase with your income, lets discuss when you may need to ask for a reduction in your premiums. The time is when you have a life-changing event, and your income is reduced. This commonly happens when someone retires at age sixty-five or later.

Return Form SSA-44 to your local Social Security Office

Here is how to reduce your Part B premiums: complete form SSA-44, which can be found on the Social Security Administrations website, SSA.gov/forms.

F5 Financial is here to answer your questions

If you need assistance or have questions in this area, the team here at F5 Financial would be happy to listen and support your family. Feel free to reach out to us at F5 Financial. Thanks for joining us!