Here are some reasons to favor Medicare Advantage plans:

- Many Medicare Advantage plans, unlike original Medicare, cover hearing, vision and/or dental care. ...

- A Medicare Advantage plancan cost you less. Original Medicare will often have you footing 20% of many bills with no limit on how much you might have to pay out ...

- While original Medicare can't be used outside U.S. ...

Full Answer

What companies offer Medicare Advantage plans?

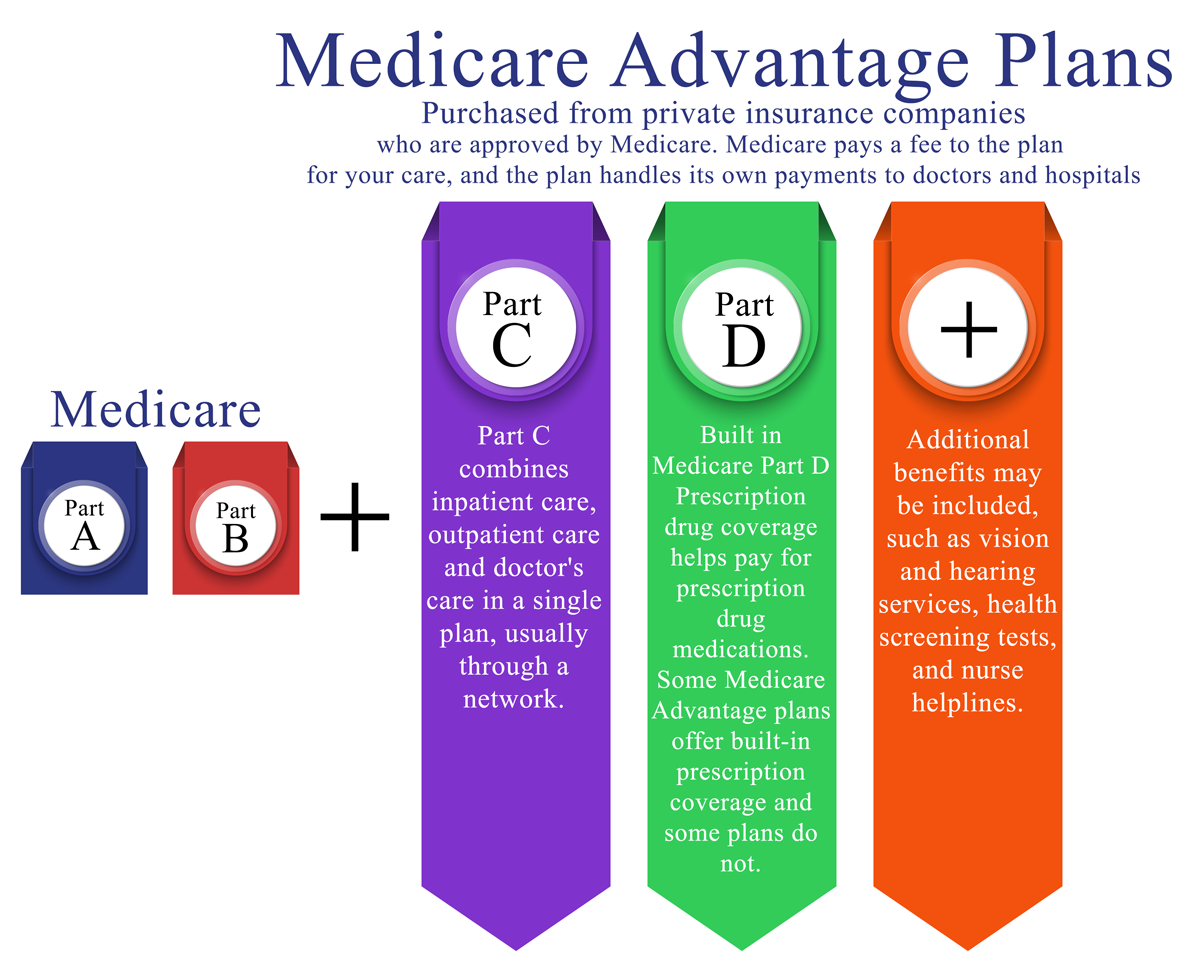

Apr 09, 2021 · What you need to know about Medicare Advantage plans. The Medicare Advantage program (also known as Medicare Part C) is an alternative way to receive your Medicare Part A and Part B benefits. Instead of getting your Medicare benefits directly from the federal government, they’re administered by a private, Medicare-approved insurance company.

What are the advantages and disadvantages of Medicare Advantage plans?

because you’ll need it if you ever switch back to Original Medicare. How do Medicare Advantage Plans work? When you join a Medicare Advantage Plan, Medicare pays a fixed amount for your coverage each month to the company offering your Medicare Advantage Plan. Companies that offer Medicare Advantage plans must follow rules set by Medicare.

Who qualifies for a Medicare Advantage plan?

Oct 01, 2021 · Medicare Advantage plans are similar to the types of health plans you may know from your working years — offering you an affordable alternative to a Medicare Supplement.

When to choose Original Medicare vs. Medicare Advantage?

Original Medicare for certain services like chemotherapy, dialysis, and skilled nursing facility care. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year.

What is the point of Medicare Advantage?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Advantage plans?

The takeaway Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Why should I get an Advantage plan?

Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.Nov 15, 2021

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

How Much Does Medicare Advantage Cost per month?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Can I drop my Medicare Advantage plan and go back to original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is Original Medicare better than an Advantage plan?

Your premiums may be higher with Original Medicare. You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan or other additional coverage. You may pay more copays with Medicare Advantage than with Original Medicare.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.May 10, 2007

Can you have Medicare and Medicare Advantage at the same time?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Why A Medicare Advantage Plan Could Be The Right Choice For You

When it comes time to choose your Medicare health plan, you’ll basically have three options: 1) Rely on Original Medicare alone — health insurance from the federal government; or 2) Supplement Original Medicare with a Medicare Supplement plan; or 3) Get affordable, all-in-one coverage from a Medicare Advantage plan, like Johns Hopkins Advantage MD.

Relying On Original Medicare Alone Puts Your Savings At Risk

Quick Fact: Medicare pays just 80% of the costs for covered medical expenses — you pay the rest.

The Affordable Solution? All-In-One Coverage From A Medicare Advantage Plan

Quick Fact: Over 17 million Americans choose Medicare Advantage plans for savings and convenience.

What to know about Medicare Advantage?

Things to know about Medicare Advantage Plans. You're still in the Medicare Program. You still have Medicare rights and protections. You still get complete Part A and Part B coverage through the plan. Some plans offer extra benefits that Original Medicare doesn ’t cover – like vision, hearing, or dental. Your out-of-pocket costs may be lower in ...

Can you check with a health insurance plan before you get a service?

You can check with the plan before you get a service to find out if it's covered and what your costs may be. Following plan rules, like getting a Referral to see a specialist in the plan's Network can keep your costs lower. Check with the plan.

Can you pay more for a Medicare Advantage plan than Original Medicare?

Medicare Advantage Plans can't charge more than Original Medicare for certain services like chemotherapy, dialysis, and skilled nursing facility care. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services.

What is Medicare Advantage?

Medicare Advantage in a nutshell. When you enroll in Medicare -- which you can do at age 65 -- you can choose either the "original" Medicare package of Part A and Part B (covering, respectively , hospital and medical expenses) or a Medicare Advantage plan, sometimes referred to as Part C. Those who opt for original Medicare typically augment it ...

How do Medicare Advantage plans earn their stars?

Medicare Advantage plans earn their stars by being evaluatedon measures such as how well they're keeping their members healthy (via screenings, checkups, and more), how well they're managing members' chronic conditions, and how good their customer service is.

Does Medicare Advantage cover dental?

Many Medicare Advantage plans, unlike original Medicare, cover hearing, vision and/or dental care. Medicare Advantage plans also typically include prescription drug coverage, while those with original Medicare have to sign up for -- and pay for -- Part D coverage. A Medicare Advantage plancan cost you less. Original Medicare will often have you ...

Does Medicare pay for the enrollee?

Once you hit the limit, the plan will pay all further costs. Better still, many plans charge the enrollee nothing in premiums. (The Medicare program pays the insurance company offering it a set sum per enrollee and if the insurer thinks it can make a profit without charging its customers anything, it can do so.)

Does Medicare Advantage give you more coverage?

Medicare Advantage plans can give you more coverage and can cost you less. Learn more about their benefits and drawbacks to see if you want to enroll in one. Selena Maranjian. (TMFSelena)

Does Medicare have to be renewed?

The insurance companies offering Medicare Advantage plans have contracts with Medicare that are not always renewed from year to year. Even when renewed, some terms of the plan may change, such as which drugs are covered.

Can you see any doctor on Medicare?

While original Medicare lets you see any healthcare provider in the country who accepts Medicare, Medicare Advantage plans, often operating as HMOs or PPOs, will typically limit you to a network of doctors -- though these networks are sometimes very big.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What is Pro 7 Medicare?

Pro 7: Lower out of pocket costs. Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Is Medicare Advantage regulated by Medicare?

If you’re new to Medicare, you may be curious about Medicare Advantage. Here are some pros and cons of enrolling in a Medicare Advantage plan. For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, ...

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

Why Should I Consider Enrolling In Medicare

When you turn 65 and are retired, many health insurance carriers assume that youll be on Medicare Part B. In turn, many people experience slight changes in their health insurance coverage as time goes on, even with FEHB.

What Doesnt Medicare Part B Cover

Original Medicare Part B doesnt cover everything. 2 Some things that arent covered by Medicare include:

Are Medicare Rules Different If I Have Fehb Coverage

Most people who have retiree coverage must enroll in Medicare Part A and Part B when first eligible. If they dont enroll, their retiree plan may pay only a small amount or nothing at all for their care. Medicares rules for you are different, however, if youre a federal retiree.

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

Do I Need Medicare Part B If I Have Other Insurance

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Medicare Part B Eligibility And Enrollment

Why do you need to pay for Medicare Part B premiums why you already pay your FEHBP premiums?

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled.

What are the resources that can't be counted as assets in Medicare?

Each Medicare Savings Plan has a specific income and asset limit, resources that can’t be counted as assets include: Your primary house. One car. Household goods and wedding/ engagement rings. Burial spaces.

How much is Medicare Part B premium 2020?

The standard Medicare Part B premium for 2020 is $144.60. While most Medicare beneficiaries will pay the standard premium amount, the premium you will pay is dependent on your income. If your income falls below the federal standards, help is available for Medicare beneficiaries through Medicare Savings Programs (MSP).

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone eligible for Social Security, even if they have not claimed benefits yet. If enrolled in Part B but not yet collecting Social Security benefits, you’ll be billed quarterly by Medicare. As a Medicare beneficiary, you have many options when it comes to how you receive your Medicare ...

Does Medicare Part B deduct premiums?

If you sign up for both Social Security and Medicare Part B – the part of Original Medicare that covers medically necessary and preventative services, The Social Security Administration will automatically deduct the premium from your monthly benefit.

Why is Medicare Advantage so bad?

These are the 7 most common reasons we’ve documented that make people feel Medicare Advantage plans are terrible: Free plans are not really free. Hospitalization costs more, not less. They make you pay multiple copays for the same issue. You are more likely to see a nurse practitioner than a doctor.

What is the difference between Medicare Advantage and Original Medicare?

Medicare Advantage plans are provided by private health insurance companies and group healthcare providers whereas Original Medicare coverage comes from the federal government’s Medicare program. Both have their pros and cons.

What is Medicare Part B rebate?

ALSO: Some zero-dollar premium Advantage health plans can rebate all or a portion of your Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... , but pay virtually nothing when you use healthcare services once the annual Part B premium is paid.

How many standardized plans are there for Medigap?

With Medigap, there are ten standardized plans (A, B, C, D, F, G, K, L, M, and N). Regardless of which insurance company you get a plan from, its benefits and coverage are the same. Only the monthly premium is different. With Medicare Advantage plans, your costs and coverage aren’t as clear-cut.

When does Medicare enroll?

It occurs every Fall from October 15 to December 7.

Does Medicare Advantage cover vision?

In addition to the fact that Medicare Advantage plan insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan (Part D). These are valuable benefits that Original Medicare does not cover.