Why Do I Need Supplement Insurance with Medicare? Original Medicare Parts A & B don’t cover all medical benefits necessary for beneficiaries, such as prescription medication and vision and dental care. Medicare supplement insurance covers medical services that Original Medicare doesn’t cover.

Full Answer

Do I need Medicare Part B If I have other insurance?

Do I Need Medicare Part B if I Have Other Insurance? Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Do I need health insurance if I have Medicare?

When you are covered by Medicare, you have widely accepted healthcare insurance. However, Medicare seldom covers all of your medical expenses. Therefore, it makes perfect sense to purchase health insurance to reinforce your Medicare coverage. Multiple private insurance companies offer supplemental coverage, called Medigap programs.

What is Medicare Part B and what does it cover?

Part A pays for your room and board in the hospital. Part B covers most of the rest. Enrolling in Part B when Medicare is primary will help you avoid unexpected medical bills. The Medicare definition for Part B is “outpatient coverage.”

When should I enroll in Medicare Parts A and B?

You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30 th, you should enroll in Medicare Parts A and/or B to begin on July 1 st.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Do I need Medicare Part D if I have Medicare Part A and B?

You must be enrolled in Medicare Part A and/or Part B to enroll in Part D. Medicare drug coverage is only available through private plans. If you have Medicare Part A and/or Part B and you do not have other drug coverage (creditable coverage), you should enroll in a Part D plan.

What are the benefits of having Medicare A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Is Medicare Part A and B good enough?

It's worthwhile to have Medicare Part A alongside Medicare Part B coverage to help pay for the complex, expensive care associated with hospital, rehab and skilled nursing stays. Like Medicare Part B, Part A services typically require you to pay deductibles and coinsurance or copayments.

What happens if I don't want Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

Does Medicare B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Which service is not covered by Part B Medicare?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Does Medicare Part A and B cover all medical expenses?

What's Not Covered By Medicare Part A & Part B? Medicare Part A and Part B, also known as Original Medicare, does not cover all medical services, including hearing, dental or vision. However, some Medicare Advantage plans may offer these benefits.

Does Medicare Part B have a deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

Why Do I Need Supplement Insurance with Medicare?

Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication and vision and dental care.

What Are The Gaps in Original Medicare?

As you may well know by this point, it is impossible to ignore the existing gaps in Original Medicare coverage. For a federal program that has so many coverage policies, there are two main forms of coverage where it usually fails to provide benefits.

Deciding On Whether You Need Supplemental Insurance

Now that we have covered all that there is to know about Medigap and Medicare, it is important you utilize this information in order to make an informed decision about your Medicare coverage. If you would like more information on either Medigap, Medicare Advantage, or Part D plans, give us a call.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

Original Medicare covers most of your healthcare needs, but you may want additional coverage for services not included with Medicare, such as prescription drugs and dental care

The answer to this question can be a bit complex, depending on what you mean. In general, you do not need additional health insurance if you have Medicare. There is no compulsion to have other health insurance legally speaking.

How Does Original Medicare Work?

Original Medicare (Parts A and B) covers medically necessary inpatient and outpatient healthcare costs. This will be divided between Part A, which covers inpatient healthcare, and Part B, which covers outpatient services. Each of these parts functions differently, so we’ll cover them both independently.

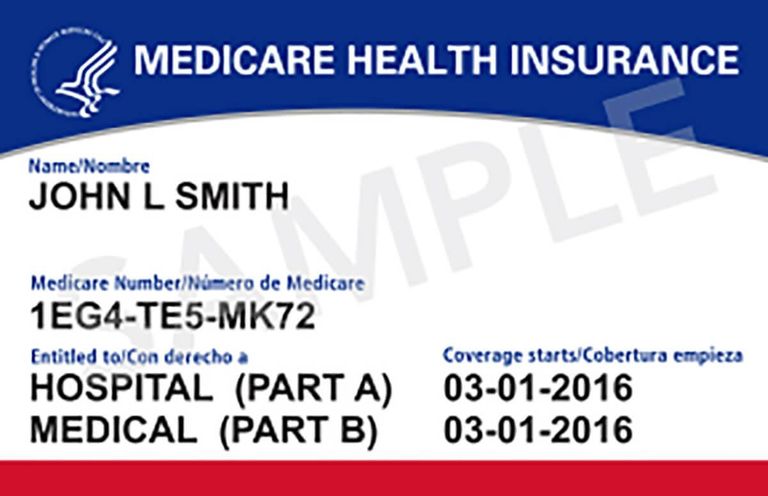

Understanding Original Medicare Eligibility and Enrollment

Original Medicare is available to a wide variety of people. Most often, Medicare enrollees are people who have reached their 65th birthday and already receive Social Security benefits. However, it is also available to certain patients with end-stage renal disease.

Medicare Part A Coverage Details

Medicare Part A, often referred to as hospital insurance, covers your inpatient healthcare costs. Most people will automatically become enrolled in Part A during their initial enrollment period if they already receive Social Security benefits. If you don't want to enroll in Part A, you'll have to contact Social Security.

Medicare Part B: What Does it Cover?

Part B of Medicare pays for medically necessary outpatient services. This can vary from diagnostic tests to doctor visits and outpatient surgeries. Medicare Part B will also usually cover durable medical equipment (DME).

Original Medicare and Other Insurance: Can You Have Both?

If you have Original Medicare, there are some other insurance plans you can have at the same time, and some you can’t. You can have Original Medicare alongside a Part D prescription drug plan, but not a Part C Medicare Advantage plan. You can also have a Medigap plan and Original Medicare at the same time.

Other Health Insurance: What Are My Options?

If you are eligible for Medicare, there are a few options that you have for additional medical insurance. Some of these plans can coexist with Original Medicare, but Part C Medicare Advantage plans cannot. We’ll run through every option you have, and discuss how it interacts with your Medicare coverage.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

What is Part B deductible?

After that, you pay daily coinsurance amounts, depending on the length of your stay. Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance (or coinsurance).

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Can you renew a Medigap policy?

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

Signing up for Medicare might make sense even if you have private insurance

Jeffrey M. Green has over 40 years of experience in the financial industry. He has written dozens of articles on investing, stocks, ETFs, asset management, cryptocurrency, insurance, and more.

How Medicare Works

Before diving into how Medicare works with your existing health coverage, it’s helpful to understand how it works on its own. Medicare has four main parts: A, B, C, and D. You can also purchase Medicare supplement insurance, known as Medigap.

Medicare Enrollment Periods

Medicare has a few enrollment periods, but the initial enrollment period may be the most important. This is when you first become eligible for Medicare. And if you miss the deadline to sign up for Parts B and D, you could face expensive penalties .

How Medicare Works If You Have Private Insurance

If you have private insurance, you may want to sign up for Parts A, B, D—and possibly a Medicare Advantage plan (Part C) and Medigap, once you become eligible. Or not. There are reasons both for and against. Consider how the following types of coverage work with Medicare to help you decide.

Primary and Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first (up to plan limits) and a secondary payer will only kick in for costs not covered by the primary payer.

Frequently Asked Questions (FAQs)

No, you can delay signing up for Medicare without penalty, as long as you are covered by another type of private insurance. Generally, if you are eligible for premium-free Part A, you should still sign up for it, even if you have additional private insurance coverage. 18

How many supplemental health insurance plans are there?

The federal government authorizes 10 different supplemental health insurance plans that complement Medicare. Some states, however, do not offer all 10. Check with your state of residence to learn about its approved menu of choices to supplement your Medicare coverage. Menus of options typically range from plans that cover most ...

What is coordination of benefits?

Coordination of Benefits. When you match Medicare with supplemental healthcare coverage, each entity becomes a "payer.". Coordination-of-benefits rules identify which entity pays first. The primary payer first reimburses medical providers up to its coverage limits.

What states have Medigap insurance?

While Medigap plans must meet federal government guidelines, states can choose which options to offer you. Three states, Massachusetts, Minnesota and Wisconsin, even have their own proprietary plans that meet government Medigap standards. You can choose a plan that has premiums you can afford.

Does Medicare cover secondary medical insurance?

2. Comparison of Medical Plans for Retirement. 3. How to Discontinue COBRA Benefits. When you are covered by Medicare, you have widely accepted healthcare insurance. However, Medicare seldom covers all of your medical expenses. Therefore, it makes perfect sense to purchase health insurance ...

Does Medicare cover all medical expenses?

However, Medicare seldom covers all of your medical expenses. Therefore, it makes perfect sense to purchase health insurance to reinforce your Medicare coverage. Multiple private insurance companies offer supplemental coverage, called Medigap programs.

When do you have to enroll in Medicare Part B?

When You Must Enroll in Medicare Part B. You may be required to get Medicare Part B even when you’re still working. There are two situations in which you must get Part B when you turn 65. If your employer has fewer than 20 employees. If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare ...

How much does Medicare Part B cost?

Part B is different. Unlike Part A, Medicare Part B has a monthly premium, which can cost $148.50 to $504.90 depending on income. It has a late enrollment penalty for anybody who enrolls without qualifying for a Special Enrollment Period.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does it take to enroll in Medicare if you lose your employer?

When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you haven’t done so already. You’ll also be able to enroll in a Medicare Advantage (Part C) plan or Part D prescription drug plan in the first two months of this period.

When do dependents have to enroll in Medicare?

If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare when they turn 65. If you’re not married but living in a domestic partnership and are covered by your partner’s employer health insurance.

Can you avoid Medicare if you file for Social Security?

PHIL: When you file for Social Security, by law you must receive Part A of Medicare. You can't avoid it. If you want to get Social Security benefits, you have to be enrolled in Part A.