The reason why can get a little messy and confusing, but here’s the gist: Each state has the liberty to make different legislation. This means that Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What is the difference between plan N and Medigap?

While Plan N covers the Medicare Part A deductible, it doesn’t cover the Medicare Part B deductible. Medigap policies typically don’t have their own deductible, including Plan N. Plan N covers copays and coinsurance associated with Medicare parts A and B. If you have a Plan N policy, you won’t be responsible for these costs.

How can I See and compare costs for my Medicare plan?

If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder. For specific cost information (like whether you've met your Deductible, how much you'll pay for an item or service you got, or the status of a Claim), log into your secure Medicare account.

Does plan N cover Medicare Part A and B deductibles?

While Plan N covers the Medicare Part A deductible, it doesn’t cover the Medicare Part B deductible. Medigap policies typically don’t have their own deductible, including Plan N. Plan N covers copays and coinsurance associated with Medicare parts A and B.

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

What is the average cost of Medicare Plan N?

between $120 and $180Monthly premiums for Plan N can average between $120 and $180, climbing to over $200 in some states and dropping as low as $80 in other states. Rates are determined by location, age, gender and in some instances, current health status. This monthly cost is on top of the cost of Original Medicare (Parts A and B).

Are all Medicare Supplement plan N the same?

Medicare Part N, Medigap Plan N, and Medicare Plan N are the same. Still, the correct term is Medicare Supplement or Medigap Plan N. Remember that Parts refer to Original Medicare, and Plans refer to Medigap.

Is plan N cheaper than plan G?

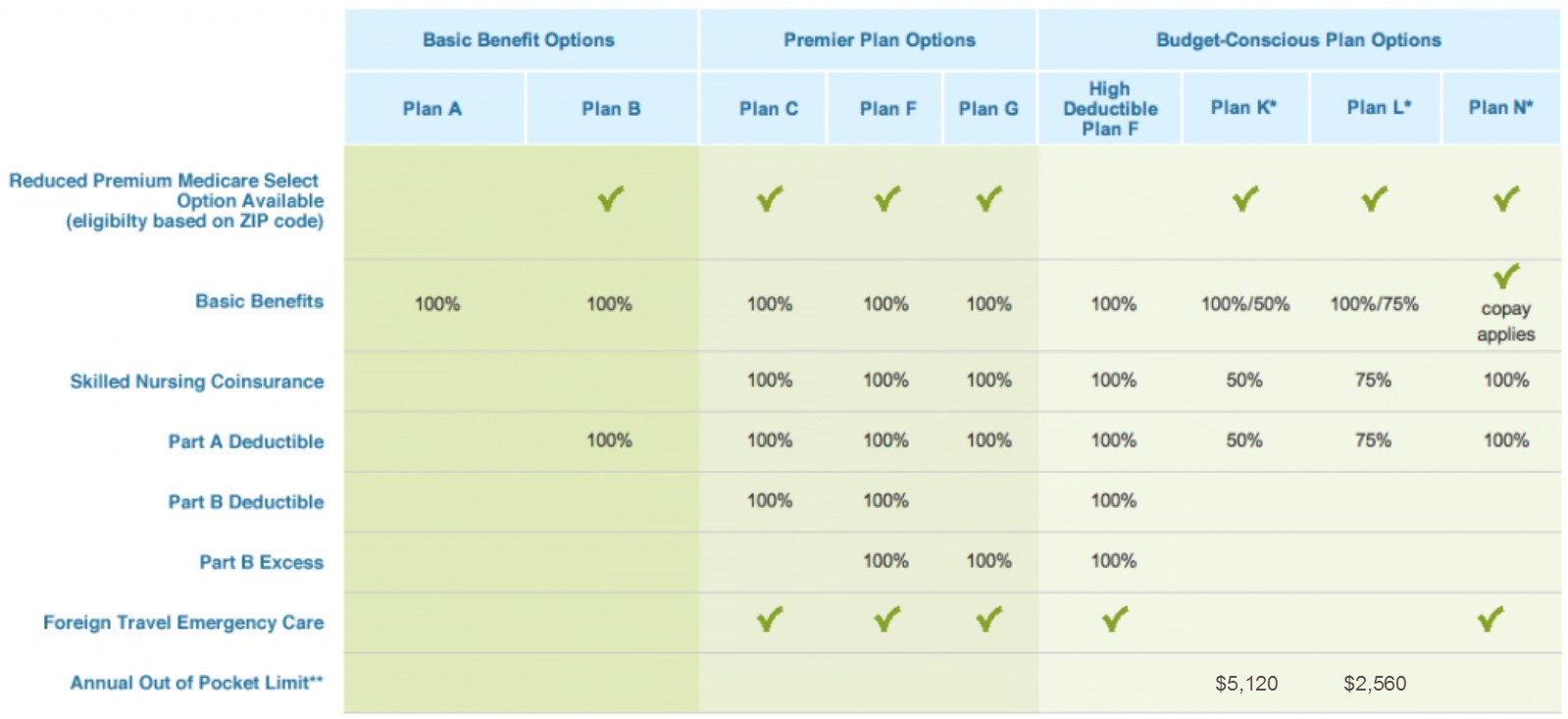

Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, it could save you money in the long run.

What is plan N on Medicare?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

Is Medicare Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Does plan n pay the Part A deductible?

Part A (hospital visits, hospice, blood) Hospitalization: Plan N pays for your Medicare Part A deductible every benefit period. Additionally, it covers all your Medicare-approved expenses during hospital stays for up to 365 days after your Original Medicare benefits end.

Which is better Medigap plan G or N?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

Can I switch from plan N to G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

Can I switch from plan N to plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.

What is the difference between Medicare Plan G and Medicare Plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Does Medicare Part N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

What is the difference between plan F and plan N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

Is Medicare Plan N a good plan?

Medigap Plan N combines fairly extensive coverage with relatively modest premiums, making Plan N a good policy. It is important to remember that Pl...

How popular is Medicare Plan N?

Amount 10% of all Medigap enrollees have Plan N, making it the third most popular plan overall and the second most popular plan for new enrollees.

Does Plan N have a deductible?

Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, which...

Does Plan N have a maximum out-of-pocket limit?

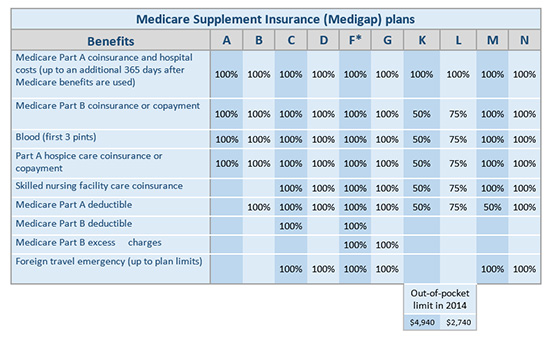

Plan N does not have an out-of-pocket limit. Only two Supplement plans have an out-of-pocket limit: Plans K and L.

Can I have Medigap Plan N while enrolled in a Medicare Advantage plan?

No. Medigap policies are only available to people enrolled in the Original Medicare program. They cannot be used by beneficiaries who have Medicare...

What is a Medigap plan?

Share on Pinterest Medicare Plan N provides an additional 365 days of hospital costs after a person has exhausted their Medicare benefits.

Medicare Plan N cost

Getting the best price for Medigap Plan N coverage depends on several factors, including:

What does Medigap Plan N cover?

Part A hospital costs and coinsurance, including up to an additional 365 days after Medicare benefits are exhausted

Out-of-pocket expenses

For Medicare enrollees who visit the doctor often or require certain routine health services, the out-of-pocket costs can add up quickly.

When to enroll in Medigap Plan N

Firstly, a person must be enrolled in Medicare Part B to be eligible for Medigap enrollment.

Considerations

Although Medigap Plan N does pay Part B coinsurance and copayments in some circumstances, it does not cover Part B deductibles or Part B excess charges.

Summary

Medicare Plan N is a Medigap plan. This supplemental insurance works in conjunction with original Medicare to cover remaining medical and out-of-pocket costs.

How much does a plan N cost?

While the price of a Plan N varies depending on where you live, how old you are, your health, and more, it generally costs between $85-$120 per month.

How much is Medicare Supplement Plan N?

On average – and this can change depending on a variety of factors – a Plan N is between $30-$50 cheaper than a Plan F. That means that every month, you pay $30-$50 less ...

What is a plan N?

What is Plan N? Plan N is one of the Medicare Supplement plan options, which are plans that help pay for gaps Medicare leaves behind. Like the other Medigap plans (such as Plan F or G), Plan N is sold by private insurance companies, such as Accendo Insurance Company or Lumico. Plan N has very similar benefits to Plan F and Plan G, ...

How much is a Medigap Plan N copay?

One of its main differences when compared to Plan F or G is the copay. When you have a Medigap Plan N, you pay a small copay when you go to the doctor’s office. However, it’s usually only about $10.

What happens if a doctor doesn't accept Medicare?

If they don’t, you would receive a bill in the form of an excess charge. However, most doctors accept Medicare (they accept Medicare assignment).

Can a doctor overcharge you for a procedure?

Doctors who don't accept Medicare assignment are allowed to overcharge you up to 15%. That 15% upcharge is called an excess charge. For example, a doctor might charge $1,500 for a procedure, but Medicare only approves $1,200 for that procedure.

Does Plan N have copays?

Yes, it has copays and excess charges , but ultimately, it's worth the premium savings for a lot of individuals. For a free, no obligation Plan N quote, call us today at 833-801-7999 or send us an email at help@medicareallies.com.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Why is it so hard to switch from one Medicare plan to another?

Another big factor is that, in general, it’s hard to switch from one Medigap plan to another, especially if you’re health isn’t in tip-top shape.

Which states have passed legislation to make it easier to switch to a different health insurance plan?

Some states have recognized this, and they’ve passed legislation to make it easier to switch. States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

What is a carrier plan G?

Carrier Determines Medigap Rates. Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.

What happens to insurance premiums at age 70?

Now, with all of these models, premiums can still go up from factors like inflation and just general rate increases, but as you can see, age often does determine how much a plan will cost.

Do you get less coverage with Medigap?

You don’t get less coverage — remember that every plan is standardized. If you’re really interested in getting an idea of how much a Medigap plan would cost you in your specific location and for your specific age, you should contact an independent broker to provide a list of available options.

Does Medigap give the same coverage as Plan G?

Medigap plans are standardized. So, your Plan G is going to give you the same coverage as your friend’s Plan G. This is important to know, because prices do vary by carrier. We’ll get to the “why” part later, but knowing that the plans are the same across the board gives you the freedom to price shop, comparing “apples to apples”.

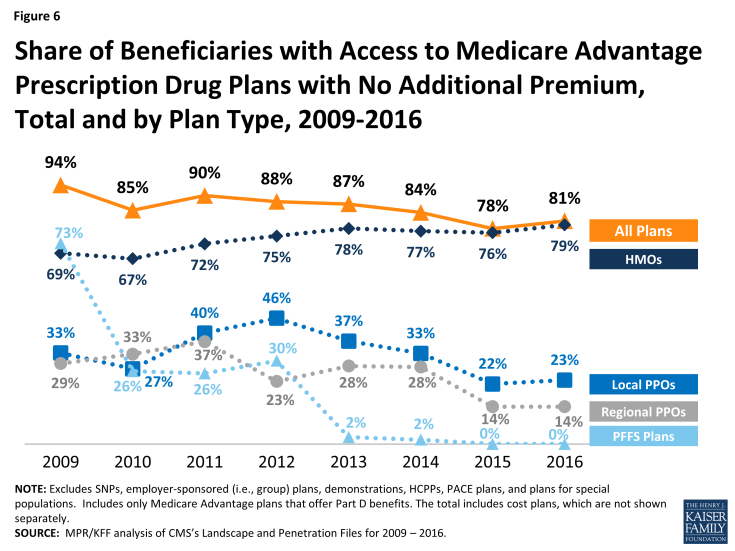

Why is Medicare Advantage Plan lower?

In sum, a Medicare Advantage plan premium is lower based upon the fact that its expenses are lower because the plan is usually either an HMO or a PPO. Physicians, specialists and medical facilities have agreed to accept lower fees for their services, which reduces the overall expenses paid by the insurance company for the Medicare beneficiary’s health care. Payment of reduced fees combined with cost-sharing and Medicare funding allows an MA plan to offer coverage for a lower monthly premium.

What happens when a Medicare beneficiary enrolls in a Medicare Advantage Plan?

When a Medicare beneficiary enrolls in a Medicare Advantage plan, the plan takes over for Medicare Part A and Medicare Part B. To support the Medicare Advantage plan’s ability to do this Medicare pays the plan to cover your Part A and Part B benefits. Medicare pays the Medicare Advantage Plan for each beneficiary who enrolls a monthly amount based ...

Why is PFFS more expensive than HMO?

A PFFS plan typically carries a higher monthly premium as well as cost-sharing because it allows more flexibility. A HMO plan restricts or controls the availability of physicians the Medicare beneficiary can see and be covered under the plan.

What is a PCP referral?

A referral to a specialist must come from the PCP and the specialist must be a part of the HMO. The physicians that are a part of the HMO plan have agreed by contract to treat patients in accordance with the HMO’s guidelines and restrictions.

What is the out of pocket limit for Medicare?

An out-of-pocket limit is defined as the maximum amount the Medicare beneficiary will pay out of their pocket before the plan is required to pay 100% of Medicare approved medical and drug expenses. Therefore, it is important to consider all plan costs and not just the premium, when considering a Medicare Advantage plan.

Does Medicare Advantage have a higher premium?

In the alternative, Medicare Advantage plans have more “cost sharing” which requires the Medicare beneficiary to pay a portion of the costs of their medical coverage. Cost sharing includes co-payments, co-insurance, and deductibles associated with doctor’s visits, hospital stays and other healthcare services. ...

Is Medicare Advantage a supplement?

Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.” Some Medicare Supplements cover 100% of the cost sharing left by Medicare on Medicare approved expenses. Therefore, they carry a higher premium. In the alternative, Medicare Advantage plans have more “cost sharing” which requires the Medicare beneficiary to pay a portion of the costs of their medical coverage. Cost sharing includes co-payments, co-insurance, and deductibles associated with doctor’s visits, hospital stays and other healthcare services.