The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

Full Answer

How much does Medicare Part D prescription drugs cost?

Policies that cover prescription drugs usually put covered drugs into cost tiers, with individual cost-sharing for the medications on each tier. How Much is Medicare Part D? The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan.

Can the amount of Medicare Part D premiums change?

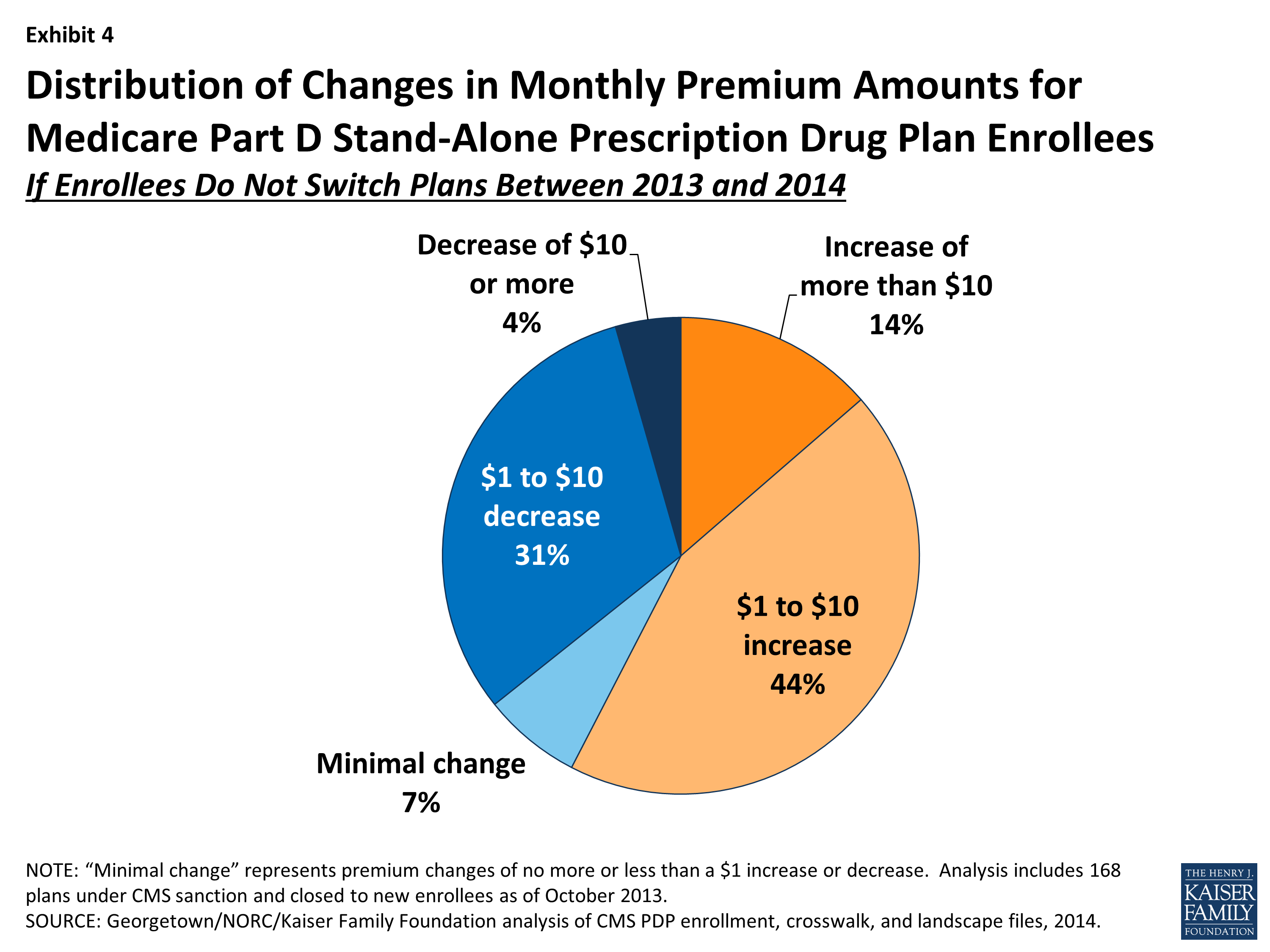

The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB]. If you have questions about your Medicare drug coverage, contact your plan.

How do I compare Medicare Part D plans?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com. 2 How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month.

Does Medicare Part D have a deductible?

Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Why do Medicare Part D premiums vary?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

Why is my Medicare Part D premium so high?

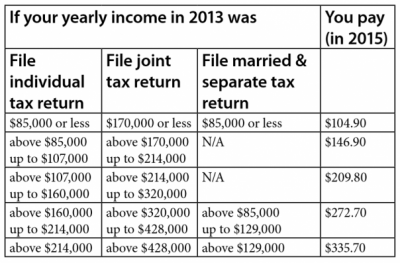

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Do Medicare Part D plans vary?

Medicare drug plans may vary in what drugs they cover, and some may have special rules that you must follow before a drug is covered. A formulary is a list of the drugs that a drug plan covers. It includes how much you pay for each drug.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How are Part D premiums determined?

Premiums. The 2022 Part D base beneficiary premium – which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment – is $33.37, a modest (1%) increase from 2021. But actual premiums paid by Part D enrollees vary considerably.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Are all Part D formularies the same?

Each Medicare Part D plan has its own unique formulary, meaning that it has its own unique list of drugs the plan covers. Medicare formularies are used to help provide Medicare beneficiaries with affordable and effective medications.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

How do insurance companies make money on Medicare Part D?

Under Medicare Part D, Medicare makes partially capitated payments to private insurers, also known as Part D sponsors, for delivering prescription drug benefits to Medicare beneficiaries. Medicare relies on transaction data reported by Part D sponsors to make sure these payments are accurate.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Why is it so hard to switch from one Medicare plan to another?

Another big factor is that, in general, it’s hard to switch from one Medigap plan to another, especially if you’re health isn’t in tip-top shape.

What happens to insurance premiums at age 70?

Now, with all of these models, premiums can still go up from factors like inflation and just general rate increases, but as you can see, age often does determine how much a plan will cost.

What is a carrier plan G?

Carrier Determines Medigap Rates. Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.

Which states have passed legislation to make it easier to switch to a different health insurance plan?

Some states have recognized this, and they’ve passed legislation to make it easier to switch. States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

Do you get less coverage with Medigap?

You don’t get less coverage — remember that every plan is standardized. If you’re really interested in getting an idea of how much a Medigap plan would cost you in your specific location and for your specific age, you should contact an independent broker to provide a list of available options.

Does Medigap give the same coverage as Plan G?

Medigap plans are standardized. So, your Plan G is going to give you the same coverage as your friend’s Plan G. This is important to know, because prices do vary by carrier. We’ll get to the “why” part later, but knowing that the plans are the same across the board gives you the freedom to price shop, comparing “apples to apples”.