This is one reason for some of the cost differences among Medicare prescription drug plans. Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What are the best Medicare Part D plans?

May 02, 2016 · Each Medicare Part D plan includes the following: Monthly premium—the cost per month. Annual deductible—the amount members must spend before initial coverage begins. Initial coverage—the coverage that begins once the deductible is met. Coverage gap or Medicare donut hole—the stage entered once members reach $3,750 in total drug cost for ...

What is the cheapest Medicare Part D plan?

Feb 14, 2018 · The coverage gap, also called the Medicare donut hole, means your plan does not cover your prescription drug costs. However, there are federally-funded discounts available. In 2018, name brand drugs will be discounted at 65% and generic drugs will be discounted 56%, meaning you’ll pay 35% for name brand drugs and 44% for generic drugs.

What is the cheapest Medicare Part D?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400.

How to compare Medicare Part D drug plans?

While U.S. federal law requires that all insurance companies that offer these prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations of coverage and cost sharing. You can enroll in Part D as a stand-alone plan in addition to your Original ...

Why are some Medicare Part D plans more expensive than others?

Do all Part D plans cost the same?

Do Medicare Part D plans vary?

How are Medicare Part D drug prices determined?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

What is the average cost for Medicare Part D?

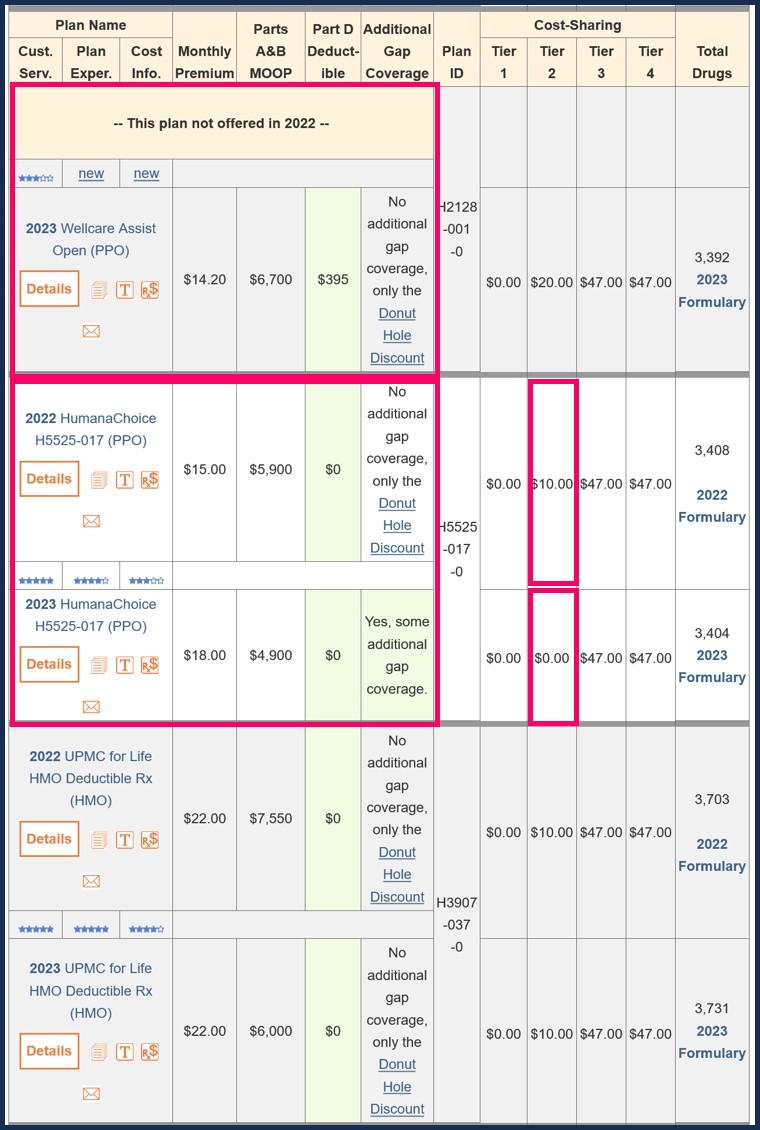

What is the best Medicare Part D plan for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What is the max out-of-pocket for Medicare Part D?

Does Medicare Part D have a maximum out-of-pocket?

Do I need Medicare Part D if I don't take any drugs?

Why do doctors not like Medicare Advantage plans?

What drugs are not covered by Medicare Part D?

- Drugs used to treat anorexia, weight loss, or weight gain. ...

- Fertility drugs.

- Drugs used for cosmetic purposes or hair growth. ...

- Drugs that are only for the relief of cold or cough symptoms.

- Drugs used to treat erectile dysfunction.

How much is the drug discount for 2018?

In 2018, name brand drugs will be discounted at 65% and generic drugs will be discounted 56%, meaning you’ll pay 35% for name brand drugs and 44% for generic drugs. The good news is that the coverage gap will be completely phased out by 2020, and you will pay no more than 25% of drug costs after you’ve met your deductible.

Why do prescriptions change?

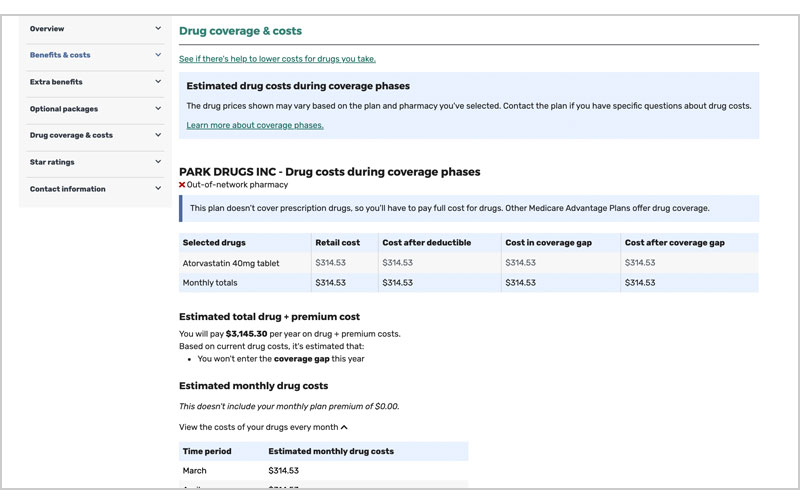

Reasons your prescription drug prices may change 1 If your dosage or quantity changes, the price of the prescription could also change. 2 Manufacturers may increase the price of the drug, and this will be reflected in the price you pay for it. 3 You may be in one of four coverage periods: deductible period, initial coverage period, coverage gap, and catastrophic coverage period.

What are the four coverage periods for a drug?

You may be in one of four coverage periods: deductible period, initial coverage period, coverage gap, and catastrophic coverage period.

How to save money on prescription drugs?

Another way to save money on prescription drugs is to make sure the pharmacy you use is a pharmacy preferred by your plan. Non-preferred pharmacies can charge you more for your prescription drugs, so it’s important to know which pharmacies you can use.

What happens after you meet your deductible?

During this period, you will be responsible for co-payments and co-insurance, which vary according to the drug and which plan you have. The length of this period depends on your out-of-pocket drug costs and your plan’s benefit structure.

What is LIS in Medicare?

Depending on your income, Extra Help, also known as the Low-Income Subsidy (LIS), may be an option for you. Extra Help, a federal program administered by Social Security, helps people with low income pay for their Medicare prescription drug costs.

Why do people choose Medicare Advantage over Part D?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not. But MA plans aren’t necessary for everyone, and you may be fine with original Medicare ...

What is a Part D plan?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400. It increases to $405 next year. Once you meet the deductible, you’ll pay 25 percent for the cost of your prescriptions while the plan pays for the remainder until you meet your plan’s coverage limit.#N#The initial coverage limit is $3,700 in 2017 and will increase to $3,750 in 2018. Once you hit the coverage limit, you’ll be stuck in a situation known as the “donut hole,” or coverage gap, a scenario that the Affordable Care Act has been working on addressing by giving seniors additional discounts while they’re in the gap.

Can you get a donut hole with Medicare Part D?

With low prescription costs, you may never reach the donut hole. Choosing between Medicare Part D and a Medicare Advantage plan with drug coverage comes down to cost and long-term benefit. Evaluate your medication needs, talk to your doctor and make a list of questions to ask a qualified Medicare specialist.

Why are Advantage plans better than Original Plans?

Advantage plans come with their own separate premium costs, but benefits can be better for a lot of people because Advantage plans are more comprehensive than original plans. Many MA plans provide prescription drug coverage, usually requiring beneficiaries to pay a set copay.

How to contact Medicare Advantage?

Medicare Part D vs. Medicare Advantage Plans. For more information on Medicare, please call the number below to speak with a healthcare specialist. 1-800-810-1437. Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations.

What are the other Medicare plans that include prescription drug benefits?

There are also other Medicare health plans that include prescription drug benefits like PACE (programs of All-Inclusive Care for the Elderly) and Medicare Cost Plans.

Does Medicare cover prescription drug plans?

federal law requires that all insurance companies that offer these prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations of coverage and cost sharing.

Who sells Medicare prescriptions?

Medicare prescription drug plans are sold by private insurance companies in the United States. While U.S. federal law requires that all insurance companies that offer these prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations ...

What is the deductible for Medicare Part D?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018.

Does Medicare Part D cover prescription drugs?

If you’re already taking prescription drugs, it’s important to see if the Medicare Part D plan you want covers your medication. In some cases, more than one or even all of the plans available in your area will cover your prescription drug . If you’re using the eHealth plan finder tool, just click “Add Rx Drugs” and type in your prescription.

Does Medicare have a stand alone plan?

Every Medicare beneficiary has access to at least one stand-alone Medicare Part D Prescription Drug Plan in 2018, according to the Centers for Medicare and Medicaid Services (CMS). This means that you, like most other Medicare beneficiaries, will have dozens of options to choose from when you’re looking for Medicare Part D Prescription Drug ...

What is Medicare Part D plan Juliet?

Premiums can vary widely; as you see here, Medicare Part D plan Juliet has more than double the monthly premium that Medicare Part D plan Penelope has. A second cost that most Medicare Part D plans have is the deductible, although some plans have a $0 deductible.

Does Juliet have a Medicare deductible?

Premiums can vary widely; as you see here, Medicare Part D plan Juliet has more than double the monthly premium that Medicare Part D plan Penelope has. A second cost that most Medicare Part D plans have is the deductible, although some plans have a $0 deductible. A Medicare Part D deductible is an amount you have to pay out ...

What is the maximum deductible for Medicare?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018. Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example.

What is the maximum amount of Medicare Part D deductible?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018. Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example. All Medicare Part D plans have an out of pocket limit, which is $5,000 in 2018.

What do Medicare Part C and Part D have in common?

Both are private insurance. The federal government offers Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). By contrast, Medicare Parts C and D are approved by Medicare but offered through private insurers.

How is Medicare Advantage different from Part D?

Medicare Part D is a supplement to Original Medicare and covers prescription drugs only. Medicare Advantage, on the other hand, replaces Original Medicare and becomes your hospital and medical insurance plan.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

What prescription drug coverage is offered through Medicare Advantage?

It depends on the type of plan that you have. Health maintenance organizations (HMOs) and preferred provider organizations (PPOs) typically include prescription drug coverage. If you have an HMO or PPO plan, you cannot purchase a stand-alone Part D plan.

What coverage gaps are present in Medicare Part C and Part D?

Medicare Part D, whether purchased on its own or as part of a Medicare Advantage plan, has a coverage gap known as “the donut hole.” It kicks in once you and your plan have paid $4,130 in drug costs for the year. Although regulations have lessened its impact, the donut hole could still increase your monthly prescription expenses.

The bottom line

Choosing the best prescription drug plan for you will involve making other Medicare-related decisions first. If you want additional coverage for expenses like dental or vision care, you can get a Medicare Advantage plan that includes a prescription drug benefit.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Why Should I Switch Part D Drug Plans?

Even if you’re happy with your current drug plan, it’s very important to run a drug comparison anyway, because drug plans change every single year!

How Do I Compare Part D Drug Plan Costs?

You can compare your Medicare Part D drug plan costs on Medicare’s website: Medicare.gov.

How to Compare Drug Plan Costs

Comparing drug plan costs can seem challenging, but the Medicare Part D Cheat Sheet gives you the power to do it on your own.

Does Medigap give the same coverage as Plan G?

Medigap plans are standardized. So, your Plan G is going to give you the same coverage as your friend’s Plan G. This is important to know, because prices do vary by carrier. We’ll get to the “why” part later, but knowing that the plans are the same across the board gives you the freedom to price shop, comparing “apples to apples”.

Do you get less coverage with Medigap?

You don’t get less coverage — remember that every plan is standardized. If you’re really interested in getting an idea of how much a Medigap plan would cost you in your specific location and for your specific age, you should contact an independent broker to provide a list of available options.

Can you switch from Medigap to another?

Another big factor is that, in general, it’s hard to switch from one Medigap plan to another, especially if you’re health isn’t in tip- top shape. Some states have recognized this, and they’ve passed legislation to make it easier to switch. States like California, Oregon, Maine, and Missouri have done this.

Which states have passed legislation to make it easier to switch to a different health insurance plan?

Some states have recognized this, and they’ve passed legislation to make it easier to switch. States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

What happens to insurance premiums at age 70?

Now, with all of these models, premiums can still go up from factors like inflation and just general rate increases, but as you can see, age often does determine how much a plan will cost.

What is a carrier plan G?

Carrier Determines Medigap Rates. Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.