This is one reason for some of the cost differences among Medicare prescription drug plans. Another reason some prescriptions may cost more than others under Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What is the difference between Medicare Part A and Part D?

Medicare Part C combines the benefits of Part A and Part B, while Medicare Part D covers prescription drugs. Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses. , and its original name was Medicare+Choice.

Can the amount of Medicare Part D premiums change?

The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB]. If you have questions about your Medicare drug coverage, contact your plan.

Is part D health insurance cheaper for prescription drugs?

On the other hand, if your prescription drug costs are relatively low, a traditional Part D plan may be cheaper. Paying 25% of a $15 prescription is only $3.75 after you meet the plan’s deductible.

How does Medicare Part D work with TRICARE?

How Part D works with other insurance. Most people with TRICARE who are entitled to Medicare Part A must have Medicare Part B to keep TRICARE prescription drug benefits. If you have TRICARE, you don’t need to join a Medicare Prescription Drug Plan. For active-duty military enrolled in Medicare, TRICARE pays first.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

How are Part D premiums determined?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

Do all Part D plans cost the same?

The amount varies by plan. Often Part D coverage uses a tiered cost-sharing structure. This means you'll pay a different price for different categories of drugs. In general, you'll pay more in copays or coinsurance for brand-name drugs and less for generics.

How are Medicare Part D drug prices determined?

Under the lock-in approach, a Part D plan agrees to pay a PBM a set rate for a particular drug. The PBM then negotiates with pharmacies to obtain the lowest possible price for the drug, which often is lower than the amount the PBM receives from the plan.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the standard Medicare Part D premium for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the Medicare Part D premium for 2022?

$33Medicare Part D Premium Will Increase in 2022. The Centers for Medicare and Medicaid Services (CMS) recently announced that the projected 2022 Medicare Part D monthly premium will average at $33. This is an increase from $31.47 in 2021.

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Can you use GoodRx with Medicare?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

How much is Medicare Part B?

If you’re new to Medicare in 2017 (and none of the other reasons above apply to you), then your Part B premium of $134 will be taken directly out of your Social Security check.

How long does Medicare Part B premium stay on Social Security?

However, when you’re not drawing income yet, you get billed for Medicare Part B for three months at a time. But, if your bill is over $800, then….

How much did Medicare start out at in 2015?

Now look at someone new to Medicare in 2015. They started out at $104.90. There was no Social Security increase in 2016, so they continued paying $104.90 last year while new folks paid $121.80. This year their increase was also 0.3%, so their Part B premium also increased a few bucks.

How many employees are required to have Part B?

Even if you had coverage through an employer group plan and there were less than 20 employees working at that employer, you’ll likely have a Part B penalty. The longer you went without Part B coverage, the larger your penalty will be.

Can you qualify for Medicare Savings Program?

You Qualify for a Medicare Savings Program. If your income and/or financial resources are below certain amounts, you may qualify for one of the Medicare Savings Programs. With some of these programs, your resident state can actually pay most, or all, of your Part B premium for you.

Can Social Security payments get smaller?

You see, there is a rule called the Hold Harmless provision that basically says your Social Security check can’t get smaller due to a Medicare premium increase. Folks new to Medicare in 2016 started paying $121.80 for Part B.

Can you get Medicare if your income is below certain amounts?

If your income and/or financial resources are below certain amounts, you may qualify for one of the Medicare Savings Programs. With some of these programs, your resident state can actually pay most, or all, of your Part B premium for you.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

How many premiums do you have to make for Medigap?

If you join a Medigap policy and a Medicare drug plan offered by the same company, you may need to make 2 separate premium payments for your coverage. Contact your insurance company for more details.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you pay extra for a Social Security plan?

The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check. If the amount isn’t taken from your check, you’ll get a bill from Medicare or the Railroad Retirement Board.

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

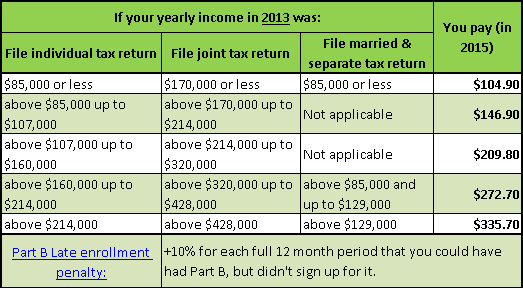

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Does Social Security pay Part D IRMAA?

Social Security will contact you if you have to pay Part D IRMAA, based on your income. The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB]. If you have questions about your Medicare drug coverage, contact your plan.

How many people are covered by Medicare Part D?

According to the Kaiser Family Foundation (KFF), Medicare Part D plans covered prescription medication costs for 45 million citizens of the United States in 2019. This article discusses Medicare Part D plans, coverage, and costs. It also looks at enrollment periods, penalties, and options for people on a limited income.

What is a Part D plan?

Most Part D plans list covered prescription drugs. The plan classifies drugs into tiers or levels that relate to cost. To pay for these medications through Part D, a person will generally pay coinsurance, copays, and a deductible. Private insurance companies, rather than federal or state offices, offer Part D plans.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much is the gap in Medicare 2020?

After Medicare and the plan holder spend a specified amount on drug costs, they enter a temporary gap in cover. In 2020, the amount is $4,020, which may increase to $4,130.00 in 2021.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What happens if a doctor doesn't include a medication in the formulary?

If doctors prescribe medications that the formulary does not include, they can request an exception. They must send a formal letter to the Part D provider explaining why their patient needs the specific medication. Medicare decides on an individual basis if they will allow the exception.

What is the difference between Medicare Part C and Medicare Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

How much does Medicare Part D pay?

The individual pays approximately 25% of the cost of prescriptions, and Medicare Part D pays the remaining 75%. If a person reaches the “ catastrophic coverage ” amount, they pay 5% of the cost of prescriptions. This feature of the plan helps individuals with high out-of-pocket prescription expenses.

What are the requirements to be eligible for Medicare Part C?

In general, a person must meet two requirements to be eligible for Medicare Part C: They must be enrolled in original Medicare, and they must live in an area where an insurance company offers Medicare Part C. During a person’s IEP, they are eligible for Medicare Part C.

What happens when you join a prescription plan?

When a person joins a prescription plan, the insurance company calculates the penalty and adds it to the premium. Generally, this penalty forms part of the premium for as long as the person has a Medicare prescription plan.

When is Medicare Part D available?

However, these changes are possible during the annual OEP that runs from October 15 to December 7. Medicare Part D is available for everyone during their IEP for original Medicare. Private insurance companies sell Medicare Part C and Part D.

How long can you be without Medicare Part D?

The company can charge a penalty when a person is without Medicare Part D for 63 continuous days or longer after the initial enrollment period (IEP) ends.

What is Medicare Part A and Part B?

Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses.

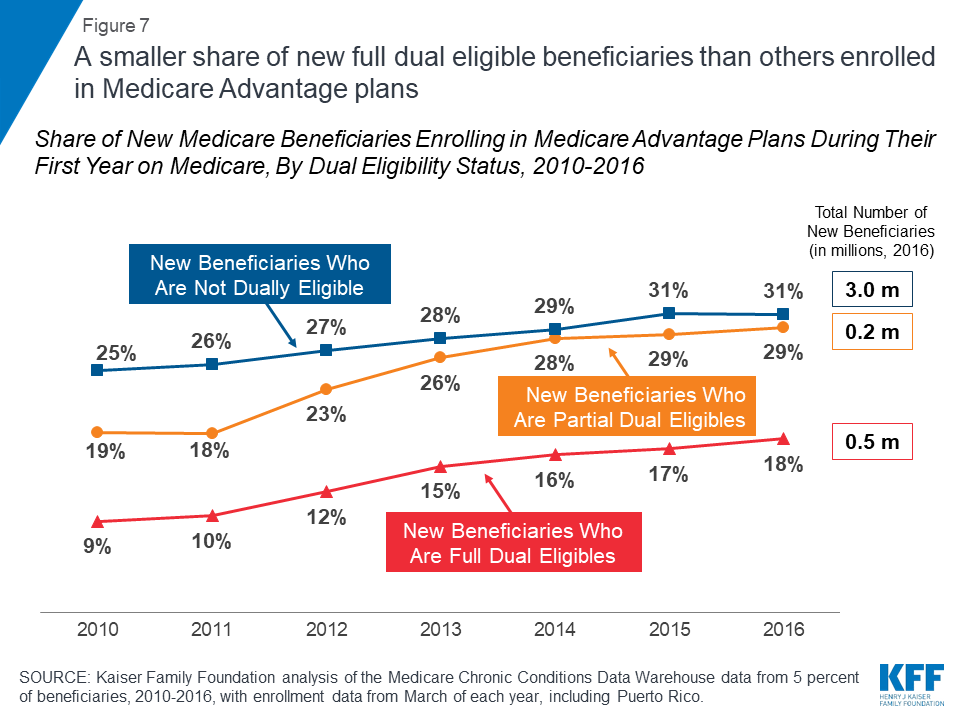

Why do people choose Medicare Advantage over Part D?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not. But MA plans aren’t necessary for everyone, and you may be fine with original Medicare ...

What is a Part D plan?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400. It increases to $405 next year. Once you meet the deductible, you’ll pay 25 percent for the cost of your prescriptions while the plan pays for the remainder until you meet your plan’s coverage limit.#N#The initial coverage limit is $3,700 in 2017 and will increase to $3,750 in 2018. Once you hit the coverage limit, you’ll be stuck in a situation known as the “donut hole,” or coverage gap, a scenario that the Affordable Care Act has been working on addressing by giving seniors additional discounts while they’re in the gap.

Why are Advantage plans better than Original Plans?

Advantage plans come with their own separate premium costs, but benefits can be better for a lot of people because Advantage plans are more comprehensive than original plans. Many MA plans provide prescription drug coverage, usually requiring beneficiaries to pay a set copay.

How to contact Medicare Advantage?

Medicare Part D vs. Medicare Advantage Plans. For more information on Medicare, please call the number below to speak with a healthcare specialist. 1-800-810-1437. Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations.

Can you get a donut hole with Medicare Part D?

With low prescription costs, you may never reach the donut hole. Choosing between Medicare Part D and a Medicare Advantage plan with drug coverage comes down to cost and long-term benefit. Evaluate your medication needs, talk to your doctor and make a list of questions to ask a qualified Medicare specialist.

Who is eligible for Medicare Part D?

Anyone who is eligible for Original Medicare benefits is also eligible for prescription drug coverage plans, or Medicare Part D. Medicare Prescription Drug Plans (PDPs) and Medicare Advantage plans with prescription drug coverage provide beneficiaries with coverage that helps them pay for brand-name and generic drugs.

What are the other Medicare plans that include prescription drug benefits?

There are also other Medicare health plans that include prescription drug benefits like PACE (programs of All-Inclusive Care for the Elderly) and Medicare Cost Plans.

What is a formulary in health insurance?

Every private health insurance company offering prescription drug plans has its own list of covered drugs, called a formulary. On the formulary, the covered drugs are further separated into tiers. Drugs categorized on tier one are mainly generic drugs which carry the lowest copayment. Drugs on tier two are brand-name drugs which are preferred drugs ...

Does Medicare cover prescription drug plans?

federal law requires that all insurance companies that offer these prescription drug plans provide at least the standard level of coverage as it is defined by Medicare, they have the option to offer different combinations of coverage and cost sharing.

How many Medicare Part D plans are there?

There are nearly 1,000 different stand-alone Medicare Part D plans, according to the Kaiser Family Foundation. Each plan maintains a formulary that classifies drugs into several tiers with different levels of coverage. Generic drugs, in the lowest tier, typically cost just a few dollars each, while specialty drugs in the highest tier may require copayments of 25% to 33% of their cost.

What to consider when choosing between Part C and Part D?

In choosing between Part C and Part D, consider whether you want coverage for other types of medical care and if you have other insurance that covers prescription drugs.

How to lower the price of prescription drugs?

Lower the price of your prescription drugs by choosing a drug plan with a formulary that includes your medications.

What is the average deductible for Part D insurance in 2021?

For 2021, the average deductible for Part D plans is $350, while for Part C drug plans the average is $102.

What is the cutoff for Medicare Advantage 2021?

To qualify in 2021, individuals must have less than $19,320 in annual income; for a married couple, the cutoff is $29,520. People who have Medicare Advantage policies are not eligible for Extra Help.

Does Medicare cover dental?

In addition, Medicare Advantage plans often cover prescription drugs as well as dental, vision, and hearing care. However, people with Medicare Advantage plans are typically limited to a network of doctors that accept their insurance, while those with Original Medicare can go to any doctor that accepts Medicare (most do).

Does Medicare Advantage include Part D?

Nearly 90% of Medicare Advantage plans include Medicare Part D, but you can also purchase Part D separately if you have an Advantage plan that does not include it. About a third of Medicare beneficiaries had Medicare Advantage plans in 2019.

What is Medicare Part D?

In most circumstances, Medicare Part D, the prescription drug benefit, is optional coverage for prescription medications that you can purchase from a retail pharmacy and take at home. Part D prescription drug coverage usually comes at a monthly premium, and the cost of this premium can be affected by different factors.

How does Medicare work?

The Medicare program is designed to pay out benefits based on money taken in through taxes from those currently working. This also means that the program receives a larger amount of funding from those who are in the top earning spots.

Is Medicare Part D optional?

In most circumstances, Medicare Part D, the prescription drug benefit, is optional coverage for prescription ...

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What type of insurance is considered creditable?

The types of insurance listed below are all considered. creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage .

Is Medicare a creditable drug?

It may be to your advantage to join a Medicare drug plan because most Medigap drug coverage isn't creditable. You may pay more if you join a drug plan later.

Can you join Medicare with meds by mail?

This is a comprehensive health care program in which the Department of Veterans Affairs shares the cost of covered health care services and supplies with eligible beneficiaries. You may join a Medicare drug plan, but if you do, you won’t be able to use the Meds by Mail program which can give your maintenance drugs to you at no charge (no premiums, deductibles, and copayments). For more information, visit va.gov/communitycare/programs/dependents/champva/ or call CHAMPVA at 800-733-8387.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare cover drug costs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs.