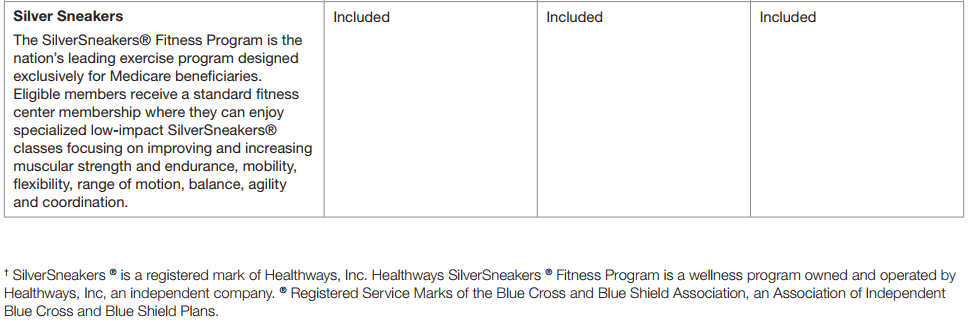

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Will My Medicare premiums go up if my income goes up?

Apr 02, 2021 · On top of the differences in price based on the plan you take, your location is a large factor. For Medigap or Medicare supplement plans, they offer the same coverage no matter where you are in the country but vary in price depending on your zip code. A Plan G for instance, is the same no matter what state you’re in.

Are Medicare Part B premiums based on income?

Feb 22, 2018 · Medicare beneficiaries whose income two years ago was above a certain amount actually pay more for Medicare. This is called an “Income Related Monthly Adjustment Amount” (IRMAA). The amount of the adjustment also varies by income. See the chart below from the Medicare.gov website. Part D varies by income as well

What factors determine the price of Medicare?

Apr 12, 2022 · You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”. The adjustment is based on adjusted gross income reported 2 years prior. The table below shows 2022 Part B premium amounts.

How are Medicare premiums calculated?

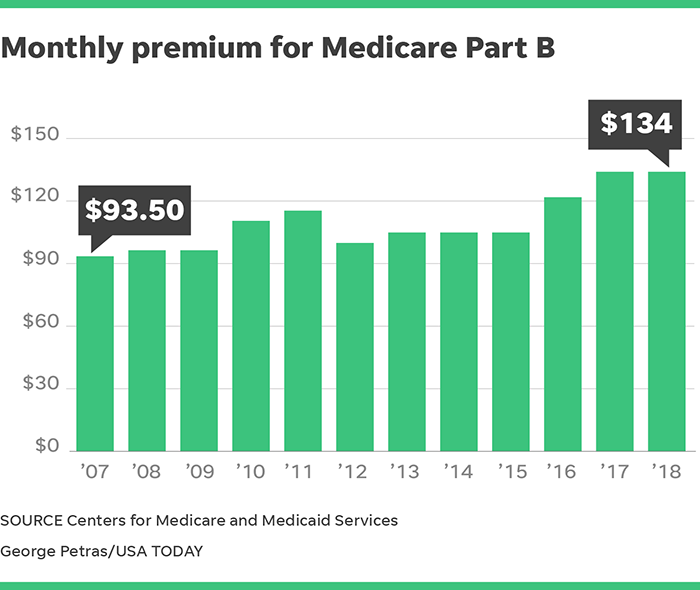

Jul 20, 2021 · The standard Medicare Part B beneficiary pays for approximately 25% of the coverage cost and the government covers the other 75%. Premiums move in correlation with inflation rates. 2021 saw a $3.90 increase to the standard premium over 2020. For this reason, even if you are paying the standard rate, your premium will fluctuate over time.

Are Medicare premiums the same for everyone?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA).

Do Medicare premiums vary by income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why is my Medicare premium higher than others?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.Nov 15, 2021

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

How is Magi calculated for Medicare premiums?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.Oct 10, 2021

Do Medicare Part B premiums change each year?

Costs for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How do I get my Medicare premium reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What is modified AGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Is Social Security included in modified adjusted gross income?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

Is Medicare Tied To Social Security?

Medicare and Social Security are both federally sponsored programs. When you begin collecting Social Security, you are automatically enrolled into Medicare. But withdrawing your Social Security benefit is not required to receive Medicare benefits.

Higher Than Standard Medicare Part B Premiums

So why may you receive a higher premium than the current standard rate? High-income earners can fall into a category of the population charged higher premiums for Medicare Part B.

What About Medicare Part A?

The average retiree is covered 100% in Medicare Part A through the federal government, meaning there are no premiums to receive hospital care.

Can You Appeal Higher Premiums?

Yes, you can appeal higher Medicare premiums. Significant life changes will be considered and your premium may be reduced if you can provide proper justification. Loss of income, change in marital status, or changes in a pension plan are all examples of situations where you are encouraged to appeal your premiums.

Stuck With Higher Premiums? What To Do Next

If you find yourself paying higher than the standard premiums, meeting with a wealth management professional is well worth your time. Creating an all-encompassing financial plan that helps you minimize your tax burden is no easy feat.

Location Determines Medigap Rates

Where you live will play a big role in how much your personal Medigap plan costs. The reason why can get a little messy and confusing, but here’s the gist: Each state has the liberty to make different legislation.

Carrier Determines Medigap Rates

Like you read earlier, a Plan G is a Plan G. This is federally regulated, so you’re able to price shop different companies and know that the coverage is exactly the same.

How Much Will It Cost Me?

You can probably see now why it’s impossible to put a “pricing” page on the internet. We’d probably be getting a lot of calls complaining about inaccurate it is. Moreover, some companies don’t even allow their rates to be quoted online. Plus, rates can change on a month to month basis.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.