Why are Medicare Part B costs so high?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

What if I have low income and can't afford Medicare Part B?

Again, if you have low income, your state may have a program that can pay your Part B premium and deductible, called a Medicare Savings Program. Note that you can't get Part B without being enrolled in Part A.

Do you have to pay a premium for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How can I reduce my Medicare Part B premiums?

There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

Does everyone pay the same amount for Medicare B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Does Medicare Part B depend on income?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI.

Why is my Medicare Part B bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Are Medicare premiums the same for everyone?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the cost of Medicare Part B in 2021?

Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Will Part B premium be reduced?

After the 2022 Medicare Part B premium was set, the manufacturer of Aduhelm™ reduced the price to an average of $26,200, and CMS finalized Medicare coverage with evidence development for Aduhelm™ and similar, future FDA-approved drugs with an indication for use in treating the Alzheimer's disease.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How do I get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is the cost of Medicare based on your income?

Medicare plan options and costs are subject to change each year. There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How much is Medicare Part B for 2017?

The basic premium for Medicare Part B for someone who signs up this year is $134 a month.

How much is Social Security premium for 2017?

[ANSWER]We'll try. The 2017 premium is officially $134, but about 70% of beneficiaries (those receiving Social Security benefits in December and not subject to high-income surcharges) will pay much less, averaging about $109. The law forbids an increase in Part B premiums to reduce January 2017 benefits below the amount received in December 2016. This means that different people will pay different premiums: last year's $104.90 plus the amount that the 2017 0.3% cost-of-living adjustment adds to their Social Security benefit. The rising premium offsets the COLA, but it can't reduce the benefit below December's level.

Can you reduce COLA benefits below December?

The rising premium offsets the COLA, but it can't reduce the benefit below December's level. Those who start receiving benefits in 2017 will pay $134 a month, because they're not protected by the "benefits can't go down" rule, unless that is, their income is high enough to trigger a surcharge.

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...

How much does it cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if you’re enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

Is working income counted in Medicare?

Certain income from working may not be counted in this estimate, as the Qualified Medicare Beneficiary program uses the supplemental security income guidelines for calculating countable income, so up to half of your working income may not be included.

Can you count your house as supplemental security income?

Some of your assets may not be counted, such as your house, car, or other household items, because this stipulation also follows the supplemental security income guidelines for countable assets.

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

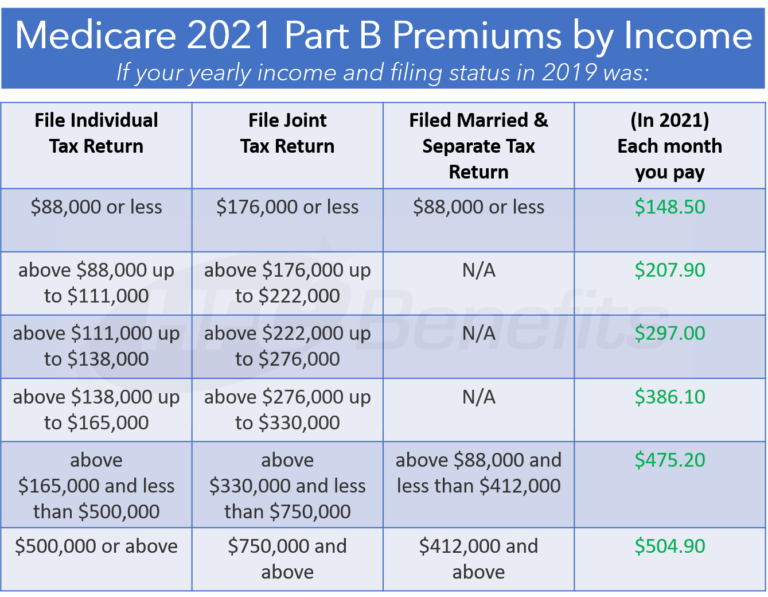

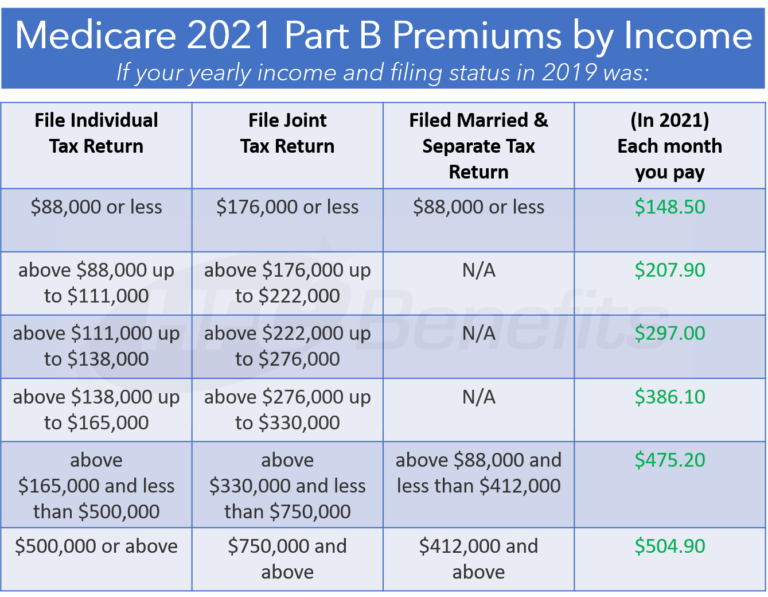

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Why did my spouse receive a settlement from my employer?

You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy or reorganization. These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

How to appeal Social Security monthly adjustment?

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration (Form SSA-561-U2) or contact your local Social Security office to file an appeal.

Does Medicare Part B premium change?

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

What is Medicare Part B?

Medicare Part B covers most of the services people expect in a health plan – such as outpatient physician visits , mental health services, lab tests, and physical therapy. It’s important to sign up at the correct time for this part of Medicare – because simple enrollment mistakes can result in gaps in coverage and lifelong premium penalties.

What is the penalty for delaying enrollment in Medicare Part B?

Those who postpone enrollment – and aren’t covered by a GHP – will owe a 10 percent Part B late-enrollment penalty (LEP) for every year they delay signing up.

How long is the Medicare Part B enrollment period?

If you meet these criteria, you’ll receive an 8-month long special enrollment period (SEP) during which you can enroll in Part B without penalty. The Medicare Part B SEP begins the sooner of when: ...

What is EGWP in Medicare?

Additionally, many employers offer retiree benefits through Employer Group Waiver Plans (EGWPs) – a type of Medicare Advantage plan. You have to be enrolled in Medicare Parts A and B to receive retiree benefits through an EGWP.

Can Medicare beneficiaries buy individual market policies?

In fact, Medicare beneficiaries are not allowed to purchase individual market policies other than Medigap plans. Many Americans are enrolled in the individual market when they qualify for Medicare – and can keep their individual market plan after becoming Medicare eligible.

Do you have to pay for Medicare if you have an individual market plan?

But once you’re eligible for Medicare, an individual market plan may pay little or nothing toward your care. This is why it’s important to enroll in Medicare (and a Medigap or Medicare Advantage plan) when you’re first eligible for the benefit.

Do large companies have to enroll in Medicare?

Employees of large companies (i.e., usually one with more than 20 employees) do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

How much is Medicare Part B?

If you’re new to Medicare in 2017 (and none of the other reasons above apply to you), then your Part B premium of $134 will be taken directly out of your Social Security check.

How long does Medicare Part B premium stay on Social Security?

However, when you’re not drawing income yet, you get billed for Medicare Part B for three months at a time. But, if your bill is over $800, then….

How much did Social Security increase in 2016?

Because there was only a 0.3% increase in Social Security income this year. Example: Let’s look at someone who got $2,000 per month of Social Security income last year, and started Medicare in 2016. If they got a 0.3% raise, their raise was $6. So, the most their Medicare premium would be allowed to increase would be $6.

How much did Medicare start out at in 2015?

Now look at someone new to Medicare in 2015. They started out at $104.90. There was no Social Security increase in 2016, so they continued paying $104.90 last year while new folks paid $121.80. This year their increase was also 0.3%, so their Part B premium also increased a few bucks.

How many employees are required to have Part B?

Even if you had coverage through an employer group plan and there were less than 20 employees working at that employer, you’ll likely have a Part B penalty. The longer you went without Part B coverage, the larger your penalty will be.

Can you qualify for Medicare Savings Program?

You Qualify for a Medicare Savings Program. If your income and/or financial resources are below certain amounts, you may qualify for one of the Medicare Savings Programs. With some of these programs, your resident state can actually pay most, or all, of your Part B premium for you.

Can Social Security payments get smaller?

You see, there is a rule called the Hold Harmless provision that basically says your Social Security check can’t get smaller due to a Medicare premium increase. Folks new to Medicare in 2016 started paying $121.80 for Part B.