If you get benefits or help from your state Medicaid program paying your Medicare premiums, you need to join a Medicare drug plan for Medicare to cover your drugs. You automatically qualify for Extra Help with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Do I need a Medicare Prescription Drug Plan for Medicare?

If you get benefits or help from your state Medicaid program paying your Medicare premiums, you need to join a Medicare Prescription Drug Plan for Medicare to cover your drugs. You automatically qualify for Extra Help with your prescription drug costs.

How do Medicare Prescription Drug Plans work?

How do Prescription Drug Plans work? If you have Original Medicare benefits, you are eligible to enroll in a Prescription Drug Plan. If you enroll in a standalone plan, you pay a monthly premium that is independent of your Part B monthly premium.

Does Medigap Cover my Prescription drugs?

If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums. Call your Medigap insurance company for more information. Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs.

How much does a Medicare prescription drug plan cost?

According to the national average for 2020, the monthly base beneficiary premium for a Medicare prescription drug plan is $32.74. For most people who are enrolled, this cost is just a fraction of what they might spend on prescription drugs without this coverage.

Does Medicare require you to have a drug plan?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

Do I need Medicare Part D if I have Medicare Advantage?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

What is the advantage of having Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I use GoodRx if I have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How long can you have opioids on Medicare?

First prescription fills for opioids. You may be limited to a 7-day supply or less if you haven’t recently taken opioids. Use of opioids and benzodiazepines at the same time.

What is the purpose of a prescription drug safety check?

When you fill a prescription at the pharmacy, Medicare drug plans and pharmacists routinely check to make sure the prescription is correct, that there are no interactions, and that the medication is appropriate for you. They also conduct safety reviews to monitor the safe use of opioids ...

What happens if a pharmacy doesn't fill a prescription?

If your pharmacy can’t fill your prescription as written, the pharmacist will give you a notice explaining how you or your doctor can call or write to your plan to ask for a coverage decision. If your health requires it, you can ask the plan for a fast coverage decision.

Does Medicare cover opioid pain?

There also may be other pain treatment options available that Medicare doesn’t cover. Tell your doctor if you have a history of depression, substance abuse, childhood trauma or other health and/or personal issues that could make opioid use more dangerous for you. Never take more opioids than prescribed.

Do you have to talk to your doctor before filling a prescription?

In some cases, the Medicare drug plan or pharmacist may need to first talk to your doctor before the prescription can be filled. Your drug plan or pharmacist may do a safety review when you fill a prescription if you: Take potentially unsafe opioid amounts as determined by the drug plan or pharmacist. Take opioids with benzodiazepines like Xanax®, ...

Does Medicare cover prescription drugs?

In most cases, the prescription drugs you get in a Hospital outpatient setting, like an emergency department or during observation services , aren't covered by Medicare Part B (Medical Insurance). These are sometimes called "self-administered drugs" that you would normally take on your own. Your Medicare drug plan may cover these drugs under certain circumstances.

Does Medicare require prior authorization?

Your Medicare drug plan may require prior authorization for certain drugs. . In most cases, you must first try a certain, less expensive drug on the plan’s. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

What is the next phase of Medicare coverage?

The next phase of your coverage is called your initial coverage phase.

How much does Medicare Advantage cost in 2020?

In the case of a standalone plan, you also pay a set annual deductible. As of 2020, the amount can be no more than $435.00 per year.

What is the tier 3 drug coverage?

Tier three includes non-preferred, brand-name drugs with a higher copayment than tier two. The initial coverage phase has a limit of $4,020.00 as of 2020. If you reach this amount you move into the next phase. The coverage gap phase begins when you reach the dollar limit set in your initial coverage phase as mentioned above.

Is it cheaper to take prescription drugs at home?

Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions and illnesses than ever before. If you are considering getting a Medicare Part D plan to help with the expense of prescription drugs, you may want to know how these plans work.

Does Medicare cover prescriptions?

Original Medicare benefits do not cover prescription drug costs unless the drugs are part of inpatient hospital care or are certain drugs that your health care provider administers in a medical facility. Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

Does a lower tier drug cost less?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions. I don't have many drug costs now, but I want coverage for peace of mind and to avoid future penalties. Look at Medicare drug plans with a low monthly. premium.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

What happens if you don't have prescription drug coverage?

If you don’t have that “Minimum Standard Prescription Drug Coverage”, there is a penalty that is enacted for the months you don’t have that Prescription Drug Coverage, if you decide to enroll later.

Does GoodRx filter pharmacies?

When you enter a medication on the GoodRx website, it searches all the pharmacies and all the deals available, and based on your zip code, will filter the pharmacies near you. If you do not enter your zip code, you can scroll down through the pharmacies to find your best deal locally and then go to that pharmacy.

Is Goodrx a Medicare plan?

GoodRx is NOT insurance. If you have Medicare you have a requirement to be enrolled in an approved (creditable) Prescription Drug Plan. If you choose to not have a creditable drug plan, you are accruing a penalty for every month you are without Prescription Drug Coverage.

Is GoodRx better than insurance?

There are situations where the GoodRx price is better than your insurance coverage price. You cannot use both; it is one or the other! Usually when our doctors call in or email medications to the pharmacy, the pharmacy fills them using your last known insurance.

Why does my employer not need Medicare?

If he does not need Medicare, the only reason I can think of is that your insurance is part of a larger group policy. Sometimes, smaller employers participate in affinity programs (say, through a trade group or local chamber of commerce) that allows their plan to be regulated as a large-employer plan.

Why did Medicare drop my insurance?

In one case, a person’s private Medicare Advantage insurer dropped them from coverage, because her Medicare number had changed and no longer appeared in their records as being a plan member. They were able to fix the problem, but it took a long time and was very stressful.

What happens to Medicare when you turn 65?

Medicare becomes the primary payer of covered claims, and your employer plan becomes the secondary payer.

Does Medicare change Social Security?

Phil Moeller: This change in Medicare numbers occurs when a person with a Medicare number begins claiming Social Security benefits based on the earnings record of another person. It is not supposed to affect either party’s Social Security or Medicare benefits in any way.

Does Medicare coverage change when it converts to a new SSN?

However, the start date of entitlement to the Medicare coverage on the old record does not change when it converts to the new SSN.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is the state pharmaceutical assistance program?

State Pharmaceutical Assistance Program. Each state decides how its State Pharmaceutical Assistance Program (SPAP) works with Medicare prescription drug coverage. Some states give extra coverage when you join a Medicare drug plan. Some states have a separate state program that helps with prescriptions.

What type of insurance is considered creditable?

The types of insurance listed below are all considered. creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage .

What is a long term care pharmacy?

Long-term care facility. Long-term care pharmacies contract with Medicare drug plans to provide drug coverage to their residents. If you're entering, living in, or leaving a nursing home, you'll have the opportunity to choose or switch your Medicare drug plan.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you keep a medicaid policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it. If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums.

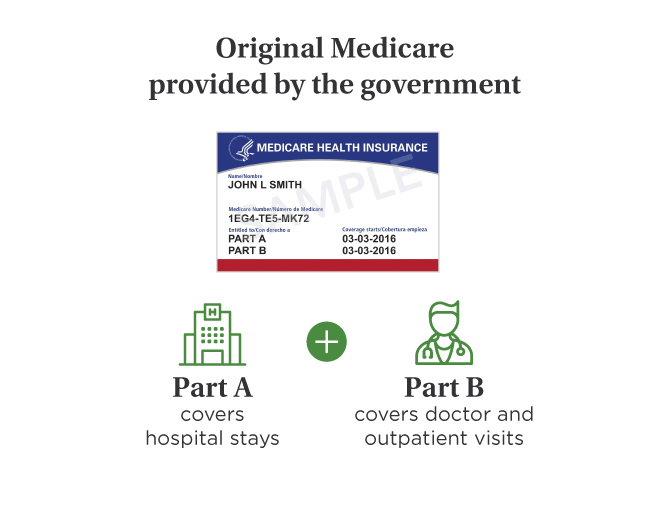

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1