What is the difference between Obamacare and Medicare?

Unlike Obamacare, coverage under Original Medicare is provided specifically by the federal government. Only people aged 65 and up and certain younger people with qualifying disabilities (like End-Stage Renal Disease) are eligible to be on Medicare.

How will Obamacare affect Medicare spending?

Over the next 20 years, Obamacare will reduce Medicare spending by about $716 billion, and those savings will be redistributed into the Medicare program itself to reduce wasteful spending. You’re entitled to all of the same rights and benefits as other American citizens when it comes to healthcare.

How much does Obamacare cost?

Cost of Obamacare depends on your age, income, family size, where you live, and choice of plan. Insurance in some states may be more expensive than in others. A family plan is more expensive than that covering an individual or a couple. The benchmark plan is the Silver plan offered in your area.

Do you need more coverage than Medicare affords you?

And if you think you need more coverage than Medicare affords? There are other options available to senior citizens and people with certain medical conditions within the Medicare system. You could enroll in a Medicare Advantage Plan or buy Medigap supplemental insurance.

Why has Medicare become more expensive?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Can I choose Obamacare instead of Medicare?

Generally, no. It's against the law for someone who knows you have Medicare to sell you a Marketplace plan. But there are a few situations where you can choose a Marketplace private health plan instead of Medicare: If you're paying a premium for Part A.

What is the difference between Obamacare and Medicare?

What Is the Difference Between Medicare and Obamacare? Medicare is insurance provided by the federal government for people over the age of 65 and the disabled, and Obamacare is a set of laws governing people's access to health insurance.

What is the most you have to pay for Medicare?

If your filing status and yearly income in 2020 wasFile individual tax returnFile joint tax returnYou pay each month (in 2022)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 or above$77.90 + your plan premium5 more rows

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What did Obamacare do to Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

Is Medicare considered health insurance?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Is Obamacare still in effect?

Yes, the Obamacare is still the law of the land, however there is no more penalty for not having health insurance.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Does Medicare cover 100 percent of hospital bills?

Medicare generally covers 100% of your medical expenses if you are admitted as a public patient in a public hospital. As a public patient, you generally won't be able to choose your own doctor or choose the day that you are admitted to hospital.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Medicare and The Healthcare Marketplace

Confusion abounds when it comes to Obamacare. One of the things people fear most is that their insurance will change drastically if they enroll in...

Does Your Medicare Coverage Meet The Affordable Care Act’S Individual Mandate?

Under the ACA, every eligible American citizen needs to obtain health insurance or face a penalty fine issued by the IRS during their annual taxes....

Essential Healthcare Benefits For All Americans

One of the biggest concerns among Medicare beneficiaries is that Obamacare will alter their existing coverage, so that they won’t enjoy the same be...

The New Standard of Care For Seniors

In many ways, the Affordable Care Act improves the standard of care that those with insurance receive. And, it helps to prevent the spread of disea...

Medicare Part D: Closing The Gap of Prescription Drug Coverage

If you have Medicare Part D prescription coverage, then you may be familiar with the concept of the coverage gap or “donut hole.” The coverage gap...

Medicare Budget Cuts Under The Affordable Care Act

For some people, the idea that the Affordable Care Act will be cutting approximately $716 billion from Medicare is frightening. The number can seem...

Changes to Medicare Premiums and Payments

We mentioned above that some people will have to pay a higher premium for Medicare coverage under the guidelines of the ACA. Obamacare works on the...

Medicare and Obamacare – Our Conclusion

There do seem to be many changes coming to Medicare as a result of the Affordable Care Act. However, these changes are aimed at improving the syste...

What is Obamacare?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: 1 Individual Mandate#N#One of the most-talked-about aspects of the ACA was its provision stating that everyone is required to have health insurance. Those who do not have health insurance face a tax penalty. 2 Coverage of Pre-Existing Conditions#N#Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. 3 Health Insurance Subsidies#N#Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. 4 Exchanges#N#Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA. Private health insurance companies offer policies in the marketplace and compete for the business of shoppers. Any legal citizen can purchase insurance from the exchanges, but not everyone qualifies for the low-income subsidies.

What changes did the ACA make to the health insurance industry?

Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. Health Insurance Subsidies.

What is Medicare for people over 65?

Medicare is a federal health insurance program for Americans over age 65 and certain people under age 65 who have qualifying conditions or disabilities. "Obamacare" is a nickname for the Patient Protection and Affordable Care Act of 2010 (also known as the ACA).

What are the health insurance subsidies under Obamacare?

Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. Exchanges. Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA.

What is the individual mandate?

Individual Mandate. One of the most-talked-about aspects of the ACA was its provision stating that everyone is required to have health insurance. Those who do not have health insurance face a tax penalty. Coverage of Pre-Existing Conditions.

What is Obamacare's primary intention?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: Individual Mandate.

Is Obamacare a private insurance?

Medicare is insurance provided by the federal government for people over the age of 65 and the disabled, and Obamacare is a set of laws governing people’s access to health insurance. There is no one type of policy that is considered “Obamacare.”. Under Obamacare, private insurance companies compete for business by offering affordable plans ...

How does Obamacare help people?

In many ways, the Affordable Care Act improves the standard of care that those with insurance receive. And, it helps to prevent the spread of diseases and other medical conditions to people without insurance. Medicare beneficiaries, in particular, gain valuable advantages, like being able to afford brand name prescription drugs or getting yearly colonoscopies to detect early forms of cancer. Obamacare seeks to help people stay healthier for longer by making better coverage an affordable option; this goal extends to Medicare beneficiaries. And despite the emphasis on better medical treatments and prevention, the new standard of healthcare doesn’t affect how you sign up for or receive your Medicare benefits.

What are the benefits of Medicare under the ACA?

One of the benefits included under minimum essential coverage is the ability to see your doctor for yearly screenings and wellness checkups.

What is a Medicare Part D coverage gap?

If you have Medicare Part D prescription coverage, then you may be familiar with the concept of the coverage gap or “donut hole.” The coverage gap happens when a person reaches the limit for covered prescriptions, but has to wait until he gets to the other side of the “donut” or coverage period to get covered prescriptions again.

What is the individual mandate?

Known as the “individual mandate,” it played an important role in the funding and ongoing sustainability of Obamacare. Fortunately, if you had Medicare Part A, then you met the individual mandate requirement up until this year, and you didn’t need to do anything else to prove your compliance.

Will Medicare pay for donut hole?

Essentially, Medicare will now pay for about half the cost of brand name prescription drugs for people in the donut hole. Each year, the amount that you have to pay for prescriptions while you’re in the coverage gap will decrease. By 2020, the Medicare donut hole will be closed for all intents and purposes.

Is Demetrius a Medicare beneficiary?

As a Medicare beneficiary for the last five years, Demetrius is already familiar with what Medicare covers and how his medical claims get filed. Demetrius is fairly healthy, but he does need to visit the doctor more frequently than some men his age, because he has a family history of diabetes and stroke.

Does Obamacare affect Medicare?

One of the biggest concerns among Medicare beneficiaries is that Obamacare will alter their existing coverage, so that they won’t enjoy the same benefits as before. In reality, the Affordable Care Act seeks to strengthen health insurance across the board, including Medicare.

Medicare Advantage Rates

Aside from traditional Medicare, seniors have the option to enroll in a Medicare Advantage plan. Since the passage of the ACA in 2010, membership in [hnd word=”Medicare Advantage”] has increased by 42 percent, reflecting the popularity of MA plans among Medicare beneficiaries.

Long-term Benefits for Beneficiaries

If you’re wondering whether your Medicare plan qualifies as minimum essential coverage under the law, then don’t worry. Medicare Part A counts as minimum coverage, so you won’t have to enroll in any additional insurance to meet the law’s requirement. However, Part B alone does not count as minimum coverage.

Questions About Obamacare And Its Effect on Medicare

Obamacare seeks to reform the healthcare industry in America by providing better coverage and legal protections to millions of citizens, but the goal of the Affordable Care Act can sometimes get lost in translation when it comes to programs like Medicare.

Medicare Funding and Cost Distribution

Before we go over the changes to Medicare, we’ll take a brief look at Medicare as it exists right now in the United States. For starters, you might be interested in knowing how Medicare gets funded and who operates the program. The U.S.

Wasteful Medicare Spending Comes To An End

What happens to the $716 billion savings that are taken from wasteful Medicare spending? In essence, the money will be redistributed back into the program to help fund various aspects of Medicare. From Advantage plans to prescription drug costs, the redistributed funds will help offset the cost of care for senior citizens in America.

Improvements To Medicare Under Obamacare

You may have been given bad information when it comes to the impact of the Affordable Care Act on Medicare, and we want to highlight some of the positives of Obamacare in relation to your current or future coverage. For one thing, Obamacare does not replace Medicare at all.

Does Obamacare Impact Medicare Part C?

Many people have expressed concern about Medicare Part C, also known as Medicare Advantage. Medicare Part C is an alternative to traditional or “original medicare” and in a short period of time, approximately less than ten years, medicare part C has become the primary preferred way that anyone over the age of 65 manages their healthcare benefits.

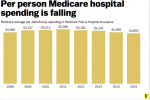

What is the purpose of the Independent Payment Advisory Board?

The purpose of the board is to oversee Medicare costs and to lower the per capita growth rate of Medicare spending.

What does the ACA do to improve Medicare?

Here are some things that the program does to improve Medicare: • The ACA (ObamaCare) closes the “donut hole” that was causing Seniors not to be able to afford their prescriptions. (The Medicare ‘donut hole’ is the Part D drug coverage limit where seniors must start paying out of pocket for their prescriptions.

How much did Obamacare cut in 2022?

ObamaCare Medicare Cuts, Changes in Medicare Spending. Over the ten year period between 2013 and 2022, ObamaCare will cut Medicare by $716 billion and spend nearly that much trying to reform it. In fact, all money cut from Medicare must be used to increase Medicare solvency, improve its services, or reduce premiums.

How much will Medicare penalties increase over the next two years?

ACA (ObamaCare) Medicare penalties and rewards will rise over the next two years to a total of 2%.

What are the Medicare cuts?

The Medicare cuts contained in the law were aimed at improving care by limiting fraud, waste, and abuse. The money saved from those cuts has been reinvested in Medicare and the ACA to improve care for seniors.

What is the ACA tax increase?

The ACA (ObamaCare) Medicare Tax Increase. The ACA (ObamaCare) implements a Medicare tax part A increase of .9% for businesses making over $250,000 in profit and employees earning over $200,000 to help pay for the improvements to Medicare.

What is the discount for Medicare Part D?

This means there’s a temporary limit on what the drug plan will cover for drugs. Seniors in the Medicare Part D “donut hole” can now get a 50% discount when buying Part D-covered brand-name prescription drugs and a 14% discount on generic drugs covered by Part D.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What percentage of poverty do you get a federal subsidy?

Fourth and fifth are your income and family size. If you make 400% or less of the federal poverty level, you will receive a subsidy. Here's how the subsidy works. Say you are a single person and you earn $47,520 (nearly 400% of the poverty level).

How much of your income do you have to pay for a silver plan?

You won't pay more than 2.06% of your income for a Silver Plan. I Make Less Than $30,350 ($62,750 for a Family of Four) - If your income is under 250% of the poverty level, you pay no more than 8.29% of income for the Silver Plan.

Which health insurance plan pays 90% of your costs?

Platinum - Pays 90% of your costs, but has the highest monthly premiums. It will make sense to pick this plan if you have a chronic health condition. The plans in each category allow you to compare monthly premiums, deductibles, copays, and annual out-of-pocket maximums. That's where it gets tricky.

Does the Affordable Care Act provide subsidies for middle-income individuals, families, and small businesses?

The Affordable Care Act provides subsidies for middle-income individuals, families, and small businesses. It also expands free Medicaid for low-income households. It taxes higher-income families and businesses that don't provide health benefits. 1. First, your cost depends on the plan category you choose.

Is a vision plan considered qualified insurance?

A vision care or discount dental plan, discount medical plan, or worker's comp is not insurance. 12. Catastrophic insurance is considered qualified insurance. But you may want to compare it to a full-coverage plan on the exchange to see if you can lower your overall health care costs.

Do you pay more for health insurance if you get sick?

You might end up paying more for health costs if you get sick than you would with a plan with a higher premium but lower deductible. So you've got to estimate how much actual health care costs will be, then determine the insurance plan that helps you cut the total cost the most. Second, your costs depend on your age.

Do you have to pay taxes on silver plan?

First, you won't have to pay the tax for not having insurance. Second, if your income is so low that you don't pay taxes, you're exempt from the tax. Third, you can still apply for insurance on the exchange. You won't pay more than 2.06% of your income for a Silver Plan.

What happens if you don't sign up for Medicare?

And if you keep your individual market exchange plan and don’t sign up for Medicare when you first become eligible, you’ll have to pay higher Medicare Part B premiums for the rest of your life, once you do enroll in Medicare, due to the late enrollment penalty.

How long does it take to get Medicare if you are not receiving Social Security?

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll have a seven-month window during which you can enroll in Medicare, which you’ll do through the Social Security Administration. Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, ...

When does Medicare coverage take effect?

If you complete the enrollment process during the three months prior to your 65th birthday, your Medicare coverage takes effect the first of the month you turn 65 ( unless your birthday is the first of the month ). Your premium subsidy eligibility continues through the last day of the month prior to the month you turn 65.

When does Medicare subsidy end?

If you enroll in Medicare during the final three months of your initial enrollment period, your premium subsidy will likely end before your Part B coverage begins, although your Part A coverage should be backdated to the month you turned 65.

When will Medicare be enrolled in Social Security?

Here are the details: If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you’ll automatically be enrolled in Medicare with an effective date of the first of the month that you turn 65. As is the case for people who enroll prior to the month they turn 65, premium subsidy eligibility ends on ...

When will Medicare be sent to you?

Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, includes the month you turn 65, and then continues for another three months. (Note that you’ll need to enroll during the months prior to your birth month in order to have coverage that takes effect the month you turn 65.

When do individual market plans end?

Individual market plans no longer terminate automatically when you turn 65. You can keep your individual market plan, but premium subsidies will terminate when you become eligible for premium-free Medicare Part A (there is some flexibility here, and the date the subsidy terminates will depend on when you enroll).

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio