There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

Full Answer

When did additional Medicare tax go into effect?

Additional Medicare Tax went into effect in 2013 and applies to wages, compensation, and self-employment income above a threshold amount received in taxable years beginning after Dec. 31, 2012. What is the rate of Additional Medicare Tax?

Is there a look-back period for Medicare premiums?

There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

Why did my Medicare premiums go up?

My Medicare premiums went up because of my income from two years ago. My income has since gone down. Is there anything I can do? Yes. You can apply to Social Security to reduce your Medicare premium in light of changed financial circumstances.

Will individuals calculate additional Medicare tax liability on their income tax returns?

Any estimated tax payments that an individual makes will apply to any and all tax liabilities on the individual income tax return (Form 1040 or 1040-SR), including any Additional Medicare Tax liability. Will individuals calculate Additional Medicare Tax liability on their income tax returns? Yes.

Does Medicare review your income every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Does Medicare look at tax returns?

In some situations, we use three-year-old data, or we base our decision on tax information you provided. We use your modified adjusted gross income (MAGI) from your federal income tax return to determine your income-related monthly adjustment amounts.

What tax year is used for Medicare premiums?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Do I have to file taxes if I am on Medicare?

In some cases, yes—you will still need to file a tax return if any of the following apply: You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What are the income limits for Medicare 2021?

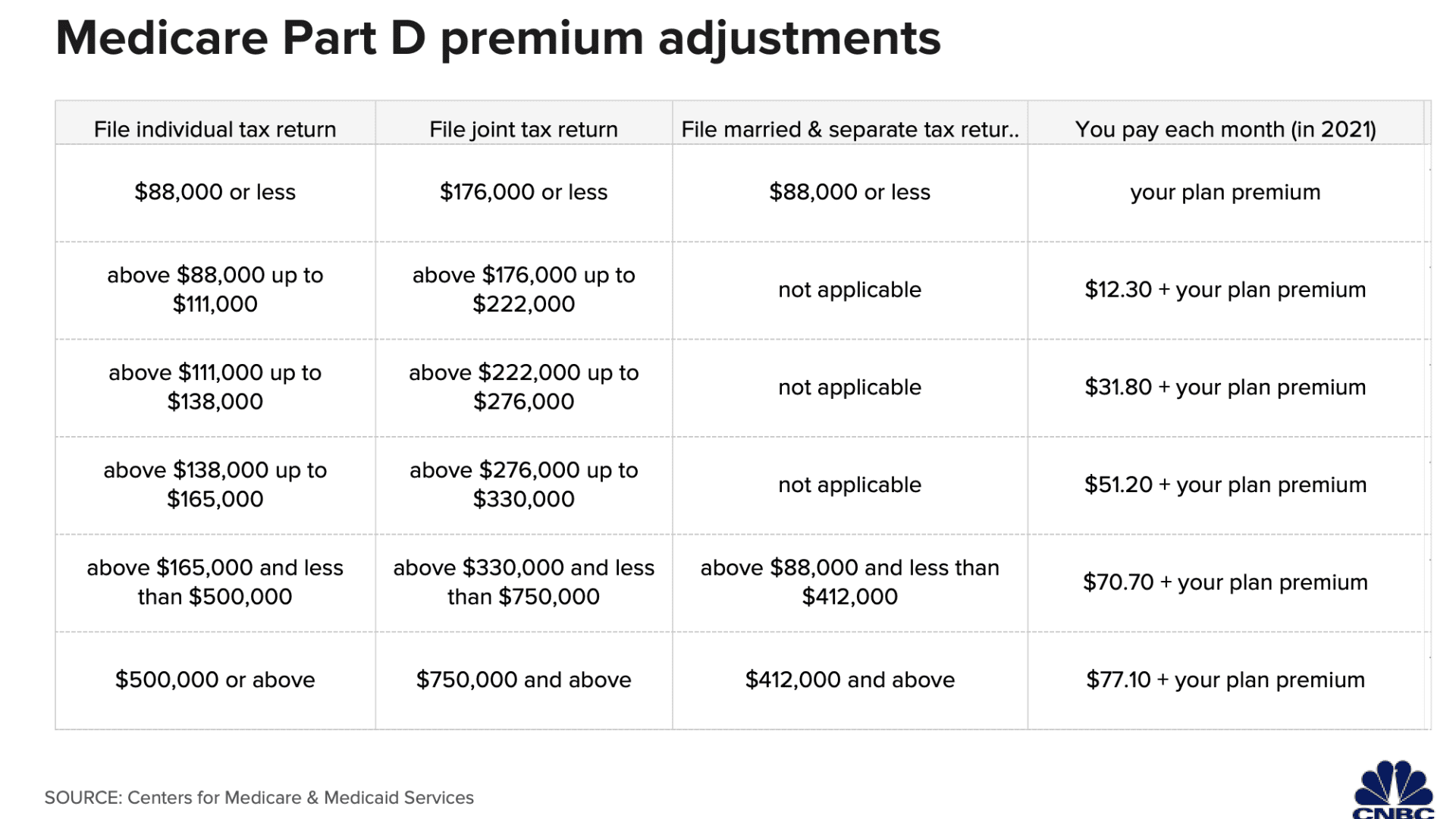

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

How long does Medicare Irmaa last?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

Does everyone pay Irmaa?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.

How to request a reduction in Medicare premium?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.

What is Social Security tax?

Social Security uses tax information from the year before last — typically the most recent data it has from the IRS — to determine if you are a “higher-income beneficiary.”. If so, you will be charged more than the “standard,” or base, premium for Medicare Part B (health insurance) and, if you have it, Part D (prescription drug coverage).

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status.

Wage Base Limits

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

Is Medicare healthy?

Not broke, but not healthy. However, that does not mean Medicare is healthy. Largely because of the inexorable aging of the Baby Boomers, program costs continue to grow. And, as the Trustee’s report forthrightly acknowledges, long-term costs could well increase even faster than the official predictions.

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

Will Medicare be insolvent in 2026?

Government Says Medicare won't be able to cover costs by 2026. Report puts Medicare insolvency sooner than forecast. Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Will MAGI income be adjusted for inflation in 2020?

The year 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). Back to top.

Does Medicare distribution increase adjusted gross income?

The amount distributed is added to your taxable income, so exercise caution when you’re receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

How many years prior to income tax do you have to pay Social Security premium?

In most cases, this information is your income two years prior to the year for which you must pay an income-related premium. If information is not yet available for the two years prior, Social Security will temporarily use information from the tax year three years prior.

Can you request Social Security to use tax information from a more recent tax year?

You may request Social Security to use the tax information from a more recent tax year under certain circumstances.