Medicare Part D In 2018 Added to the Medicare lineup in 2003, Medicare Part D is the prescription drug coverage portion. These plans are sold separately from original Medicare and cover prescription drugs. Because seniors tend to need more drug coverage as they age, Part D is a popular portion.

Full Answer

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

What is the cheapest Medicare Part D plan?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

What is the average cost of Part D?

Today, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that would make updates to the Medicare Advantage (MA) and Medicare Part D programs that would lower out-of-pocket prescription drug costs for beneficiaries with Medicare Part D and improve price transparency and market competition.

How to find the best Medicare Part D drug plan?

Why you should compare Medicare Part D plans

- The plan provides coverage for all your prescription drugs.

- You’ve evaluated the copayment and coinsurance costs for your prescription drugs.

- You’ve weighed your options between a standalone Medicare prescription drug plan (PDP) as a supplement to Original Medicare or a Medicare Advantage prescription drug plan (MAPD).

Why has my Medicare payment increased?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Did Medicare Part D go up?

The Medicare Part D total out-of-pocket threshold will bump up to $7,050 in 2022, a $500 increase from the previous year.

Why do some Part D plans cost more?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

Which factors impact Medicare Part D costs?

Part D spending depends on several factors, including the total number of Part D enrollees, their health status and drug use, the number of high-cost enrollees (those with drug spending above the catastrophic threshold), the number of enrollees receiving the Low-Income Subsidy, and plans' ability to negotiate discounts ...

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What does Medicare Part D cost in 2021?

Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021. If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what's known as an income-related monthly adjustment amount (IRMAA).

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How are Part D premiums determined?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

How are Medicare Part D drug prices determined?

Under the lock-in approach, a Part D plan agrees to pay a PBM a set rate for a particular drug. The PBM then negotiates with pharmacies to obtain the lowest possible price for the drug, which often is lower than the amount the PBM receives from the plan.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is the donut hole in Medicare?

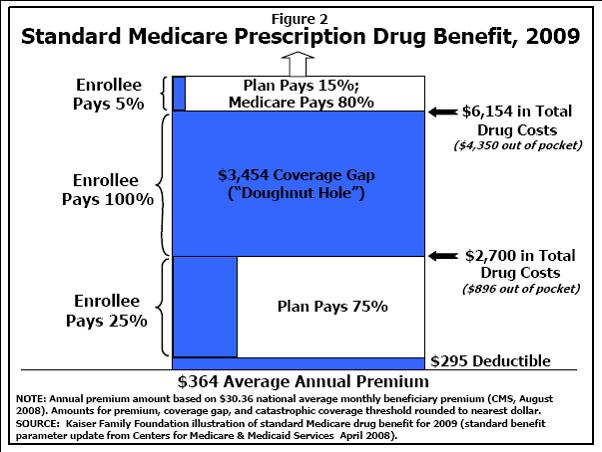

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

Why do people pay less on Social Security?

Most people pay less than the standard amount in 2017 because of the hold harmless provision under the Social Security Act. Usually, Social Security beneficiaries get a cost-of-living adjustment (COLA) to their payments each year, but in 2016, there was no COLA. The hold harmless clause protects people getting Social Security from rising Medicare costs. In 2017, there was a very small COLA of about 0.3 percent, which kept people in the hold harmless group protected from the higher standard premium. This rule doesn’t apply to new enrollees or people who don’t have Part B premiums deducted from Social Security payments.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What happens if you don't enroll in Part B?

If you don’t enroll in Part B when you first become eligible – the 7-month window that starts three months before the month you turn 65 and ends three months after that month – then you may have to pay a penalty fee if you decide to en roll later. For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B.

How many Medicare beneficiaries are in Part D?

Enrollment. More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans. This total includes plans open to everyone and employer-only group plans for retirees of a former employer or union (Figure 2). Most Part D enrollees (58 percent) are in stand-alone prescription drug plans ...

What percentage of Medicare Part D enrollees are in stand alone plans?

Most Part D enrollees (58 percent) are in stand-alone prescription drug plans (PDPs), but a rising share (42 percent in 2018, up from 28 percent in 2006) are in Medicare Advantage prescription drug plans (MA-PDs), reflecting overall enrollment growth in Medicare Advantage.

How much is the PDP premium in 2018?

Deductibles: More than 4 in 10 PDP and MA-PD enrollees are in plans that charge no Part D deductible, but a larger share of PDP enrollees than MA-PD enrollees are in plans that charge the standard deductible amount of $405 in 2018.

What is the average monthly premium for a PDP?

PDP enrollees are in plans with an average monthly premium of $41 in 2018, a modest 2 percent increase over 2017 but up by 11 percent since 2015 (Figure 5). The combined average Part D premium for PDP and MA-PD enrollees is $32 in 2018. This is lower than the average for PDPs due in part to the ability of MA-PD sponsors to use rebate dollars from Medicare payments for benefits covered under Parts A and B to lower their Part D premiums. The average MA-PD premium is $34 in 2018, which includes Part D and other benefits.

What would happen if CVS and Aetna merge?

The proposed mergers of CVS Health and Aetna, and Cigna and Express Scripts would result in further consolidation of the Part D marketplace. If these mergers go through, four firms—the two merged firms plus UnitedHealth and Humana—would cover 71 percent of all Part D enrollees and 86 percent of stand-alone drug plan enrollees, based on 2018 enrollment.

How much is the deductible for PDP?

While more than 4 in 10 PDP and MA-PD enrollees (45%) are in plans that charge no deductible, a larger share of PDP enrollees than MA-PD enrollees are in plans charging the standard deductible amount of $405 in 2018 (46% and 3%, respectively), while a larger share of MA-PD enrollees than PDP enrollees face a partial deductible amount (Table 4). As a result, the weighted average Part D deductible is higher among PDP enrollees than MA-PD enrollees in 2018 ($213 and $129, respectively).

How much is Part D PDP?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.

How much Medicare Part D coverage is there in 2018?

will increase from $4,950 in 2017 to $5,000 in 2018. begins once you reach your Medicare Part D plan’s initial coverage limit ($3,750 in 2018) and ends when you spend a total of $5,000 out of pocket in 2018.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 44% co-pay on generic drugs purchased while in the coverage gap (a 56% discount). For example: If you reach the 2018 Donut Hole, and your generic medication has a retail cost of $100, you will pay $44.

What is the increase in the cost of a generic drug?

will increase to greater of 5% or $3.35 for generic or preferred drug that is a multi-source drug and the greater of 5% or $8.35 for all other drugs in 2018. will increase to $3.35 for generic or preferred drug that is a multi-source drug and $8.35 for all other drugs in 2018.

Does Medicare Part D have a variation?

However, CMS does allow Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible). will be increased by $5 to $405 in 2018. will increase from $3,700 in 2017 to $3,750 in 2018. will increase from $4,950 in 2017 to $5,000 in 2018.