Key Takeaways:

- Original Medicare doesn’t cover all of your covered hospital and medical services.

- Medicare Supplement insurance can help you pay your copayments, coinsurance, and deductible.

- Some Medicare Supplement plans also cover other services, like health care received when you travel outside of the United States.

Full Answer

Why should I buy a Medicare supplement plan?

Sep 16, 2018 · Ten advantages of Medicare Supplement plans Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Coverage outside of the United States If you’re on vacation outside the U.S. and an accident or sudden illness happens... Guaranteed ...

Are Medicare supplement plans worth it?

Medigap is Medicare Supplement Insurance that helps fill "gaps" in . Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments

What are the top 5 Medicare supplement plans?

Why choose a Medicare supplement? Medicare supplements are popular with people who have been paying for their own health insurance before they turned 65. These folks were paying $400 – $1000 for health insurance, so when they see they can get Medicare ($104.90) plus a supplement ($147) and have no co-pays or deductibles…..well, they know this is a really good …

What is the best and cheapest Medicare supplement insurance?

Jan 12, 2021 · Medicare supplements plans were designed to fill the gap in your medical coverage left by Medicare. You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have …

What is the point of Medicare supplement plan?

Is it worth getting supplemental insurance?

What is the difference between Medicare and Medicare supplement?

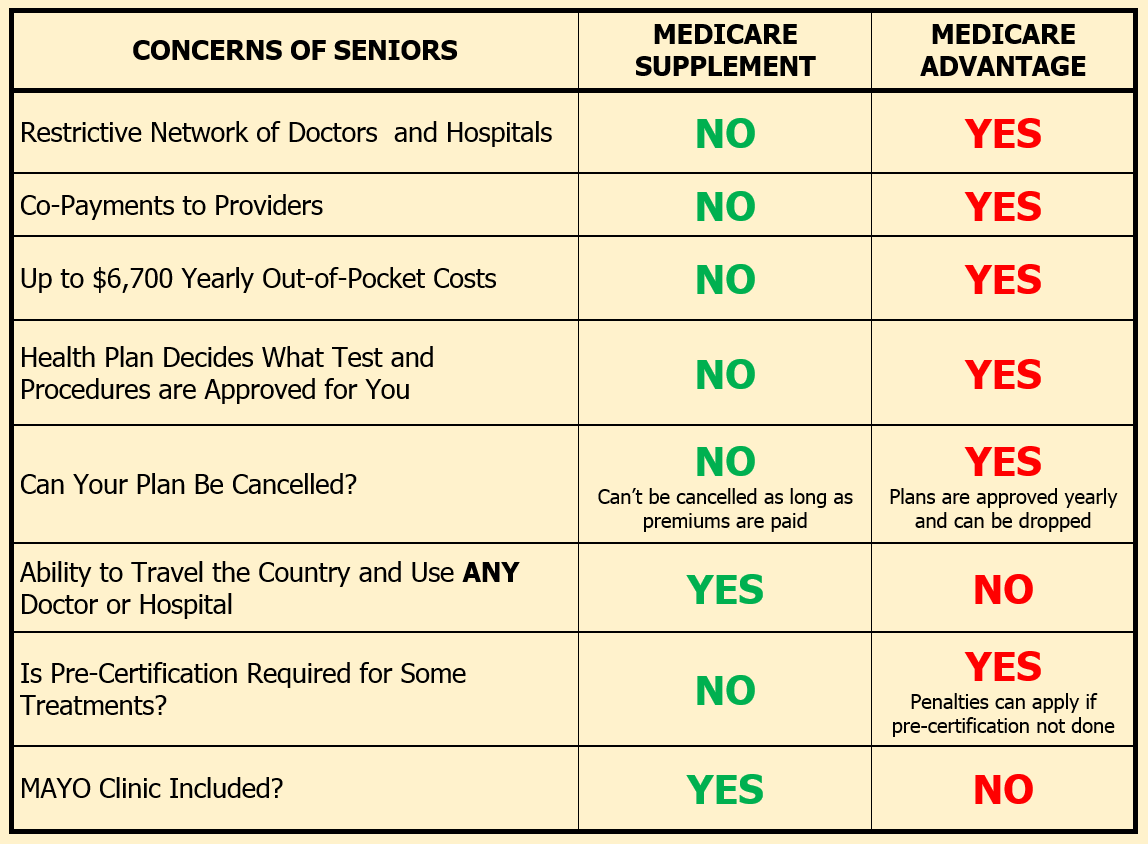

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Who might benefit from supplemental insurance and why?

Can you cash out supplemental life insurance?

Is it better to have a Medicare supplement or an Advantage plan?

Is Medigap the same as supplemental?

Can I switch from a Medicare supplement to an Advantage plan?

Does Medicare cover dental?

Why is Medigap so expensive?

Who is the largest Medicare Advantage provider?

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Does Medicare Supplement Insurance cover Part B?

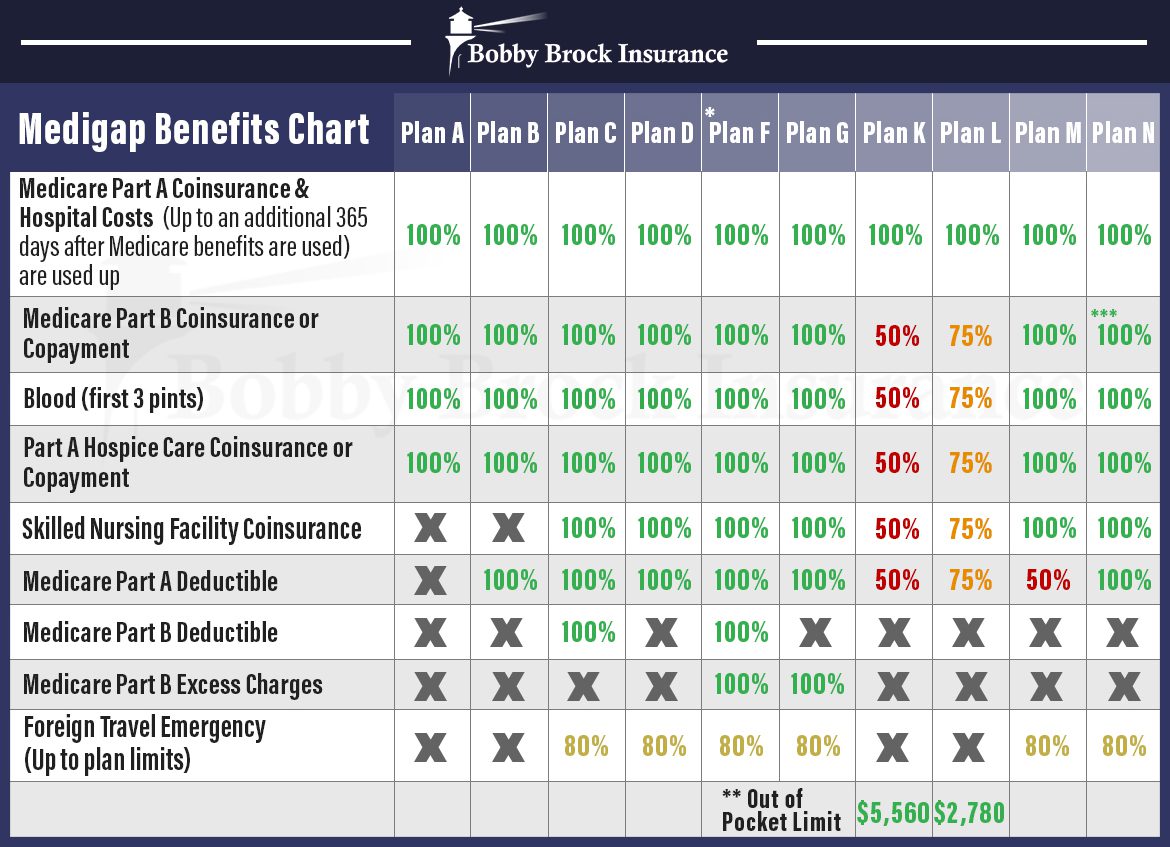

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare pay its share of the approved amount?

Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

Is it time to buy a Medicare supplement?

There are nearly 10,000 Baby Boomers turning 65 and becoming eligible for Medicare each day. You may be one of them.

10 reasons to get supplemental coverage

1. Avoid the high cost of hospitalization. There is a good chance that you will require inpatient care sometime in the future. The Part A hospital deductible is $1316. There is a per day charge of $329 for days 60-90 and a $658 per day charge for days 91+.

Why are Medicare supplements called medicap?

Medicare supplements are also known as “medigap” plans because they fill the gaps in Medicare. Medicare supplements cost more than Medicare Advantage – up front. Lately, most of my clients who are turning 65 have chosen a Medicare supplement over Medicare Advantage.

What is Plan F Medicare Supplement?

Plan F (as in “full coverage”) is the most expensive medigap plan, but it is the simplest plan. That’s because it fills all the gaps in Medicare and a person should never get a bill.

Is Medicare Advantage popular in Arizona?

And this is true. Usually, a bill results from a mistake in coding at the doctor’s office. Medicare Advantage is very popular in Arizona, with nearly 50% of Medicare beneficiaries in Pima, Pinal and Maricopa counties enrolled in these private plans.

Does Medicare Advantage cover doctor visits?

Medicare Advantage plans are popular with people who would rather take their chances that they will stay healthy and will not have the “pay as you go” costs that are part of every Advantage plan (co-pays for doctor visits, labs, therapy, hospital stays).

What is the most expensive Medicare plan?

Plan F (as in “full coverage”) is the most expensive medigap plan, but it is the simplest plan. That’s because it fills all the gaps in Medicare and a person should never get a bill. As long as Medicare pays the claim, the medigap Plan F will pay it’s part – and the patient has no co-pays.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

Does Medicare Supplement pay 100% of out-of-pocket expenses?

Many people need a Medicare supplement to help cover cost-sharing they otherwise could not afford. Plan F pays 100% of all out-of-pocket expenses. If you are looking for a comprehensive plan that will pay for everything, this one is it. Here are a few of the benefits that a Medigap plan can help pay for:

Is Medicare Part B free?

When Americans reach retirement age and start their Medicare coverage, many are shocked to realize that Medicare is not free. If you didn’t know to save for Medicare Part B premiums during your retirement, you may find that money is tight.

How long does Medicare cover hospitalization?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021. If you are in the hospital longer than 60 days, you begin paying an expensive daily copay for your hospital care. If you are in the hospital 150 days, your hospital coverage runs out altogether.

How much does Medicare pay for ER visits?

Then Part B Medicare only pay 80% of approved services. This means you are responsible for paying 20% of all your doctor visits, your ER visits, blood tests, X-rays, surgeries, durable medical equipment and even high-priced things like chemotherapy.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

Is Medicare Advantage a good plan?

For those who may find that the premium for a Medigap plan does not fit within their budget, a Medicare Advantage Plan is a good alternative. In fact, these plans were specifically created to provide Medicare beneficiaries like yourself with an alternative to Original Medicare + Medigap.

How much does Medicare pay for doctor visits?

All the standardized Medicare Supplement insurance plans generally pay for Medicare-covered doctor visit copayments at least 50%. A Medicare Supplement insurance plan could be useful if you know that you will have a lot of doctor visits. If you visit the doctor frequently, the copayments could add up. The Medicare Part B (medical care) deductible is $203 in 2021. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services. If you know that you will be visiting the doctor multiple times a month, the amount you could save on copayments by having a Medicare Supplement insurance plan could exceed the cost of the additional insurance plan.

Does Medicare cover travel abroad?

In general, Medicare doesn’t cover health care you get outside of the U.S. (Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands and American Samoa are considered part of the U. S.) Six Medicare Supplement insurance plans may help with foreign travel medical emergencies at 80% (up to plan limits): Plans C*, D, F*, G, M, and N.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

Does Medicare Supplement cover out of pocket?

Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs if you face a serious health setback.

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

Is Medicare Supplement insurance mutually exclusive?

Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are mutually exclusive; this means that you will have to choose between Medicare Advantage vs Medicare Supplement. Also, it may be illegal for a private insurer to sell you one plan knowing you ...

Is Medicare Advantage mutually exclusive?

However, Medicare Advantage and Medicare Supplement insurance plans are mutually exclusive ; this means that you will have to choose between Medicare Advantage vs Medicare Supplement. Also, it may be illegal for a private insurer to sell you one plan knowing you have the other.

Do you pay separate premiums for Medicare Part B?

You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance , and Medicare prescription drug coverage . If the above equation seems like too many pieces to put together, you may appreciate the simplicity of a Medicare Advantage plan.

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

Is it a good idea to enroll in Medicare if you already have health insurance?

Is it to your advantage to enroll in Medicare if you already have health insurance? The short answer is yes. It usually doesn’t cost anything to enroll in Medicare Part A (hospital). The vast majority of people receive Part A benefits without paying any premiums at all.

Does Medicare Part A cost anything?

The short answer is yes. It usually doesn’t cost anything to enroll in Medicare Part A (hospital). The vast majority of people receive Part A benefits without paying any premiums at all. Even if you are currently insured, you should go ahead and sign up for Medicare Part A.

How much does Medicare Part B cost?

The standard premium for Medicare Part B, however, is $90.90 per month. From there, premiums are tied to annual income, so Part B coverage can cost anywhere from $99 .90 to $319.70 monthly.

How long do you have to sign up for Medicare Part B?

You are able to sign up for Part B anytime you have current employer health coverage. Once employment ends, you will have eight months to sign up for Medicare Part B without having to pay a penalty. If you are enrolled in Medicare and another health plan, one of your insurers is the primary payer. The other is the secondary payer.

How many employees does Medicare pay first?

If you are covered under both Medicare and a current employer’s group health plan, your employer’s plan will pay first if your employer has more than 20 employees.

Is Medicare your primary payer?

If you work for a smaller company and are covered under both Medicare and your current employer’s group health plan, Medicare will normally be your primary payer. If you are covered under both Medicare and a former employer’s group health plan, Medicare is your primary payer.

What is the primary payer?

While each insurer is a payer, your primary payer is the one with the responsibility to pay first for services you receive. Your primary payer is required to pay all costs to the limits of its coverage. Once the primary payer’s obligations are met, your secondary payer does likewise.

You may not be guaranteed Medigap coverage

Lora Shinn has been writing about personal finance for more than 12 years. Her articles have also been published by CNN Money, U.S. News & World Report, and Bankrate, among others.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately).

Can You Be Denied Medigap Coverage?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Denial of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

Medigap and Medicare Advantage

If you have a Medicare Advantage (MA) plan, it’s illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after you’ve purchased a Medigap policy, you’ll probably want to drop your policy since you can’t use it to supplement your MA plan.