A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

- Copayments

- Coinsurance

- Deductibles

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

Do I really need a Medicare supplement?

You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have your credit ruined because of unpaid medical bills. Medicare supplements take care of things like co-payments, deductibles, and coinsurance that you are responsible for, and some plans even cover you if you travel outside of the United States.

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

What is the purpose of a Medicare Supplement policy?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Why is supplemental insurance necessary?

Supplemental health insurance provides an extra level of coverage by helping consumers meet out-of-pocket expenses and other costs not covered by their regular insurance. Supplemental plans serve as secondary payers, filling in coverage gaps and complementing regular insurance.

What does Medicare supplement insurance primarily cover?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

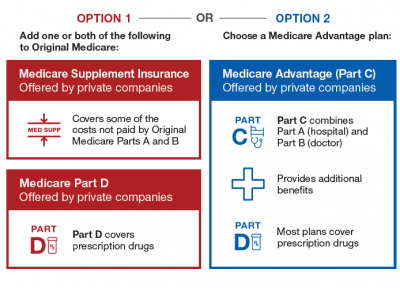

What is the difference between Medicare Advantage and Medicare supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Who would benefit from supplemental insurance?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

Do Medicare Supplement plans cover prescription drugs?

Medicare supplement plans don't include prescription drug coverage. You'll need a separate Medicare Part D prescription drug plan if you: Have a plan purchased after 2006.

Is supplemental insurance tax deductible?

Yes, your supplemental health insurance is deductible as a medical expense on Schedule A, Itemized Deductions, for Form 1040. You can deduct the amount that exceeds a certain percentage of your adjusted gross income, or AGI, and that depends on your age during the year.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for hospitalization in 2020?

You are responsible for the balance (or coinsurance). In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Can you renew a Medigap policy?

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

How long is a hospital stay for Medicare?

1. The average length of a hospitalization, even for Medicare patients, is about 5 days. Hospitalizations rarely exceed two weeks and 60-day hospitalizations are practically unheard of. Even hospitalizations for heart attacks or major surgeries rarely exceed a week. 2.

How much does Medicare pay for an MRI?

That means that Medicare pays $464 for that MRI, you pay $116, and the remainder is completely disregarded. No health care provider who accepts Medicare is allowed to go after you for any more than what Medicare approves.

How many times can you be hospitalized after retirement?

An average person might expect to be hospitalized a total of four times after they've retired. Those facts should make it clear to you that you're unlikely to ever owe more than your $1,184 deductible for a hospitalization any year you have Medicare part A. Advertisement.

Can you buy supplemental insurance with your own money?

Otherwise, if you have Medicare and buy a supplemental policy with your own money, you are effectively giving an insurance company your money so that they can keep it. Here's why: Advertisement. Supplemental insurance (they'll tell you) covers what Medicare doesn't.

Is a supplemental policy good for Medicare?

If you need at least 20 times more medical care than that every year, a supplemental policy might be a good deal. But Medicare coverage goes far beyond what almost anyone would ever need so buying a Medicare supplemental policy amounts to little more than giving an insurance company your money so that they can keep it.

Does Medicare Part B cover MRIs?

If you have Medicare Part B, it will cover 80 percent of all approved charges for doctor's office visits, blood tests, X-Rays, CT scans, MRIs and ER visits. It even covers IV medications when given at an office or hospital infusion center or a nursing home. This is after you pay a $147 deductible each year.

Does Medicare Supplemental Insurance cover outpatient care?

Unless a supplemental policy specifically states otherwise, the most it will cover are the Medicare deductibles ($147 outpatient and $1,187 hospitalization) and the 20 percent co-insurance. Supplemental policies do not usually cover any medical services Medicare won't cover. What's more, Medicare supplemental insurance will only pay health care ...

What is Medicare Supplement Policy?

So, many individuals who turn 65 purchase a Medicare supplement policy (also known as a Medigap policy) to pay for those out-of-pocket health care costs that Medicare doesn’t pay.

What is the first significant pro for Medicare Supplement?

The first significant “pro” is that all insurance companies that offer a Medicare Supplement policy have several plans to choose from, giving you choices of coverage and cost. All plan names are letters like Plan A, Plan B, Plan F, Plan N, etc.

How much does an insurance premium cost at 65?

The average monthly premium for someone age 65 ranges from about $127 to over $200 depending on the insurance company. Premiums vary from company to company. The second “con” is that your premium will most likely go up a few percentage points every year.

How long past your 65th birthday can you get supplement insurance?

The third ‘con” is that you must qualify medically for a supplement policy if you are more than 6 months past your 65 th birthday and do not have current qualifying coverage.

What age do you have to be to qualify for Medicare?

Most people qualify for Medicare when they turn 65. It covers most but not all of your health care costs. Original Medicare has two parts, Part A and Part B.

Do you have to worry about copays and deductibles with Medicare?

You will no longer have to worry about copays and deductibles of any Medicare approved costs. Another significant “pro” is that with a Medicare supplement policy, you may see any doctor or specialist that accepts Medicare. You are not subject to an HMO network and “gatekeeper” rules. For most people who compare Medicare supplement plans, ...

Do you have to pay deductible for outpatient surgery?

You will pay a deductible out-of-pocket when you enter the hospital, and you will pay about 20% out-of-pocket for doctors charges, all outpatient costs like doctor visits, lab work, tests, ambulance service, and outpatient surgeries. Generally, you will not have to pay a monthly premium for Part A, and you will pay a monthly premium ...

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

Prescription Drug Coverage

Medicare Supplement Plans have not covered prescription drugs since January 1, 2006. If you have Original Medicare and need prescription drug coverage, you should consider Medicare Part D.

Buyer Beware

A Medicare Advantage Plan is not the same as a Medicare Supplement Plan/Medigap policy. You’ll have to choose between a Medigap Plan or Medicare Advantage because you can’t have both.

You can only buy a Medicare Supplement Plan if you have Original Medicare (Parts A and B)

Some people try to sell Medigap plans illegally, so it’s important to understand when you qualify for them.

What are Medicare Supplement plans?

Under Original Medicare, which includes Medicare Part A and Medicare Part B, you get coverage from the federal government for hospital and medical expenses. However, you still have out-of-pocket costs that aren’t covered by Medicare.

How much does Medigap cost?

Medicare doesn’t cover any of the costs of a Medigap policy. For this reason, you may wonder if Medigap is worth it. Medicare Supplement plans aren’t the right choice for everyone.

Is Medigap insurance worth it?

Medigap plans can often have a steep monthly premium. Are these plans worth the money?

Medigap vs. Medicare Advantage plans

An alternative to Medigap is enrolling in a Medicare Advantage plan, also known as Medicare Part C. When evaluating your options, consider that you can’t have a Medigap policy and a Medicare Advantage plan.

How to find a Medicare Supplement policy

Are Medicare Supplement plans worth it in 2021? Depending on your health care needs, a Medigap policy can be a worthwhile investment. If you decide to get a Medigap policy, the best time to enroll is during the six-month Open Enrollment Period.

When to buy a Medigap policy

The best time to buy a Medigap Medicare Supplement Insurance (Medigap) An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare). policy is when you’re 65 (or older) and first get both Part A and Part B. You need both Part A and Part B to buy a Medigap policy.

How to buy a Medigap policy

Medigap plans are standardized, and in most cases named by letters, like Plan G or Plan K.

You may not be guaranteed Medigap coverage

Lora Shinn has been writing about personal finance for more than 12 years. Her articles have also been published by CNN Money, U.S. News & World Report, and Bankrate, among others.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately).

Can You Be Denied Medigap Coverage?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Denial of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

Medigap and Medicare Advantage

If you have a Medicare Advantage (MA) plan, it’s illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after you’ve purchased a Medigap policy, you’ll probably want to drop your policy since you can’t use it to supplement your MA plan.