Medicare Advantage vs. Medicare Supplement

| Medicare Advantage plans | Medicare Supplement plans |

| Replace Part A and Part B | Work with Part A and Part B |

| Pay for your health care | Pay your out-of-pocket costs with Origin ... |

| Usually include Part D prescription drug ... | Do not cover Part D prescription drug co ... |

| Usually cover routine vision and dental ... | Do not pay for services not covered by M ... |

Full Answer

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

Do I really need a Medicare supplement?

You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have your credit ruined because of unpaid medical bills. Medicare supplements take care of things like co-payments, deductibles, and coinsurance that you are responsible for, and some plans even cover you if you travel outside of the United States.

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the difference between Medicare Advantage and supplemental?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much do most seniors pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What are the disadvantages of a Medicare Supplement plans?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the downside to Medigap?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Can I switch from an Advantage plan to a supplement?

If you have a Medicare Advantage plan, it is against the law for a company to sell you a Medicare Supplement insurance plan, unless you are planning to switch to Original Medicare.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Do Medicare supplements cover drugs?

Medicare Supplement insurance plans typically help cover the costs associated with Original Medicare. Medicare Supplement insurance plans sold today do not cover prescription drugs. Original Medicare consists of Part A (hospital coverage) and Part B (medical coverage).

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for hospitalization in 2020?

You are responsible for the balance (or coinsurance). In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

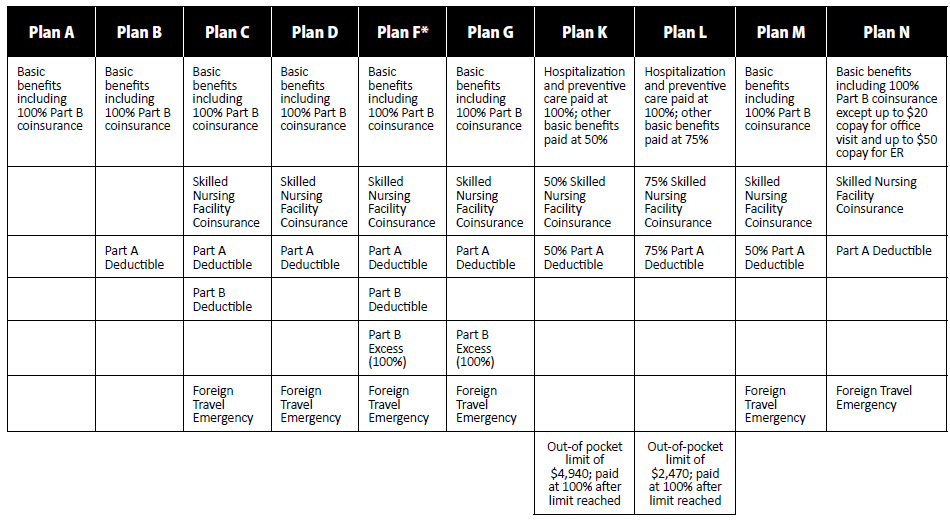

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

Can you renew a Medigap policy?

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

Why to Get Affordable Medicare Supplement Insurance Plans

If you’re currently on Medicare, you are probably keenly aware of everything that it covers. From surgery to physical therapy, this government entitlement benefit provides health insurance for Americans 65 and older who have worked into the system and are now retired.

What is Medicare Supplement Insurance?

Also known as Medigap, Medicare Supplement Insurance is sold by private companies to cover the costs that Medicare doesn’t — like copayments, coinsurance, and deductibles. If you have significant healthcare needs, Medicare Supplement Insurance can be more economically viable than paying for each non-Medicare item separately.

What about prescription drugs?

Unfortunately, the one thing Medicare Supplement Insurance doesn’t cover is prescription drug plans. These plans still have to be purchased separately under Medicare Part D.

What are some reasons to purchase Medicare Supplement Insurance?

Medicare Supplement Insurance is popular because it helps insure medical expenses that Original Medicare doesn’t cover — so if you expect to need any of services that happen to be Medicare gaps, like hospice care or foreign travel emergency care, it makes sense to buy Medigap so that these gaps are filled.

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Can you keep Plan C?

If you do, you will be “grandfathered in,” which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

Does Medicare Supplement Plan D cover prescription drugs?

But these plans are not the same thing as Medicare Part D, which is for prescription drug coverage. Medicare Supplement Plan D policies do not cover prescription drugs.

How does Medicare Supplement work?

The way a Medicare Supplement policy works, according to Medicare.gov, is it "helps pay some of the health care costs that Original Medicare doesn't cover, like: Copayments; Coinsurance; Deductibles," and these policies are sold by private companies. 3. Plus, Medicare Supplement policies give you options.

Is United American a Medicare Supplement?

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.

What are Medicare Supplement plans?

Under Original Medicare, which includes Medicare Part A and Medicare Part B, you get coverage from the federal government for hospital and medical expenses. However, you still have out-of-pocket costs that aren’t covered by Medicare.

How much does Medigap cost?

Medicare doesn’t cover any of the costs of a Medigap policy. For this reason, you may wonder if Medigap is worth it. Medicare Supplement plans aren’t the right choice for everyone.

Is Medigap insurance worth it?

Medigap plans can often have a steep monthly premium. Are these plans worth the money?

Medigap vs. Medicare Advantage plans

An alternative to Medigap is enrolling in a Medicare Advantage plan, also known as Medicare Part C. When evaluating your options, consider that you can’t have a Medigap policy and a Medicare Advantage plan.

How to find a Medicare Supplement policy

Are Medicare Supplement plans worth it in 2021? Depending on your health care needs, a Medigap policy can be a worthwhile investment. If you decide to get a Medigap policy, the best time to enroll is during the six-month Open Enrollment Period.

What is supplemental insurance?

Supplemental insurance is extra or additional insurance that you can purchase to help you pay for services and out-of-pocket expenses that your regular insurance doesn't cover. Some supplemental insurance plans will pay for the out-of-pocket cost-sharing that goes along with your health insurance plan (ie, deductibles, copayments, and coinsurance), ...

What can you use supplemental benefits for?

The cash can be used for: Covering lost wages. Transportation related to your health condition. Food, medication, and other unexpected expenses you have due to an illness or injury.

What is hospital indemnity insurance?

Hospital indemnity insurance, also known as hospital confinement insurance, provides a cash benefit if you're confined to a hospital due to an illness or serious injury. The cash benefit, doled out either in one lump sum or as daily/weekly payments, may not start until after a minimum waiting period.

What does an accident medical policy cover?

Some of these policies may also pay for extended home care services and travel and lodging expenses for family members.

What is an accident supplement policy?

Accident supplement policies are popular with healthy people who have high-deductible insurance plans, defraying upfront premium costs while providing a "backup plan" in the unlikely event of a calamity. The money can then be used to pay the health insurance deductible.

What happens if you get sick on a critical illness insurance plan?

Critical illness plans generally have a very specific list of diagnoses that will trigger a payout. If you get seriously sick with something that isn't specifically listed on your policy, the plan won't pay you anything—even if you incur substantial out-of-pocket costs as a result of the illness.

What is lump sum benefit?

These policies may provide a lump-sum cash benefit to help you pay for additional costs that are related to your illness but not covered by your regular health plan or disability coverage. The money can then be used to pay for various expenses, including: Deductibles. Out-of-network specialists.

Why do seniors opt for Medicare Advantage?

Many seniors opt for Medicare Advantage over original Medicare because of the additional benefits associated with it . Dental care, vision screenings, and hearing aids, for example, are all non-covered services under Original Medicare, whereas Medicare Advantage plans commonly pick up their tab. And supplemental benefits are making Medicare ...

What are the benefits of Medicare Advantage 2021?

These perks include masks, thermometers, and hand sanitizer. Meanwhile, in 2021: 98% of Advantage plans will offer vision plans. 94% will cover hearing services.

What are the rules for Medicare?

Here’s what that means, under Medicare rules: 1 You have at least one condition that’s either life-threatening or that significantly impairs your function; 2 You have a high risk of hospitalization or negative health consequences; and 3 You require intensive coordination for your healthcare.

What is the benefit for homebound seniors in 2021?

Meanwhile, in 2021: Benefits for homebound seniors and those with mobility issues will also be more widely available in 2021, with 57% of Advantage plans offering meal delivery (up from 23% in 2018) and 47% offering transportation to medical appointments.

When does Medicare open enrollment start?

If you are interested in pursuing these new benefits, it pays to assess your choices during the Medicare Advantage open enrollment period, which runs from January 1 through March 31. During this window, people who are already enrolled in Medicare Advantage can switch to a different Advantage plan, including one that offers the new supplemental benefits (note that only one plan change is allowed during this window, as opposed to the fall enrollment window, when multiple plan changes are allowed).

Can you qualify for supplemental benefits if you have a chronic health condition?

If you have a chronic health condition, you may qualify for supplemental benefits if it’s determined that they’ll improve your health or function. For example, as a diabetes patient, you may qualify for cooking classes that improve your diet, thereby resulting in fewer hospital visits.

Does Medicare cover carpet cleaning?

Take an asthma patient who frequently sees a doctor or gets hospitalized for recurring attacks. If a Medicare Advantage plan were to cover the cost of a carpet cleaning or air purifier, that patient would potentially suffer fewer attacks, thereby reducing the extent to which actual medical care is needed.

What is Medigap?

The Medigap definition is easy: Medigap and Medicare Supplement are the same thing. In this article, we’ll use “Medicare Supplement” to keep things simple.

What is Medicare Part C?

Here is another easy one. Medicare Part C and Medicare Advantage are the same thing. This article will use “Medicare Advantage”. So far, so good.

What is Medicare Supplement?

Medicare Supplement is just that, a supplement to Medicare coverage. In order to use Medicare Supplement, you must have Original Medicare coverage (Medicare Parts A and B).

What plan is more affordable?

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits too —such as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

What is an Enrollment Period?

If you just became eligible for Medicare, you can enroll in a Medicare Advantage plan right away.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.