Why did my Medicare premiums go up?

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey...

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

What is the average cost of Medicare per month?

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans. While the average cost for Medicare Part C is $25 per month, it’s possible to get a Medicare Advantage plan with a $0 monthly premium.

Why are Medicare premiums increasing in 2022?

Statement from HHS Secretary Becerra: 2022 Medicare Part B Premium Increase Attributable to Alzheimer's Drug Aduhelm Will Be Adjusted and Incorporated Into Upcoming 2023 Medicare Premium Determination.

Will the 2022 Medicare premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Did Medicare premiums go up in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

Why did Medicare Part B go up for 2022?

The increases in the 2022 Medicare Part B premium and deductible are due to: Rising prices and utilization across the health care system that drive higher premiums year-over-year alongside anticipated increases in the intensity of care provided.

How much will Social Security take out for Medicare in 2022?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Why is my Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

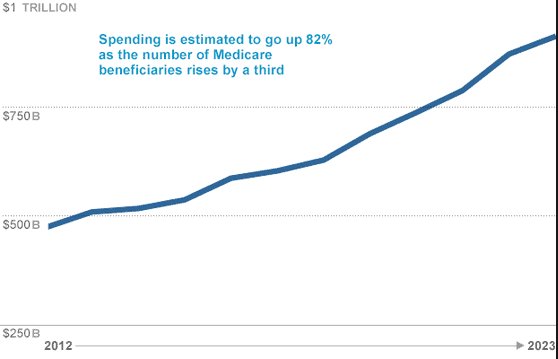

What happens when you add up Medicare taxes?

When you add it all up, you have fewer people paying Medicare taxes that support an increasing number of Medicare beneficiaries who are themselves living longer and being charged more for their care.

How does the population age affect Medicare?

As the population ages, the ratio of employed workers (who support Medicare through taxes) to retirees (who receive the benefits from those taxes) continues to shrink. The cost of health care continues to rise.

How is Medicare paid for?

Approximately 27 percent of Medicare Part B funding in 2017 came from beneficiaries’ premiums. Nearly 71 percent of Part B funding in 2017 came from general revenue, which consists mostly of federal income taxes.

What is the Medicare Hold Harmless Rule?

Your Medicare premiums aren’t the only thing that will go up each year: your Social Security benefit payment will typically also increase each year.

How to save money on Medicare?

If you’re concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs: 1 Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs. 2 Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. 3 Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare).#N#Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

How much is Medicare Part B?

The standard Medicare Part B premium increased to $135.50 per month in 2019, up from $134 in 2018.

Does Medicare Supplement Insurance cover out of pocket expenses?

Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses.

Medicare premiums set to increase in 2022

In a notice, CMS said there are five key factors behind the 2022 Part B premium increase:

How big will the increase be?

Monthly Medicare premiums for physician and outpatient services will increase by almost 15% in 2022, Modern Healthcare reports.

Advisory Board's take

CMS’s rate announcement should be viewed as a bellwether for the finances of many plans and purchasers. The two abnormal factors they cite—pandemic-related spending and Aduhelm—are massive uncertainties that CMS must proactively price into their coverage.

Why did the Medicare premium increase in 2021?

Besides Aduhelm, the CMS gave a couple other reasons for the premium increase: Higher healthcare spending attributed to COVID-19 care and compensation for the unusually low Part B premium increase – a mere $3 – in 2021, something Congress mandated because of the pandemic. Congress also mandated the CMS to compensate for that lower premium with an increase in 2022.

What is the Medicare premium for 2022?

The standard monthly Medicare Part B premium in 2022 rose to $170.10 from $148.50 in 2021 – a 14.55% jump and more than double what had been expected. Nevertheless most people with Medicare will still get more in Social Security benefits. For example, a retired worker who gets $1,565 per month from Social Security will actually get a net increase of $70.40 more per month after the newly increased Medicare Part B premium is deducted. The premium increase may increase pressure on lawmakers, embroiled in horse trading over details of Biden’s spending plans, to give Medicare the right to negotiate high-price drugs like Aduhelm.

How much does Aduhelm cost for Medicare?

The Kaiser Family Foundation in July said it conservatively estimates the cost to Medicare of Aduhelm at $29 billion in one year, based on 500,000 Medicare patients getting the new drug. For perspective, the total Medicare spending for all physician-administered drugs in 2019 was $37 billion.

Is healthcare a part of retirement?

Given that healthcare costs are a big chunk of retirement expenses it’s important to know what your financial resources are, or will be when the time comes to retire. To find out, use our free retirement calculator.

Will Medicare Part B be increased in 2022?

The surprisingly big jump in Medicare Part B premiums for 2022 reflects the sky-high cost of a controversial Alzheimer’s disease drug. The premium hike will put more than a dent in the newly increased Social Security cost-of-living allowance, which worked out to $92 a month for the average retired worker. If you’re wondering how to pay for healthcare after retirement, consider working with a financial advisor.

Why are healthcare costs rising?

One reason for rising healthcare costs is government policy. Since the inception of Medicare and Medicaid —programs that help people without health insurance—providers have been able to increase prices. Still, there's more to rising healthcare costs than government policy.

How much do healthcare costs rise each year?

According to the American Medical Association (AMA), healthcare costs are rising by about 4.5% a year. Spending on healthcare in the United States increased by 4.6% in 2019—to $3.8 trillion across the country, or $11,582 per person. This growth rate is in line with 2018 (4.7%) and slightly faster than what was observed in 2017 (4.3%). 19

What is the cost of the average health insurance premium?

The average cost of health insurance in 2020 was $456 for an individual and $1,152 for a family per month. However, this figure can vary widely depending on where you live and your healthcare needs. And no matter which type of health insurance you buy, it’s likely that you’ll see yearly cost increases. 20

How many factors were associated with healthcare increases from 1996 to 2013?

A 2017 Journal of the American Medical Association ( JAMA) study investigated how five key factors were associated with healthcare increases from 1996 to 2013: 4

Why is healthcare so expensive?

Healthcare gets more expensive when the population expands —as people get older and live longer. Therefore, it’s not surprising that 50% of the increase in healthcare spending comes from increased costs for services, especially inpatient hospital care.

How much did healthcare cost in 2019?

1. The study reported that healthcare spending in the U.S. during 2019 was nearly $3.8 trillion, or $11,582 per person.

What are the factors that affect the cost of healthcare?

A JAMA study found five factors that affect the cost of healthcare: a growing population, aging seniors, disease prevalence or incidence, medical-service utilization, and service price and intensity.

How much is Medicare Part A?

Monthly premiums for Medicare Part A recipients who paid Medicare taxes for 30-39 quarters before retirement will increase from $259 to $274. For seniors who paid Medicare taxes for fewer than 30 quarters before retirement, the full monthly premium will increase from $471 to $499. If you worked and paid Medicare taxes for 40 quarters or more, your Medicare Part A monthly premiums will still be free. Medicare Part B monthly premiums will increase from the base rate of $148.50 to a new base rate of $170.10, and scale up based on your reported income on your tax returns.

How much will Medicare Part A cost in 2022?

If you worked between 30 and 39 quarters during your employment years, you’ll only have to pay a partial monthly premium of $274 for Medicare Part A in 2022. This is a $15 increase over the previous year’s $259 partial premium. But if you worked less than 30 quarters, you’ll have to pay the full premium, which will be $499 in 2022. This is a $28 increase over the previous year’s $471 monthly premium.

What is the Medicare premium for 2022?

In 2022, the standard Part B premium will be $170.10 per month. In 2021, the Medicare Part B premium was $148.50. That’s an annual increase of $21.60.

What is the average Medicare Advantage rating for 2022?

For 2022, there was a big Medicare Advantage average star rating jump from 4.06 stars up to 4.37 stars. For Medicare Part D prescription drug plans, the overall rating keeps climbing from 3.58 in 2021 up to 3.7 in 2022.

How much is Medicare Part B deductible?

Right now, your annual Medicare Part B deductible is $203 for outpatient care. You only have to pay this once per year, and you’ll only be responsible for 20% of your Medicare-approved expenses for the rest of the year thereafter. In 2022, that price will increase to $233. That’s a $30 annual increase.

How many Medicare Advantage plans will be available in 2022?

There will be 295 plans to choose from next year, as opposed to the previous year’s 256.

How much will prescriptions cost in 2022?

The average premium cost was $31.47 in 2021. Thankfully, though, 2022 premiums will only be $33 per month on average, which is a manageable increase for the vast majority of seniors.

How does Medicare affect healthcare?

How Medicare Impacts U.S. Healthcare Costs. A recent study suggests that Medicare does much more than provide health insurance for 48 million Americans. It also plays a significant role in determining the pricing for most medical treatments and services provided in the U.S. For almost every procedure – from routine checkups to heart transplants – ...

How Are Medicare Rates Set?

Medicare compensates physicians based on the relative cost of providing services as calculated by the Resource-Based Relative Value Scale (RBRVS).

Why is correcting Medicare pricing errors important?

Economists believe that correcting Medicare pricing errors will be crucial in stabilizing healthcare costs because, in the absence of a traditional consumer market for medical services and because setting pricing is a complex and time-consuming task, Medicare forms the foundation of pricing for private insurers.

Is Medicare overspending?

Currently, the government is overspending by billions of dollars on Medicare payments. And because of the influence, Medicare has on the prices set by private insurers, these mistakes are being replicated by payers across the industry.

Does Medicare pay rates to private health insurance?

Pay rates are then opened to public and private health insurers for comment and analysis. After an agreed-upon fee is decided, Medicare applies this to all medical services.

Does Medicare pay fair prices?

For almost every procedure – from routine checkups to heart transplants – Medicare sets what it considers a “fair price” for services rendered. And because of its enormous size, Medicare’s rates seem to have a significant impact on what other insurers pay as well.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Does Medicare Part D increase with income?

Premiums for Medicare Part D (prescription-drug coverage), if you have it , also rise with higher incomes .

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...