In 2020, they increased the income categories for inflation. If you do not pay your IRMAA in a timely fashion, your Part D plan could be canceled. 3 The Donut Hole Medicare Part D is far from perfect. In fact, it has a big hole in it.

How to find the best Medicare Part D drug plan?

Why you should compare Medicare Part D plans

- The plan provides coverage for all your prescription drugs.

- You’ve evaluated the copayment and coinsurance costs for your prescription drugs.

- You’ve weighed your options between a standalone Medicare prescription drug plan (PDP) as a supplement to Original Medicare or a Medicare Advantage prescription drug plan (MAPD).

What plans are available for Medicare Part D?

- Monthly premiums

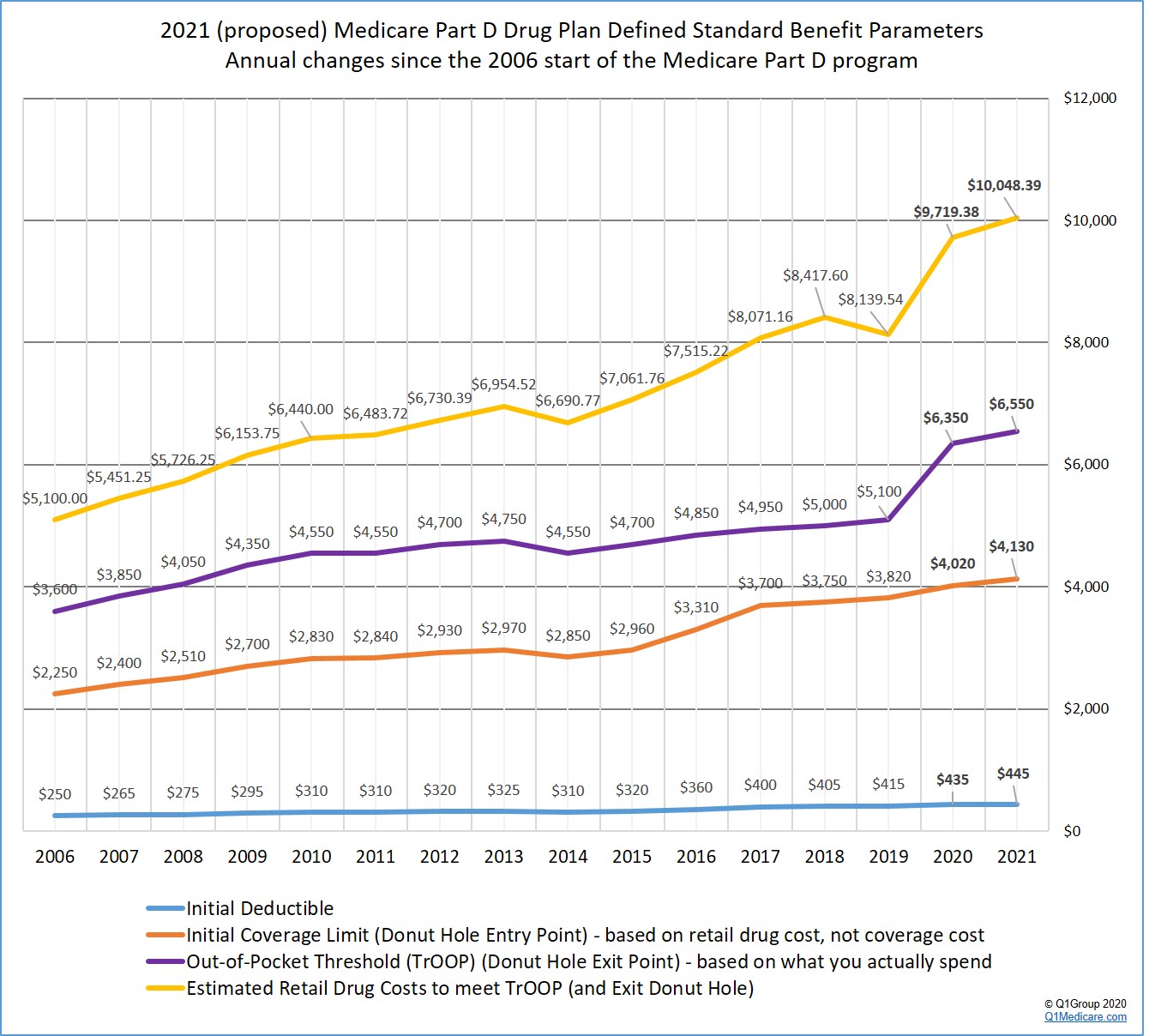

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

How to compare Medicare Part D plans?

- Biggest Medicare changes for 2022

- Medicare proposes limited coverage of controversial new Alzheimer's drug

- AARP interview: new Medicare chief outlines her vision

How do you add Part D to Medicare?

Things to Consider

- Costs for Part D plans can vary, so choose a plan that meets your needs and budget.

- Part D insurance premiums may change each year. ...

- Medicare Part D has a low-income subsidy program, and Medicare beneficiaries may qualify for financial assistance with the cost of their medications based upon their income and assets.

Why Did My Part D premium double?

Most likely, your Part D plan experienced a high loss or claim rate in your area causing them to raise prices so as to meet the increased costs. We notice that in some states, the number of prescription drug users is simply higher or increasing as compared to other states.

Why is my Medicare Part D premium so high?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Did Medicare Part D go up?

The Medicare Part D total out-of-pocket threshold will bump up to $7,050 in 2022, a $500 increase from the previous year.

What is the cost of Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the Medicare Part D premium for 2022?

$33The Centers for Medicare and Medicaid Services (CMS) recently announced that the projected 2022 Medicare Part D monthly premium will average at $33. This is an increase from $31.47 in 2021.

What changes are coming to Medicare Part D in 2021?

Summary: Changes in 2021 for Medicare Part D include:Increased IRMMA amounts.A lower national base beneficiary premium.Increased deductible.Increased threshold to enter the donut hole.Equal percentage payments for prescription and generic drugs in the donut hole.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is going on with Medicare Part D?

CMS anticipates releasing the final 2022 premium and cost-sharing information for 2022 Medicare Advantage and Part D plans in mid- to late-September 2021. The Medicare Part D program helps people with Medicare pay for both brand-name and generic prescription drugs.

What is the national average premium for Medicare Part D?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What is the average Medicare Part D premium?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium.

Who is the vice president of Medicare at Independence Blue Cross?

As Vice President of Sales and Marketing for Medicare at Independence Blue Cross, Kortney is a long-time leader accountable for marketing Medicare products and services to the communities we serve, and helping those communities enroll into the Medicare coverage they need. She is directly responsible for acquisition and member retention marketing, product development, sales operations and sales management at Independence in the Medicare area. Her goal is to deliver innovative and value driven communications, and she is passionate about enriching the connection between Independence Blue Cross and our membership.

Does Medicare cover prescription drugs?

Medicare prescription drug plan coverage and costs can vary from year to year. These changes can impact you financially. Make sure you understand the latest Medicare Part D 2020 so you can plan for any upcoming costs associated with prescription drugs.

The Four Phases of Medicare Part D

Before we look at the changes planned for 2020, you need to understand the four phases of Medicare Part D.

Medicare Part D Changes Under Current Law

The big news for 2020 is that the donut hole has closed, but what does that really mean? After all, you’re still paying 25 percent of costs.

If the Donut Hole Is Closed, Why Is There Still a Coverage Gap?

The coverage gap phase used to refer mainly to the fact that beneficiaries shouldered 100 percent of their prescription costs. However, ACA also included provisions for calculating costs that qualify you for the catastrophic coverage phase.

How Do You Enter the Donut Hole?

Medicare counts 100 percent of your prescription drug costs toward entering the coverage gap. That means that, if your prescription costs $100, even though your co-pay is only $25, the entire $100 counts toward the $4,020 cap that moves you from the initial coverage phase to the coverage gap.

How Are Costs Shared in the Coverage Gap in 2020?

For generic prescriptions, it’s much simpler: 25 percent to you, 25 percent to your plan.

Proposed Changes that Would Impact Medicare Part D

There are currently three proposals in the White House that would impact Medicare Part D.

Understanding Medicare Part D Changes in 2020

Medicare can be confusing even when nothing has changed. The licensed agents at Medicare Solutions are here to help. Just call us toll-free at 855-350-8101 to get started. The best part? It won’t cost you a cent! You can also start comparing plan options in your area with our easy-to-use online tool.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

What is a Part D plan?

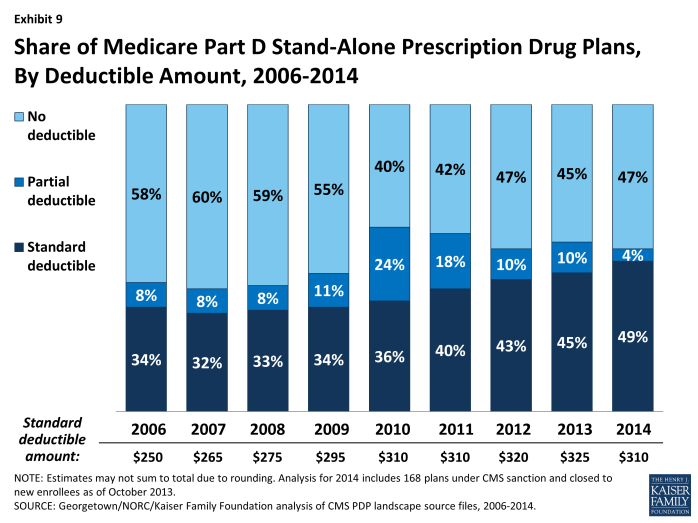

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What is the IRMAA for 2020?

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan; this is called the Part D income-related monthly adjust amount (IRMAA). For 2020, this amount is based on the recipient’s tax filing status for 2018.

Does Medicare limit copayments?

Medicare does not limit the amount plans can require for copayments and coinsurance amounts. Medicare also does not standardize how drugs are categorized into different tiers, which impacts how much the copayment or coinsurance amount for that medication may be in each tier.

How much did Medicare spend on Part D in 2019?

Since its start in 2006, Part D has undergone little change, even as Medicare spending on the prescription drug benefit has grown substantially, from $44.3 billion in 2006 to $102.3 billion in 2019. Most of this growth has been in the catastrophic phase of coverage — which begins when beneficiaries have spent $6,550 out of pocket.

How much does Part D pay for generics?

They continue to pay 25 percent of costs, while drug manufacturers pay 70 percent of costs for brand-name and biosimilar drugs and the Part D plan pays the remaining 5 percent for brand-name and biosimilar drugs, or 75 percent for generics.

Is redesigning Part D necessary?

Others argue that redesign isn’t necessary , pointing to the popularity of the Part D program and the fact that premiums have been stable for years. Opponents of the proposed changes also say they could lead to significant increases in the size of discounts manufacturers owe for certain classes of drugs.

Does Medicare Part D plan sponsor?

By shifting financial responsibility for these claims from Medicare to the plans themselves, some analysts believe that Part D plan sponsors — the organizations that contract with Medicare to offer plans — would be likely to negotiate more aggressively with drug manufacturers for better prices and formulary placement.

Does Medicare have a hard cap on drug costs?

Under current policy, Medicare beneficiaries have no hard cap on out-of-pocket drug costs. The table below lays out the similarities and differences between the three congressional proposals for redesigning the Part D program. These bills, introduced during the last Congress (116th), are the starting point for the policy debate in 2021.

How much is the Medicare deductible for 2020?

Medicare Part D deductible caps at $435 in 2020. Stand-alone Medicare Part D Prescription Drug Plans may charge an annual deductible. The federal government sets a limit on the Medicare Part D deductible each year. For 2020, a Medicare Part D plan cannot set a deductible higher than $435, which is $20 over the maximum Medicare Part D deductible in ...

What is the Medicare Part D coverage gap?

If the total cost of your prescriptions reaches a certain amount— set each year by the federal government — you pay more for your prescriptions. This is the Medicare Part D coverage gap, also known as the out-of-pocket threshold or “donut hole.”. In 2020, once you and your plan have spent $4,020 on your prescription ...

Does Medicare Part D cover outpatient prescriptions?

Medicare Part D helps cover outpatient prescription drugs. Each plan has its own formulary, or list of drugs the plan covers, so not every plan will necessarily cover the same medications. A plan’s formulary may change at any time. You will receive notice from your plan when necessary.

Does Medicare have a monthly premium?

Medicare prescription drug plans set their own monthly premium amounts. Premiums may vary depending on where you live, what plan you select, and whether you qualify for help paying your Part D premium.

Does Medicare cover insulin?

Medicare Part D also may cover some self-injected medicines, such as insulin for diabetes . But if you go to a doctor’s office or other outpatient facility to receive, for example, chemotherapy, dialysis or other medicines that are injected or given intravenously, Medicare Part B — not Part D —may help pay for those treatments.

What is the gap in Medicare Part D?

The gap in the middle is called the donut hole.#N#Over the course of several years, the ACA gradually closed the donut hole. Instead of having to pay the full cost of medications while in the donut hole , beneficiaries began paying a percentage of the cost ( this chart shows how these percentages have been changing since the ACA began closing the donut hole ). The donut hole was scheduled to close in 2020, but it closed one year early, in 2019 instead of 2020, for brand-name drugs. It was fully closed, including generic drugs, as of 2020.

How much is the donut hole in 2021?

But don’t confuse this with getting into the donut hole in the first place… to reach that limit, which is $4,130 in 2021 (up from $4,020 in 2020), the total cost of your drugs is counted, including the part you pay and the part your plan pays. So for getting into the donut hole, the amount your plan pays is counted.

How much money have seniors saved on prescriptions?

Seniors saved nearly $27 billion on prescriptions, thanks to the ACA. In January 2017, CMS announced that nearly 12 million people have saved more than $2 billion on prescription drugs since 2010, thanks to the ACA’s progress in closing the donut hole. Of that total, $5.65 billion was realized in 2016 alone.

Is the maximum deductible higher than the donut hole?

A: Yes. The maximum deductible is slightly higher, and the upper and lower thresholds for the “ donut hole ” have changed again (although the donut hole has technically closed as a result of the ACA, beneficiaries’ out-of-pocket costs can still change once they reach the lower threshold where the donut hole begins, ...

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...