What happens if you don’t pay Medicare premiums?

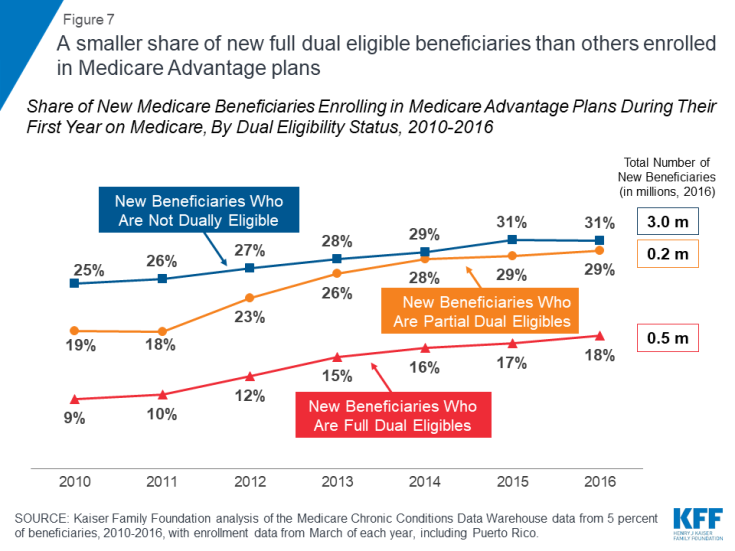

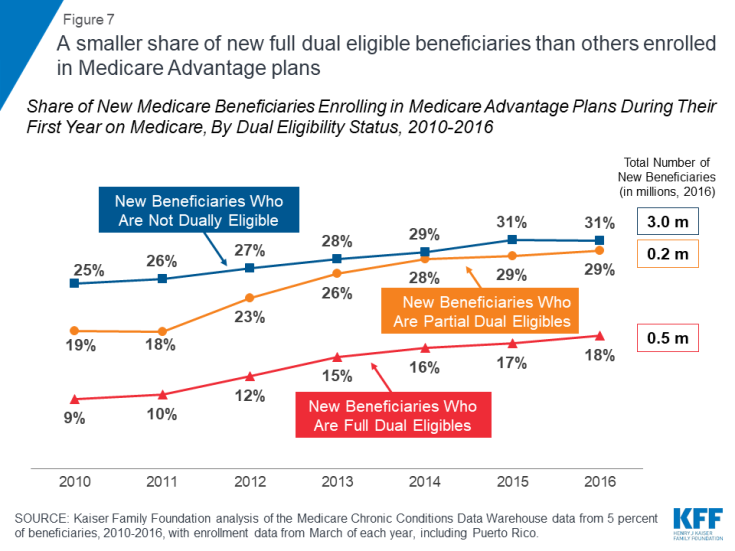

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals. This process promotes access to Medicare coverage for low-income older adults and people with disabilities, and it helps states ensure that Medicare is the first and primary payer for Medicare covered services for dually eligible beneficiaries.

How does Medicare work in North Carolina?

Jul 14, 2021 · If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment. That second bill will be due by the 25th of the following month – in this case, April 25. If your second bill remains unpaid by its due date, you’ll receive a delinquency notice from Medicare. At that point, you’ll need to send in ...

What happens if you have a delinquent Medicare premium Bill?

1. Medicare Savings Programs automatically pay the Medicare Part B premium on your behalf. 2. The doctor’s office will use your Medicare-Aid card to bill Medicaid for your medical expenses that are partially covered by Medicare. If You Have Medicare and Other Health Insurance

What happens if I miss a Medicare Part C or D premium?

Most people don't get a premium bill from Medicare because they get their Medicare Part B (Medical Insurance) premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Why would my Medicare be Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

What is the income limit for the Medicare Savings Program?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

How do I get my Medicare premium back?

In order to enroll in a Medicare Advantage plan, you'll need to be enrolled in or eligible for both Medicare Part A and B. To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium.

Can Medicare be suspended?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

Can you lose your Medicare?

If you qualify for Medicare by age, you cannot lose your Medicare eligibility.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Does Social Security count as income for extra help?

We do not count: You should contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) for other income exclusions.

What is the income limit for extra help in 2021?

You should apply for Extra Help if: Your yearly income is $19,140 or less for an individual or $25,860 or less for a married couple living together. Even if your yearly income is higher, you still may qualify if you or your spouse meet one of these conditions: – You support other family members who live with you.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Types of Medicare Coverage in North Carolina

In North Carolina, as in every state, you’re typically eligible for Medicare when you turn 65 or collect disability benefits. Most beneficiaries ar...

Local Resources For Medicare in North Carolina

1. North Carolina State Health Insurance Counseling and Assistance Program (SHIP): North Carolina SHIP staff members counsel the state’s Medicare b...

How to Apply For Medicare in North Carolina

Enrollment in Original Medicare works the same in all states. To qualify for Medicare, you must be either a United States citizen or a legal perman...

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.

When does Medicare start?

Keep track of your payments. Medicare eligibility begins at 65, whereas full retirement age for Social Security doesn’t start until 66, 67, or somewhere in between, depending on your year of birth.

What happens if you fail to pay your premium?

If you fail to make a premium payment, your plan must send you a written notice of non-payment and tell you when your grace period ends. Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan.

When is Medicare Part B due?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, is an option that provides your Original Medicare benefits through insurance companies that contract with Medicare. Many of them include prescription drug coverage; these are called Medicare Advantage Prescription Drug plans. Not every Medicare Part C plan may be available in every county in North Carolina.

What is a North Carolina Ship?

North Carolina State Health Insurance Counseling and Assistance Program (SHIP): North Carolina SHIP staff members counsel the state’s Medicare beneficiaries and caregivers on many different topics related to Medicare. The counselors also help beneficiaries and their caregivers recognize and prevent billing errors and possible Medicare fraud. To learn more about the North Carolina SHIP program, visit the North Carolina Department of Insurance website.

How long do you have to pay your insurance premiums?

If you get behind on your premiums (and you’re receiving subsidies), you’d need to fully pay premiums for all three months of the grace period in order to retain your coverage. If your coverage is terminated back to the end of the first month of the grace period due to non-payment of premiums, it’s important to note that you’re not eligible ...

How long is the grace period for Medicare?

For those without a subsidy the grace period is one month (the one-month grace period also applies to plans purchased outside the exchange, since none of those plans qualify for subsidies). For enrollees who are not receiving subsidies, if payment is not made prior to the end of the one-month grace period, coverage will be retroactively terminated ...

How long is the grace period for health insurance?

The grace period is either one month or three months long, depending on whether or not you're receiving subsidies and whether or not you've paid at least one premium so far during the year. find a plan. A TRUSTED INDEPENDENT HEALTH INSURANCE GUIDE SINCE 1994. Coverage in your state.

What happens if you don't pay Cobra?

But in general, if you never effectuate your COBRA coverage (ie, you don’t make your premium payment), there’s no debt owed to the insurer because they never actually provided any coverage. Your coverage would simply terminate back to the date that your group plan was in force with premiums paid-up.