Why Do I Need Supplement Insurance with Medicare?

- Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication and vision and dental care.

- Medicare supplement insurance covers medical services that Original Medicare doesn’t cover.

- Medigap, Medicare Advantage, and Medicare Part D are the most common examples of supplemental coverage.

Full Answer

Why should everyone have PIP insurance?

Sep 16, 2018 · Medicare Supplement (also known as Medigap and MedSupp) insurance can help downsize your Original Medicare cost burden. For example, some plans pay the Medicare Part A deductible. Ten advantages of Medicare Supplement plans Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies.

Why every senior should have a Medicare supplement plan?

Nov 20, 2021 · Supplemental Medicare policies help pay some of the shared costs baked into the Medicare system. Oftentimes people look at the monthly premiums for a Medicare supplement and want to know if the extra coverage is really necessary? And more importantly, are they worth the cost? Medicare Only Pays About 80%

What is the best and cheapest Medicare supplement insurance?

Medigap is Medicare Supplement Insurance that helps fill "gaps" in . Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments

What are the top 5 Medicare supplement plans?

Dec 16, 2021 · Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation.

What is the purpose of Medicare supplemental insurance?

Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

Is it worth getting supplemental insurance?

In addition, supplemental insurance is a great choice for you if you believe you're at risk for needing it. If you have a family history of cancer, for example, it's worth considering cancer insurance coverage, since you likely have a higher risk of being diagnosed with cancer.Dec 7, 2021

Do most people on Medicare have supplemental insurance?

Among Medicare beneficiaries in traditional Medicare, most (83%) have supplemental coverage, either through Medigap (34%), employer-sponsored retiree health coverage (29%), or Medicaid (20%).Mar 23, 2021

Is Medicare supplemental required?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What happens to supplemental life insurance when you leave a job?

Supplemental life insurance policies are generally job dependent: When you leave your job, you lose the coverage. However, some companies allow you to “port” coverage, meaning you continue to buy the group life insurance after you've left the job.Dec 20, 2021

Who might benefit from supplemental insurance and why?

With a supplemental health insurance plan, you get extra protection that helps pay for covered accidents and unexpected critical illnesses. This coverage also can help you pay for those other non-medical expenses that go along with an injury or serious illness.

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

Do I need Medigap insurance?

Most retirees have a fixed budget and can't afford to pay that much out of pocket. Without a Medicare supplement, you will not be protected from ca...

Is supplemental Medicare insurance a waste of money?

Going with just Original Medicare and no supplemental coverage is financially unwise. The coverage gaps in Medicare are considerable, leaving you t...

Is Medicare Advantage or supplement better?

A Medicare Advantage plan may be a better choice if you are exceptionally healthy or if you can get an employer-sponsored plan. The reason is that...

What is the difference between Medicare Advantage and Supplemental?

With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance. This causes great confusion for many people and it gets them in trouble.

What is Medicare Advantage enrollment?

With Medicare Advantage, enrollment and dis-enrollment are only available during certain enrollment periods. The most common of these is the annual open enrollment. In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits.

How much does Medicare cover?

A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs. The other 20 percent is paid by the beneficiary, via deductibles.

Does Medicare Advantage cover the same benefits as Original Medicare?

Your health now and in the future is a serious factor in choosing the best Medicare insurance. Sure, both Original Medicare and Medicare Advantage cover the same core major medical benefits. But, did you know that Medicare Advantage plans#N#Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medicare Part A and Medicare Part B)....#N#are not required to cover your Medicare Part A and Medicare Part B benefits in the same way as Original Medicare?

What age do you have to be to get medicare?

Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... , and most states, only require insurance companies to issue a Medigap policy, without restrictions, for a very limited time. That time is when you first turn age 65 and have a guaranteed issue right.

Is Medicare Advantage expensive?

In other words, if you are not a healthy person, Medicare Advantage can get very expensive. Private insurance companies are in business to make money, and the monthly premiums on their top insurance plans and the copayment they attach to various healthcare services reflect this.

Do you have to pay Medicare Part B premiums?

NOTE: No matter which Medicare insurance option you choose, you must continue to pay your monthly Medicare Part B premium for outpatient coverage. MA plan premiums and Medigap premiums do not replace what you owe for your Part B coverage. In other words, there’s no such thing as a free Medicare Advantage plan.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for Medicare Supplement 2020?

In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

Does Medicare Advantage cover vision?

Medicare Advantage plans cap out-of-pocket expenses. Medicare Advantage is all-encompassing, even offering dental and vision coverage (Original Medicare does not). But, you are limited to its doctor network and need referrals to see specialists.

Does private insurance cover out of pocket expenses?

Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage. Instead, they help pay for what Medicare Part A and B does not, including copays, coinsurance, and deductibles. 2 It does not affect which doctors you can see.

Does Medicare cover out of pocket medical expenses?

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs. Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs.

Why Do I Need Supplemental Insurance If I Have Medicare?

If you look at the Medicare website, they list out what you could owe out of pocket for needing care. You may be responsible for some sizable deductibles, co-payments and coinsurance costs.

How Do I Choose Medicare Supplement Insurance?

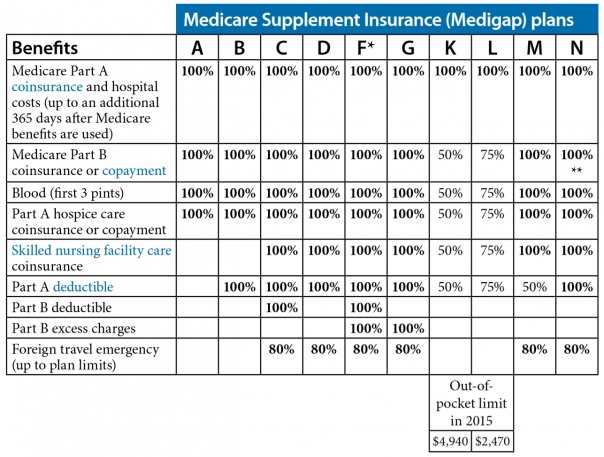

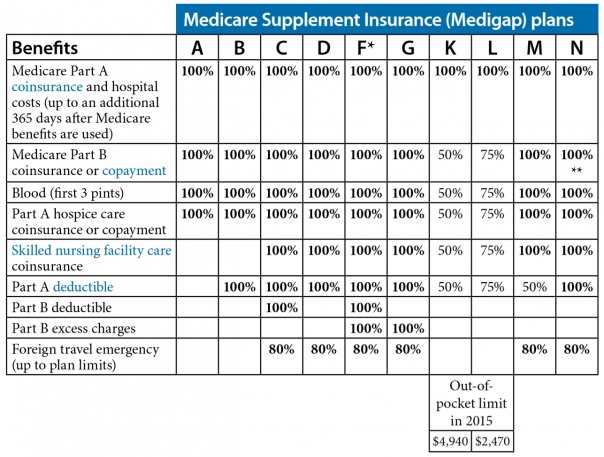

Insurance companies label Medigap plans with a letter (A through N) to show what benefits are included. For example, according to Medicare.gov, Medigap Plan F will pay for health care during foreign travel but Plan A will not.

Who Is Eligible for Supplemental Insurance?

Anyone who has Medicare Part A and Part B is eligible to apply for a Medicare supplement plan. However, you need to qualify for coverage with the private insurance company. When you first turn 65 and sign up for Medicare Part B, you have a Medigap open enrollment period that lasts six months.

Are There Any Other Considerations?

To keep your Medicare supplemental insurance coverage, you need to pay premiums throughout the year. This is an additional cost during retirement. If you don't end up needing treatment, it's possible you could pay more in premiums than the value you'd get from the policy, similar to any health insurance program.

Are There Alternative Insurance Programs?

Besides Medigap, you could also cover your retirement health insurance costs through a Medicare Advantage plan. Medicare Advantage is private health insurance. Through this program, you would leave traditional Medicare and instead have the private insurer pay for your health care bills.

The Bottom Line

As you figure out how to manage your retirement health care coverage, consider speaking with a financial representative. They can help you determine the next steps for managing health care costs in retirement.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

How much does Medicare cover?

To make things simple, Medicare covers about 80% of bills that are Medicare-approved. This leaves you with a 20% coinsurance on all Medicare-approved bills. In addition, you also have deductibles for hospital bills (Medicare Part A) and medical bills (Medicare Part B).

How much does a heart attack cost?

Many sources state that the cost of a heart attack can range from $750,000 to $1 million. With time, those costs will only continue to go up. The bills come from a mixture of: Hospitalization, Rehabilitation, Physician costs, Hospital readmission, Medications, and more.