What is the Medicare Part B copayment?

Apr 11, 2021 · Comparison. Summary. Medicare has four parts, and each one covers different healthcare costs. Part B is medical insurance. Together with Part A, which is hospital insurance, it is called original ...

How are Medicare Part C and Part D copay amounts determined?

Jul 07, 2021 · monthly premium, which is $148.50 or higher; yearly deductible, which is $203 ... meaning that you will not owe a copay for Part B services. Part C (Medicare Advantage) Under Medicare Part C, ...

What is the difference between Medicare Parts b and C?

Jan 20, 2022 · Medicare Part B. The Medicare Part B deductible in 2022 is $233 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent of ...

Why are Medicare Part B costs so high?

Your Part B premium could be higher depending on your income. Other Part B costs: There is a $203 annual deductible for Medicare Part B in 2021. After the deductible, you’ll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy. There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health …

Does Medicare Part C have copays?

Copays are a flat fee for medical services. Some Medicare Part C plans may have a higher copay for healthcare providers not in their plan (i.e., out of network). Once you calculate the added benefits of a Medicare Part C plan, you may see the value that comes with this type of coverage.

What is the difference between Part B and Part C?

Is there a copay with Medicare Part B?

What is the advantage of having Medicare Part C?

What is covered by Medicare Part C?

- doctor's appointments, including specialists.

- emergency ambulance transportation.

- durable medical equipment like wheelchairs and home oxygen equipment.

- emergency room care.

- laboratory testing, such as blood tests and urinalysis.

- occupational, physical, and speech therapy.

Why do doctors not like Medicare Advantage plans?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the average cost of supplemental insurance for Medicare?

What is the new Medicare Part B deductible for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Does Medicare Part C cover the 20%?

Does Medicare Part C replace A and B?

Who is the largest Medicare Advantage provider?

What is a copay in Medicare?

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in ...

What is covered by Medicare Part C?

Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

What is Medicare for 65?

Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions. Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

What is Medicare for seniors?

Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions . Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

Does Medicare pay for out of pocket costs?

Medicare beneficiaries are responsible for out-of-pocket costs such as copa yments, or copays for certain services and prescription drugs. There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs.

How much is Medicare Part A 2021?

You’ll have the following costs for your Part A services in 2021: monthly premium, which varies from $0 up to $471. per benefits period deductible, which is $1,484. coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay.

Does Medicare Part A have coinsurance?

coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay. These are the only costs associated with Medicare Part A, meaning that you will not owe a copay for Part A services.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

Does Medicare cover out of pocket costs?

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs. Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay ...

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

How much is the deductible for Medicare Part B 2020?

There is a $198 annual deductible for Medicare Part B in 2020. After the deductible, you’ll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy. There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

What happens if you don't enroll in Medicare Part B?

If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll. The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled. Your Part B premium could be higher depending on your income.

Why don't people pay Medicare premiums?

Most people don't pay a monthly premium for Medicare Part A because they paid Medicare taxes while they were working. However, there are costs you will have to deal with.

How much is the 2020 Part A deductible?

However, there are costs you will have to deal with. Other Part A costs for 2020: An annual deductible of $1,408 for in-patient hospital stays. A $352 per day coinsurance payment for in-patient hospital stays for days 61 to 90. After day 91 there is a $704 daily coinsurance payment for each lifetime reserve day used.

Does Medicare cover hospice care?

Medicare does not cover any room and board costs for hospice care in your home or in a nursing home if that is where you live. There is a $176 coinsurance payment for days 21 to 100 for a skilled nursing facility stay. After day 100 you are responsible for all costs. There is a 20% copay for mental health services connected with a hospital stay.

How much is the coinsurance for skilled nursing?

There is a $176 coinsurance payment for days 21 to 100 for a skilled nursing facility stay. After day 100 you are responsible for all costs. There is a 20% copay for mental health services connected with a hospital stay.

How much does Medicare cost in 2020?

Many preventive services. What it costs: Most 2020 Medicare members must pay a monthly premium of $144.60. If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

What is Medicare Part B?

Medicare Part B is offered by the U.S. government to help cover the costs of doctor visits and outpatient services. Medicare Part C is offered by private companies. It includes Medicare Part B along with Part A and often Part D. Medicare Part C can also include services not offered by Medicare, such as vision and dental.

Does Medicare Advantage have a deductible?

Your Medicare Advantage plan’s premiums, deductibles, and services can change annually. A Part C plan will bundle all of your part A and part B coverage, along with several extra services, into an all-in-one plan.

What are the different parts of Medicare?

The four parts of Medicare are: Part A: hospital services. Part B: outpatient services. Part C: Medicare Advantage. Part D: prescription drugs. Part B is a portion of your healthcare ...

What is Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, is a combination of A and B with various extras depending on plan type. Part C is sold through private companies, but it’s also partially sponsored by the government.

How much is Medicare Part B 2020?

Medicare Part B has a standard monthly premium of $144.60 for new enrollees in 2020, with a yearly deductible of $198. These amounts increase to $148.50 and $203, respectively, in 2021.

Does Medicare Part C cover prescription drugs?

Medicare Part C plans have to offer at least the same services as you would find in Medicare Parts A and B. Medicare Advantage plans typically cover prescription drugs as well, but it’s not a guarantee. Check with the plan ahead of time to make sure.

Does Medicare Advantage cover hospice?

Most Medicare Advantage plans do not offer hospice care, which is available under Original Medicare. The same goes with prescription drug coverage. While many plans will include this benefit, they do not have to include Part D in any plan. You can still purchase Part D separately if you want prescription drug coverage.

When do you enroll in Medicare Advantage?

Enroll in a Medicare Advantage plan for the first time. Beginning 21 months after you start receiving SSI or Railroad Retirement benefits and ending the 28th month you get those benefits. Already enrolled in Medicare due to disability and you turn 65. Enroll in a Medicare Advantage plan for the first time -OR-.

Is Medicare Part A premium free?

These plans do exist. Medicare Part A is premium-free for most enrollees. However, you will have cost sharing, such as the benefit period deductible of $1,408 in 2020 ($1,484 in 2021). Medicare Part B has a standard monthly premium of $144.60 for new enrollees in 2020, with a yearly deductible of $198.

How much does Medicare Advantage cost in 2021?

With Medicare Advantage, you pay a Part B premium and a premium for your Medicare Advantage plan. Premiums for Medicare Advantage average less than $30 in 2021. And as we said earlier, there are Medicare Advantage with zero dollar premiums, meaning you’ll pay nothing on top of your Part B premium for this coverage.

What are the out-of-pocket costs of Medicare?

Medicare Advantage out-of-pocket costs can include: 1 Medicare Part B premium#N#Even under Medicare Advantage, you must still pay your Part B premium (unless your plan helps pay for it). The standard Part B premium in 2021 is $148.50 per month. 2 Deductibles#N#Some plans require you to meet a deductible when seeing doctors, visiting hospitals, or getting your drugs filled. 3 Medicare copay#N#Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. 4 Premiums#N#As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $33.57 per month in 2021.

What are the benefits of Medicare Advantage?

Many are likely drawn to the unique benefits of Medicare Advantage, as compared with Original Medicare: 1 Medicare Advantage plans may often include additional benefits for prescription drugs, dental care, and vision care. 2 The average premium for a Medicare Advantage plan that offers prescription drug coverage is $33.57 per month in 2021. 2 Some plans may not have a monthly premium, and some may even help pay you back for your Medicare Part B premium. 3 Medicare Advantage, unlike Original Medicare, comes with an out-of-pocket limit, which means your out-of-pocket spending will be capped. 4 While plans are offered by private insurers, you are still guaranteed the benefits of Original Medicare.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

Does Medicare Part B increase Social Security?

The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

What is Medicare Advantage Plan?

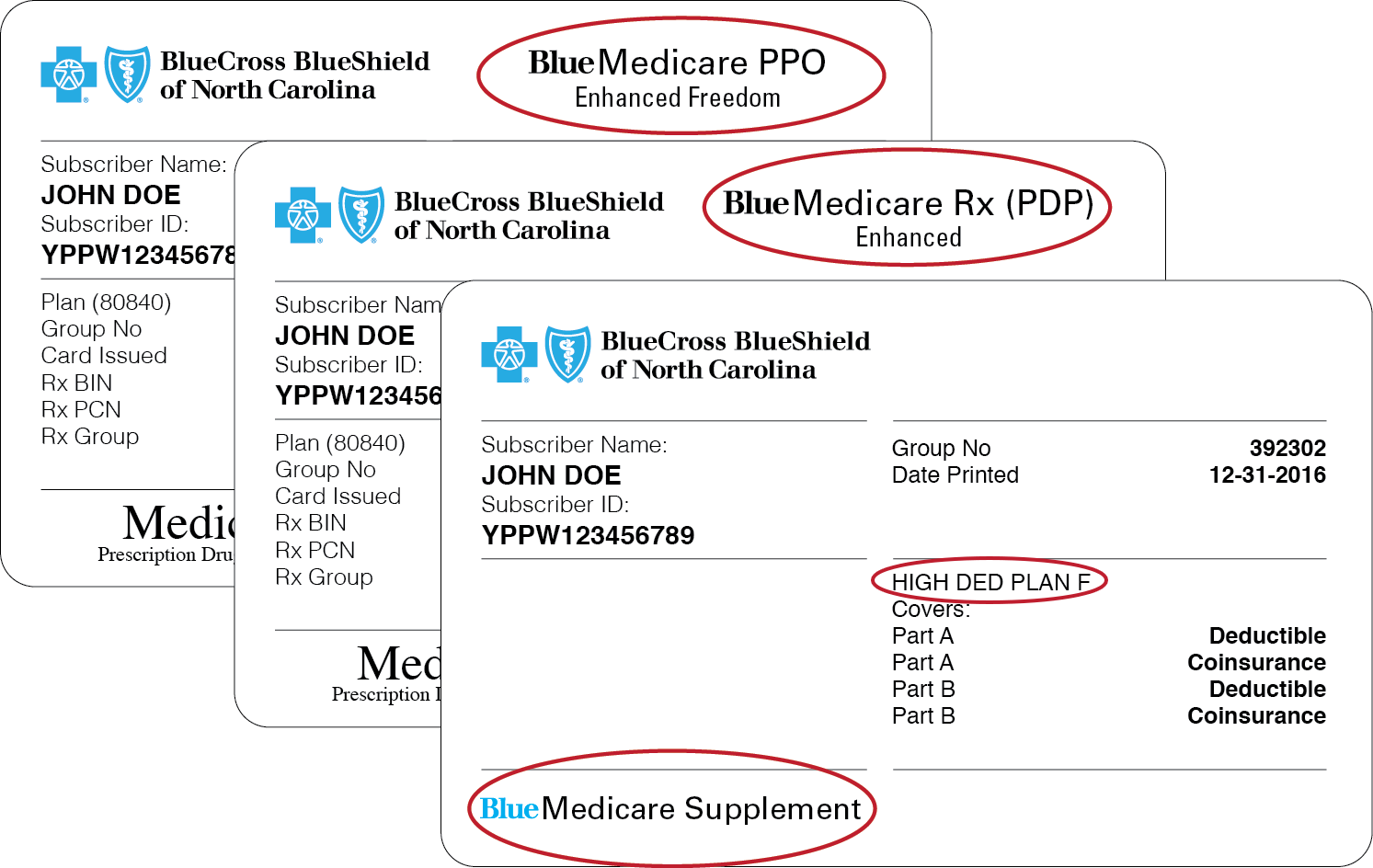

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.