What you should know about Medicare before age 65?

- You have no other health insurance

- You have health insurance that you bought yourself (not provided by an employer)

- You have retiree benefits from a former employer (your own or your spouse’s)

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

What to do before you turn 65 Medicare?

at least 3 months BEFORE you turn 65. EVERYONE WHO IS TURNING 65 should complete these tasks: Get familiar with Medicare and its “parts” To learn about Medicare, see the “ Introduction to Medicare ” fact sheet. You can also visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227); TTY users should call 1-877-486-2048.

Does one get Medicare benefits automatically at age 65?

You’ll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early. 1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

How much will Medicare cost me at age 65?

The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you’re a man and $146,000 if you’re a woman, according to one study....

What happens if you don't sign up for Medicare?

If you do not sign up for Medicare Part A or Part B when you first become eligible, you may be subject to a late enrollment penalty if you choose to sign up later on. The Part A late enrollment penalty is only applicable to beneficiaries who do not qualify for premium-free Part A (which we’ll outline below).

How long do you have to pay Medicare taxes to get premium free?

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years (40 quarters).

What is the cost of Medicare Part B in 2021?

Most beneficiaries pay the standard Part B premium of $148.50 per month in 2021. Some higher income-earners will pay more for their Part B coverage.

How much will Medicare pay in 2021?

You will pay $259 per month in 2021 for Medicare Part A if you paid Medicare taxes for between 30 and 39 quarters. If you paid Medicare taxes for fewer than 30 quarters, your Part A premium will be $471 per month in 2021. If you do not qualify for premium-free Part A, you will need to manually enroll in Medicare Part A.

What happens if you have health insurance and still work?

If you are still working and have quality health insurance provided by your employer, you can have coordination of benefits to cover your health care costs. If your employer has fewer than 20 employees, Medicare will be the primary payer.

Is it mandatory to enroll in Medicare Advantage?

It is not mandatory to enroll in Medicare Advantage plans or Medicare Part D prescription drug plans. However, Part D plans also have late enrollment penalties if you choose not to sign up but decide you want a plan later.

Is Medicare mandatory for seniors?

Health Insurance Coverage Options for Seniors. Medicare is not mandatory, but you could face late enrollment penalties for not signing up when you’re first eligible. Learn more about Medicare enrollment and how it affects you. More than 61.2 million people in the United States are Medicare beneficiaries, making it one of ...

Do You Have to Sign up For Medicare if You Are Still Working?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Can I Get Social Security and Not Sign up for Medicare?

Yes and no. Medicare Part B is optional. If you’re automatically enrolled in Medicare Part A, you will be automatically enrolled in Part B and then given the option of opting out. You may still continue to receive your Social Security benefits without having Part B.

What happens if you fail to enroll in Medicare?

If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Is Medicare a secondary plan?

Medicare would be secondary. If you were to have both Medicare and group coverage, your Medicare would supplement your group plan and may reduce some health spending. However, that might only be important to you if you have some health care spending going on and you just want more robust overall coverage.

Can you delay Medicare if you retire?

Many people enroll in Part A and delay Parts B and D until they retire. However, you may not want to delay Medicare.

Can you enroll in Medicare if you never enroll?

With that said, if you were to never enroll in Medicare, you wouldn’t end up paying those penalties. However, lasting your entire life without ever needing to sign up for Medicare is unlikely.

Is it mandatory to sign up for Medicare Part A?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage. So…the straightest answer I can give you is yes and no.

Do I have to cancel my Medicare plan?

You don’t need to cancel your private plan if you enroll in Medicare, though you may choose to do so. In most cases, Medicare will be your secondary payer, helping to cover some costs your private insurance won’t cover.

Can I have cobra and Medicare?

In some cases you can have COBRA and Medicare coverage simultaneously. If you receive COBRA coverage after enrolling in Medicare, Medicare will be your primary payer. You’ll be responsible for paying both COBRA and Medicare Part B premiums, though you’ll have the option of leaving Medicare Part B.

Who Should Enroll in Medicare at Age 65?

Many people don’t need to enroll in Medicare because it happens automatically. If you’re already receiving Social Security retirement benefits or Railroad Retirement Board benefits, then you’ll be automatically enrolled in Medicare. Do you have to sign up for Medicare at age 65 if you are still working? You don’t.

How to Enroll in Medicare at Age 65?

You become eligible for Medicare at age 65 and you should enroll as soon as possible so that your coverage begins as soon as you turn 65. Coverage begins the first day of the month you turn 65 and you can enroll as early as three months before your birthday month and up to three months after your birthday month.

Keep Proof of Enrollment

One important tip is to make sure you keep proof of your attempt at enrollment, in order to protect yourself from any late enrollment penalties should your application be lost. Print any confirmation information, note dates, times, and representatives you spoke with, and request any receipts possible in person.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

How many employees do you need to be to receive Medicare?

The law requires a large employer — one with at least 20 employees — to offer you (and your spouse) the same benefits that it offers to younger employees (and their spouses). It is entirely your choice (not the employer’s) whether to: accept the employer health plan and delay Medicare enrollment.

What happens if you don't sign up for Medicare?

Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage. It’s therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability.

How long can you delay Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare.

Is Medicare Part B primary or group?

If you enroll in both the group plan and Medicare Part B, be aware of the consequences. In this situation, the employer plan is always primary, meaning that it settles medical bills first and Medicare only pays for services that it covers but the employer plan doesn’t.

Can you delay Medicare enrollment?

You can’t delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA — by definition, these do not count as active employment. Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer.

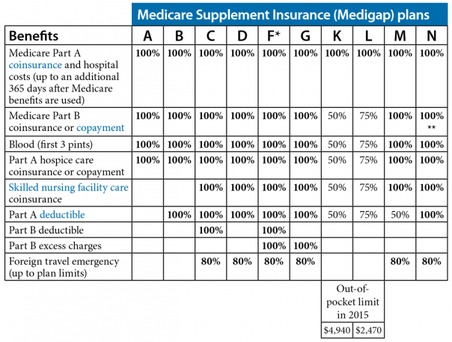

Can you sell a Medigap policy?

Insurance companies are prohibited from refusing to sell you a Medigap policy or charge higher premiums based on your health or preexisting medical conditions, if you buy the policy within six months of enrolling in Part B. Outside of that six-month window, except in very limited circumstances, they can do both.

Do you have to do anything to get Medicare?

Fact #1: Those who are already receiving Social Security benefits before age 65 will be enrolled in Medicare automatically when they turn 65. They do not have to do anything; they will get their Medicare card in the mail.

Do you have to have Medicare at 65?

Fact #2: Those who plan to enroll in Social Security at age 65 must also enroll in Medicare. In both cases (already on Social Security or just signing up for it), enrollment in Medicare, at a minimum Part A, hospital insurance, is required because it is a condition of receiving benefits. If you don’t want Medicare, ...

Is Medicare a stress?

Many people thinking about Medicare enrollment experience stress. Adding to that stress is a variety of Medicare myths and misunderstandings. Perhaps one of the biggest myths is “I must enroll in Medicare at age 65, no matter what.”. Let’s look at a few facts of Medicare enrollment. Fact #1: Those who are already receiving Social Security benefits ...