Social programs are designed to ensure the basic needs of the population. Medicare is a social program in the same fashion as Social Security, Medicaid

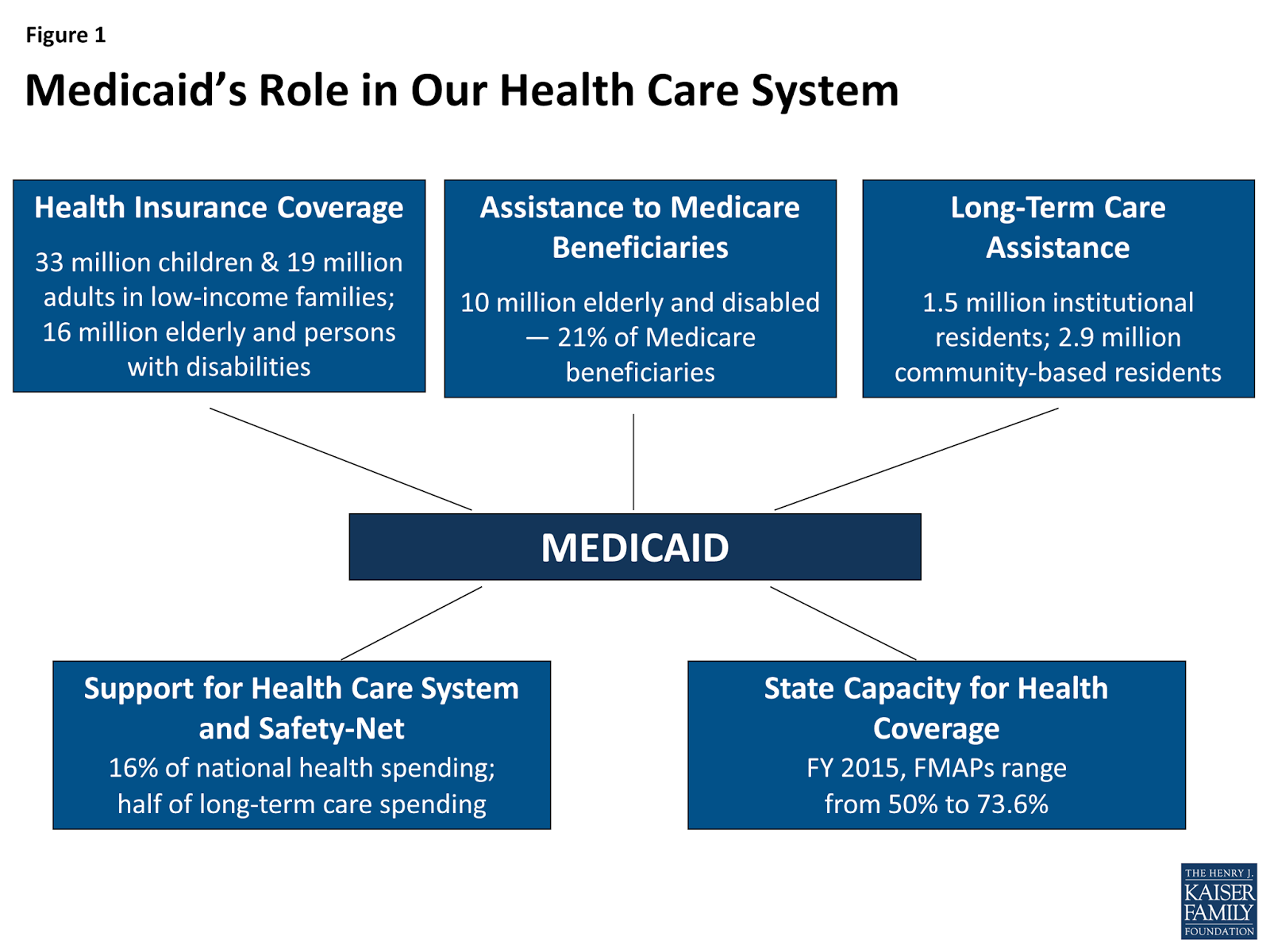

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Is Medicare a socialized healthcare system?

Deciding whether Medicare is “socialism”. When we call a health care system socialized, we need to clarify what part of the system we are talking about. For example, Canada has a socialized payment system, which they (unoriginally) call Medicare. But Canada doesn’t have a socialized provider system.

What is the difference between social security and Medicare?

Social Security and Medicare are federal programs for Americans who are no longer working. Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How does Social Security affect my Medicare eligibility?

If you’re receiving Social Security benefits, you’ll be automatically enrolled in Medicare once you’re eligible. Medicare premiums can be deducted from your Social Security benefit payment.

Is Medicare and Social Security a government handout?

Let’s get our facts straight: Medicare and Social Security were paid for by the recipients during the years they worked and is not a government handout as the writer is suggesting. Review your paycheck under deductions for clarification. Take a look at how Venezuela is doing today after years of socialism. Is that what you’re hoping for?”

Is Medicare a social policy?

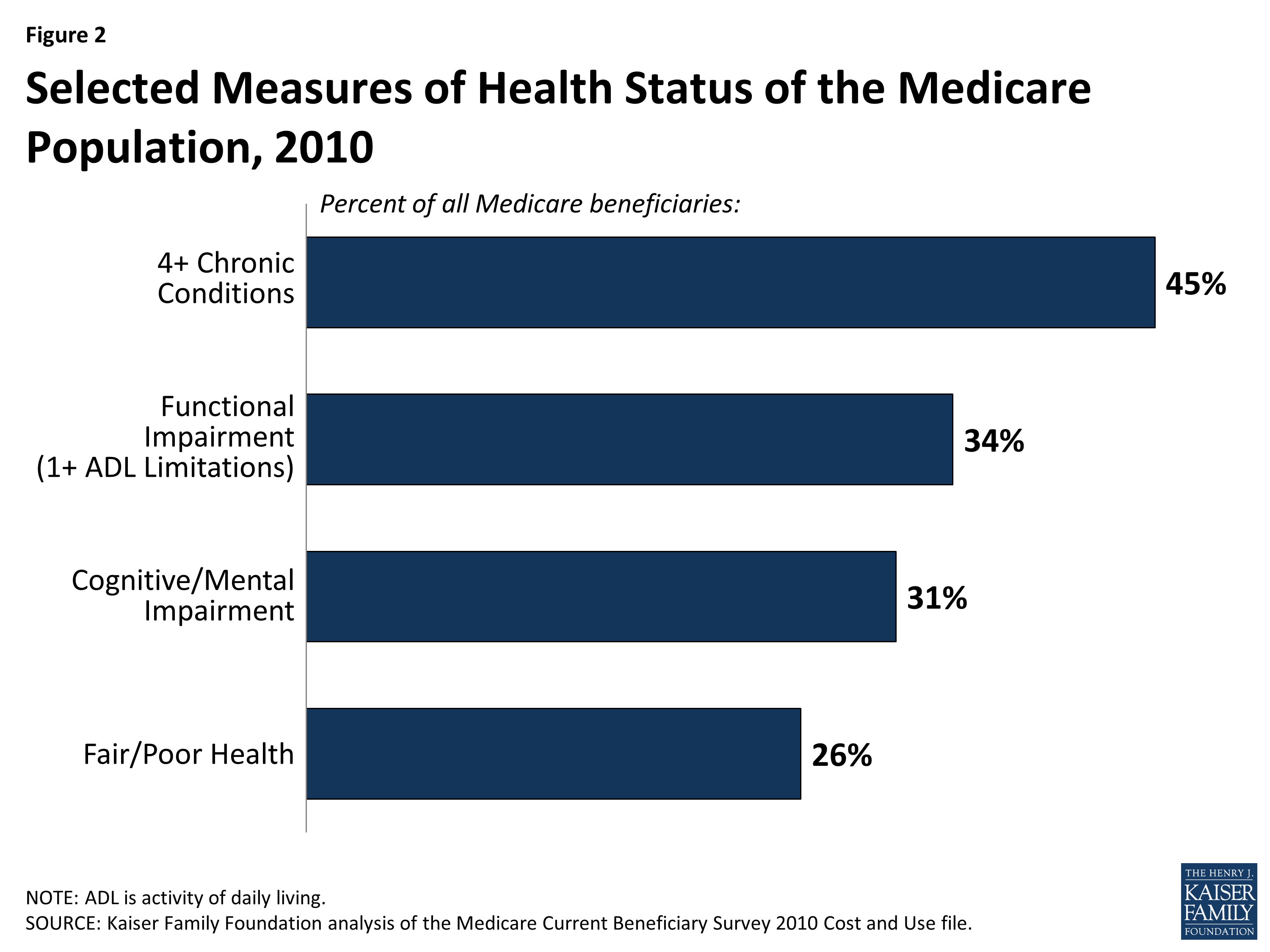

Medicare is a social insurance program that provides health insurance coverage to about 60 million Americans- 51.2 million ages 65 and older and 8.8 million persons with disabilities- and is one of the nation's largest sources of health coverage.

Is Medicare an example of social insurance?

The major U.S. social insurance programs are Social Security, Medicare, Unemployment Insurance, Workers' Compensation, and Disability Insurance.

What is the relationship between Medicare and Social Security?

Social Security provides financial support, and Medicare is a health insurance program that helps cover doctor visits, hospital stays and other medical treatments. While the programs are separate, Social Security and Medicare are intertwined in several ways.

What type of program is Medicare referred to as?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities.

What is an example of social insurance?

Types of social insurance include: Public health insurance. Social Security. Public Unemployment Insurance.

What is meant by social insurance?

social insurance, public insurance program that provides protection against various economic risks (e.g., loss of income due to sickness, old age, or unemployment) and in which participation is compulsory.

Is Medicare separate from Social Security?

Medicare and Social Security are two separate programs, but the Social Security Administration runs enrollment for traditional Medicare.

Do I have to be on Social Security to get Medicare?

Collecting Social Security is by no means a prerequisite to getting Medicare. In fact, it's often advisable to sign up for Medicare as soon as you're eligible (assuming you don't have other health coverage) but wait on Social Security to avoid a reduction in benefits, or boost them as much as possible.

Can you get Medicare without getting Social Security?

If you aren't eligible for full Social Security retirement benefits at age 65, and you aren't getting Social Security benefits, you can still get your full Medicare benefits (including premium-free Part A) at age 65, but you must contact Social Security to sign up.

What is Medicare in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.

What is meant by Medicare?

/ˈmedɪkeər/ us. in the US, a government program that pays for medical treatment for people aged 65 or over: Medicare programs/reforms/benefits. Medicare patients/recipients/beneficiaries. in Australia, the national system that provides medical treatment, which is paid for by taxes.

Which type of program is Medicare quizlet?

Medicare is a social insurance program administered by the United States government, providing health insurance coverage to people who are aged 65 and over, or who meet other special criteria.

What would Medicare for All allow people to do?

2. “Medicare for all” would allow people to choose among health care in surers, both public and private, and both for-profit and nonprofit. 3. “Medicare for all” would allow people to seek care at private hospitals and medical clinics — public or private, for-profit or not-for-profit. 4.

How does Medicare work?

Medicare provides health insurance for Americans aged 65 and older who have worked and paid into the system through a payroll tax.Medicare is funded by payroll tax, premiums and surtaxes from beneficiaries, and general revenue.

When did Medicare start?

Medicare is a single-payer national health insurance program. It began in 1966 under the auspices of the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services of the federal government.

Is Medicare paid in Canada?

Instead, Canadian hospitals and clinicians work in private enterprises, billing Medicare for their services. By contrast, the United Kingdom has a fully socialized system, with payment coming from the government, providers working with government employees, and hospitals and clinics owned and operated by the government.

Is Medicare a single payer?

Currently, Medicare is available to Americans 65 or older, as well as to those with kidney failure or chronic disability. But Medicare is not a single-payer. That’s because Americans are increasingly receiving Medicare coverage through private insurance companies, i.e., Medicare Advantage.

Is Medicare for All a socialist idea?

Medicare for All’ Isn’t Just Socialism. Everyone thinks of “Medicare for all” as a liberal idea, an extremely liberal one embraced by the socialist wing of the Democratic Party. It’s an idea Democrats were hesitant to embrace in the Obama era, for being too far out of mainstream political thought.

Is Medicare for all a socialized payment system?

Even more important, we can’t even call “Medicare for all” a socialized payment system.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

Who reviewed Medicare and Social Security?

Medically reviewed by Alana Biggers, M.D., MPH — Written by S. Behring on May 13, 2020. Medicare and Social Security are federally managed benefits that you’re entitled to based on your age, the number of years you have paid into the system, or if you have a qualifying disability. If you’re receiving Social Security benefits, ...

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

What is Social Security?

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration (SSA). You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

What is socialism in government?

Socialism is where the government provides services to all, irrespective of whether they contribute. The federal government has borrowed heavily from Social Security and Medicare, as they have been well funded for decades. Unfortunately the federal government has run up a deficit in excess of $20 trillion and may not be able to pay back these two ...

Does the government contribute to social security?

The government does not contribute any funds into the programs. In order to qualify for each of these programs an individual must have worked and contributed for a minimum amount of terms. If one qualifies for Social Security then you automatically qualify for Medicare. Note the term qualify. Socialism is where the government provides services ...

Is Social Security funded by the government?

Social Security and Medicare are two separate programs administered by the government, but funded by individuals and their employers. The government does not contribute any funds into the programs.

Is Social Security a socialist program?

Feb 13, 2019 at 8:00 AM. To take the sting out of the word socialism, some on the political left have pointed out that United States has had some programs for years, such as Social Security, that might be considered socialist. (Bradley C Bower/AP) A letter by Michael Egry of Allentown sparked other reader reaction.

How much is Medicare Part B?

As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly. As income levels continue to rise above either $85,000 or $170,000, there is an increase in premium payments for Part B.

Is Social Security income taxed?

In simple cases, Social Security benefits are not taxed and are not counted as income by the Internal Revenue Service (IRS). This means that if Social Security payments are the only means by which an individual subsides, he or she does not need to report the payments as income, and these payments should not effect eligibility for medical benefit ...

Who runs Social Security?

The government, not individuals or businesses , runs the Social Security system. It tracks Social Security earnings and benefits, runs the website that lets people check their benefits record, approves or denies retirement benefit applications, collects Social Security taxes, and distributes retirement benefits. 8 9 .

Where did the idea for social security come from?

It’s interesting to remember that the U.S. got the idea for a social security system from 19th century Germany. That very capitalist monarchy launched an old-age social insurance program in 1889 at the behest of Chancellor Otto von Bismarck, partly to stave off radical socialist ideas being floated at the time.

How much of your paycheck is taxed for Social Security?

Congress decides how much of your paycheck is taxed in order to contribute to the Social Security fund. For example, in 2021, 6.2% of your gross pay goes to Social Security, and your employer typically kicks in an equal amount.

Is Social Security a form of social welfare?

Some people consider this socialism, as the government is involved in the rules, collection, and distribution of funds. Social Security is, at least, a form of social welfare that ensures that the elderly have some minimum level of income.

Is 12.4% Social Security tax unreasonable?

It’s not unreasonable to consider whether, even if you work for someone else, you’re effectively paying the whole 12.4%—“bearing the incidence of the tax,” in economist speak—because if your employer didn’t have to make Social Security payments on your behalf, it could instead include that money in your paycheck.