Why is Medicare spending growing so slowly?

In addition, although Medicare enrollment has been growing between 2 percent and 3 percent annually for several years with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending.

Will My Medicare premiums be automatically deducted from my paycheck?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it’s either sent to you or deposited.

How do I Pay my Medicare premiums?

Medicare allows you to pay online or by mail without a fee. If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it’s either sent to you or deposited.

Are Medicare payments on hold?

The Centers for Medicare & Medicaid Services' notice, which was obtained by Fierce Healthcare, comes nearly a week after the Senate passed legislation to extend through the rest of 2021 a moratorium on a 2% cut to all Medicare payments that was installed under the sequester.

Is Medicare holding payments for 2022?

However, the legislation only stops a 2 percent Medicare sequester cut until April 2022, when providers will face a 1 percent cut through June and the full cut after. The PAYGO cuts are also slated to resume at the start of 2023, and Congress failed to delay the Medicare Physician Fee Schedule cuts entirely.

What is the payment schedule for Medicare?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of our billing timeline. For your payment to be on time, we must get your payment by the due date on your bill.

Are Medicare reimbursements decreasing?

Since 2013, Medicare payments have been subject to a 2% annual reduction that was established by the Budget Control Act of 2011. But a temporary moratorium was put in place during the pandemic, and these sequestration cuts were paused through the end of 2021.

Why are Medicare payments delayed?

The legislation would delay a 2% cut to Medicare payments that was created under sequestration but has been put on hold over the past two years due to the pandemic. Congress decided to delay the 2% cut until April, when it will install a 1% cut to payments until June.

When did Medicare stop taking sequestration?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act suspended the sequestration payment adjustment percentage of 2% applied to all Medicare Fee-for-Service (FFS) claims from May 1 through December 31, 2020.

Why is my Medicare bill for three months?

If your income exceeds a certain amount, you'll receive a monthly bill for your Part D income-related monthly adjustment amount (IRMAA) surcharge. If you have only Part B, the bill for your Part B premium will be sent quarterly and will include the cost of 3 months' worth of premiums.

Why is my Medicare bill for 5 months?

You have been charged for 5 months of Medicare Part B premiums because you are not receiving a Social Security check to have your Medicare premiums deducted.

Did Medicare reimbursement go up in 2021?

On December 27, the Consolidated Appropriations Act, 2021 modified the Calendar Year (CY) 2021 Medicare Physician Fee Schedule (MPFS): Provided a 3.75% increase in MPFS payments for CY 2021.

How much is the Medicare reimbursement for 2021?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

Why are reimbursements declining?

There are several factors that are currently playing a role in reimbursement declines for hospitals. Fee schedule reductions for Medicare and Medicaid as well as lower rates for commercial plans are key causes, in addition to initiatives found in the Affordable Care Act (ACA) such as readmission penalties.

Are Medicare payments tied to inflation?

A feature of each payment system is an annual adjustment reflecting rising input costs, as measured by “market baskets” created specifically for the various provider groupings. Thus, as inflation rises, so too do the base payments for a wide array of Medicare-covered services.

Why has Medicare not increased?

The reason Congress hasn’t instituted any meaningful increases in Medicare physician payments is simple: it is extremely expensive. When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA), it tried to keep the overall cost of the legislation low by including small physician updates over time. The law included a 0.5 percent from July 2015 through then end of 2019, and then a 0.0 percent update from 2020 through 2025. Starting in 2026, there will be a 0.75 percent update for physicians and other clinicians who participate in certain alternative payment models and a 0.25 percent update for everyone else. All these updates are much less than what inflation is projected to be. MACRA was seen as a permanent solution to the flawed “sustainable growth rate” (SGR) formula, but in the end, we have the same result—unsustainably low payments.

What is the cut in Medicare 2022?

Adding up the PFS conversion factor cut of 3.75 percent and the two sequester reductions (2 percent and 4 percent), you get a total cut of 9.75 percent. I don’t have to tell you what impact a nearly 10 percent cut to Medicare payments in 2022 would have on you as emergency physicians! It would be catastrophic.

What is Medicare sequester?

Sequestration acts like a payment “chopper.” Whatever payment you as a physician are owed by Medicare for delivering a service is simply chopped by a specific percentage. Congress instituted a 2 percent Medicare sequester as part of the Budget Control Act of 2011. The sequester has been place since 2013, but luckily has been put on hold during much of the COVID-19 public health emergency. Unfortunately, the moratorium on the 2 percent sequester is set to expire at the end of the year—meaning that it will rear its ugly head once again starting on January 1, 2022. Congress unfortunately loves using this sequester as a way to pay for additional spending way out into the future. Thus, once the 2 percent sequester starts up again, it is set to continue until 2030!

When did CMS add QW modifier?

Effective for dates of service on and after March 2, 2020, CMS added the QW modifier to procedure codes 87635 and U0002. However, the Common Working File (CWF) wasn’t updated to accommodate this request. An update has been made to the system. Open.

When will First Coast reprocess claims?

First Coast will reprocess claims for dates of service on and after March 2, 2020, that were denied when the QW modifier was reported on 87635 and U0002.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

What is Medicare Part C and Part D?

Medicare Part C and Part D. Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services.

Why do people pay less for Part B?

Some people will pay less because the cost increase of the Part B premium is larger than the cost-of-living increase to Social Security benefits. You might also be eligible to receive Part B at a lower cost — or even for free — if you have a limited income.

Is Medicare premium tax deductible?

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

Can a deceased spouse receive Medicare?

You can also receive Part A without paying a premium if you qualify because of a disability. You can qualify for Medicare because of a disability at any age.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

What has changed in Medicare spending in the past 10 years?

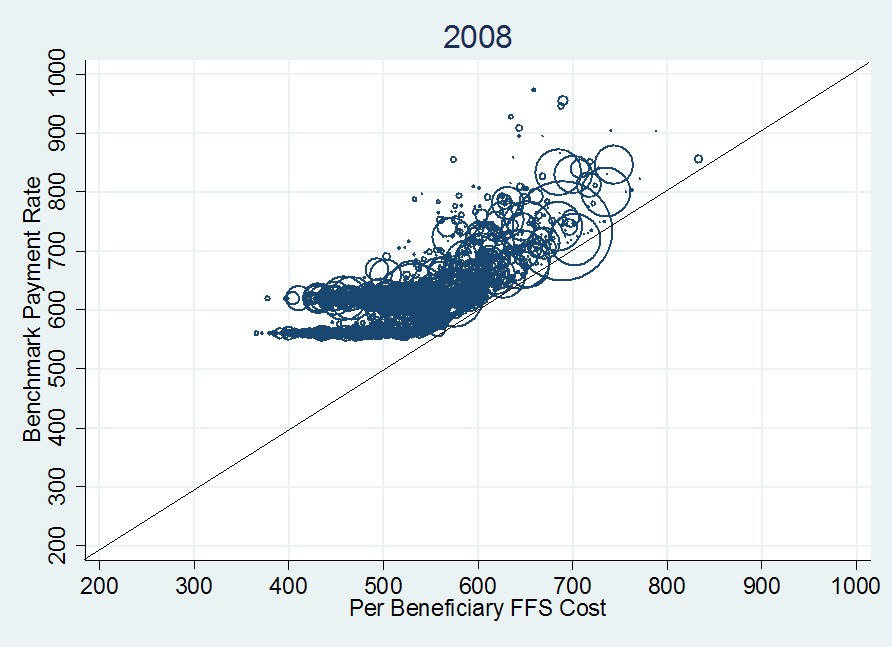

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

How is Medicare Financed?

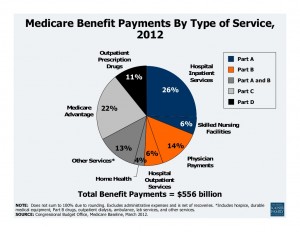

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7) .

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.