Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

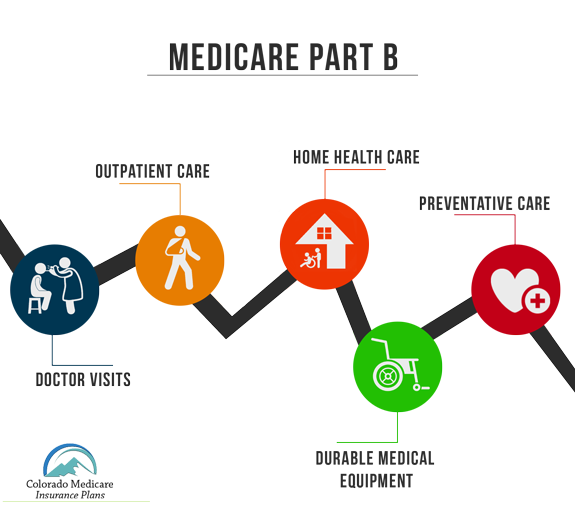

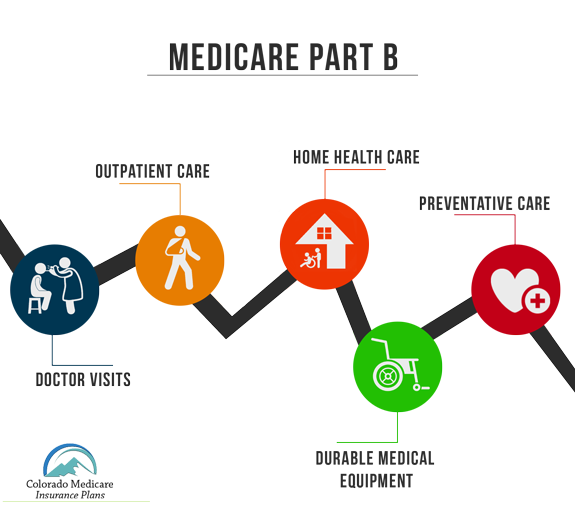

What are the benefits of Medicare Part B?

for these:

- Most doctor services (including most doctor services while you're a hospital inpatient)

- Outpatient therapy

- Durable Medical Equipment (Dme) Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

What are the advantages and disadvantages of Medicare?

What Are the Pros of a Medicare Advantage Plan?

- Additional Benefits. As mentioned above, Medicare Advantage plans can provide additional benefits that are not found in Original Medicare.

- Out-Of-Pocket Protection. ...

- Coordinated Care. ...

- Plan Selection. ...

- Customized Coverage. ...

What does Part B Medicare mean?

What is Medicare Part B? Medicare Part B is medical insurance. It may cover a wide range of items and services. Here’s a partial list of what Part B may cover: Doctor visits; Preventive services, like annual checkups and flu shots; Medical supplies and durable medical equipment, such as walkers and wheelchairs; Certain lab tests and screenings

What do Medicare Parts A, B, C, D mean?

Medicare parts A and B together are known as original Medicare. Medicare Part C plans cover everything that original Medicare does and often include additional coverage options. Medicare Part D is prescription drug coverage.

What is the benefit of having Medicare Part B?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary.

What does Medicare Part B is known for?

Medicare Part B (medical insurance) is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment.

Does Medicare Part B pay everything?

What Medicare Part B Covers. Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

Do most people buy Medicare Part B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the importance of Part B?

Part B coverage offers medically necessary doctor's services, outpatient care, and most other services that Part A does not cover. These may include physical or occupational therapies and some home health care services. Part B also covers some preventive services.

What services does Medicare Part B not cover?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What happens if I cancel Medicare Part B?

The Part B late penalty is especially important to understand because it will stay with you the entire time that you have Medicare. The way the penalty works is that you pay a 10 percent increase for every 12-month period that you could have had Medicare coverage, but didn't.

When should I apply for Medicare Part B?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

What is Medicare Part C?

Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage. Medicare Part D offers only prescription drug coverage. Below, we examine the differences between Medicare Part B and Part C in terms ...

Does Medicare have a monthly premium?

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums. Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium.

Does Medicare Part A cover dental care?

As original Medicare comprises Part A and Part B, a person who enrolls in Part B is automatically enrolled in Part A, which covers inpatient hospital care, hospice care, skilled nursing facility care, lab tests, and home health care. Medicare Part A and Part B do not cover the following: prescription drugs. dental care.

Does Medicare pay for Part A?

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

How much is Part B premium?

For you and your husband, a year of Part B premiums adds up to $2,770, meaning that if you wait a year before signing up, your premiums will be $277 a year more than they would have been otherwise. Choice 2. Take both Part B and your FEHB plan.

Do you have to take Part B if you are retired?

You are in a position that many retirees would kill for, but you still have decisions to make. While most retirees must take Part B once they or their spouse are no longer actively employed, such is not the case for federal retirees. You basically have three choices, all with pros and cons.

Is FEHB a Medigap?

This will be more expensive because you will be paying two sets of premiums, but your FEHB plan will now function as a Medigap plan for both your hospital and doctor bills, and cover your drugs as it always did.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What are the factors that affect the cost of private insurance?

Other factors affecting the cost of private insurance include: the age of the person. where they live. the benefits of the plan. the out-of-pocket expenses. Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

Does Medicare cover physical therapy?

Private insurance and original Medicare plans provide varying benefits and coverage. Most of both types of plans cover hospital care and outpatient medical services, including doctor’s visits, physical therapy, and diagnostic tests. However, Medicare may have gaps in coverage that private insurers cover.

What is Medicare Part B?

Under original Medicare, the federal government sets the premiums, deductibles and coinsurance amounts for Part A (hospitalizations) and Part B (physician and outpatient services ). For example, under Part B, beneficiaries are responsible for 20 percent of a doctor visit or lab test bill. The government also sets maximum deductible rates for the Part D prescription drug program, although premiums and copays vary by plan. Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

What are the elements of Medicare?

Under original Medicare, to get the full array of services you will likely have to enroll in four separate elements: Part A; Part B; a Part D prescription drug program; and a supplemental or Medigap policy. Physicians and hospitals have to file claims for each service with Medicare that you'll have to review.

Is Medicare Advantage a PPO or HMO?

Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Is Medicare Advantage based on out-of-network providers?

Medicare Advantage plans are based around networks of providers that are usually self-contained in a specific geographic area. So, if you travel a lot or have a vacation home where you spend a lot of time, your care may not be covered if you go to out-of- network providers, or you would have to pay more for care.

Does Medicare have an annual cap?

Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.