According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”1 Part B Premiums for 2022

Full Answer

Do Medicare Part B premiums go up every year?

Learn more about how your income could affect your premiums and why Part B costs more this year. The standard Medicare Part B premium increased to $170.10 per month in 2022, up from $148.50 in 2021. The premium went up even more for higher income earners who pay an …

What is the cost of Medicare Part B in 2019?

Nov 08, 2021 · If your MAGI is over a certain threshold, your Part B premium is more than the standard $148.50. Since you were already collecting Social Security when you turned 65, you were automatically enrolled in Medicare Part A (which is free) and Medicare Part B (for which you …

Will your Medicare Part B premiums be reduced for 2022?

In 2022, you pay $233 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you …

Will Medicare Part B premiums increase after Cola goes into effect?

May 04, 2022 · The standard Part B premium for 2022 is $170.10 to $578.30 per month depending on your income. However, some people may pay less than this amount because of …

Why is my Medicare Part B premium so high?

What is the standard Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the highest rate for Medicare Part B?

What makes your Medicare premium go up?

Is Medicare Part B going up 2022?

Does Medicare Part B have a monthly premium?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

What is the premium for Medicare Part B for 2020?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Why do doctors not like Medicare Advantage plans?

Do Medicare Part B premiums change each year?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

Is Medicare Part B premium automatically deducted from Social Security?

Why did my Medicare Part B premium decrease?

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

Do you pay Medicare premiums if your income is above a certain amount?

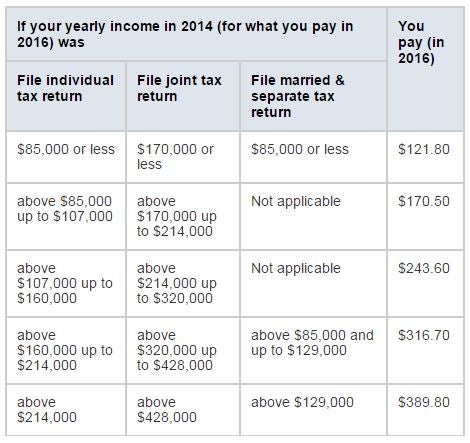

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

Does Medicare Part B increase Social Security?

The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How does the hold harmless rule work?

How ‘hold harmless’ works. To keep up with inflation, Social Security benefits are adjusted annually for increases in cost of living (COLA). The “hold harmless” rule says that Part B premiums can’t go up more than an existing beneficiary’s COLA increase. “This is designed to prevent people from receiving a lower Social Security benefit ...

Can Part B premiums go up?

The “hold harmless” rule says that Part B premiums can’t go up more than an existing beneficiary’s COLA increase. “This is designed to prevent people from receiving a lower Social Security benefit than they got the year before as a result of the higher Medicare premium,” explains Juliette Cubanski, a Medicare expert from ...

Medicare typically bills in 3-month increments, if you don't have your premiums automatically deducted from Social Security

Medicare helps pay for a variety of healthcare services, but it isn't free. Beneficiaries are responsible for a variety of Medicare costs, including monthly premiums, deductibles, and coinsurance or copayments.

Who Gets a Medicare Premium Bill?

The Medicare Premium Bill (CMS-500) goes to beneficiaries who pay Medicare directly for their Part A premium, Part B premium, or who owe the Part D Income-Related Monthly Adjustment Amount (IRMAA). Please note that, even if you collect Social Security, if you owe the Part D IRMAA, you must pay the surcharge directly to Medicare.

How Much Should Your Medicare Premium Bill Be?

How much your Medicare premiums cost depends on which parts of Medicare you have and whether you qualify for premium-free Part A.

How Do You Know if You Owe the Income-Related Monthly Adjustment Amount?

Using data from the Internal Revenue Service (IRS), the Social Security Administration (SSA) determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

Did You Delay Signing Up for Medicare?

If you delayed Medicare enrollment and did not qualify for a Special Enrollment Period (SEP), your monthly premiums may be higher due to late enrollment penalties.

What Is the Medicare Late Enrollment Penalty?

You may owe the late enrollment penalty for Part A, Part B, or Part D – or all three. How much you owe and how it's calculated depends on the part and how long you went without Medicare coverage.

Ways to Pay Your Medicare Premium Bill

Sign up for Medicare Easy Pay, which allows Medicare to automatically deduct your premiums from your personal savings or checking account.

Can you get Medicare if your income is below certain amounts?

If your income and/or financial resources are below certain amounts, you may qualify for one of the Medicare Savings Programs. With some of these programs, your resident state can actually pay most, or all, of your Part B premium for you.

How long does Medicare Part B premium stay on Social Security?

However, when you’re not drawing income yet, you get billed for Medicare Part B for three months at a time. But, if your bill is over $800, then….

How much did Medicare start out at in 2015?

Now look at someone new to Medicare in 2015. They started out at $104.90. There was no Social Security increase in 2016, so they continued paying $104.90 last year while new folks paid $121.80. This year their increase was also 0.3%, so their Part B premium also increased a few bucks.

Can you qualify for Medicare Savings Program?

You Qualify for a Medicare Savings Program. If your income and/or financial resources are below certain amounts, you may qualify for one of the Medicare Savings Programs. With some of these programs, your resident state can actually pay most, or all, of your Part B premium for you.

Can Social Security payments get smaller?

You see, there is a rule called the Hold Harmless provision that basically says your Social Security check can’t get smaller due to a Medicare premium increase. Folks new to Medicare in 2016 started paying $121.80 for Part B.

How much did Social Security increase in 2016?

Because there was only a 0.3% increase in Social Security income this year. Example: Let’s look at someone who got $2,000 per month of Social Security income last year, and started Medicare in 2016. If they got a 0.3% raise, their raise was $6. So, the most their Medicare premium would be allowed to increase would be $6.