That means your premium is based on your modified adjusted gross income from two years prior. You can ask the Social Security Administration to re-evaluate your premium if your income lowers because of a life-changing event. Examples of life-changing events include retirement, divorce, and the death of your spouse.

Full Answer

Can I reduce my Medicare premiums?

Almost everyone pays a premium for Part B, Part D, Medigap, vision, dental, and hearing. All those premiums can add up, but there are ways to save money, whether you’re already on Medicare or signing up for the first time. Below, we’ll share five ways you can reduce your Medicare premiums. How Do I Get Medicare Surcharges Reassessed?

Can I lower my Medicare Part B premium?

You can ask the Social Security Administration to re-evaluate your premium if your income lowers because of a life-changing event. Examples of life-changing events include retirement, divorce, and the death of your spouse. How Can I Lower My Medicare Part B Premium? Everyone must pay a premium for Part B.

Does my income affect my Medicare premiums?

However, your income can impact how much you pay for coverage. If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change. On the other hand, you might be eligible for assistance paying your premiums if you have a limited income. How will my income affect my Medicare premiums?

What do you need to know about Medicare premiums?

What you need to know about Medicare premiums -- and how to reduce yours under certain circumstances. Question: I can’t get my head around the Medicare Part B premium. I’ve read that the basic premium is supposed to be $134 for 2017, but that most seniors will pay $109 a month and some will pay more than $400.

Why Could the Premium Change?

According to the Washington Post, this is the first time that Medicare has considered a change to its premiums after announcing its annual figures. But this year’s Part B premium rise – the largest dollar amount increase in program history – has been an unusual situation.

How Much Will the New Part B Premium Be?

It is currently unclear how much beneficiaries could see their Part B premium decrease if Medicare does opt to make a change to this year’s amounts. But the updated premium could be significantly lower.

How much is Medicare Part B for 2017?

The basic premium for Medicare Part B for someone who signs up this year is $134 a month.

How much is Social Security premium for 2017?

The 2017 premium is officially $134, but about 70% of beneficiaries (those receiving Social Security benefits in December and not subject to high-income surcharges) will pay much less, averaging about $109.

How to contact Social Security about overpayment?

We’ve heard that the most efficient way to handle this is to call Social Security (800-772-1213) to set up a face-to-face meeting at a local office. If you wind up paying the surcharge for a month or two before your appeal is approved, Social Security will reimburse you for the overpayment. health insurance. Medicare.

Can you reduce COLA benefits below December?

The rising premium offsets the COLA, but it can’t reduce the benefit below December’s level. Those who start receiving benefits in 2017 will pay $134 a month, because they’re not protected by the “benefits can’t go down” rule, unless that is, their income is high enough to trigger a surcharge.

Why do people delay enrolling in Medicare?

Some people delay enrolling in Medicare because they have other insurance that’s cheaper or has other advantages. Those advantages won’t matter if your plan doesn’t count as “creditable coverage” and you have to pay a late enrollment penalty.

How to avoid late penalties on Medicare?

Avoid Late Penalties by Signing Up When First Eligible. While avoiding penalties doesn’t directly reduce Medicare premiums, it does prevent them from becoming higher. You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll ...

What is Social Security premium based on?

That means your premium is based on your modified adjusted gross income from two years prior. You can ask the Social Security Administration to re-evaluate your premium if your income lowers because of a life-changing event. Examples of life-changing events include retirement, divorce, and the death of your spouse.

Is Medicare tax free?

It’s best to get advice from a professional about ways to grow your income tax-free. Medicare rules change from year to year, and so do the plans available in your area. It makes good financial sense to contact an agent every year to compare your options.

Can you change your Medigap plan at another time?

If you try to join a Medigap plan at another time, health issues can raise your premium. There are also yearly opportunities to change your advantage or Part D plans. These give you a chance to compare options and choose one with a lower cost.

Do you pay Medicare if you are a high income taxpayer?

Most people pay a standard rate for Medicare. If you’re a high-income taxpayer, you pay more. If your income is more than $88,000 for individuals or $176,000 for married couples, you’ll have a higher premium or an Income Related Monthly Adjustment Amount .In assessing IRMAA, Medicare doesn’t look at your current income.

Can you get extra help if you don't qualify for medicaid?

People with Medicaid automatically qualify for the Extra Help subsidy. However, you can obtain Extra Help, even if you don’t qualify for Medicaid. When your income is low, a subsidy can help reduce Medicare premiums and other costs.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

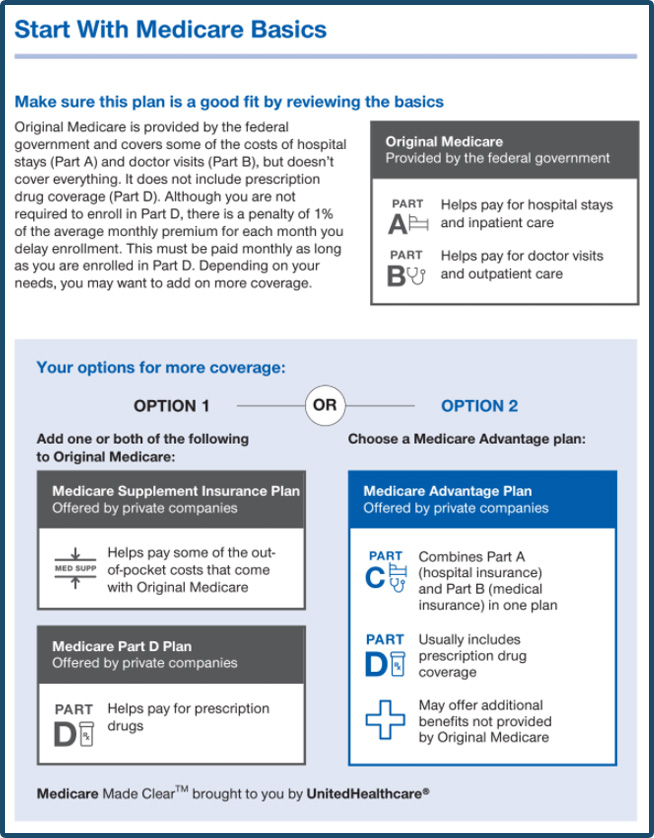

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.