What is the combined tax rate for Social Security and Medicare?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable maximum taxable amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is the standard Medicare Part B premium for 2020?

The standard Medicare Part B premium for medical insurance in 2020 is $144.60. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2020 Social Security benefits.

What is the income-related monthly adjustment amount for Medicare Part B?

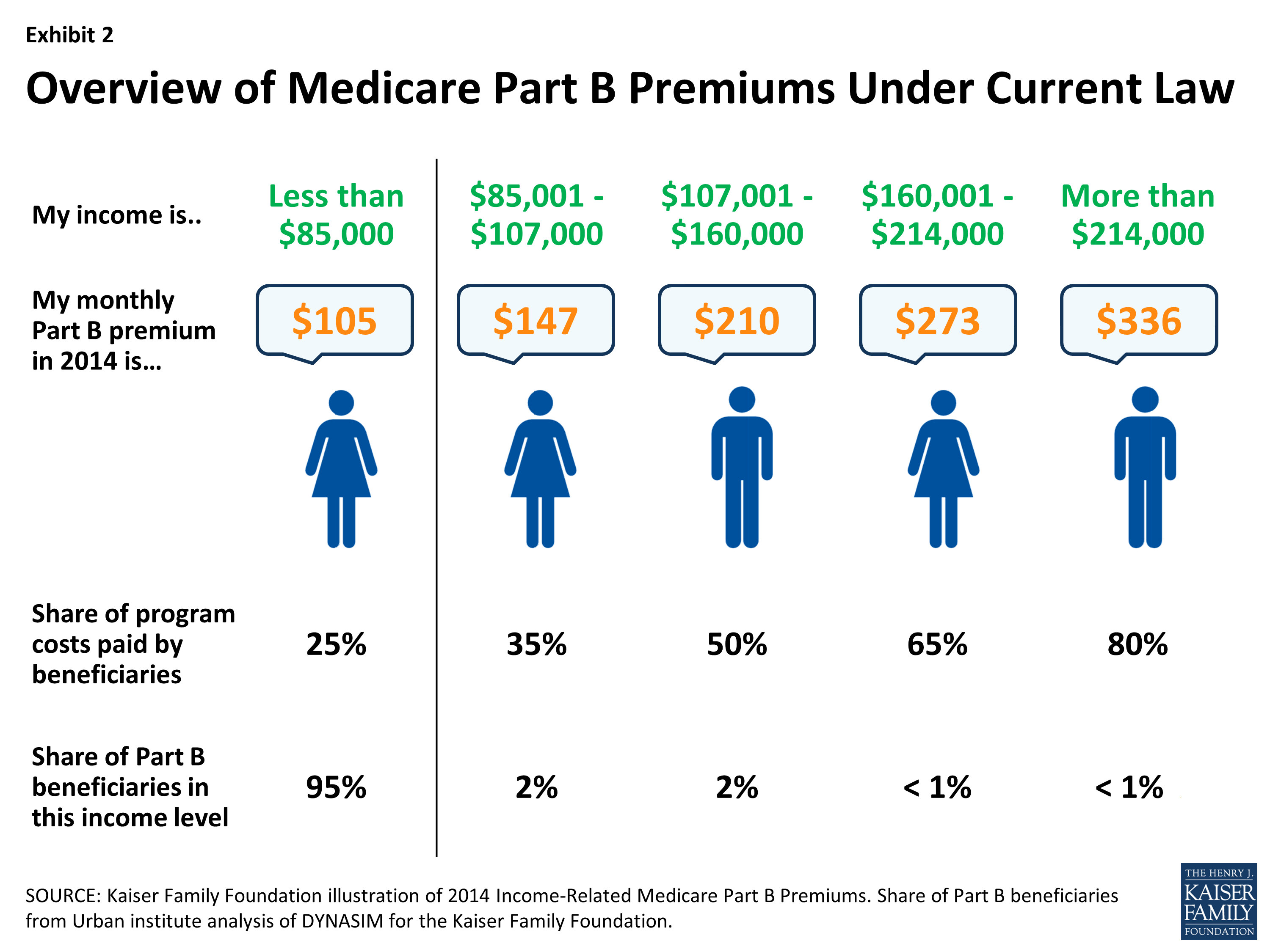

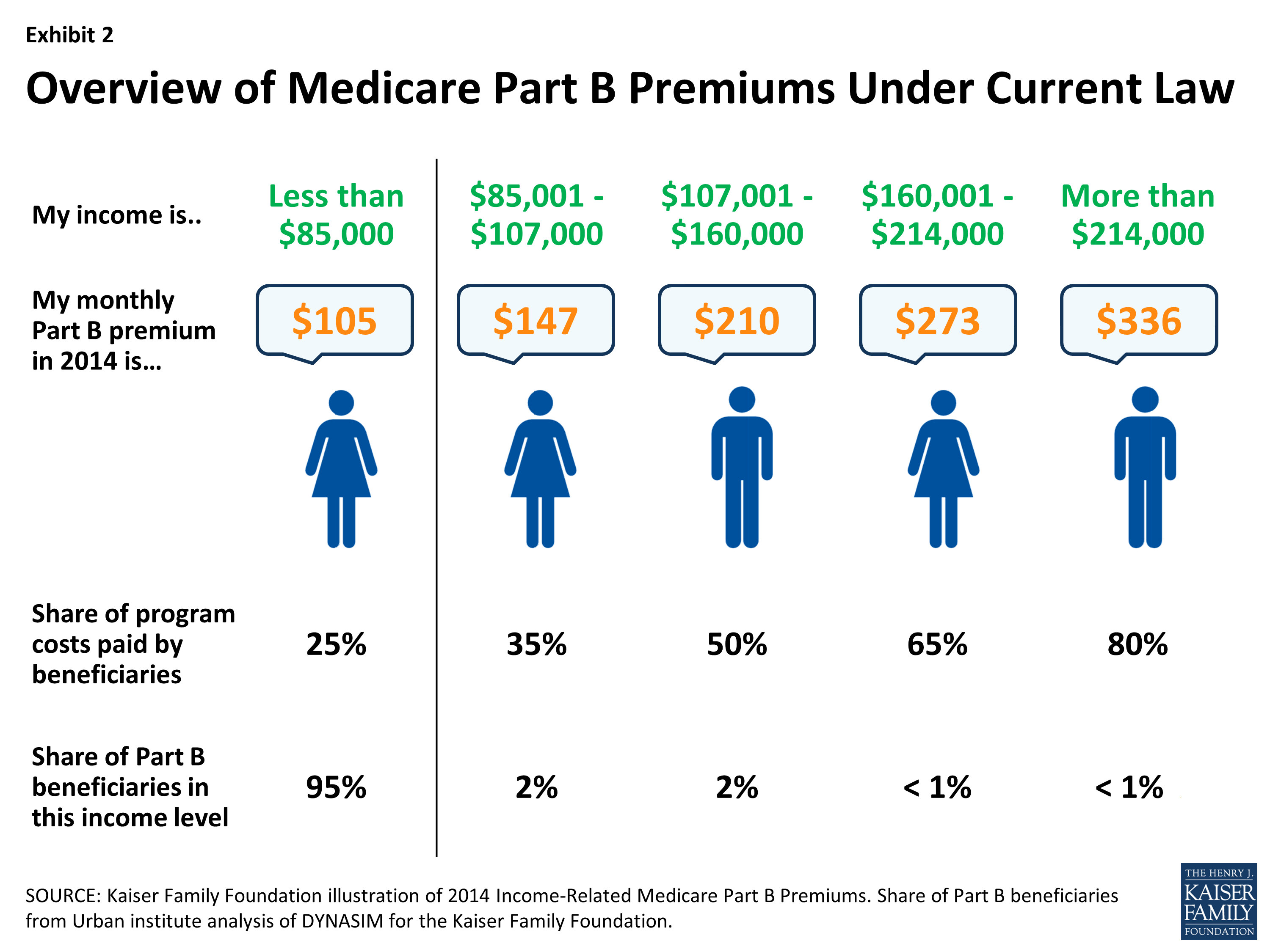

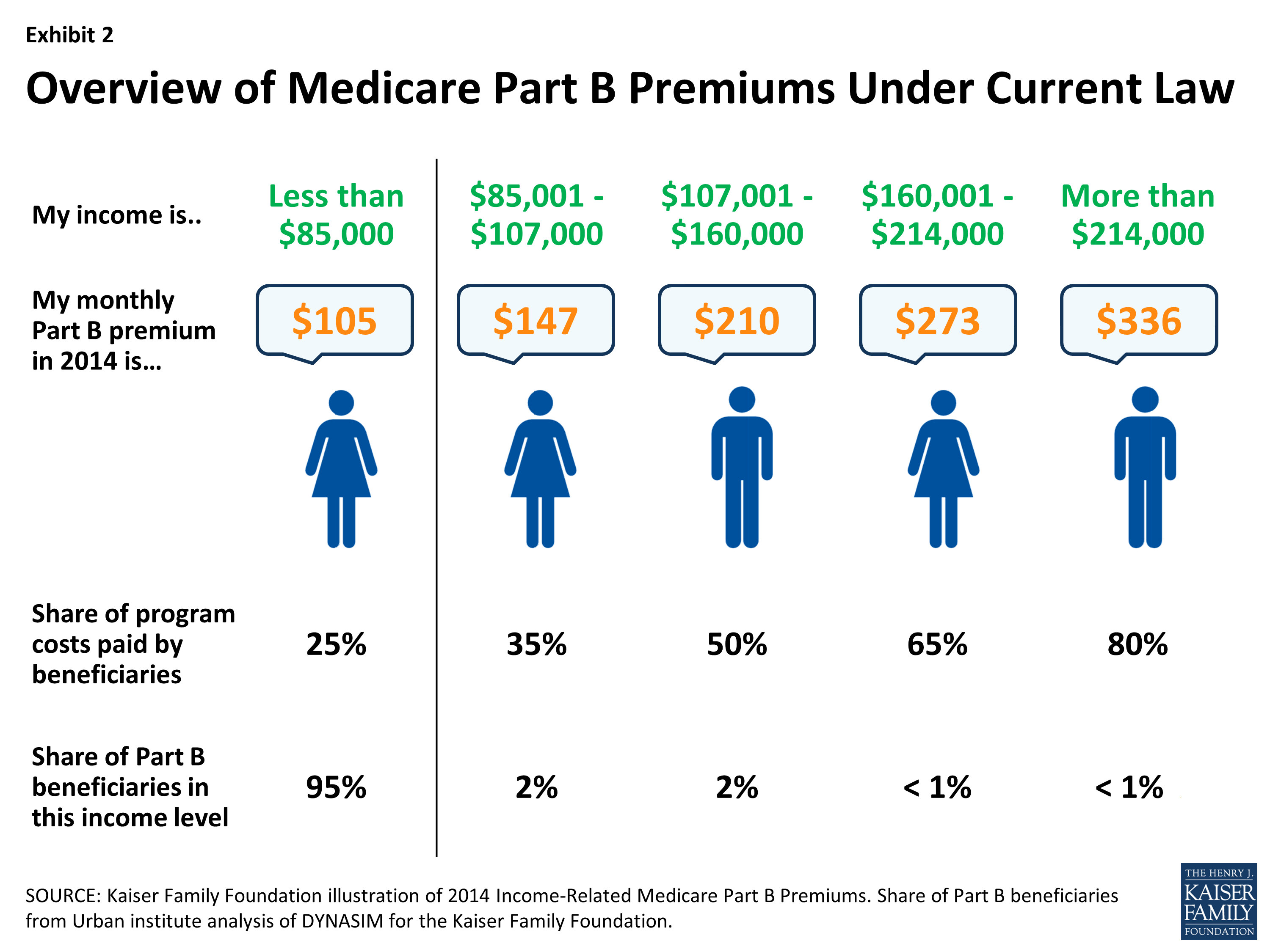

If you have higher income, you’ll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the income-related monthly adjustment amount. Here’s how it works: Part B helps pay for your doctors’ services and outpatient care.

How much do Medicare Part B premiums cost?

You’ll pay monthly Part B premiums equal to 35, 50, 65, 80, or 85 percent of the total cost, depending on what you report to the IRS. Medicare prescription drug coverage helps pay for your prescription drugs.

Are Medicare premiums taken out of Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What income level triggers higher Medicare premiums?

You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

What year's income is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What income is used to determine Medicare premiums 2020?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Why is my Medicare premium so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Are Medicare premiums adjusted annually?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How are Medicare premiums calculated 2022?

Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

What are the magi limits for Medicare?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2022, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

How is Medicare Part B funded?

Medicare Part B - which provides health insurance for people over age 65 and for individuals with disabilities - is financed primarily from two sources: (1) premiums paid by beneficiaries, and (2) general revenues. In recent years, beneficiaries' premium payments have been set at approximately one-fourth of Part B program costs and this will continue in 1999. In 1998, the monthly Part B premium was $43.80, the same as it was in 1997. In 1999, the premium will be $45.50. Because Part B costs are projected to rise rapidly, Part B premiums are expected to increase, on average, by more than 9 percent per year between 1998 and 2004. This is partly due to rising health costs and the shift in more medical services from hospital in-patient (Part A) payments to Part B out-patient and doctors' offices.

When was the Oasdi adjusted?

Since 1974 , OASDI benefits have been adjusted annually to reflect changes in the cost-of-living based on the CPI. While the CPI is not perfect, it is the best measure currently available of the costs of goods and services that households experience.

When did Medicare change to catastrophic care?

For the period 1/89 through 12/89, the Medicare program was changed by the Medicare Catastrophic Coverage Act of 1988 from an acute care program into a catastrophic care program.

When was the catastrophic add on repealed?

The income tax-based premium was never collected; however, the catastrophic add-on was collected from 1/89 through 12/89 for those who were enrolled in Part B during some or all of those months to help finance the Part A catastrophic benefits that had been in effect for 1989.