Why is my Medicare so expensive?

- Tier 1 is generally for low-cost generic drugs; these usually have very low copays or coinsurance percentages.

- Tier 2 is for preferred brand-name medications and non-preferred generic drugs; these have a low-to-moderate copayment or coinsurance amount.

- Tier 3 is for non-preferred brand-name prescription drugs and has moderate-to-high copayments.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Will My Medicare premiums increase?

Your Medicare Supplement Insurance premiums may increase over time, but the amount and timing depend on several factors. Some insurance plans will have increases simply because you're getting older.

How much is Medicare increasing?

Medicare's Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month. In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233. That's a 14.8% increase from 2021 to 2022. The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

What is one of the reasons why Medicare costs have been rising?

The aging of the population, growth in Medicare enrollment due to the baby boom generation reaching the age of eligibility, and increases in per capita health care costs are leading to growth in overall Medicare spending.

What are the 3 main reasons for the rising cost of healthcare?

Seven reasons for rising healthcare costsMedical providers are paid for quantity, not quality. ... The U.S. population is growing more unhealthy. ... The newer the tech, the more expensive. ... Many Americans don't choose their own healthcare plan. ... There's a lack of information about medical care and its costs.More items...•

What are the 5 main reasons for rising health care costs?

Five factors contribute to the rise in health care costs in the US: (1) more people; (2) an aging population; (3) changes in disease prevalence or incidence; (4) increases in how often people use health care services; and (5) increases in the price and intensity of services.

Why are costs increasing in the health care system?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Why are costs rising?

In short, during the pandemic, we saw supply chain disruptions (decreased supply) combined with a massive increase to the money supply (increased demand). Basic economics tells us that less supply combined with greater demand means higher prices, explains Hoffer.

Why is health insurance so expensive 2021?

The most common factors that insurers cited as driving up health costs in 2021 were the continued cost of COVID-19 testing, the potential for widespread vaccination, the rebounding of medical services delayed from 2020, and morbidity from deferred or foregone care.

When did healthcare become so expensive?

How Health Care Became So Expensive Health care spending in the United States more than tripled between 1990 and 2007. This 3-part series explores the rising costs, and why our care hasn't necessarily gotten better.

Which of the following contributes to rising healthcare costs?

The two most-cited reasons for these increases were government policy and lifestyle changes. Government programs like Medicare and Medicaid have increased overall demand for medical services—resulting in higher prices.

What is a reason that healthcare costs are rising quizlet?

Three factors contribute to the rising healthcare costs; a fragmented system that multiplies administrative costs (track patient expenses and bills to multiple insurers), the power that health care providers have over consumers, and the for-profit basis of the health care system.

What are the biggest drivers of healthcare costs?

Instead, they found that prices of labor and goods, including pharmaceuticals and devices, and administrative costs appear to be the main drivers of the differences in spending.

Why are healthcare costs rising?

One reason for rising healthcare costs is government policy. Since the inception of Medicare and Medicaid —programs that help people without health insurance—providers have been able to increase prices. Still, there's more to rising healthcare costs than government policy.

Why is healthcare so expensive?

Healthcare gets more expensive when the population expands —as people get older and live longer. Therefore, it’s not surprising that 50% of the increase in healthcare spending comes from increased costs for services, especially inpatient hospital care.

How much of healthcare costs are chronic diseases?

Chronic diseases constitute 85% of healthcare costs, and more than half of all Americans have a chronic illness. 2 9 . Demand for medical services has increased because of Medicare and Medicaid, resulting in higher prices.

How much does healthcare cost in the US?

Healthcare costs in the U.S. have been rising for decades and are expected to keep increasing. The U.S. spent more than $3.8 trillion on healthcare in 2019 and was expected to exceed $4 trillion in 2020, according to a study by the Peterson and Kaiser Foundations. A JAMA study found five factors that affect the cost of healthcare: ...

Why do people avoid medical care?

People avoiding needed medical care due to concerns about costs has been a problem for several years. A 2019 survey by the Physicians Advocacy Institute (PAI) found patients avoiding care due to an inability to afford covering deductibles under their HDHPs. 12

Why is it so hard to know the cost of healthcare?

Thanks to a lack of transparency and underlying inefficiency, it’s difficult to know the actual cost of healthcare. Most people know the cost of care is going up, but with few details and complicated medical bills, it’s not easy to know what you're getting for the price.

What was the biggest increase in spending in the JAMA study?

The authors of the JAMA study point to diabetes as the medical condition responsible for the greatest increase in spending over the study period. The increased cost of diabetes medications alone was responsible for $44.4 billion of the $64.4 billion increase in costs to treat that disease. 4

1. Part B premium costs are rising

Though Medicare Part A, which covers hospital care, is available at no cost to most enrollees, there's a premium associated with Part B that changes from year to year. This year, that standard premium costs $148.50 a month. Next year, it's rising to $170.10.

2. Your prescriptions may be getting pushed into a higher tier

All Medicare Part D drug plans have a formulary that groups medications by tiers. The higher a tier your prescriptions fall into, the more they'll cost you.

3. You may be subject to an IRMAA

Next year, $170.10 will represent the standard Medicare Part B premium. But some seniors will pay a lot more money than that for coverage in the form of an IRMAA, or Income Related Monthly Adjustment Amount.

4. Part B deductibles are going up

It's not just Medicare Part B premiums that are rising. Deductibles are increasing as well. Right now, the annual Part B deductible is $203. Come next year, it will amount to $233.

Gear up for rising costs

Medicare costs can rise from year to year, making healthcare a tricky thing to budget for during your senior years. If you're already retired and fear you'll struggle to keep up with your costs, you may need to look at cutting back on other less essential expenses or taking a part-time job.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

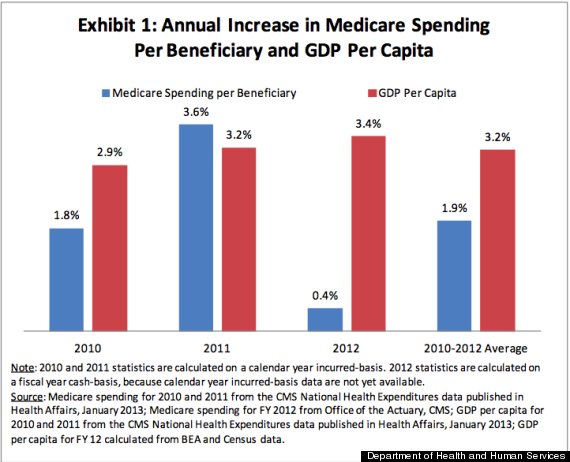

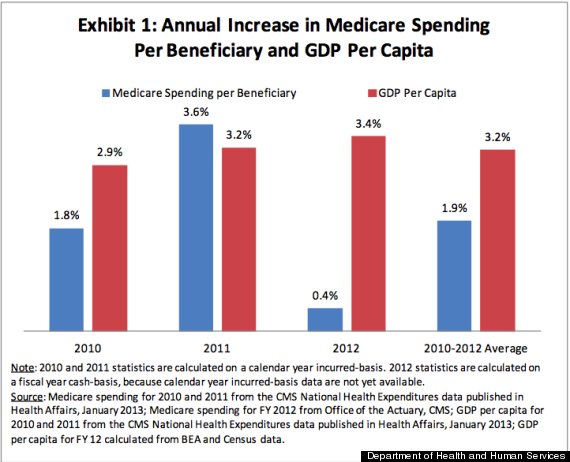

When did Medicare per capita increase?

Between 2000 and 2011, Medicare per capita spending grew faster for beneficiaries ages 90 and older than for younger beneficiaries over age 65, both including and excluding spending on the Part D prescription drug benefit beginning in 2006.

How much did Medicare spend in 2011?

Average Medicare per capita spending in 2011 more than doubled between age 70 ($7,566) and age 96 ($16,145). The increase in Medicare per capita spending as beneficiaries age can be partially, but not completely, explained by the high cost of end-of-life care.

Why is the analysis focusing on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare?

The analysis focuses on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare because of a permanent disability to develop a better understanding of the relationship between Medicare spending and advancing age. This study examines patterns of Medicare spending among beneficiaries in traditional Medicare rather ...

What percentage of Medicare beneficiaries were enrolled in 2011?

Because we lack comparable data for the 25 percent of beneficiaries enrolled in Medicare Advantage in 2011, it is not possible to assess whether patterns of service use and spending in traditional Medicare apply to the Medicare population overall. More information about the data, methods, and limitations can be found in the Methodology.

Is Medicare spending data available for all people?

The analysis excludes beneficiaries who are age 65 because some of these beneficiaries are enrolled for less than a full year; therefore, a full year of Medicare spending data is not available for all people at this year of age. The analysis focuses on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare because ...

Will population aging affect health care?

According to the Congressional Budget Office, population aging is expected to account for a larger share of spending growth on the nation’s major health care programs through 2039 than either “excess spending growth” or subsidies for the coverage expansions provided under the Affordable Care Act. 2. To inform discussions about Medicare’s role in ...

Does Medicare increase as you age?

As the U.S. population ages, the increase in the number of people on Medicare and the aging of the Medicare population are expected to increase both total and per capita Medicare spending. The increase in per capita spending by age not only affects Medicare, but other payers as well.