What is a Medicare Advantage plan limit?

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year. You should consider this when choosing a plan.

Can I get Medicare Advantage with ESRD?

However, Medicare Advantage Plans cannot set cost-sharing for either outpatient dialysis or immunosuppressant drugs higher than would be the beneficiary responsibility under Original Medicare. If you have ESRD and are interested in enrolling in a Medicare Advantage Plan, it is important to consider provider networks and costs as you evaluate plans.

Do Medicare Advantage plans have out-of-pocket spending limits?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

Can I enroll in Medicare Advantage plans with end-stage renal disease?

Beginning in 2021, people with End-Stage Renal Disease (ESRD) can enroll in Medicare Advantage Plans. Medicare Advantage Plans must cover the same services as Original Medicare but may have different costs and restrictions.

Do Medicare Advantage plans have limits?

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you'll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year. You should consider this when choosing a plan.

What are the negatives to a Medicare Advantage Plan?

The takeaway There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

How does Medicare Advantage OOP maximum work?

Maximum out-of-pocket: the most money you'll pay for covered health care in a calendar year, aside from any monthly premium. After reaching your MOOP, your insurance company pays for 100% of covered services. The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year.

Can Medicare Advantage plans deny coverage for pre existing conditions?

As with Original Medicare, Medicare Advantage plans can't charge you more for preexisting conditions. Because they are offered by private insurance companies, basic costs for Medicare Advantage plans will vary by plan. In addition, you can't be denied coverage based on preexisting conditions.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Who is the largest Medicare Advantage provider?

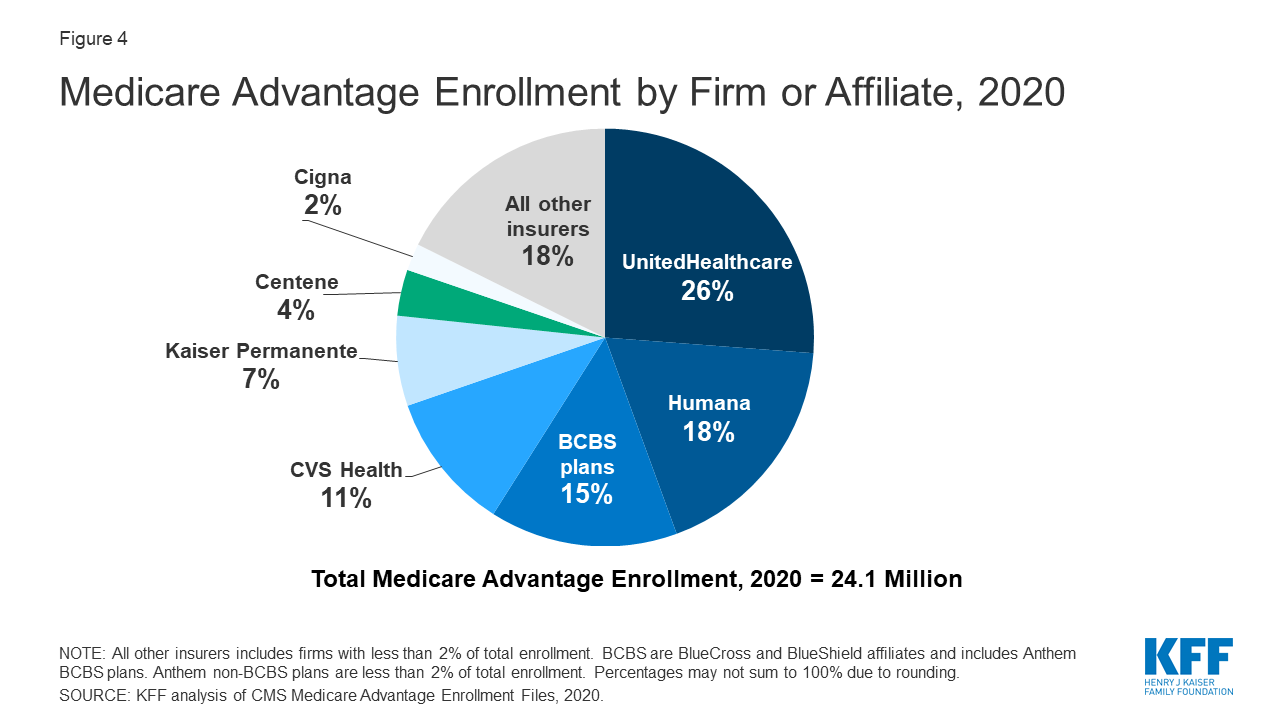

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is true about the Medicare Advantage out-of-pocket maximum?

Does Medicare have a maximum out-of-pocket limit? There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum; if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

What is the out-of-pocket maximum for Medicare Advantage plans for 2021?

Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.

Do prescriptions count towards out-of-pocket maximum Medicare Advantage?

While you only pay 25 percent of the medication cost, the entire cost of the medication will count toward your out-of-pocket maximum to get you out of the donut hole. If you are in the Extra Help plan, you won't enter the donut hole. Catastrophic coverage.

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

Will pre-existing conditions be covered in 2022?

Yes. Under the Affordable Care Act, health insurance companies can't refuse to cover you or charge you more just because you have a “pre-existing condition” — that is, a health problem you had before the date that new health coverage starts. They also can't charge women more than men.

Is there a waiting period for pre-existing conditions with Medicare?

For up to six months after your Medicare Supplement plan begins, your new plan can choose not to cover its portion of payments for preexisting conditions that were treated or diagnosed within six months of the start of the policy.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

When Does Medicare Cover ESRD?

Medicare coverage for ESRD has been in place since Congress passed the Social Security Amendment in 1972.

Medicare Supplement Plans In Some States Can Help Cover ESRD

Depending on where you live, ESRD patients may be able to purchase Medicare Supplement Insurance plans, also called Medigap. There are 10 standardized Medigap plans available for purchase from private insurance companies in most states.

When does ESRD end?

For example, coverage for at-home dialysis kicks in before dialysis at a hospital or an outpatient facility and typically ends 12 months after the beneficiary stops dialysis.

How long do you have to wait to get Medicare for ALS?

While people younger than 65 who have been on Social Security Disability Insurance have to wait for 24 months before they can enroll in Medicare, patients with ALS can receive Medicare as soon as those disability benefits begin.