Several factors may be contributing to the rise in prescription drug prices. One notable driver is a lack of competition resulting from the U.S. patent system for brand-name drugs, which gives the manufacturer monopolistic control over a given market and therefore the ability to increase prices without competition.

Full Answer

Why is Medicare becoming so expensive?

Nov 15, 2021 · The standard monthly Medicare Part B premium in 2022 rose to $170.10 from $148.50 in 2021 – a 14.55% jump and more than double what had been expected. Nevertheless most people with Medicare will ...

Why did my Medicare premium just go up?

Learn more about how your income could affect your premiums and why Part B costs more this year. The standard Medicare Part B premium increased to $170.10 per month in 2022, up from $148.50 in 2021. The premium went up even more for higher income earners who pay an income-related monthly adjustment amount (IRMAA), with the most expensive Part B ...

Why did my home insurance premium increase so much?

Nov 13, 2021 · Medicare is the federal health insurance plan covering more than 62 million people, mostly 65 and older. Part B premiums are based on income. Individuals earning $500,000 or more a year and joint ...

Why are my medication costs increasing in every year?

Nov 14, 2019 · The Total Cost of Prescription Drugs Is Projected to Continue Climbing. U.S. spending on prescription drugs has grown rapidly over the past decade, climbing from $783 per capita in 2007 to $1,025 per capita in 2017. The Centers for Medicare and Medicaid Services project that such spending will continue climbing to $1,635 per capita by 2027, an ...

Why are prescription drugs going up in price?

Did prescription drug prices increase in 2021?

Why Do drugs cost More on Medicare?

Did Medicare prescriptions go up?

Are prescription prices going up?

Did prescription prices go up in 2022?

What is maximum out-of-pocket for Medicare Part D?

Why are drugs so expensive with insurance?

Does Medicare Part D have a maximum out-of-pocket?

Is GoodRx better than Medicare Part D?

Why do doctors not like Medicare Advantage plans?

Can Medicare beneficiaries use GoodRx?

Why do prescriptions change?

Reasons your prescription drug prices may change 1 If your dosage or quantity changes, the price of the prescription could also change. 2 Manufacturers may increase the price of the drug, and this will be reflected in the price you pay for it. 3 You may be in one of four coverage periods: deductible period, initial coverage period, coverage gap, and catastrophic coverage period.

How to save money on prescription drugs?

Another way to save money on prescription drugs is to make sure the pharmacy you use is a pharmacy preferred by your plan. Non-preferred pharmacies can charge you more for your prescription drugs, so it’s important to know which pharmacies you can use.

How long does Medicare cover prescriptions?

Four different coverage periods for Medicare prescription drug coverage 1 Deductible period. If your plan has a deductible, you will have to pay the full cost of your drugs until you meet the deductible. Deductibles can vary from plan to plan, but no plan’s deductible can be higher than $405 in 2018, and some plans have no deductibles at all. 2 Initial coverage period. This begins after you’ve met your deductible. During this period, you will be responsible for co-payments and co-insurance, which vary according to the drug and which plan you have. The length of this period depends on your out-of-pocket drug costs and your plan’s benefit structure. Once you have reached $3,750 in total drug costs, you move on to the next stage. 3 Coverage gap. The coverage gap, also called the Medicare donut hole, means your plan does not cover your prescription drug costs. However, there are federally-funded discounts available. In 2018, name brand drugs will be discounted at 65% and generic drugs will be discounted 56%, meaning you’ll pay 35% for name brand drugs and 44% for generic drugs. The good news is that the coverage gap will be completely phased out by 2020, and you will pay no more than 25% of drug costs after you’ve met your deductible. 4 Catastrophic coverage. In 2018, you will reach catastrophic coverage once your total out-of-pocket costs have reached $5,000, regardless of your drug costs. Here are the ways you can reach catastrophic coverage:

What happens after you meet your deductible?

During this period, you will be responsible for co-payments and co-insurance, which vary according to the drug and which plan you have. The length of this period depends on your out-of-pocket drug costs and your plan’s benefit structure.

What is the Medicare coverage gap?

Coverage gap. The coverage gap, also called the Medicare donut hole, means your plan does not cover your prescription drug costs. However, there are federally-funded discounts available. In 2018, name brand drugs will be discounted at 65% and generic drugs will be discounted 56%, meaning you’ll pay 35% for name brand drugs and 44% for generic drugs.

What is the Medicare donut hole?

The coverage gap, also called the Medicare donut hole, means your plan does not cover your prescription drug costs. However, there are federally-funded discounts available. In 2018, name brand drugs will be discounted at 65% and generic drugs will be discounted 56%, meaning you’ll pay 35% for name brand drugs and 44% for generic drugs.

What is LIS in Medicare?

Depending on your income, Extra Help, also known as the Low-Income Subsidy (LIS), may be an option for you. Extra Help, a federal program administered by Social Security, helps people with low income pay for their Medicare prescription drug costs.

Does Medicare increase deductibles?

The Medicare Part A (hospital insurance) premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well. Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, ...

Does Medicare Part A and Part B increase each year?

Medicare Part A and Part B deductibles typically increase each year, as well. Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year. There are a number of contributing factors ...

How to save money on Medicare?

If you’re concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs: 1 Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs. 2 Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. 3 Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare).#N#Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

Does Medicare Advantage cover Part B?

While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare). Most Medicare Advantage plans also offer extra benefits such as dental, ...

How much is the Part B premium?

The premium went up even more for higher income earners who pay an income-related monthly adjustment amount (IRMAA), with the most expensive Part B premium increasing from $428.60 per month in 2018 to $460.50 per month in 2019.

What is the CPI W?

The Social Security Administration (SSA) uses the consumer price index for workers (CPI-W) to make annual adjustments to benefit payment amounts. This is called the cost of living adjustment, or COLA, and is a way to help benefit payments keep up with the cost of living.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the rising cost of prescription drugs?

The rising cost of prescription drugs is a key driver of overall healthcare spending in the U.S. This trend has significant implications not only for Americans who rely on medications, but also for our nation’s budget and fiscal outlook. Recent proposals to reduce such costs indicate a bipartisan desire to curb growth in prescription drug prices, ...

How to reduce prescription drug prices?

Because of the financial and economic strain that high prescription drug prices can have on American families and the country’s fiscal health, numerous proposals to reduce such prices have been released by policymakers and think tanks. Among those that have garnered recent attention include: 1 A proposed rule from the Trump administration to strengthen certain Medicare plans and allow the importation of prescription drugs from other countries 2 A proposal from House Democrats that would allow Medicare to negotiate prices on many expensive brand-name drugs 3 A bill from the Senate Finance Committee to make several changes to Medicare and Medicaid drug policies — notably redesigning Medicare Part D and implementing policies that could reduce costs for drug prices growing faster than inflation 4 A number of joint recommendations from scholars at the Brookings Institution and the American Enterprise Institute, including increasing funding for more effective anti-trust enforcement in the healthcare market and reforming the low-income subsidy under Medicare Part D to encourage greater use of generic drugs

What are the recommendations of the Brookings Institution?

A number of joint recommendations from scholars at the Brookings Institution and the American Enterprise Institute, including increasing funding for more effective anti-trust enforcement in the healthcare market and reforming the low-income subsidy under Medicare Part D to encourage greater use of generic drugs.

How much did Medicare spend on prescription drugs in 2006?

In 2006, prescription drugs represented about 10 percent of Medicare spending. That figure increased to 14 percent, or $95 billion, in 2016. The rising costs of prescription drugs and their effect on Medicare could have serious consequences on our healthcare system and our nation’s long-term fiscal well-being.

How much did prescription drugs cost in 2016?

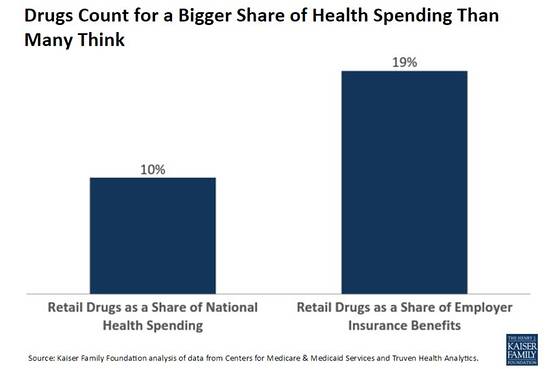

By 2016, prescription drugs accounted for 10 percent of healthcare costs, or about $330 billion, and that amount is projected to nearly double within the next decade. In real (inflation adjusted) terms, prescription drug expenditures have increased by almost $300 billion from 1980 to 2016.

How much did healthcare cost in 1980?

In 1980, such spending totaled around $12 billion and accounted for about 5 percent of total healthcare costs.

When did Medicare add Part D?

In 2006, “Part D” was added to Medicare to provide prescription drug coverage to beneficiaries; thus, the rising costs of prescription drugs has had a substantial impact on the program.

Do pharmacies post prescriptions?

Unlike gas stations, pharmacies don’t post their prescription prices on brightly lit signs out front. But there are still ways to find out how much your medicine will cost before you make the trip.

Can you get a better deal with a medicine shortage?

Sometimes, like in the case of a medicine shortage, it’s just not possible to get a better deal. That’s when you could talk to your doctor about making a change.

What is the purpose of the ICER?

A governmental or a nongovernmental agency, such as the Institute for Clinical and Economic Review (ICER), must be authorized in the United States by law, to set ceiling prices for new drugs based on incremental value, and monitor and approve future price increases.

How much is Humalog?

One vial of Humalog (insulin lispro), that costs $21 in 1999, is now priced at over $300. On January 1, 2020, drugmakers increased prices on over 250 drugs by approximately 5%20. The United States clearly needs state and/or federal legislation to prevent such unjustified price increases21.

What is the Doha Declaration?

This process permitted under the Doha declaration of 2001, allows countries to override patent protection and issue a license to manufacture and distribute a given prescription drug at low cost in the interest of public health. Solutions: additional policy changes needed in the United States.

Do prescription drugs increase as much as inflation?

En español | Retail prices for some of the most widely used brand name prescription drugs continue to increase twice as much as inflation, making these life-sustaining medicines potentially unaffordable to many older Americans, according to a new report from AARP’s Public Policy Institute.

How to lower prescription drug prices?

AARP continues to push for a number of policy changes it believes will lead to lower prescription drug prices. These include: 1 Medicare price negotiations. Allow the program to negotiate the prices of prescription drugs and allow private insurance plans to have access to those lower prices. 2 Inflation-based rebates. Require drug manufacturers to pay a penalty when their prices for prescription drugs covered by Medicare parts B and D increase faster than inflation. 3 Out-of-pocket cap. Create a hard out-of-pocket spending limit for Medicare Part D prescription drug plan enrollees.

What are the most expensive drugs?

Prices for 8 popular drugs 1 Duexis, used for pain relief. Price increased by 60 percent, from $18,287 to $29,342. 2 Lyrica, treats fibromyalgia and diabetic nerve pain. Price increased 47 percent, from $5,827 to $8,562. 3 Symbicort, treats asthma and COPD. Price increased 46 percent, from $2,940 to $4,282. 4 Victoza, treats diabetes. Price increased 42 percent, from $7,936 to $11,300. 5 Lumigan, treats glaucoma and high eye pressure. Price increased 42 percent, from $1,689 to $2,400. 6 Bystolic, treats high blood pressure. Price increased by 41 percent, from $1,239 to $1,747. 7 Linzess treats irritable bowel syndrome. Price increased 39 percent from $3,747 to $5,207. 8 Eliquis, treats atrial fibrillation and prevents strokes. Price increased 33 percent, from $4,109 to $5,473.

How much does Victoza cost in 2020?

For example, between 2015 and 2020, the annual price of Victoza, a diabetes medication, increased by 42 percent, with the price of a year’s supply rising from $7,936 to $11,300. During that same period the price of Lyrica, used to treat fibromyalgia, increased by 47 percent — from $5,827 a year to $8,562. “AARP is calling on Congress ...

What is the AARP campaign?

AARP has renewed its campaign to convince federal and state governments to adopt policies that will help lower prescription drug prices. As part of its “ Fair Drug Prices Now ” initiative, AARP is calling on Americans to contact their representatives to urge them to act.

What are the policies of AARP?

AARP continues to push for a number of policy changes it believes will lead to lower prescription drug prices. These include: Medicare price negotiations. Allow the program to negotiate the prices of prescription drugs and allow private insurance plans to have access to those lower prices. Inflation-based rebates.