One of the things you cannot receive coverage for with a Medicare Supplement is prescription drug coverage. Original Medicare does not cover prescription drugs, meaning you cannot receive coverage for prescription drugs under Medigap. Also, Medigap does not cover dental, vision, long-term care, eye glasses, or hearing aid costs.

Full Answer

What does Medigap pay for what medicare doesn't cover?

Medigap pays some or all of the costs Medicare doesn’t cover, depending on the level of coverage you choose. The costs of what Medicare doesn’t cover can be substantial, especially if you need extensive treatment or long-term hospitalization. Many private insurance companies offer Medigap policies, so be sure to shop around.

Can I Keep my Medigap plan if I have Original Medicare?

If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

What does Medigap cover?

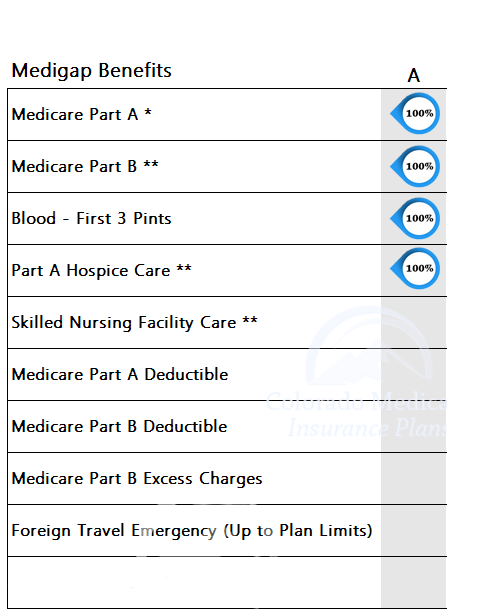

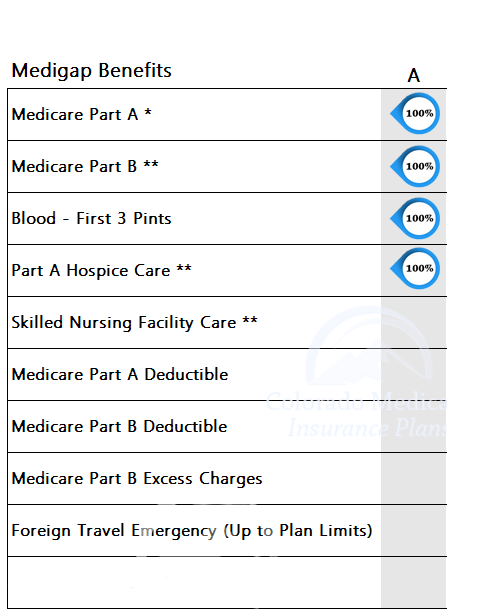

Medigap plans cover a lot of costs, however there are few things you may have thought Medicare and/or Medigap covers and they actually don’t. Medigap plans fill in the gaps of Original Medicare, however, each Medigap plan offers different coverage. Here is a list of what Medigap can cover:

What is the difference between Medicare and Medigap?

Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medigap policy pays its share. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What is not covered in Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...

Why does Medigap no longer cover Part B deductible?

note: As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

Can Medigap plans deny coverage?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Does Medigap cover all costs?

Medigap plans cover all or some of the following costs, with a few exceptions: Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Medicare Part B coinsurance or copayment.

What are the pros and cons of Medigap plans?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Jun 4, 2015

What is the difference between Medigap and Medicare Advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What is creditable coverage for Medigap?

For Medigap policies, certain health insurance coverage you had within 63 days of securing a new policy can be used to shorten the waiting period for pre-existing conditions. This type of coverage that shortens the waiting period would be called creditable coverage.

Does Medigap cover out of network?

Medigap plans themselves do NOT have networks. If your doctor is a non-participating provider with Medicare itself (rare), then they will NOT accept your Medigap plan either.

Can Medicare Supplement plans deny coverage for pre-existing conditions?

Summary: A Medicare Supplement insurance plan may not deny coverage because of a pre-existing condition. However, a Medicare Supplement plan may deny you coverage for being under 65. A health problem you had diagnosed or treated before enrolling in a Medicare Supplement plan is a pre-existing condition.

Does Medigap cover all out-of-pocket costs?

Medigap plans help cover original Medicare costs including deductibles, copayments, and coinsurance. The price you pay for a Medigap plan can depends on which plan you choose, where you live, your age, and more. Only two Medigap plans — Plan K and Plan L — have out-of-pocket limits.

Does Medigap cover copays and deductibles?

Medigap supplemental insurance covers the cost of Original Medicare deductibles, coinsurance, and copays. It may also cover a range of services excluded from Original Medicare coverage.

Do Medigap plans have an out-of-pocket maximum?

Do Medigap Plans have an Out-of-Pocket Maximum? Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare Medigap?

Medigap is supplemental insurance sold by private insurance companies that have been approved by Medicare. Medigap is there to help you cover some of the out-of-pocket costs associated with Original Medicare ( Part A and Part B) if you have a chronic illness or frequent doctor visits.

Why am I denied Medicare?

1. You aren’t enrolled in Medicare Part A and Part B. While most people will automatically be enrolled in Medicare Part A when they turn 65, you will probably have to enroll in Medicare Part B yourself.

What is medical underwriting?

Medical underwriting is where private insurance companies that sell Medigap can limit or deny coverage or charge you more for your premiums based on your health history. This might happen if you switch from Medicare Advantage to Original Medicare plus Medigap and have a pre-existing condition on your health record.

How long do you have to wait to buy a Medigap policy?

If you want to purchase a Medigap policy with a pre-existing condition, you may be denied coverage or have a 6-month waiting period before your coverage kicks in. The purpose for this waiting period is to make sure people don’t wait until they have a major medical issue to buy a policy, which could raise premiums.

How long is the waiting period for Medigap?

The waiting period is reduced by one month for each month you had creditable coverage before you purchased your Medigap policy. For example, if you don’t have insurance for four months before purchasing your policy, your waiting period will be at least four months long.

When does Medigap open enrollment start?

Your 6-month Medigap open enrollment period begins when you are age 65 or older and enrolled in Part B coverage. During this enrollment period, insurance companies cannot deny you coverage based on your medical history, age, gender, or health status.

Can I get a Medigap policy if I have Medicare?

Until you enroll in both Part A and Part B (Original Medicare), you cannot purchase a Medigap policy. 2. You have Original Medicare, but you’re younger than 65. Some people may qualify for Medicare due to a disability or certain illness, like end-stage renal disease (ESRD) or ALS.

What is Medicare Advantage vs Medigap?

Medicare Advantage. A Medigap policy is a supplement to your Original Medicare coverage that pays expenses that Original Medicare doesn’t cover. A Medicare Advantage Plan (Medicare Part C) is a private replacement for the public Medicare program.

What is a Medigap plan?

The purpose of a Medigap plan is to be reimbursed for the costs you pay directly out of your own pocket. These plans are offered by private insurance companies, so you'll have to do some comparison shopping to get the one that fits your needs and financial situation.

How much does Medicare Plan F cost?

The average cost per month for the most popular Medigap F Plan is approximately $326. 5. As of January 1, 2020, however, Plan F is no longer available to people newly eligible for Medicare.

How much is hospitalization coverage for 2021?

If you are admitted to the hospital, you have 100% hospitalization coverage after the $1,484 annual deductible under Original Medicare Part A, as of 2021. That’s the basic bed and board. However, you may owe up to 20% of some other costs, such as anesthesiologist fees. 2 . If you are in the hospital for more than 60 days, ...

What is the deductible for dental insurance in 2021?

Your deductible for 2021 is $203, but after that, you’ll pay up to 20% of the Medicare-approved amount for most doctor services. There’s no upper limit. 2 . If you do not have coverage for dental expenses, you may want to look into a standalone dental insurance plan.

How much do you have to pay for drugs in 2021?

At a certain level—$4,130 in 2021—you enter the notorious donut hole in coverage that requires you to pay up to 25% of covered brand-name and generic drug costs. When costs go above $6,550 in 2021, you pass through the donut hole and owe only 5% of the cost of drugs. 3 .

How much does it cost to be in the hospital for 60 days?

If you are in the hospital for more than 60 days, you have to pay $371 per day. There are similar copayments for long stays in nursing facilities and hospices. Regular doctor visits and outpatient medical care may cost you too.

What is a Medigap policy?

Medigap policies are a supplemental insurance option for people enrolled in original Medicare that are looking for additional financial coverage. When you enroll in a Medigap policy, you’ll be covered for certain costs, such as deductibles, copayments, and coinsurance.

How many Medigap plans are there?

There are 10 Medigap plans available: A, B, C, D, F, G, K, L, M, and N. Some Medigap plans no longer for sale to new Medicare enrollees. These include plans C, F, E, H, I, and J. However, if you already have one of these plans, you can keep it. If you were eligible for Medicare before January 1, 2020, you can still buy Plan C or Plan F.

What is a medicaid supplemental insurance?

What is Medigap? Medigap is Medicare supplemental insurance sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . In some cases, Medigap will also cover emergency medical fees when you’re traveling outside the United States.

Is Medigap the same as Medicare Advantage?

Please note that Medigap is not the same as Medicare Advantage. Medicare Advantage plans offer coverage in addition to what original Medicare offers. Medigap plans only help pay for whatever coverage you already have.

Does Medigap cover hospital coinsurance?

Most of these Medigap plans differ in what types of copayment, coinsurance, or other medical fees they will cover. All Medigap plans cover at least some portion, if notall, of: Medicare Part A coinsurance and hospital fees. Medicare Part A hospice coinsurance or copayment costs. Medicare Part B coinsurance or copayment costs.

Does Medigap charge more as you age?

Attained age–rated Medigap policies charge higher premiums as you age, and your monthly premium amount is determined based on your age. Unlike issue-age-rated policies, these types become more expensive as you get older.

Does Medicare Part A have out-of-pocket limits?

However, neither Medicare Part A nor Part B have out-of-pocket limits. If you choose a Medigap policy that doesn’t cover least most, or all, of your Medicare fees, you’ll still have to pay out-of-pocket for these costs.

What is a Medigap plan?

From its name, Medigap means filling the gap that Original Medicare does not cover. Original Medicare only covers 80 percent of Part B costs. You are responsible for the remaining 20 percent, like deductibles, copays, and coinsurance. Plus, on Original Medicare, there is no maximum cap on how much you need to pay in one year, unlike coverage under the Affordable Care Act (ACA).

Is Medigap insurance good?

But, there are situations when you can. Medigap insurance is excellent for people who already have some health conditions.