These Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Can you switch from Medigap to Medicare Advantage?

Medigap policies must offer Open Enrollment without underwriting when a senior first becomes Medicare eligible, but only in limited situations thereafter. If you have been enrolled in a Medicare Advantage Plan less than a year and want to switch back to ...

How to switch from Medicare Advantage to Medigap?

- Call the Medicare Advantage plan you wish to leave and ask for a disenrollment form.

- Call 1-800-MEDICARE (1-800-633-4227) to request that your disenrollment be processed over the phone. TTY users should call 1-877-486-2048. ...

- Call the Social Security Administration or visit your Social Security Office to file your disenrollment request.

How to choose between Medicare Advantage, Medigap and Part D?

- How many prescriptions am I likely to need during each plan year? ...

- Can you afford the copays, coinsurance or deductibles involved? ...

- Are you likely to hit the coverage gap? ...

- How expensive are your monthly medications? ...

- Which plan has a formulary that covers most if not all of your current prescriptions? ...

Which Medigap plan is the best?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for ...

Is plan G better than an Advantage plan?

Strong financial pressures exist for most private health insurance companies to initially direct new enrollees to a Medicare Advantage plan. A Medicare Supplement Plan G is a much better choice for many. (Also called a Medigap Plan G).

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Part G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the downside to Medigap plans?

Because Medigap plans are sold by private insurance companies, they can charge different monthly premiums. While plans are standardized in regard to coverage and benefits, they are not standardized in regards to cost. Cost can even increase over time based on inflation, your age and other factors.

Can you change from Medicare Advantage to Medigap?

You may have chosen Medicare Advantage and later decided that you'd rather have the protections of a Medicare Supplement (Medigap) insurance plan that go along with Original Medicare. The good news is that you can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

What is Medicare Plan G?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Is Medigap plan G guaranteed issue?

Medigap Plan G is only available as a guaranteed issue plan to people who became eligible for Medicare on or after January 1st, 2020. You may still apply for Medigap Plan G through the usual methods (link to article) if you entered Medicare before 2020, but your acceptance may not be guaranteed.

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Why should I choose a Medigap plan?

Since Medicare only covers about 80% of medical costs, signing up for Medigap can give you fuller coverage and peace of mind. 1 Medigap is a private insurance option that is designed to work well with Medicare (Part A and Part B) plans.

Who are Medigap plans good for?

Who Is Eligible for Medigap Plans? To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories: Age 65 and older.

Do Medigap plans have a maximum out-of-pocket?

Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

How much does Medicare Advantage cost?

Medicare Advantage plans typically have multiple copays with a maximum out-of-pocket cost limit of $4,000-$6,700/year. For years with high use of medical care including hospitalizations, the total cost (including premiums) of a Medicare Supplement Plan G approach will usually be less expensive.

What is the best Medicare Supplement Plan?

The simple answer is that a Medicare Supplement Plan G is the best option for most Medicare enrollees currently initially enrolling in a Medicare Supplement plan. (There is both a standard [low deductible] and a high deductible version of Plan G.

How much is Medicare Part B deductible in 2021?

Medicare Plan G with the standard (low) deductible has a $203 Medicare Part B deductible in 2021. This deductible amount is indexed to the inflation rate and will change annually. (Three states, Massachusetts, Minnesota, and Wisconsin, use a different system and the comments on this website don’t apply.) top of page.

How long does it take to switch to Medicare Supplement?

In contrast, after initially choosing a Medicare Advantage plan, changing to a Medicare Supplement plan can be very difficult. After the initial 12 months of being in a Medicare Advantage plan, an individual usually no longer has the right to go to any Medicare Supplement plan.

Is there a high deductible for Medicare Supplement Plan G?

Update: As of 2020, in addition to the standard Medicare Supplement Plan G, there is a Medicare Supplement Plan G with a high deductible option ($2,370 in 2021): Plan G- HD. The following comments are for the standard Medicare Supplement Plan G with the lower deductible- ($203 in 2021).

Does Medicare Supplement Plan have a separate drug plan?

With a Medicare Supplement plan approach, a separate drug prescription plan (Medicare Part D) needs to be purchased. The government heavily subsidizes both the Medicare Advantage drug plan and the separate Medicare Part D drug plan. 5. Best Medicare option for most individuals when turning 65 years of age.

Is Medicare Supplement Plan G better than Medicare Advantage Plan?

A Medicare Supplement Plan G is a much better choice for many. ( Also called a Medigap Plan G ). (As of 2020, there is now a High Deductible version of Plan G in addition to the standard Plan G.)

What is a Medigap plan?

The most basic Medigap plan (Plan A) covers your Original Medicare coinsurance and little else. The most comprehensive plan (Plan F, for those Medicare-eligible before 2020, and Plan G, for those newly eligible) covers virtually all out-of-pocket costs associated with your Medicare-covered treatment.

What percentage of Medicare enrollees switch to a different plan each year?

Enrollees who re-evaluate and switch their Medicare Advantage plan could potentially save on their premiums and out-of-pocket limits. 16% of Medicare Advantage enrollees switch to a different Medicare Advantage plan each year. 3 An additional two percent of enrollees per year return to traditional Medicare.

How much does Donna pay for Medicare Supplement?

With Plan F, the most extensive Medicare Supplement plan, Donna would pay $2,832 per year in premiums with no additional out of pocket expenses. If Donna signed up for a less comprehensive Medigap plan – Plan K – she’d pay around $1,800 in premiums, plus the $198 Part B deductible.

How much does Medicare Supplement cost?

Medigap: The average cost of Medigap Plan G – the most expensive Medicare Supplement plan still available to new enrollees – starts at around $90 a month and can be much higher, depending on your state and other factors.

What is Medicare Supplement?

The time-tested and widely available model for Medicare beneficiaries is Medicare Supplement, also known as Medigap. A newer and more flexible option called Medicare Advantage – formally known as Medicare Part C – is increasingly popular. You have to decide which one is right for you.

What happens if you change your Medicare Supplement?

With Medicare Supplement plans, your main concern will be price and plan type. Since plans are standardized and pay for all doctors who accept Medicare, there’s little room for variation between insurance carriers. If you do change your plan, it will likely be due to price increases. Also, your application will likely require medical underwriting, because there’s no federally mandated annual enrollment period.

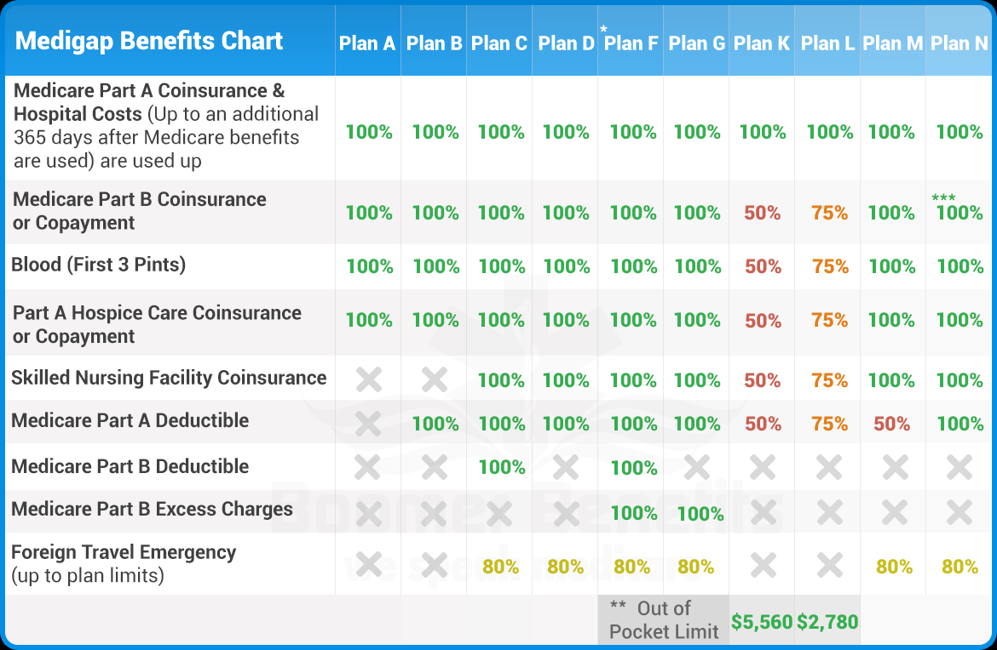

How many types of Medigap are there?

There are 10 types of Medigap plans, which are standardized so that plans within each level provide the same exact coverage. For example, all Plan L policies – regardless of which company offers them – must provide the same exact benefits.

Can You Change From Medicare Advantage to Medigap Coverage?

You can change from Medicare Advantage to Original Medicare with Medigap coverage with certain limitations. If you missed your initial six-month enrollment period for Medigap, you might not be able to purchase Medigap policies sold in your area.

Which is Better: Medicare Advantage or Medigap?

The question of whether Medicare Advantage or Medigap is better is one of the most common questions Cicchelli gets, but unfortunately comes with no easy answer, he says. The reason is that the decision is subjective and depends on your individual needs.

Experts

Ryan Cicchelli, founder of Generations Insurance & Financial Services in Cadillac, Michigan Joe Boden, CFP, vice president and partner at EP Wealth Advisors in Seattle, Washington

What is Medicare Advantage?

About Medicare Advantage. About 33% of beneficiaries choose to enroll into Medicare Advantage policies, which are private insurance plans. They usually have lower premiums than Medigap plans....sometimes even a $0 premium on some plans in some areas.

Why do you have to use a Medigap plan?

Because you agree to use the plan's network providers to get your care. This means you'll have substantially fewer doctors to choose from than if you chose a Medigap plan. The insurance company has more control over your choice of providers, with whom they negotiate contracted rates.

What is a Medicare supplement plan?

Medicare supplement plans are also called Medigap plans. Having a Medigap plan means you are still enrolled in Original Medicare as your primary insurance. You can see any provider that participates in Medicare, regardless of which supplement company you choose.

What does $0 mean on Medicare?

When a plan has a $0 premium, it means that you will pay no additional premiums for the plan itself. You will still pay for your Part B premiums monthly though. You must be enrolled in both Medicare Parts A and B to be eligible for a Medicare Advantage plan.

What is the maximum amount you can get on Medicare in 2021?

In 2021, Medicare has declared that this maximum cannot be any higher than $7,550 . However, $7,550 is a lot of money for people on fixed incomes.

Is Medicare Advantage separate from Medicare?

Medicare Advantage plans, on the other hand, are entirely separate from Medicare. When you enroll into a Medicare Advantage policy, you get your benefits from the plan, not Medicare. You agree to use the plan's network of providers except in emergencies. You'll pay copays for your health care treatment as you go along.

Does Medicare cover everything?

As you may know by now, Medicare alone doesn’t cover everything. Most people buy additional insurance to bridge the gaps. When considering Medicare Advantage vs Medigap plans, it’s important to understand that both types of plans will help to reduce your out of pocket spending.

What is the difference between Medicare Advantage and Medigap?

What are the differences between Medicare Advantage and Medigap? Within Medicare Advantage and Medigap, there will be differences in coverage, cost and the provider networks. These will vary greatly and thus are important to recognize before you decide on a plan that will be right for your health situation.

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, is an alternative to the original Medicare Parts A and B. This plan is a bundled policy that includes Part A, Part B and sometimes Part D. Furthermore, an Advantage plan will provide some added benefits that original Medicare will not cover such as vision, hearing and dental care.

How much does Medicare Supplement cost?

Specifically, Medicare Advantage plans could cost between $0 and $100 a month while Supplement coverage can vary between $50 and $1,000 per month.

What is Medicare Supplement?

Medicare Supplement, sometimes called Medigap, is a health insurance plan that will complement your original Medicare. In other words, Medicare Supplement helps fill the gaps for Medicare parts A and B by providing financial help for deductibles, out-of-pocket costs and coinsurance. Medigap plans are organized by different letters: plans A, B, C, ...

What are the parts of Medicare?

Initially, both policies require and include Medicare parts A and B. These plans represent original Medicare and are your base Medicare health insurance. Beyond parts A and B, you can customize your coverage (through Medicare Supplement) or purchase a simple, comprehensive policy (through Medicare Advantage).

Which Medicare supplement is best for Part B?

For example, if you want coverage for the Part B deductible, the best Medicare supplement policy would be Plan C . However, if you want to cover Part B excess charges, then Plan G would be the right purchase.

Is Medigap the same as UHC?

Medigap policies are offered through private health insurance companies, such as Kaiser Permanente or UnitedHealthcare. However, there's no difference in coverage between the plans offered by the companies. For example, Plan K through Kaiser Permanente will be the same Plan K that is offered by UHC.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.