Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

How does Medigap differ from Medicare Advantage?

Dec 20, 2021 · Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program. While this may be the more expensive option, it has a few...

What is the difference between Medigap and Medicare Advantage plans?

Jan 17, 2022 · Medigap policies are great because they give you the freedom to see any doctor, anytime, without hassle. Plus, since it works with Medicare to cover you, there are little to no costs when you see the doctor. If you have serious medical conditions or serious medical conditions run in your family, a Medigap plan could be a huge money saver.

Is it better to have Medicare Advantage or Medigap?

Mar 30, 2022 · Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

How to switch to Medigap when you have Medicare Advantage?

Sep 15, 2021 · Medicare Advantage is an alternative to Medicare, bundling Medicare’s parts together. Medigap works as a wraparound to original Medicare, covering out-of-pocket costs for Parts A and B. Medicare allows enrollees to use only one of these two plans at a time, though.

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is Medigap and why would someone choose it?

Why do I need Medigap? Medigap policy supplements your Original Medicare coverage, covering more expenses. Medigap provides more choice and covers a larger network of healthcare providers than other options. If you travel or need coverage that Original Medicare doesn't provide, Medigap might be a good option for you.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Sep 26, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Does Medigap make sense?

Thus, if you're always in doctor's office, Medigap saves you money. You have high out of pocket costs: If you struggle paying for deductibles, copayments, or coinsurance, consider Medigap. It can help mitigate your expenses. For example, all MedSup plans cover Medicare Part A and B coinsurance and deductibles.Jun 11, 2018

Who pays for Medigap?

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can I switch from Medigap to Medicare Advantage?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.Jun 24, 2021

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What are the advantages and disadvantages of Medicare Advantage plans?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider net...

Why are some Medicare Advantage plans free?

Some Medicare Advantage plans offer a zero-dollar monthly premium because what Medicare pays the plan, plus your Medicare Part B premium, cover the...

Is it better to have Medicare Advantage or Original Medicare and Medigap?

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it cost...

What are the pros and cons of a Medicare Advantage plan?

MA Plan ProsThe maximum out-of-pocket cost is $7,550 a yearMany plans cost $0 extra a monthMost plans include drug coverageMany include basic heari...

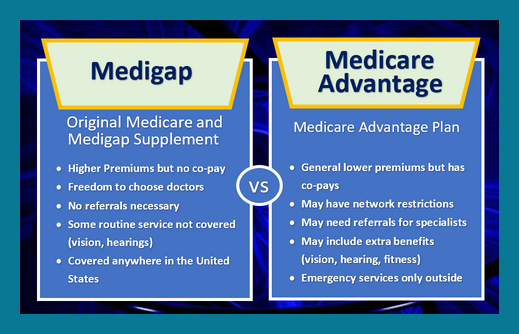

What is the difference between Medicare Advantage and Medigap?

Medicare Advantage and Medigap plans are both sold through private insurers, but there are major differences. Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the advantages of Medigap?

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare. If your doctor is not in a Medicare Advantage plan you’re considering, and you don’t want to switch doctors, you may want to consider Medigap.

How much is Medicare Advantage 2021?

Medicare Advantage: An average $21 a month premium (for 2021) on top of your Medicare Part B premium. Medigap: The average Medigap cost is $2,100 per year ($175 per month), and covers about $1,600 in out-of-pocket expenses per year, on average. Coverage.

When can I switch to a different Medicare Advantage plan?

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicare’s open enrollment period, which runs from October 15 through December 7 each year. You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan.

What is the difference between Medicare Supplement and Medicare Advantage?

Licensed insurance advisor John Clark explains the main difference between Medicare Supplement plans and Medicare Advantage plans. You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

How much does Medicare cost out of pocket?

Medicare Advantage: Plans must cap annual out-of-pocket costs at $7,550 for in network services and $11,300 for in - and out-of-network services combined. Medigap: A Medigap policy can ease concerns about Medicare's lack of caps or limits. Each plan has specific benefits with specified out-of-pocket costs. Prescription Drug Coverage.

Does Medicare Advantage include prescription drug coverage?

Medicare Advantage: Plans may include prescription drug coverage. Medigap: You have to buy separate Medicare Part D prescription drug coverage. Referrals. Medicare Advantage: You may be required to get a referral from your primary care doctor to see a specialist.

What is the difference between Medicare Part B and Medicare Part B?

And it does it all for one manageable cost ( Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

What percentage of Medicare is paid?

Medicare pays 80 percent and the patient pays the remaining 20 percent of all covered services. If the beneficiary wants additional coverage, to isolate themselves from the 20 percent gap, they simply buy a Medigap plan (supplemental Medicare coverage).

What is PFFS insurance?

With PFFS Medicare health insurance, healthcare providers bill Medicare directly for the services they provide to its beneficiaries. It’s a simple system that prevents healthcare billing nightmares. It’s easy for the patients, easy for healthcare providers, and easy for Medicare.

When was Medicare first introduced?

Garfield Kaiser invented the HMO healthcare delivery system in 1945, but it took the government a few decades to recognize its benefits.

When did Kaiser start?

When the Kaiser Permanente health plan was launched on July 21, 1945, it put in motion the most enduring health care system in history and became a model for healthcare delivery. In fact, Kaiser has had more 5-star Medicare Advantage plans than any other insurer, but they only operate in a handful of states.

Do you need a referral for Medicare Advantage?

No referrals are required to use healthcare services. Plan benefits never change. Your plan and coverage travel with you. In Why Medicare Advantage Plans are Bad: 7 Reasons, I talk about all of the many reasons that Medicare Advantage may not be a good fit for someone.

Do all doctors accept Medicare?

And, not all doctors accept Medicare-assignment, which requires them to take payment Medicare establishes for each healthcare service. Many doctors and specialists who don’t accept Medicare-assigned will see patients for an additional 15 percent fee, which is billed to the patient as Part B Excess Charges.

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

When is the best time to buy a Medigap plan?

The best time to buy a Medigap plan is during the 6-month open enrollment period (OEP). This window automatically begins the month a person reaches the age of 65 years.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

What is a bundle plan?

Coverage. Bundled plans that include all the benefits of original Medicare and more. Plans help cover out-of-pocket costs associated with original Medicare’s parts A and B. Extra benefits. Many plans offer dental, vision, and hearing care. Plans may cover emergency care if a person travels overseas.

Does Medicare cover Part B?

Most charge a monthly premium in addition to the Part B premium, but some don't.

Can you use Medigap for Medicare?

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare.

How to compare Medicare Advantage and Medigap?

Still asking yourself "Should I get Medigap or Medicare Advantage?" It's critical to compare the costs and benefits of each type of plan in relation to your personal healthcare needs and budget. Some of the key factors for comparison are: 1 Monthly premiums 2 Deductibles, if any 3 Expected costs of healthcare services on each plan 4 How often you use healthcare services 5 Areas where you will need access to care 6 Expected copays for your medications 7 Potential out of pocket spending for you on each plan type 8 Remember, you get what you pay for

What is Medicare Advantage?

About Medicare Advantage. About 33% of beneficiaries choose to enroll into Medicare Advantage policies, which are private insurance plans. They usually have lower premiums than Medigap plans....sometimes even a $0 premium on some plans in some areas.

What is a Medicare supplement plan?

Medicare supplement plans are also called Medigap plans. Having a Medigap plan means you are still enrolled in Original Medicare as your primary insurance. You can see any provider that participates in Medicare, regardless of which supplement company you choose.

Is Medicare Advantage separate from Medicare?

Medicare Advantage plans, on the other hand, are entirely separate from Medicare. When you enroll into a Medicare Advantage policy, you get your benefits from the plan, not Medicare. You agree to use the plan's network of providers except in emergencies. You'll pay copays for your health care treatment as you go along.

What does $0 mean on Medicare?

When a plan has a $0 premium, it means that you will pay no additional premiums for the plan itself. You will still pay for your Part B premiums monthly though. You must be enrolled in both Medicare Parts A and B to be eligible for a Medicare Advantage plan.

Do you need a referral for Medicare Supplement?

You have access to all the Medicare providers nationwide - no referrals necessary. If you enroll in a comprehensive plan like Plan F or Plan G, you will have very little out of pocket. Not even doctor copays! When you enroll, your Medicare supplement insurance company notifies Medicare that you have purchased a policy.

Do you need a referral to see a specialist for Medicare?

No referrals are necessary to see a specialist on this type of coverage. Medigap plans allow you to see any doctor in the nation that participates in Medicare. Because these plans offer you the most freedom and flexibility, they have higher premiums than Medicare Advantage plans.

How much does Medicare Advantage cost?

Medicare Advantage plans typically have multiple copays with a maximum out-of-pocket cost limit of $4,000-$6,700/year. For years with high use of medical care including hospitalizations, the total cost (including premiums) of a Medicare Supplement Plan G approach will usually be less expensive.

What is the best Medicare Supplement Plan?

The simple answer is that a Medicare Supplement Plan G is the best option for most Medicare enrollees currently initially enrolling in a Medicare Supplement plan. (There is both a standard [low deductible] and a high deductible version of Plan G.

How much is Medicare Part B deductible in 2021?

Medicare Plan G with the standard (low) deductible has a $203 Medicare Part B deductible in 2021. This deductible amount is indexed to the inflation rate and will change annually. (Three states, Massachusetts, Minnesota, and Wisconsin, use a different system and the comments on this website don’t apply.) top of page.