Supplemental Insurance covers all the gaps left by the Original Medicare, which is why it is also called the Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Is supplemental insurance mandatory if I qualify for Medicare?

You'll need supplemental insurance with Medicare to help relieve some of the financial burden of medical costs, like deductibles and coinsurance.

Why to get affordable Medicare supplement insurance plans?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between Medicare and Medicare Supplement?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the cost of supplemental insurance for Medicare?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Which of the following is true about Medicare supplemental insurance plans?

Which of the following is true about Medicare Supplement Insurance Plans? They are regulated by the Centers for Medicare & Medicaid Services (CMS). Plan benefit amounts automatically update when Medicare changes cost sharing amounts, such as deductibles, coinsurance and copayments.

Medicare Supplement Plans Help Pay Medicare Part A and Part B Costs

Original Medicare, the health coverage you can get when you turn 65 or have a qualifying disability, consists of Medicare Part A and Part B. Part A...

Ten Advantages of Medicare Supplement Plans

1. Large medical bill protectionLet’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80...

Medicare Supplement Plans by State

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N;...

Medicare Supplement Plans and The Part B Premium

You need to keep your Original Medicare insurance and continue paying your Part B premium when you get a Medicare Supplement plan. Medicare Supplem...

What is Medicare insurance?

Medicare Insurance is the largest health insurance program that provides health coverage for individuals 65 years or older. It also can apply to specific younger individuals with disabilities and individuals at any age with end-stage renal disease.

What are the parts of Medicare?

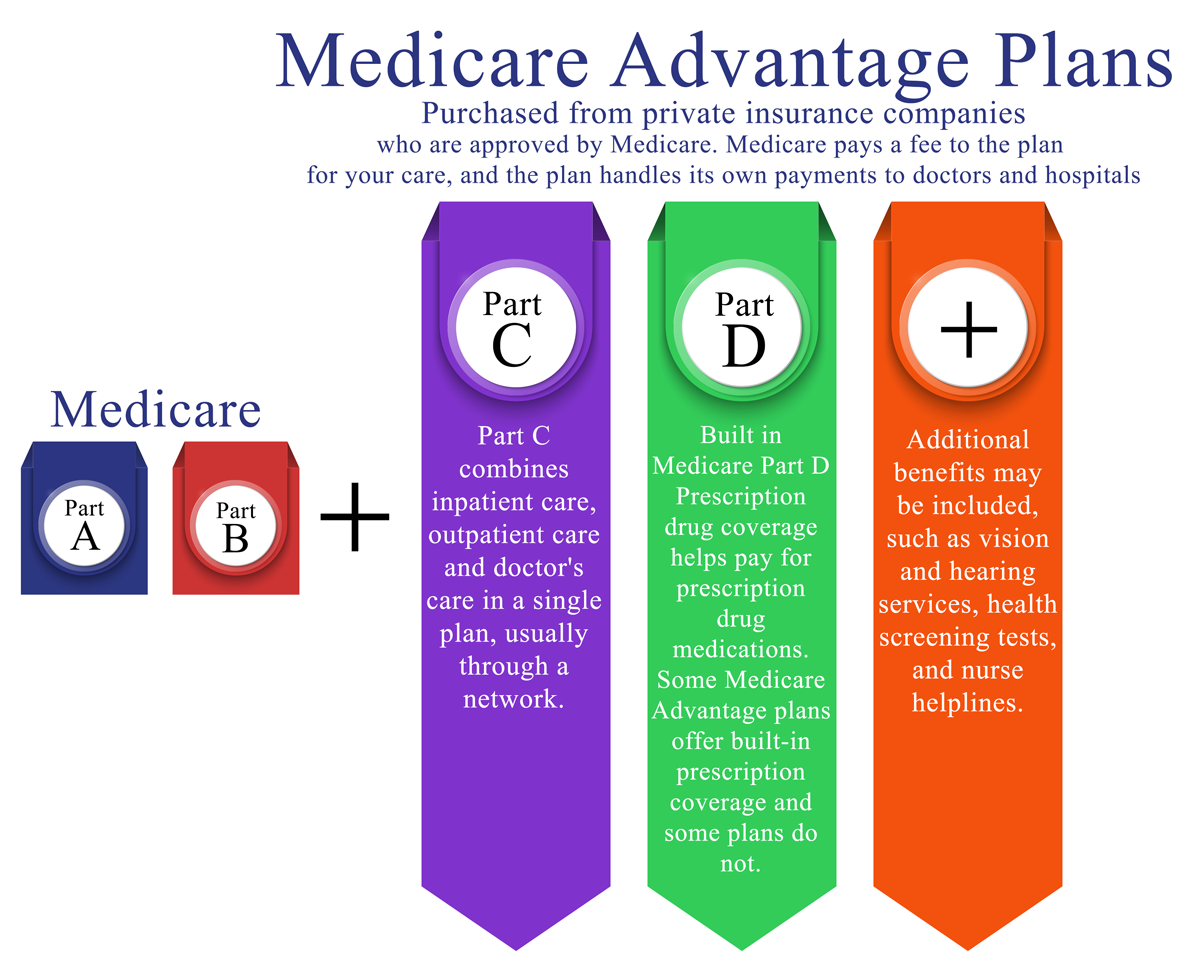

There are four parts to Medicare that ensure that individuals will be taken care of in all departments. Part A and B , also called original Medicare, supply inpatient/hospital coverage and outpatient/medical coverage . Part C also called the Medicare Advantage plan, allows an alternative way to receive your Medicare benefits. Lastly, Part D provides prescription drug coverage. Considering the different options of Medicare programs, you may ask yourself, “Why would I need supplemental insurance?”

Is supplemental insurance expensive?

However, any medicine not prescribed in a hospital setting will not get covered. Even though the supplemental plan is beneficial, it can also be expensive. So, when choosing whether to get the plan, you might want to think of certain aspects such as deductibles, copays, and monthly premiums.

What is Medicare Supplement Insurance?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage. Instead, they help pay for what Medicare Part A and B does not, including copays, coinsurance, and deductibles. 2 It does not affect which doctors you can see.

Where do you pay Medicare Supplement?

You pay the premium for your selected Medicare Supplement plan directly to the private insurance company . This is in addition to the monthly Part B premium that you pay to Medicare (most likely a deduction from your Social Security check).

How Does Medigap Serve or Help Me?

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

How Does Medigap Work?

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

What Are My Choices of Medigap Policies?

You receive the same coverage no matter which insurance company sells you the Medigap plan. Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary.

How much is Medicare Advantage 2021?

The bundled coverage of Medicare Advantage includes additional services but has yearly out-of-pocket costs up to $7,500 in 2021.

What is the first decision when it comes to health coverage after 65?

Your first decision when it comes to health coverage after 65 is between Original Medicare and Medicare Part C .

Why Do I Need Supplement Insurance with Medicare?

Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication and vision and dental care.

What Are The Gaps in Original Medicare?

As you may well know by this point, it is impossible to ignore the existing gaps in Original Medicare coverage. For a federal program that has so many coverage policies, there are two main forms of coverage where it usually fails to provide benefits.

Deciding On Whether You Need Supplemental Insurance

Now that we have covered all that there is to know about Medigap and Medicare, it is important you utilize this information in order to make an informed decision about your Medicare coverage. If you would like more information on either Medigap, Medicare Advantage, or Part D plans, give us a call.