Medicare supplements

Medicare

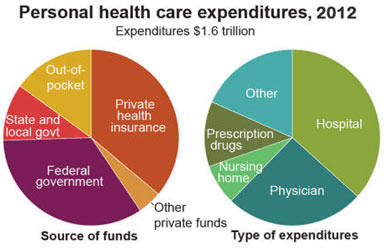

Medicare is a national health insurance program in the United States, begun in 1966 under the Social Security Administration and now administered by the Centers for Medicare and Medicaid Services. It provides health insurance for Americans aged 65 and older, younger people with some disability st…

Full Answer

Why every senior should have a Medicare supplement plan?

Sep 16, 2018 · Ten advantages of Medicare Supplement plans Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Coverage outside of the United States If you’re on vacation outside the U.S. and an accident or sudden illness happens... Guaranteed ...

What are the top 5 Medicare supplement plans?

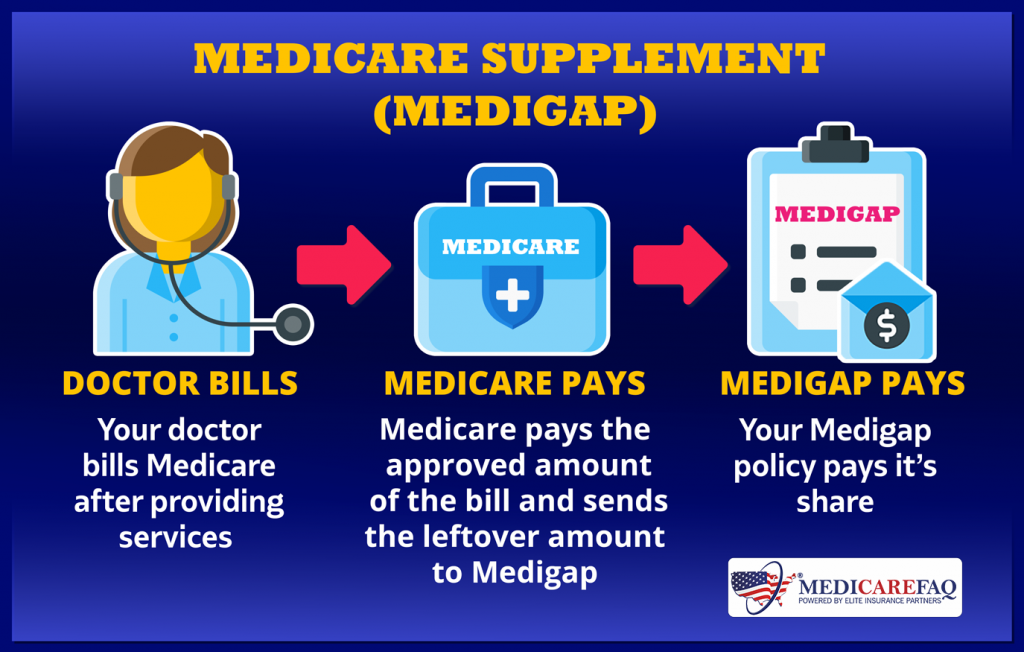

Jan 12, 2021 · You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have your credit ruined because of unpaid medical bills. Medicare supplements take care of things like co-payments, deductibles, and coinsurance that you are responsible for, and some plans even cover you if you travel outside of the United States.

Are You paying too much for your Medicare supplement?

Medicare Supplement insurance can help reduce out-of-pocket medical expenses. Medicare Supplement insurance policies (also known as Medigap) are offered by private insurance companies and are regulated by the State Departments of Insurance. These policies provide insurance coverage that supplements the coverage provided by Medicare Parts A and B.

Does a Medicare Supplemental Plan replace original Medicare?

Dec 16, 2021 · Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation.

What is the point of Medicare supplement plan?

Is it worth getting supplemental insurance?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What is the difference between Medicare and Medicare supplement?

Can you cash out supplemental life insurance?

Who might benefit from supplemental insurance and why?

What is the difference between Medicare Supplement and Advantage plans?

Does Medicare cover dental?

Is Medigap the same as supplemental?

Can you be denied a Medicare Supplement plan?

Can I switch from a Medicare Supplement to an Advantage plan?

What is the biggest difference between Medicare and Medicare Advantage?

Medicare Supplement Plans Help Pay Medicare Part A and Part B Costs

Original Medicare, the health coverage you can get when you turn 65 or have a qualifying disability, consists of Medicare Part A and Part B. Part A...

Ten Advantages of Medicare Supplement Plans

1. Large medical bill protectionLet’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80...

Medicare Supplement Plans by State

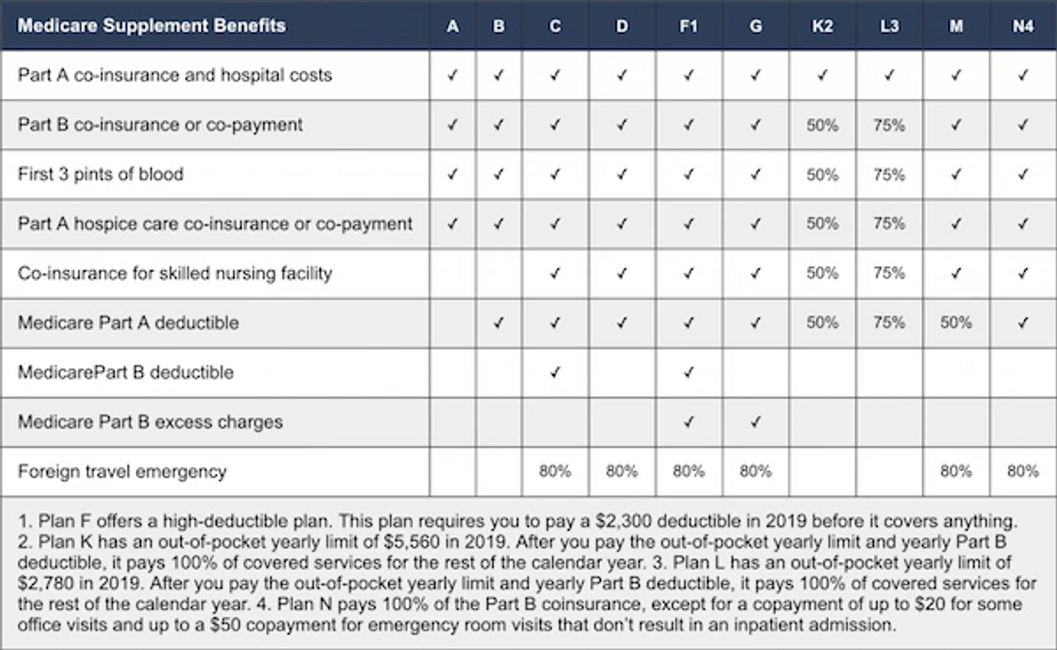

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N;...

Medicare Supplement Plans and The Part B Premium

You need to keep your Original Medicare insurance and continue paying your Part B premium when you get a Medicare Supplement plan. Medicare Supplem...

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

Does Medicare pay for prescription drugs?

One popular feature of Medicare Advantage plans is that most include coverage for prescription drugs (Part D). These plans pay instead of Medicare (as opposed to after Medicare, as Medigap plans do). When you join a Medicare Advantage plan, Medicare pays that plan to deliver your care.

Is Medicare Part B free?

When Americans reach retirement age and start their Medicare coverage, many are shocked to realize that Medicare is not free. If you didn’t know to save for Medicare Part B premiums during your retirement, you may find that money is tight.

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

How long does Medicare cover hospitalization?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021. If you are in the hospital longer than 60 days, you begin paying an expensive daily copay for your hospital care. If you are in the hospital 150 days, your hospital coverage runs out altogether.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

Does Medicare Advantage have a whole state network?

That network might be just in one or two counties or occasionally we see them include a whole state. You agree to treat with those providers according to the plan’s rules.

What is Medicare Supplement Insurance?

Medicare supplement insurance can help reduce out-of-pocket medical expenses. Medical Supplement Insurance Policies (also known as Medigap) are offered by private insurance companies and are regulated by the State Departments of Insurance. These policies provide insurance coverage that supplements the coverage provided by Medicare Parts A and B.

What are the benefits of Medicare?

All standarized plans include the following basic benefits: 1 Hospitalization: Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. 2 Medical Expenses: Part B coinsurance (generally 20 percent of Medicare approved expenses) or copayments for hospital outpatient services. Plans K, L, and N require insureds to pay a portion of the Part B coinsurance or copayment. 3 Blood: First three pints of blood each year. 4 Hospice: Part A coinsurance for eligible hospice/respite care expenses.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

Does Medicare cover prescriptions?

Original Medicare covers most hospital and doctor expenses. (It does not cover prescription drugs, although you can buy separate private drug plans.) The balance is left to you, with no cap on how high your out-of-pocket costs can go. Original Medicare allows you to see any doctor in the U.S. who accepts Medicare.

Does Medicare have a cap on out-of-pocket costs?

The balance is left to you, with no cap on how high your out-of-pocket costs can go. Original Medicare allows you to see any doctor in the U.S. who accepts Medicare. It provides excellent flexibility: it has no networks or referral requirements.

Does Medicare Advantage cover vision?

Medicare Advantage plans cap out-of-pocket expenses. Medicare Advantage is all-encompassing, even offering dental and vision coverage (Original Medicare does not). But, you are limited to its doctor network and need referrals to see specialists.

What is the deductible for Medicare Supplement 2020?

In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

Does Medicare cover out of pocket medical expenses?

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs. Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs.

What is Plan F Medicare Supplement?

Plan F (as in “full coverage”) is the most expensive medigap plan, but it is the simplest plan. That’s because it fills all the gaps in Medicare and a person should never get a bill.

What is the most expensive Medicare plan?

Plan F (as in “full coverage”) is the most expensive medigap plan, but it is the simplest plan. That’s because it fills all the gaps in Medicare and a person should never get a bill. As long as Medicare pays the claim, the medigap Plan F will pay it’s part – and the patient has no co-pays.

Does Medicare Supplemental Insurance cover outpatient care?

Unless a supplemental policy specifically states otherwise, the most it will cover are the Medicare deductibles ($147 outpatient and $1,187 hospitalization) and the 20 percent co-insurance. Supplemental policies do not usually cover any medical services Medicare won't cover. What's more, Medicare supplemental insurance will only pay health care ...

How long is a hospital stay for Medicare?

1. The average length of a hospitalization, even for Medicare patients, is about 5 days. Hospitalizations rarely exceed two weeks and 60-day hospitalizations are practically unheard of. Even hospitalizations for heart attacks or major surgeries rarely exceed a week. 2.

How much does Medicare cover for X-rays?

How well does Medicare cover you for all of the tests, office visits and treatments you might need if you're not treated in a hospital? If you have Medicare Part B, it will cover 80 percent of all approved charges for doctor's office visits, blood tests, X-Rays, CT scans, MRIs and ER visits.

Does Medicare Supplement Insurance cover deductibles?

The purpose of Medicare Supplement Insurance is to cover the cost left by deductibles and coinsurance in Original Medicare, but as full Medicaid coverage should cover the majority of those costs, a Medicare Supplement Insurance policy isn’t necessary. 3.

Is United American a Medicare Supplement?

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.

Is United American Insurance endorsed by the government?

The purpose of this communication is the solicitation of insurance. United American Insurance Company is not connected with, endorsed by, or sponsored by the U.S. government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services. Policies and benefits may vary by state and have some limitations and exclusions. Individual Medicare Supplement insurance policy forms MSA10, MSB10, MSC10, MSD10, MSF10, MSHDF10, MSG10, MSHDG, MSK06R, MSL06R, MSN10 and in WI, MC4810 and MC4810HD, MC4810HDG are available from our Company where state-approved. Some states require these plans be available to persons under age 65 eligible for Medicare due to disability or End Stage Renal disease (ESRD). You may be contacted by an agent or producer representing United American Insurance Company, PO Box 8080, McKinney, TX 75070-8080. OUTLINE OF COVERAGE PROVIDED UPON REQUEST.

Is Medicare Advantage better than Medicare Advantage?

Medicare Advantage plans provide significantly lower-quality home health care to seniors than traditional Medicare, according to a 2019 study by Brown University. The study found seniors with traditional Medicare were 4.9 percent more likely to receive top care compared to those in a low-rated Medicare Advantage plan and 2.8 percent more likely to receive top care compared to those in a high-rated Medicare Advantage plan.

How many people will be in Medicare Advantage in 2021?

Still, people are increasingly opting for Medicare Advantage plans. In 2021, 26.9 million beneficiaries are expected to be enrolled in Medicare Advantage. That's almost a 10 percent increase over the 24.4 million currently enrolled.

Does Medicare cover dental implants?

Medicare parts A and B, which most American retirees are eligible for, mainly covers hospital stays and doctors' visits, after certain deductibles and copays are met. But there is no coverage for drugs, dental, vision or hearing. Just one dental implant can set you back as much as $6,000, as can a pair of top-quality hearing aids.

Does Medicare have a maximum out of pocket limit?

And while Medicare Advantage plans do set maximum out-of-pocket limits, Price says most people will never hit them. Before making any decision on coverage, though, it's always wisest to consult with a Medicare specialist who can help determine your best option.

How much will Medicare cost in 2021?

Medigap premiums differ by insurer, age, location and plan selected, so retirees could pay an average of between $40 and nearly $1,000, for 2021 premiums according to Healthline. Medicare Advantage plan s, also offered by private insurers, provide all of the same benefits as Medicare ...

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

Does Medicare Supplement cover out of pocket?

Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs if you face a serious health setback.

Does Medicare cover vision?

There may be some services that Original Medicare generally doesn’t cover , such as routine vision care. You may also have to pay coinsurance amounts, like 20% for most covered doctor services.

What is Medicare Advantage?

A Medicare Advantage covers all the hospital and medical services that Original Medicare covers and usually includes prescription drug benefits as well. Medicare Advantage plans also all have out-of-pocket maximums, so you may be spared from high medical bills.

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

What is deductible insurance?

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Why are networks important?

Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like. However, you don’t need to worry about networks in the case of an emergency.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

What is medicaid?

Medicaid is a joint federal and state program that: 1 Helps with medical costs for some people with limited income and resources 2 Offers benefits not normally covered by Medicare, like nursing home care and personal care services

Is Medicare part of Medicaid?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.