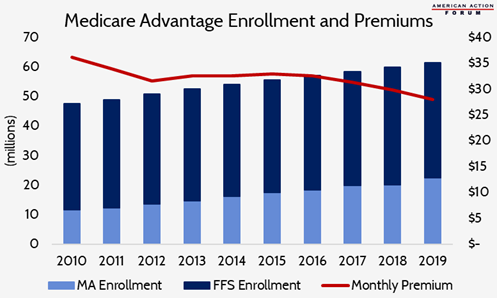

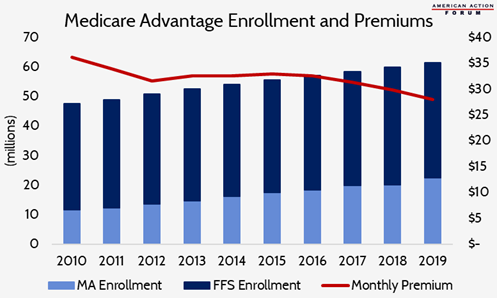

Why Did Medicare Advantage Enrollment Grow As Payment Pressure Increased? The Affordable Care Act (ACA) introduced several changes to Medicare Advantage (MA) plan payment to better align Medicare spending on MA enrollees with average spending per traditional Medicare enrollee.

Full Answer

Why did my Medicare premiums go up?

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey...

How much is Medicare increasing?

Medicare's Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month. In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233. That's a 14.8% increase from 2021 to 2022. The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

Will My Medicare premiums increase?

Your Medicare Supplement Insurance premiums may increase over time, but the amount and timing depend on several factors. Some insurance plans will have increases simply because you're getting older.

Did Medicare premiums go up?

Medicare Part B. Beneficiaries of Medicare Part B will be seeing a moderate increase over the costs in 2019. For 2020, the standard monthly premium will increase $9.10, from $135.50 in 2019 to $144.60, unless you’re considered held harmless. Many people subtract their Part B premiums from their monthly Social Security check.

Why are Medicare Advantage plans being promoted?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

Why did Medicare premiums go up?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

What is the future of Medicare Advantage?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

Are Medicare Advantage plans growing?

Enrollment in Medicare Advantage plans has doubled over the past decade and continues to grow. In 2022, approximately 28 million people (43% of Medicare beneficiaries) are enrolled in Medicare Advantage plans; by 2025, Medicare Advantage is projected to be the dominant way people receive their Medicare benefits.

Why did my Medicare premium increase for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Why is Medicare going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Is Medicare Advantage going to be eliminated?

In a word—no, Medicare isn't going away any time soon, and Medicare Advantage plans aren't being phased out. The Medicare Advantage (Part C) program is administered through Medicare-approved private insurance companies.

Will Medicare Advantage plans increase in 2022?

The average premium for Medicare Advantage plans will be lower in 2022 at $19 per month, compared to $21.22 in 2021, while projected enrollment continues to increase.

What is the best Medicare Advantage plan for 2022?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

How popular are Medicare Advantage plans?

All that marketing seems to be working. Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation. Those numbers include 50 percent of Black and 54 percent of Hispanic enrollees vs. 36 percent of whites in 2018.

What is Medicare Advantage?

Medicare Advantage is private healthcare offered by companies like BlueCross BlueShield, UnitedHealthcare, and AARP (just to name a few). MA plans are able to offer extra benefits and even $0 premium plans because the federal government subsidizes it.

What is the difference between Medicare Advantage and Medicare Advantage?

It also failed to highlight the clear difference between Medicare and Medicare Advantage, which is the networks! Medicare gives you access to any provider that accepts Medicare assignment. Medicare Advantage limits your access to a network of providers in a specific area.

What is the 2019 Medicare handbook?

The Center for Medicare Advocacy explained in a 2018 statement about the 2019 handbook draft: “ [I]nformation about traditional Medicare and Medicare Advantage (MA) distorts and mischaracterizes facts in serious ways.”. For example, the 2019 handbook draft suggested that Medicare Advantage is the less expensive alternative for beneficiaries.

Why is CMS promoting MA?

We believe CMS is promoting MA so heavily because it puts the risk on insurance carriers, not the federal government. CMS demonstrates this big Medicare Advantage push on its unclear Plan Finder tool, past drafts of the Medicare & You Handbook, and AEP email campaigns.

How many people will choose Medicare Advantage in 2020?

According to the 2020 Medicare Trustees Report, 37.5% of Medicare beneficiaries choose Medicare Advantage. The Board of Trustees expects 43.2% to choose Medicare Advantage by 2029.

How much does Medicare cost in MA?

Many MA plans have $0 premium, while Medicare Supplements routinely cost $100-$125 per month in premium. The Plan Finder tool is hyper-focused on premium, and there are a lot of non-monetary components that the Plan Finder fails to highlight.

Can you enroll in Medicare Advantage instead of Original?

That private insurance company then offers Medicare Advantage plans you can enroll in instead of Original Medicare. CMS, the Centers for Medicare & Medicaid Services, believes they are saving money by getting you off of Original Medicare and moving you over to a Medicare Advantage plan. That helps explain why CMS has been accused ...

How does the population age affect Medicare?

As the population ages, the ratio of employed workers (who support Medicare through taxes) to retirees (who receive the benefits from those taxes) continues to shrink. The cost of health care continues to rise.

How to save money on Medicare?

If you’re concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs: 1 Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs. 2 Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. 3 Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare).#N#Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

How much does Medicare Part B coinsurance go up?

Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year. There are a number of contributing factors to why Medicare costs go up each year, such as:

What percentage of Medicare Part B funding came from beneficiaries?

Approximately 27 percent of Medicare Part B funding in 2017 came from beneficiaries’ premiums. Nearly 71 percent of Part B funding in 2017 came from general revenue, which consists mostly of federal income taxes. Increasing the Part B premium by only a small percentage for each beneficiary can raise tens of millions of dollars for ...

Does Medicare Part B go up every year?

Does the Medicare Part B premium go up every year? The Part B premium is hardly the only Medicare cost that will go up every year. The Medicare Part A (hospital insurance) premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.

Does Medicare go up or down each year?

Your Medicare premiums aren’t the only thing that will go up each year : your Social Security benefit payment will typically also increase each year. The Social Security Administration (SSA) uses the consumer price index for workers (CPI-W) to make annual adjustments to benefit payment amounts.

Does the hold harmless rule apply to Medicare Part B?

The hold harmless rule does not apply to you, however, if: This is your first year receiving Medicare Part B benefits. You are enrolled in a Medicare Savings Program (MSP) You pay an IRMAA. You were enrolled in an MSP in 2018 but lost program coverage because your income increased.

How much will Medicare Advantage increase in 2023?

By 2023, available annual profit pools will range from $11 billion to $13 billion, making Medicare Advantage the single biggest driver of profit growth for health care payers.

How much will Medicare be in 2023?

It’s a vast market—projected to reach more than $360 billion a year by 2023—with attractive growth baked in. Below the surface, though, lie difficult dynamics and increasingly tough competition. Medicare Advantage—the insurance programs that private companies offer through Medicare—has established itself as a hot market segment that shows no signs of cooling, and lots of health care payers are eyeing it. But they should look carefully before they leap. Large incumbents such as United Health, Humana, CVS Aetna, and Anthem, along with powerful regional players such as WellCare, have built strong defenses. New entrants must develop a compelling value case if they are to gain a foothold, much less seize significant share. Here’s what companies need to know to get into the market or increase their current share.

Why do payers invest in in-home care?

Some payers are investing in in-home care and wellness programs designed to help people return home more quickly after hospitalization or live more easily at home when managing long-term illnesses or chronic conditions. Listening to Members. Payers in general receive low trust scores from consumers.

Why should health plans align their network design and their stars?

Health plans should align their network design and their Stars strategies to create the foundation for a high-quality provider partner base.

Is Medicare Advantage challenging?

Cracking the Medicare Advantage market has proved equally challenging for existing health plans, such as regional Blue Cross Blue Shield plans, which have often found it difficult to translate their historical strength in employer-sponsored commercial insurance into success in Medicare Advantage.

Does Medicare Advantage require a different operating model?

Payers need to recognize that Medicare Advantage requires a fundamentally different operating model and set of capabilities than those they have developed for their commercial group and individual lines of business. While many of the competencies may seem similar and scalable, they have proved not to be.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.