Since Medicare is not considered an HDHP, enrolling makes you ineligible to contribute to an HSA. Once you enroll in Medicare, it’s illegal to continue to contribute to a Health Savings Account. The only exception to continue contributing to your HSA is to postpone enrolling in Medicare.

Can I use an HSA to pay Medicare supplement premiums?

Can I Use An HSA To Pay Medicare Supplement Premiums? HSA’s and Medicare can be tricky to maneuver. Not only do you have to worry about what you can use your funds on when you’re in retirement, but you also need to know how to avoid a taxable event when you’re about to retire from work.

Can I keep contributing to my HSA if I have Medicare?

You just have to be aware that you can’t keep contributing into that HSA if you enroll in any part of Medicare. Most Medicare beneficiaries who are still working at age 65 choose to enroll in Medicare Part A. That’s because Part A can limit your hospital spending to $1,484 (in 2021) if you ever have a hospital stay.

Can I add to my HSA if my plan isn’t eligible?

If you later switch to a non-eligible plan, you can not add contributions for that year, however you can use the funds that are already in the account for qualified expenses. If your current health insurance plan isn’t HSA-eligible, despite its high deductible, you’re out of luck for this year.

Should I delay enrollment in Medicare to contribute to my HSA?

Whether you should delay enrollment in Medicare so you can continue contributing to your HSA depends on your circumstances. If you work for an employer with fewer than 20 employees, you may need Medicare in order to have primary insurance, even though you will lose the tax advantages of your HSA.

Can HSA funds be used for Medicare supplement premiums?

After you turn 65, you can use HSA money tax-free to pay premiums for Medicare parts B and D and Medicare Advantage plans (but not premiums for Medicare supplement policies), in addition to paying for other out-of-pocket medical expenses.

Why can't HSA be used for premiums?

Can I use my HSA to pay for health insurance premiums? Generally, you cannot treat insurance premiums as qualified medical expenses unless the premiums are for: a. Long-term care insurance, subject to IRS mandated limits based on age and adjusted annually (see IRS Publication 502: Long-Term Care).

What is the downside of an HSA?

What are some potential disadvantages to health savings accounts? Illness can be unpredictable, making it hard to accurately budget for health care expenses. Information about the cost and quality of medical care can be difficult to find. Some people find it challenging to set aside money to put into their HSAs .

Can you use HSA funds for anything after age 65?

At age 65, you can withdraw your HSA funds for non-qualified expenses at any time although they are subject to regular income tax. You can avoid paying taxes by continuing to use the funds for qualified medical expenses.

Medicare Part A & Group Health Coordination

Why would someone with group health insurance from a large employer (20+ employees) want to enroll in Part A any? Well, Part A can limit your hospi...

The HSA and Medicare Exception

Let’s first define what an HSA is. HSA stands for Health Savings Account. This is a tax-favored account that eligible individuals can open to save...

The Potential Consequences of Having HSA and Medicare

What if you didn’t realize this and have already signed up for Part A and Social Security income benefits? You would need to stop contributing to t...

Late Enrollment Penalty For Part D

Many high-deductible health plans do not have drug coverage that is considered creditable for Part D. In other words, the insurance plan will not p...

Common Questions About HSA and Medicare

Yes you can pay for Medicare premiums, deductibles, copays and coinsurance from existing funds in a health savings account. If you have long-term c...

Medicare and HSA: Confusing!

We realize these rules can be confusing and sometimes downright mind-boggling! That’s why the insurance experts at Boomer Benefits are here to guid...

How long do you have to stop contributing to HSA before you can get Medicare?

According to CMS (the agency that oversee’s the Medicare program,) you should stop contributing to your HSA 6 months before you sign up for premium free Part A. This is because Premium-free Part A retroactively backdates 6 months.

How much is the high deductible plan G?

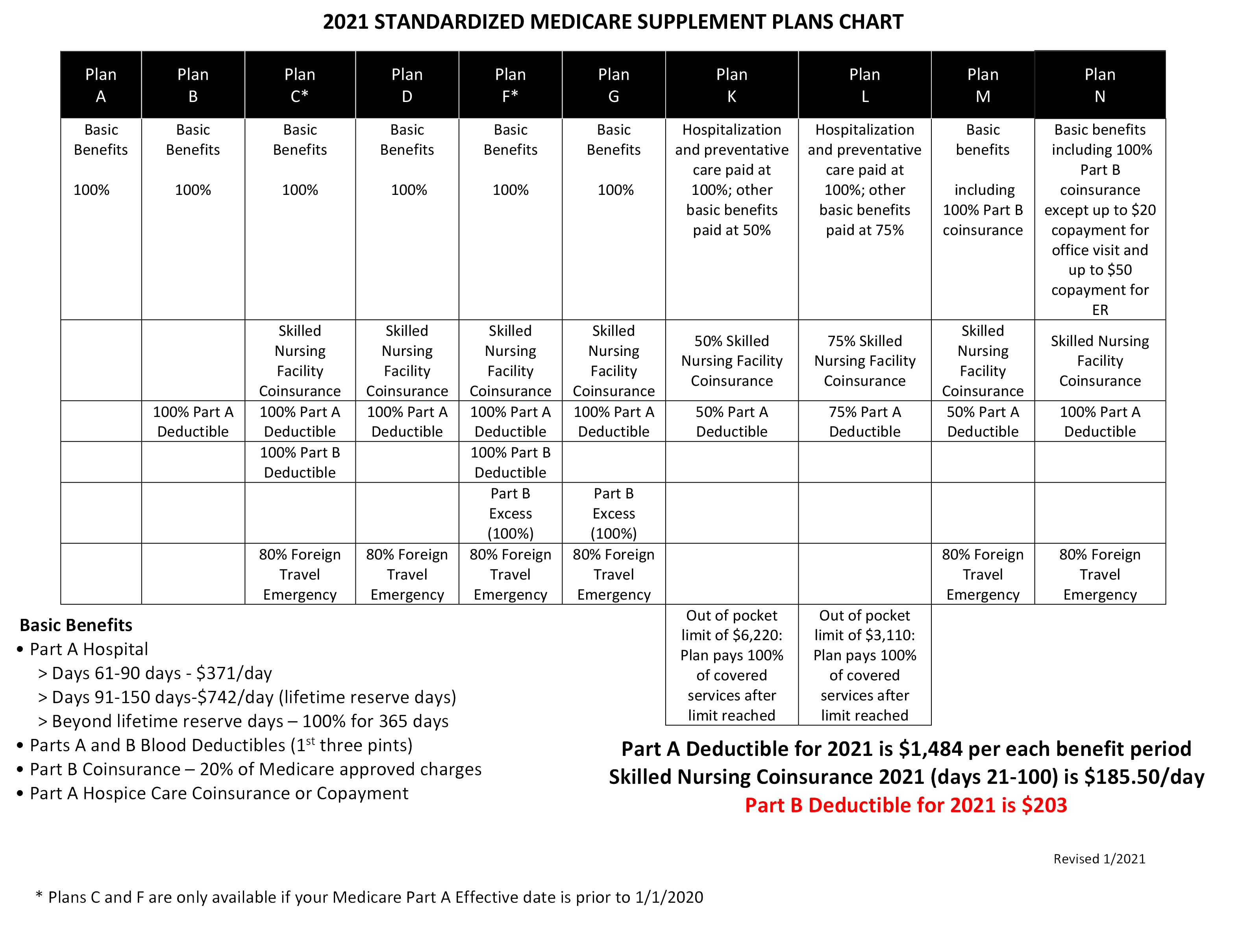

The cost of High Deductible Plan G is $38 dollars a month. This saves Tom over $720 dollars a year with no difference in coverage. Only paying the High Deductible Medicare Supplement deductible with his HSA plan instead of paying the insurance company to cover it.

Is HSA contribution tax free?

Contributions are tax-free, up to their annual limit (2020 limit is $3,550 for an individual and $7,100 for a family.) Investment gains in the HSA are tax deferred (like your 401k plan.) If you use proceeds (earnings from investments and what you contribute) on qualified medical expenses, they are non-taxable.

Is Medicare Part A free?

For most working Americans, Medicare Part A is premium free. Since there’s no cost associated with it to the beneficiary, most people sign up for Part A at age 65. This is generally a good idea. Usually, Medicare is a secondary insurance behind your work plan. That means your work plan must pay it’s portion first.

What is HSA 2021?

Medicare and Health Savings Accounts (HSA) Home / FAQs / General Medicare / Medicare and Health Savings Accounts (HSA) Updated on June 9, 2021. There are guidelines and rules you must follow when it comes to Medicare and Health Savings Accounts. A Health Savings Account is a savings account in which money can be set aside for certain medical ...

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.

HSA fast facts

Health savings accounts (HSAs) were created as part of the Medicare Prescription Drug, Improvement, and Modernization Act, or MMA, signed into law by President George W. Bush on December 8, 2003. The MMA was the largest overhaul to Medicare in the program's history.

What about FSA and HRA eligibility?

The same HSA eligibility status for Medicare Supplemental Insurance applies to flexible spending accounts (FSAs) and health reimbursement arrangements (HRAs) as well.

Sources

Coming up with accurate eligibility status for the list of HSA eligible expenses can be a challenge at times. The IRS only provides a partial list of eligible expenses, so consumers and even insurance companies are left to wonder exactly what products are eligible.

What is an HSA account?

An HSA account provides you with an unparalleled triple tax break: tax-deferred contributions, tax-free investment growth, and tax-free withdrawals for qualified medical expenses. The HDHP is there when you need it, kicking in once your health-care spending reaches a specified amount.

How long does it take to get Medicare back?

When you start drawing Social Security benefits, the Social Security Administration backdates your Medicare Part A enrollment by, at the most, six months (it depends on when you became eligible for Medicare). To avoid any overlap, stop contributing to your HSA six months before applying for Social Security benefits.

Is HSA deductible for Medicare?

IRS law states that HSA eligibility requires enrollment in only a high-deductible health plan (HDHP). Enrollment in an additional health plan is forbidden— including Medicare. Because of the enormous tax benefits included with an HSA, the IRS upholds this rule strictly.

Can I use my HSA to pay my Medicare Advantage premiums?

Good news – you can use funds in your HSA to pay for Medicare Advantage insurance premiums in the form of a reimbursement. Medicare Advantage plans, also called Part C plans, also come with out-of-pocket costs, like copays and deductibles. You can pay for those costs with your HSA funds, as well.

Can I pay Medicare Supplement premiums from my HSA?

Unfortunately, you cannot pay Medicare Supplements premiums using HSA funds. Medicare Supplement premiums, or Medigap premiums, are one of the only Medicare plan types that you cannot pay for using HSA funds ( Publication 969, 2020 ).

Can I use my HSA to pay for Medicare Part D?

Yes, you can use accumulated HSA funds to pay for Medicare Part D premiums. You can also use your HSA funds to cover copays at the pharmacy.

Can I reimburse myself for past Medicare premiums?

If you have an HSA and didn’t realize you could use those funds to pay for Medicare premiums and other out-of-pocket costs, you can still reimburse yourself.

Conclusion

Contributing to an HSA in your working years is an excellent way to help plan for healthcare costs in retirement.

Is HSA taxed?

Funds contributed to an HSA are not taxed when put into the HSA or when taken out, as long as they are used to pay for qualified medical expenses. Your employer may oversee your HSA, or you may have an individual HSA that is overseen by a bank, credit union, or insurance company.

Can you use HSA for qualified medical expenses?

If you use the account for qualified medical expenses, its funds will continue to be tax-free. Whether you should delay enrollment in Medicare so you can continue contributing to your HSA depends on your circumstances.

Does HDHP have a deductible?

HDHPs have large deductibles that members must meet before receiving coverage. This means HDHP members pay in full for most health care services until they reach their deductible for the year. Afterwards, the HDHP covers all the member’s costs for the remainder of the year.

What happens to my HSA once I enroll in medicare?

When you enroll in Medicare, you can continue to withdraw money from your HSA. The money is yours forever. Your HSA dollars can cover qualified medical expenses — 100% tax-free — if your insurance doesn’t reimburse you.

Are there penalties for having both an HSA and Medicare?

The IRS won’t penalize you if you still have money in your HSA when you enroll in Medicare. You can use your HSA dollars to pay for qualified medical expenses if you want to save money on taxes. Unlike a flexible spending account (FSA), all the unused funds in your HSA will continue to roll over every year.

What costs are not covered by Medicare?

Before you apply for Medicare, you should review your major out-of-pocket costs. This will help you determine the best time to apply for coverage.

What happens when I buy an eligible expense vs. an ineligible expense with HSA funds?

When you turn 65, you will have more flexibility over how you use the funds in your HSA. You can pay for all qualified expenses, free of taxes. You’ll have to pay income tax on money you withdraw to pay for nonqualified expenses. If you’re under 65, you may also owe a 20% tax penalty.

Are my withdrawals for HSA tax-free?

One of the benefits of an HSA is that your withdrawals can be tax-free if used for qualified medical expenses. All nonqualified expenses will be subject to federal and state income taxes.

The bottom line

Enrolling in Medicare can affect your ability to make contributions to a health savings account (HSA). Before you sign up for Medicare, make sure you understand HSA rules to avoid unexpected taxes and penalties. Although Medicare beneficiaries cannot contribute to an HSA, they can still withdraw money from the account.

How to find out if my health insurance is HSA eligible?

Find Out if Your Plan is HSA-Eligible. If you aren’t sure if your health insurance qualifies you for an HSA, call the insurer and ask. If you purchase a plan through a federal or state exchange, the answer should be in the plan information available through the exchange website.

How much has the deductible risen in 2015?

Deductibles alone have risen 67%—about seven times as fast as wages and inflation. In 2015, the average individual deductible was $1,318, according to a 2015 Kaiser Family Foundation/Health Research & Educational Trust survey. At the same time, a tool that could soften the blow—the Health Savings Account (HSA), ...

Is an X-ray deductible HSA eligible?

That means that a slightly more generous plan, which pays for any portion of things like prescription drugs or specialist visits or an X-ray (with or without a co-pay or co-insurance) before the deductible is met is not HSA-eligible.

Does pre-tax help with health insurance?

It even includes expenses that may not be covered by health insurance at all, like laser eye surgery, guide dogs or fertility treatments. Since almost everyone eventually faces health expenses, paying for them with pre-tax dollars can really help your bottom line. Let’s look at an example.

Is HSA tax deductible?

At the same time, a tool that could soften the blow—the Health Savings Account (HSA), which allows people to pay many of their health care costs with tax-deductible dollars—is not available to most Americans with high-deductible plans. In 2016, 3365 of the 4058 plans (83%) on the federal exchange had deductibles greater than $1,300.

What is the difference between an FSA and an HSA?

With an FSA, you must deplete your plan balance year after year , or you risk losing your remaining funds. An HSA , on the other hand, lets you contribute funds that never expire. In fact, the purpose of an HSA is to put in more money than you need in the near term, and then invest your balance for added growth. ...

What is the maximum deductible for Medicare 2020?

For 2020, it means a deductible of at least $1,400 as an individual or $2,800 as a family. But what happens when you sign up for Medicare as your health insurance? ...

How long does it take to get Medicare?

Medicare eligibility begins at age 65, and your initial enrollment window spans seven months, starting three months before the month of your 65th birthday and ending three months after that month. If you don't sign up on time, you'll risk a 10% penalty on your Part B premiums for life (Part A doesn't typically charge a premium to begin with, so there's no financial hit there if you sign up late).

Can seniors sign up for Medicare?

Many seniors jump to sign up for Medicare as soon as they're able, but if doing so prevents you from contributing to an HSA, then you may want to consider delaying enrollment. This especially holds true if you get good coverage from your group health plan and are able to manage your existing deductibles under it.

Is HSA tax free?

IMAGE SOURCE: GETTY IMAGES. The beauty of the HSA is that it's triple tax-advantaged. Contributions are made on a pre-tax basis, investments gains aren't taxed, and withdrawals are tax-free provided they're used for qualified medical expenses. There is, however, one major catch when it comes to HSAs, and it's that not everyone can qualify ...