Medicare may issue denial letters for various reasons. Example of these reasons include: You received services that your plan doesn’t consider medically necessary. You have a Medicare Advantage (Part C) plan, and you went outside the provider network to receive care.

Full Answer

How do I resolve a Medicare lien?

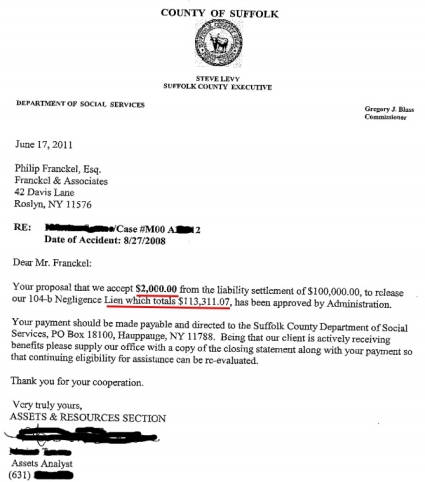

The issue of payment of a potential Medicare lien should be resolved as part of settlement discussions. It should be made clear which party will be responsible for paying the Medicare lien. Once payment of the lien is made to CMS, a closure letter will be issued advising the parties that the lien issue has been resolved.

What happens when you get a lien letter from CMS?

Once payment of the lien is made to CMS, a closure letter will be issued advising the parties that the lien issue has been resolved. It should also be noted that a lien letter from CMS will only cover any medical payments issued by Medicare Parts A and B.

Do you know the final Medicare lien amount?

Synergy’s lien resolution group has seen many cases like this one, where attorneys settle a case based on the assumption that they know the final Medicare lien amount, only to later receive a Final Demand which is much greater than anticipated. Fortunately, Medicare has recently released a tool which is very useful in avoiding such situations.

Who is responsible for a Medicare lien in a liability claim?

In a liability claim, the claimant should be the one disputing the lien. The issue of payment of a potential Medicare lien should be resolved as part of settlement discussions. It should be made clear which party will be responsible for paying the Medicare lien.

How do I get a final payment letter from Medicare?

To request a Final CP Amount, go to the Case Information page and select the Calculate Final Conditional Payment Amount action. Click [Continue] to proceed. The Warning - Calculate Final Conditional Payment Amount Can Only Be Selected Once page displays.

What are Medicare liens?

A Medicare lien results when Medicare makes a “conditional payment” for healthcare, even though a liability claim is in process that could eventually result in payment for the same care, as is the case with many asbestos-related illnesses.

How long does Medicare assert a lien?

Any settlement or payment must be reported to Medicare within 60 days and their valid lien amount must be paid.

Do you have to repay Medicare?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Are Medicare liens negotiable?

The lien gives Medicare a claim to the judgment or settlement funds and the Medicare lien is superior to any other person or entity, including you as the insured party. Unlike cases involving private health insurance, Medicare offers little to no flexibility to negotiate away, or negotiate down, its lien amount.

How far back can Medicare recoup payments?

(1) Medicare contractors can begin recoupment no earlier than 41 days from the date of the initial overpayment demand but shall cease recoupment of the overpayment in question, upon receipt of a timely and valid request for a redetermination of an overpayment.

Does Medicare have a statute of limitations?

FEDERAL STATUTE OF LIMITATIONS For Medicaid and Medicare fraud, federal law establishes (1) a civil statute of limitations of six years (42 U.S.C. § 1320a-7a(c)(1)), and (2) a criminal statute of limitations of five years (18 U.S.C. § 3282).

How is Medicare lien amount calculated?

Formula 1: Step number one: add attorney fees and costs to determine the total procurement cost. Step number two: take the total procurement cost and divide that by the gross settlement amount to determine the ratio. Step number three: multiply the lien amount by the ratio to determine the reduction amount.

What is a Medicare demand letter?

When the most recent search is completed and related claims are identified, the recovery contractor will issue a demand letter advising the debtor of the amount of money owed to the Medicare program and how to resolve the debt by repayment. The demand letter also includes information on administrative appeal rights.

Does Medicare Subrogate?

Subrogation rules are written into the statutes that govern Medicare and Medicaid. Virtually always, if Medicare or Medicaid paid medical expenses incurred because of a personal injury, there will be at least some subrogation payment from a personal injury judgment or settlement.

How do I stop Medicare set aside?

The short answer is if your settlement includes future medical expenses and there's likelihood a cost-shift could occur to Medicare (i.e. Medicare could reasonably be expected to pay for injury-related medicals), then it is not advised to attempt to avoid a Medicare Set Aside.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How many days before the anticipated date of settlement for Medicare?

The process begins when the beneficiary, their attorney, or another representative (SLRS), provides the required notice of pending liability insurance settlement to the appropriate Medicare contractor at least one hundred twenty (120) days before the anticipated date of settlement.

Does Medicare use synergy?

Fortunately, Medicare has recently released a tool which is very useful in avoiding such situations. Synergy regularly utilizes this tool to achieve exceptional results in cases for clients which have enrolled in this process prior to settlement.

Does Synergy have a lien resolution group?

Synergy’s lien resolution group has seen many cases like this one, where attorneys settle a case based on the assumption that they know the final Medicare lien amount, only to later receive a Final Demand which is much greater than anticipated. Fortunately, Medicare has recently released a tool which is very useful in avoiding such situations. Synergy regularly utilizes this tool to achieve exceptional results in cases for clients which have enrolled in this process prior to settlement. Using this tool can eliminate cases, like Mayo, where attorneys are surprised once they receive a Final Demand from Medicare.

What to ask a client about Medicare?

Ask the client if they have received any correspondence from Medicare; be sure to make copies of those as well. These may be in the form of Explanation of Benefits statements, bills, or letters.

How long does it take to get a final demand from Medicare?

Warn your clients though, even with timely reporting of the settlement information, obtaining the Final Demand amount can take up to a month if you are lucky, and if you are not, well, then buckle in, because it could be a very long while.

What is the black hole in Medicare?

It takes FOREVER to get a response from the black hole that is known as Medicare's Benefits Coordination and Recovery Contractor. The BCRC collects the information for Medicare and opens the file with the Medicare Secondary Payor Recovery Center (MSPRC).

How to mark unrelated claims?

Make sure to mark the unrelated claims with pen, either by crossing it out or by marking it with an "X." One thing that Medicare mentions nowhere on their website is that when documents are transmitted to them, for some reason, highlighting does not show up, so do not use highlighting as your means of indicating what charges are unrelated. Fax a letter back to MSPRC asking them to remove the unrelated charges, and include a copy of the itemization with the crossed out claims.

What to do if you disagree with the final demand amount?

If you disagree with the final demand amount, you can appeal or request a waiver. You must do so in writing. Upon receipt of the request, MSPRC will ask you to fill out a waiver form.

Can you stop Medicare from holding up settlement check?

If you start early, and remain organized, you can prevent Medicare from holding up your settlement check at the end of your case, which can happen if you do not have Medicare's final demand when it's time for the adjuster to issue the settlement check.

Can you self calculate Medicare payment?

You can also self-calcula te your conditional payment amount if you meet certain eligibility criteria. Use this form to indicate that you meet the criteria, and what you calculate to be the conditional payment amount, and send it in to the Medicare address listed on the form.

What is a closure letter for Medicare lien?

Once payment of the lien is made to CMS, a closure letter will be issued advising the parties that the lien issue has been resolved.

How to determine if a claimant is a Medicare beneficiary?

This can usually be determined by evaluating a claimant’s age. Most individuals are entitled to Medicare coverage when they reach sixty-five (65) years of age. However, a claimant can become a Medicare beneficiary prior to reaching sixty-five (65) years of age in certain circumstances. Usually, this will occur when a claimant has applied for, and is awarded, Social Security Disability benefits. A claimant can also be entitled to Medicare coverage if he/she had End Stage Renal Disease (ESRD). As such, prior to settling a claim, you always want to determine if the claimant is a Medicare beneficiary, and in fact, federal law requires you to make that determination.

How old do you have to be to get Medicare?

Most individuals are entitled to Medicare coverage when they reach sixty-five (65) years of age. However, a claimant can become a Medicare beneficiary prior to reaching sixty-five (65) years of age in certain circumstances.

Does an Erisa lien complicate a settlement?

In our last post, we discussed the issues posed by ERISA liens and how the presence of an ERISA lien can complicate a potential settlement. Another similar issue that complicates settlements is the potential presence of a Medicare lien. This applies to workers’ compensation and liability cases.

Does Medicare have a lien on workers compensation?

Usually, if a workers’ compensation claim has been accepted as compensable and all medical payments have been made through workers’ compensation, there should be no lien. However, you will still need to confirm this with Medicare prior to any settlement through a request for lien information to the Centers for Medicare and Medicaid Services’ (CMS) relevant contractor. The CMS contractor that handles lien recovery in accepted workers’ compensation claims is the Commercial Repayment Center (CRC).

How long does it take to pay a final demand letter?

There is a possibility that the Final Demand Letter will be incorrect when it does come. You absolutely must pay the amount demanded within 60 days, no matter what. You may also dispute the amount in the Final Demand Letter. But if you do not pay the amount demanded within 60 days, interest will accrue, starting from the date of the Final Demand Letter, regardless of whether you were correct and the amount demanded was inaccurate.

Does Medicare delay a case?

Medicare has extremely specific reporting procedures that, if not followed correctly, can delay your entire case. Thus, any time a client has medical bills that have been paid by Medicare, you will want to start this process as soon as you decide to pursue the case.

Does MSPRC have a deadline for final demand letters?

Unfortunately, MSPRC does not have a deadline for issuing the Final Demand Letter, and is processing them on a first-come, first-served basis. The operators are not allowed to “expedite” the letters, even if an excessive amount of time has passed. Many insurance companies will not issue settlement checks until the Final Demand Letter is received, resulting in continued delay of payment, and likely, client frustration. Odds are, the number that was on the most recent CPL is the same (unless there have been bills paid in the interim) as the amount on the Final Demand Letter. As such, some insurance companies will accept a recent CPL as proof of the amount of the Medicare lien or at least proof that you will take care of the Medicare lien. However, if the insurance company needs the Final Demand Letter, just sit tight and eventually MSPRC will send it to you.

Why does Medicare take so long to resolve liens?

There are several reasons it takes a long time to resolve Medicare liens. First, the private company that handles the lien recovery for Medicare must go out and find all the medical expenses that have been paid on your behalf by the Part A and Part B medical service providers. Complicating matters, in certain situations your medical providers have ...

How long does it take to resolve a Medicare lien?

How long does it normally take to resolve a Medicare lien in an individual case? In an individual case, the entire process can take as long as six months. The first task is to establish a case with Medicare’s recovery department and request a list of all expenses Medicare paid on your behalf.

How long does Medicare have to bill?

Complicating matters, in certain situations your medical providers have up to one year to bill Medicare after providing medical services to you. After all the expenses have been billed to Medicare, someone must review them.

When did Plaintiff file a third amended complaint?

On October 25, 2009, Plaintiff filed a Third Amended Complaint which added certain Respondents in Discovery. Both Complaints are enclosed for your review. During the course of discovery, it became clear that the evidence did not support the counts brought pursuant to the Survival Act.

What is a lawsuit arising from the death of an individual?

Written By: Scott D. Lane, Esq. A lawsuit arising from the death of an individual has two main potential causes of action – an action brought pursuant to the Survival Act (755 ILCS 5/27-6), and an action brought pursuant to the Wrongful Death Act (740 ILCS 180/1). Essentially, the survival action seeks to recover damages suffered by ...

Does Medicare pay for wrongful death?

Even though Medicare has no right of reimbursement in a wrongful death action, when Medicare becomes aware of such litigation, it often sends notice of a right of reimbursement to counsel for all parties. Moreover, mostly for reasons related to self-protection, before issuing a settlement check, defense counsel often require plaintiff’s counsel ...

Is Medicare a survival action?

As noted above, medical expenses are recoverable in survival actions. Therefore, the law is clear that Medicare has a right of reimbursement for bills paid by Medicare with respect to proceeds recovered pursuant to a survival action. Medical expenses, however, are not recoverable in wrongful death actions. Therefore, the law is equally clear that Medicare does not have a right of reimbursement against the proceeds recovered pursuant to a purely wrongful death action.

Does Medicare have a right to reimbursement for wrongful death?

As noted above, medical expenses are recoverable in survival actions. Therefore, the law is clear that Medicare has a right of reimbursement ...

Can Plaintiff's counsel dispute Medicare reimbursement?

We have found Medicare to be very responsive to the above letter. Of course, Plaintiff’s counsel may dispute Medicare’s right of reimbursement for several reasons. Hopefully, the above letter (or one of the many possible variations thereof) will assist Plaintiff’s counsel in obtaining a rapid response from Medicare and facilitate distribution of the proceeds recovered.

Can you include Medicare on a check?

If no such written confirmation is provided , defense counsel often insist on including Medicare as a payee on the check. Of course, including Medicare on the check causes a variety of problems, including significant delay in the distribution of the proceeds. One option in these situations is to file a motion to compel defense counsel to provide ...

Why won't my Medicare claim be filed?

Your provider believes Medicare will deny coverage. Your provider must ask you to sign an Advance Beneficiary Notice (ABN).

How to report Medicare fraud?

To report fraud, contact 1-800-MEDICARE, the Senior Medicare Patrol (SMP) Resource Center (877-808-2468), or the Inspector General’s fraud hotline at 800-HHS-TIPS. If a provider continues to refuse to bill Medicare, you may want to try filing the claim yourself.

What does it mean when a provider opts out of Medicare?

Your provider has opted out of Medicare. Opt-out providers have signed an agreement to be excluded from the Medicare program. They do not bill Medicare for services you receive. You should not submit a reimbursement request form to Medicare for costs associated with services you received from an opt-out provider.

What to do before signing an ABN?

Before signing an ABN, ask additional questions to find out whether your provider considers the service to be medically necessary, and whether they will help you appeal. Ask your provider to still file a claim with Medicare, even if they believe coverage will be denied. You may be able to appeal if Medicare denies coverage.

Can non-participating providers receive Medicare?

Non-participating providers are allowed to request payment up front at the time of service. Ask your provider to file a claim with Medicare on your behalf, so you can receive Medicare reimbursement (80% of the Medicare-approved amount ). Your provider has opted out of Medicare.

Can you appeal a Medicare deny?

You may be able to appeal if Medicare denies coverage. Your provider may ask that you pay in full for services. If you are seeing a participating provider, ask your provider to submit the claim to Medicare. Medicare should let you know what you owe after it has processed the claim.