Medicare

Medicare is a national health insurance program in the United States, begun in 1966 under the Social Security Administration and now administered by the Centers for Medicare and Medicaid Services. It provides health insurance for Americans aged 65 and older, younger people with some disability st…

Full Answer

What is the best and cheapest Medicare supplement insurance?

Sep 16, 2018 · Medicare Supplement (also known as Medigap and MedSupp) insurance can help downsize your Original Medicare cost burden. For example, some plans pay the Medicare Part A deductible. Ten advantages of Medicare Supplement plans Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies.

What are the top 5 Medicare supplement plans?

Aug 04, 2021 · Medicare Supplement plans were designed to minimize individuals out of pocket funds. Supplemental insurance can be a useful addition because it acts as a safety net for Medicare. However, to partake in a Medicare Supplemental plan, you need to have Part A and B of Original Medicare. Your original Medicare gets notified once you purchase the supplemental plan.

Is supplemental insurance mandatory if I qualify for Medicare?

Nov 20, 2021 · In this article, we’ll explain why a Medicare supplement plan is the best option for most people. Key Takeaways There are no out-of-pocket limits on Original Medicare coverage. A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs.

Why to get affordable Medicare supplement insurance plans?

Jan 12, 2021 · Medicare supplements plans were designed to fill the gap in your medical coverage left by Medicare. You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have …

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What are the advantages and disadvantages of Medicare supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Is Medicare supplemental required?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What's the difference between a Medicare supplement plan and a Medicare Advantage plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is it worth getting supplemental insurance?

In addition, supplemental insurance is a great choice for you if you believe you're at risk for needing it. If you have a family history of cancer, for example, it's worth considering cancer insurance coverage, since you likely have a higher risk of being diagnosed with cancer.Dec 7, 2021

Are supplemental health plans worth it?

It can actually cover a lot more. Expense reimbursed supplemental insured plans provide coverage for everyday expenses like deductibles, co-pays and prescriptions, as well as the more unexpected expenses like hospital stays and cancer treatments.Oct 25, 2021

Do I need supplemental insurance if I have Medicare and Medicaid?

Do You Need Medicare Supplement Insurance if You Qualify for Medicare and Medicaid? The short answer is no. If you have dual eligibility for Medicare and full Medicaid coverage, most of your health costs are likely covered.

Can I switch from Medicare Advantage to Medicare Supplement?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the difference between Medicare Advantage and Supplemental?

With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance. This causes great confusion for many people and it gets them in trouble.

What age do you have to be to get medicare?

Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... , and most states, only require insurance companies to issue a Medigap policy, without restrictions, for a very limited time. That time is when you first turn age 65 and have a guaranteed issue right.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... and coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... payments, or by the beneficiary’s Medigap insurance.

How much does Medicare cover?

A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs. The other 20 percent is paid by the beneficiary, via deductibles.

Why do people with Medicare Advantage plan have a maximum out of pocket?

The reason is that Medicare Advantage plans have an out-of-pocket maximum that protects you from serious medical bills. Healthy people rarely have large medical bills, so they get to take advantage of low premiums. People with an employer-sponsored plan generally get help with their copays.

How to talk to your insurance agent about Medigap?

Ask your agent if a Medigap policy is right for you. Be specific and ask about hospital stays, long-term care, and other important insurance topics. If you don’t have an agent, or you want a second opinion, Call 1-855-728-0510 (TTY 711) and speak with a licensed HealthCompare insurance agent. There’s no obligation, and they offer more plan options than any other national agency.

Do you have to pay Medicare Part B premiums?

NOTE: No matter which Medicare insurance option you choose, you must continue to pay your monthly Medicare Part B premium for outpatient coverage. MA plan premiums and Medigap premiums do not replace what you owe for your Part B coverage. In other words, there’s no such thing as a free Medicare Advantage plan.

What is Plan F?

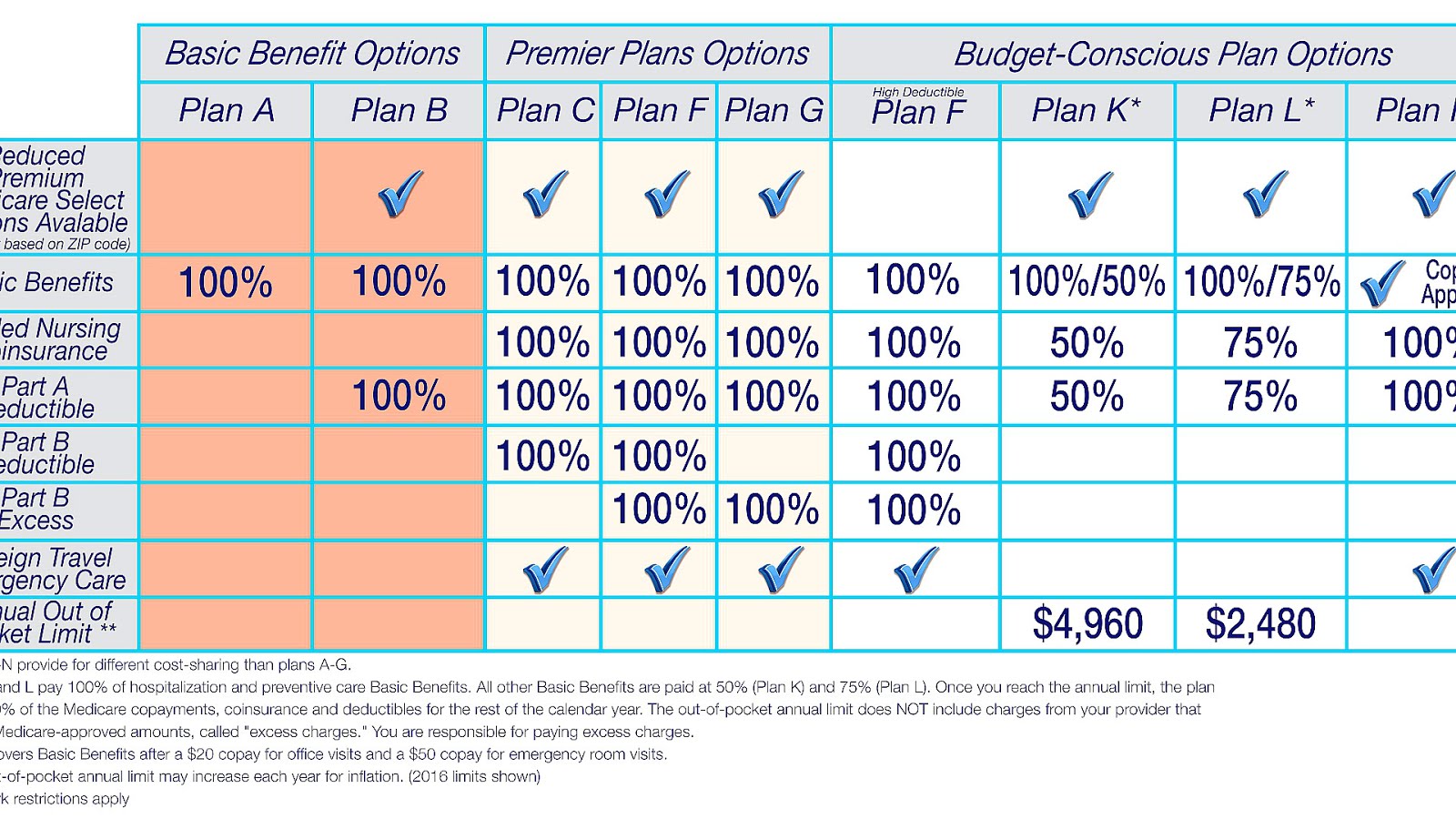

Plan F pays 100% of all out-of-pocket expenses. If you are looking for a comprehensive plan that will pay for everything, this one is it. Here are a few of the benefits that a Medigap plan can help pay for: Medicare Part A coinsurance hospital costs after initial Medicare coverage is exhausted. Medicare Part B copayment.

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

How much does Medicare pay for ER visits?

Then Part B Medicare only pay 80% of approved services. This means you are responsible for paying 20% of all your doctor visits, your ER visits, blood tests, X-rays, surgeries, durable medical equipment and even high-priced things like chemotherapy.

Does Medicare pay for prescription drugs?

One popular feature of Medicare Advantage plans is that most include coverage for prescription drugs (Part D). These plans pay instead of Medicare (as opposed to after Medicare, as Medigap plans do). When you join a Medicare Advantage plan, Medicare pays that plan to deliver your care.

Is Medicare Advantage a good plan?

For those who may find that the premium for a Medigap plan does not fit within their budget, a Medicare Advantage Plan is a good alternative. In fact, these plans were specifically created to provide Medicare beneficiaries like yourself with an alternative to Original Medicare + Medigap.

How does a Medigap plan work?

A Medigap plan works in concert with your Medicare Part A and Part B to pay some or all of your out-of-pocket costs, including deductibles, copays, and coinsurance. To compare what each plan offers, see our Medicare Supplement Plans Comparison Chart.

What is the most comprehensive Medicare supplement?

If you're turning age 65 this year, Medicare Supplement Plan G is the most comprehensive Medicare supplement you can buy. It's also the most popular. You might be thinking that Medicare Supplement Plan F is... is identical to Plan F with a single exception. Plan G does not cover the annual Medicare Part B deductible.

What is Medicare Supplement?

The Original Medicare#N#Original Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage....#N#system (Part A and Part B) is designed to pay for about 80% of your major medical costs. The other 20% is paid by the beneficiary out-of-pocket or through additional insurance. That’s where supplemental Medicare insurance comes in. It helps fill the 20% gap. That’s why Medicare calls them Medigap plans, but the insurance companies more commonly called them Medicare Supplement plans. Both terms are correct.

What is Medicare deductible?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... , coinsurance.

What is coinsurance in healthcare?

Coinsurance is a percentage of the total you are required to pay for a medical service. ... or copayments. A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , excess charges, and the cost of blood.

How long does Medicare cover skilled nursing?

Medicare Part A Skilled Nursing Facility coinsurance: Medicare covers up to 100 days of skilled nursing care after a stay in the hospital when ordered by your doctor. But, Medicare only pays for the first 20 days. You’ll need to choose a plan that offers skilled nursing coverage to get the additional 80 days.

What is Medicare Part B?

and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care.... benefits. Also known as Medigap, there are 10 standardized plans, A to N.

Why Do I Need Supplement Insurance with Medicare?

Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication and vision and dental care.

What Are The Gaps in Original Medicare?

As you may well know by this point, it is impossible to ignore the existing gaps in Original Medicare coverage. For a federal program that has so many coverage policies, there are two main forms of coverage where it usually fails to provide benefits.

Deciding On Whether You Need Supplemental Insurance

Now that we have covered all that there is to know about Medigap and Medicare, it is important you utilize this information in order to make an informed decision about your Medicare coverage. If you would like more information on either Medigap, Medicare Advantage, or Part D plans, give us a call.

Medicare Supplements

Medicare Supplements are plans that fill in the holes of Medicare and cover things that normally would not be covered by Medicare, For example, going to the optometrist to get an eye exam or a prescription for eyeglasses may not be covered under Medicare and may require a Medicare Supplement plan if this is something you need to do often.

What Plans are there?

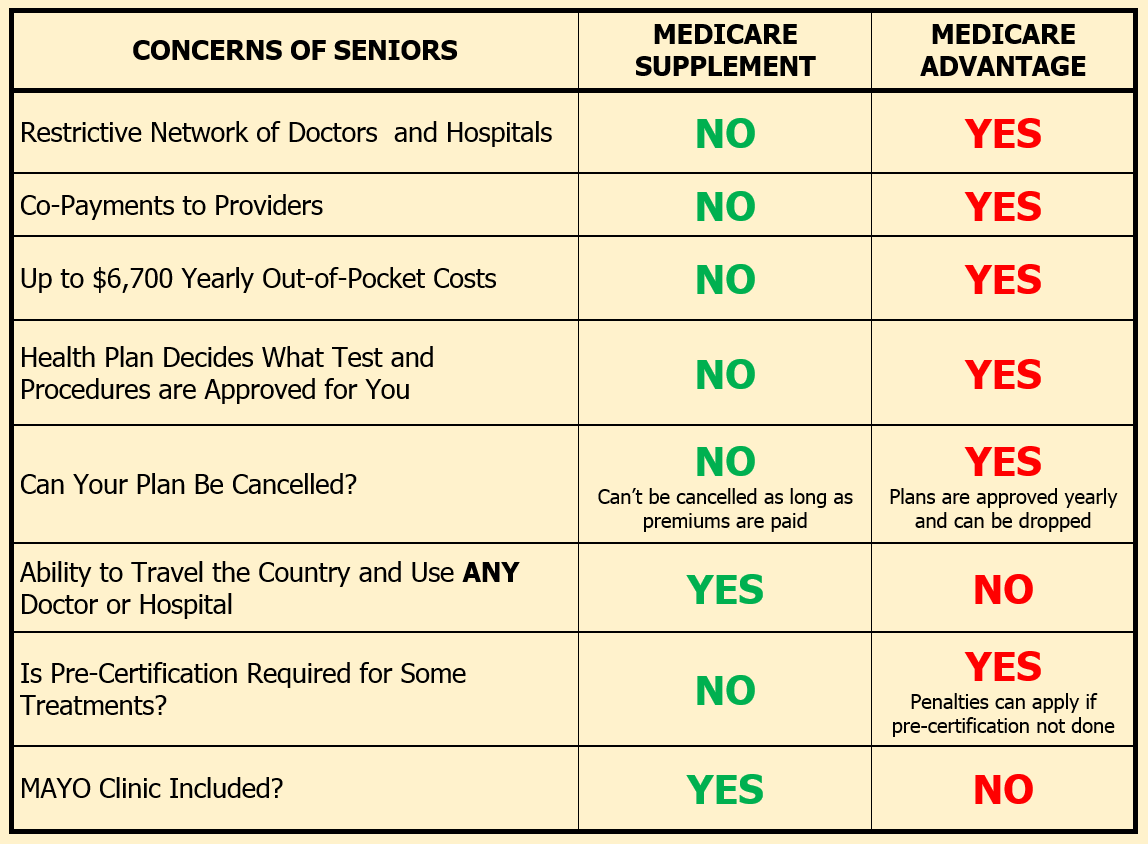

There are more than 8 Medicare Supplemental plans, refer to the below image for any questions you have regarding the plans. If you have additional questions feel free to give us a call at (888)-446-9157

Why is it important to have a supplement plan?

Supplement plans cover more than just the basics, these plans cover costs that Medicare doesn’t cover. Other supplemental coverage can also cover things like Dental, Vision and Hearing needs. Let’s say that you have Original Medicare parts A & B without any other add-ons, and no supplements.

Why not just get Medicare Advantage?

Well, while Medicare Advantage may be right for some people it may not be right for everyone. Particularly this may be the case if you have specific doctors you want to use and if they aren’t on the Advantage Plan you are considering. In this situation, it may be more beneficial to get a Supplement plan, even a high deductible plan F.

What is the deductible for hospitalization in 2020?

You are responsible for the balance (or coinsurance). In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

What is Part B deductible?

After that, you pay daily coinsurance amounts, depending on the length of your stay. Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance (or coinsurance).

Does Medicare cover out of pocket medical expenses?

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs. Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Who said if you buy Medicare Supplement with your own money, you are effectively giving an insurance company your money?

David Belk , a doctor and anti-supplement activist says, “…If you have Medicare and buy a supplemental policy with your own money, you are effectively giving an insurance company your money so that they can keep it.”. Wow. This statement is moving. For those who have had a Medicare Supplement Policy for years, it slaps you in the face with regret.

Is Medicare Supplement Insurance true?

It justifies a decision that will save you money on premium month to month. However, it is not entirely true.

Should I buy Medicare Supplement?

So yes…I do recommend buying Medicare Supplement Insurance. You don’t necessarily need an expensive, luxury plan, but having something in place is essential. Even if you can’t afford a Supplement, you can (at the very least), purchase a low or no cost Medicare Advantage Plan that will cap your annual out-of-pocket spending at $4-6,000. ...

Does Medicare cover nickel and dime?

Sure, a lot of them cover “nickel and dime” copays and coinsurance costs that virtually eliminate hassle and reduce costs, but this is just icing on the cake.

Who is Dan Hoelscher?

Dan is a Certified Financial Planner™ Practitioner and holds Certified Senior Advisor (CSA)© and Certified Kingdom Advisor™ certifications. Since founding Seniormark, Dan has helped thousands of retirees throughout Ohio.