Full Answer

Are You paying too much for your Medicare supplement?

Yes. There can be good reasons to consider switching your Medigap plan. Maybe you’re paying too much for benefits you don’t need, or your health needs have changed and now you need more benefits. Starting with Medigap can be a wise strategy because you are guaranteed enrollment when you are first eligible for Medicare at age 65.

Why every senior should have a Medicare supplement plan?

Why Every Senior Should Have a Medicare Supplement Plan Medicare supplement plans are largely considered to be essential for seniors who wish to avoid costly expenses that could put a dent into their retirement savings. There are many reasons as to why every senior should have a Medicare supplement plan.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

What is the downside to Medigap?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What are the disadvantages of Medigap?

There are five primary disadvantages to Medigap plans to review when considering your choices for coverage.Cost. ... Not Guaranteed After Open Enrollment. ... No Part D Coverage. ... Difficult to Switch. ... Some Inconsistencies State-to-State. ... Helps Pay for Medicare Costs. ... Covers Additional Services.More items...•

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can I switch from an Advantage plan to a supplement?

If you have a Medicare Advantage plan, it is against the law for a company to sell you a Medicare Supplement insurance plan, unless you are planning to switch to Original Medicare.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Medicare Supplements

Medicare Supplements are plans that fill in the holes of Medicare and cover things that normally would not be covered by Medicare, For example, going to the optometrist to get an eye exam or a prescription for eyeglasses may not be covered under Medicare and may require a Medicare Supplement plan if this is something you need to do often.

What Plans are there?

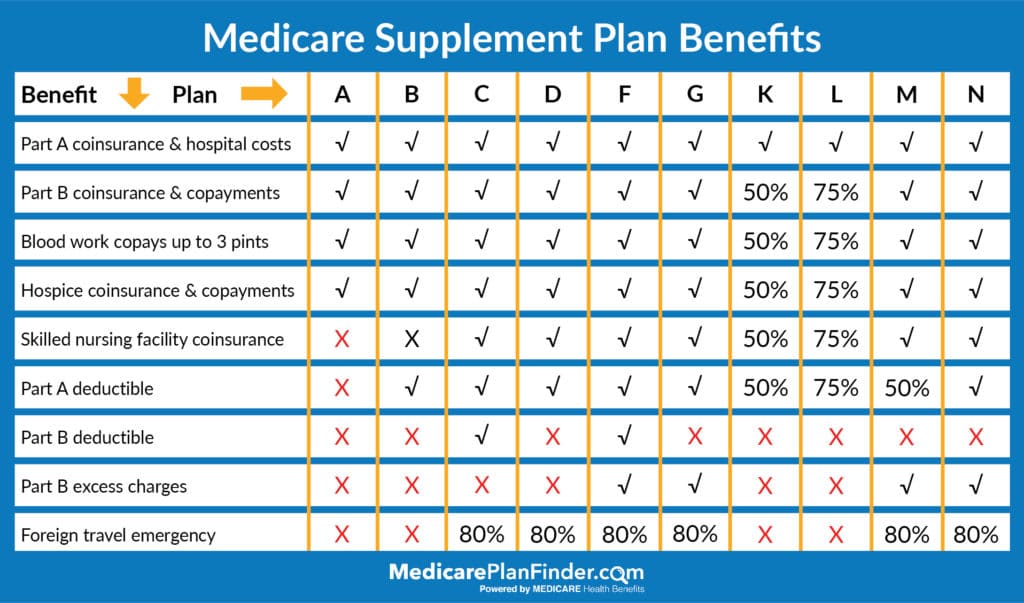

There are more than 8 Medicare Supplemental plans, refer to the below image for any questions you have regarding the plans. If you have additional questions feel free to give us a call at (888)-446-9157

Why is it important to have a supplement plan?

Supplement plans cover more than just the basics, these plans cover costs that Medicare doesn’t cover. Other supplemental coverage can also cover things like Dental, Vision and Hearing needs. Let’s say that you have Original Medicare parts A & B without any other add-ons, and no supplements.

Why not just get Medicare Advantage?

Well, while Medicare Advantage may be right for some people it may not be right for everyone. Particularly this may be the case if you have specific doctors you want to use and if they aren’t on the Advantage Plan you are considering. In this situation, it may be more beneficial to get a Supplement plan, even a high deductible plan F.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Who said if you buy Medicare Supplement with your own money, you are effectively giving an insurance company your money?

David Belk , a doctor and anti-supplement activist says, “…If you have Medicare and buy a supplemental policy with your own money, you are effectively giving an insurance company your money so that they can keep it.”. Wow. This statement is moving. For those who have had a Medicare Supplement Policy for years, it slaps you in the face with regret.

Does Medicare cover nickel and dime?

Sure, a lot of them cover “nickel and dime” copays and coinsurance costs that virtually eliminate hassle and reduce costs, but this is just icing on the cake.

Should I buy Medicare Supplement?

So yes…I do recommend buying Medicare Supplement Insurance. You don’t necessarily need an expensive, luxury plan, but having something in place is essential. Even if you can’t afford a Supplement, you can (at the very least), purchase a low or no cost Medicare Advantage Plan that will cap your annual out-of-pocket spending at $4-6,000. ...

Is Medicare Supplement Insurance true?

It justifies a decision that will save you money on premium month to month. However, it is not entirely true.

Medicare Supplements

- Medicare Supplements are plans that fill in the holes of Medicare and cover things that normally would not be covered by Medicare, For example, going to the optometrist to get an eye exam or a prescription for eyeglasses may not be covered under Medicare and may require a Medicare Supplement plan if this is something you need to do often. These pla...

What Plans Are there?

- There are more than 8 Medicare Supplemental plans, refer to the below image for any questions you have regarding the plans. If you have additional questions feel free to give us a call at (888)-446-9157

Why Is It Important to Have A Supplement Plan?

- Supplement plans cover more than just the basics, these plans cover costs that Medicare doesn’t cover. Other supplemental coverage can also cover things like Dental, Vision and Hearing needs. Let’s say that you have Original Medicare parts A & B without any other add-ons, and no supplements. What are you going to do when you need to go to see an ophthalmologist? Unfortu…

Why Not Just Get Medicare Advantage?

- Well, while Medicare Advantage may be right for some people it may not be right for everyone. Particularly this may be the case if you have specific doctors you want to use and if they aren’t on the Advantage Plan you are considering. In this situation, it may be more beneficial to get a Supplement plan, even a high deductible plan F. Maybe it is cheaper or maybe it just suits your n…