But now the IRS says that premiums for all forms of Medicare are deductible (Parts A, B, C, and D). You can use this deduction only if you own a business as a sole proprietor, partner in a partnership, limited liability company member, or S corporation shareholder who owns more than 2% of the company stock. This is a special personal deduction that applies only to your federal, state, and local income taxes, not to your self-employment taxes.

Full Answer

Are Medicare premiums for business owners tax deductible?

But now the IRS says that premiums for all forms of Medicare are deductible (Parts A, B, C, and D). You can use this deduction only if you own a business as a sole proprietor, partner in a partnership, limited liability company member, or S corporation shareholder who owns more than 2% of the company stock.

Are Medicare premiums deductible if you are self employed?

This is the second-best way to deduct your Medicare premiums. You may qualify for it if you’re self-employed. You could be a sole proprietor, partner, S corporation shareholder-employee, or an LLC member who is treated as a partner for tax reasons. You could also qualify if you are an LLC member who is treated as a sole proprietor for tax reasons.

Is Medicare insurance an expense for a sole proprietorship?

Generally, CPAs might recommend establishing the Medicare insurance as a business expense by having the sole proprietor reimburse the spouse for the premiums. Get the tax guidance you need at The Royce CPA Firm in Tucson.

Are Medicare premiums deductible for partpartners and LLC members?

Partners, as well as LLC members treated as partners for tax reasons, may be eligible to deduct Medicare premiums. The health insurance policy may be in the name of either the taxpayer or the LLC partnership.

How much of your medical expenses can you claim on your 2018 taxes?

If you itemize your deductions, you have to look at the floors on your medical deductions to see whether you realize any tax benefits: For 2018, you can claim itemized medical expenses only to the extent that your total qualifying medical expenses exceed 7.5 percent of your adjusted gross income.

Can you pay health insurance premiums on W-2?

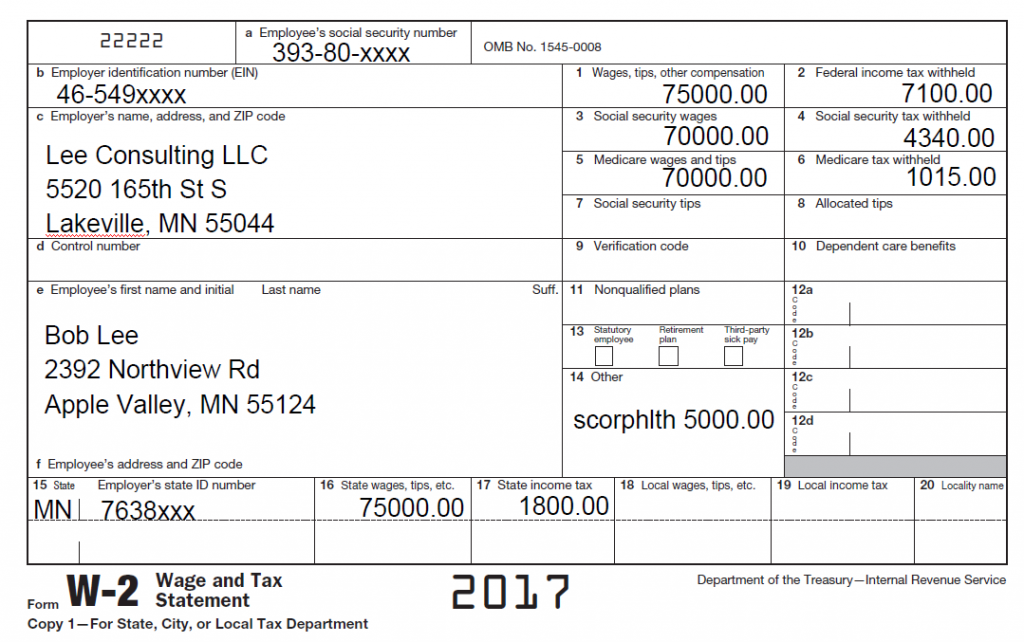

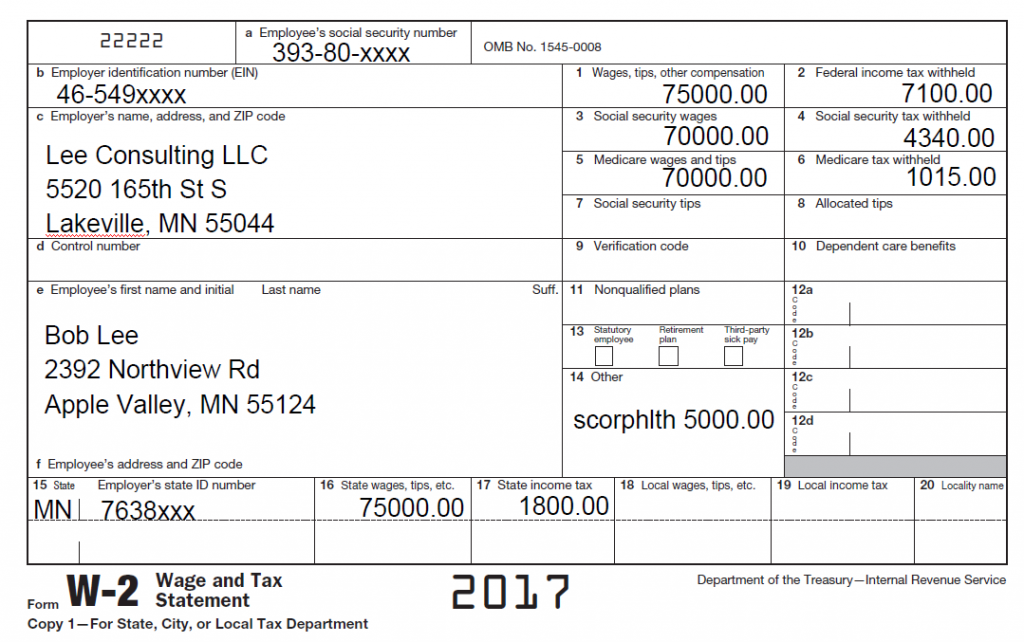

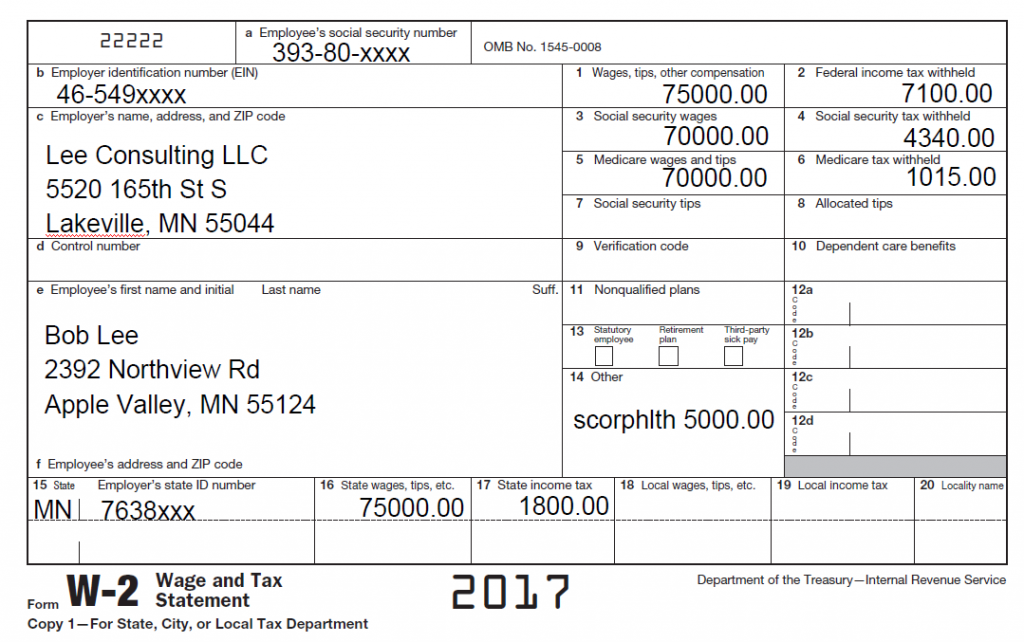

If you are a shareholder employee who owns more than 2 percent of the S corporation, the health insurance policy can be either in the name of the S corporation or in your own name . You can pay the premiums yourself, or the S corporation can pay them and report the premium amounts on your Form W-2 as additional taxable wages.

Do you need to itemize health insurance?

You don’t need to itemize deductions to get the tax-saving benefit from this above-the-line self-employed health insurance deduction. According to IRS Publication 535 (Business Expenses), the health insurance coverage must be established or considered to be established for your business as per the following explanations.

Can LLC insurance be deducted from taxes?

Otherwise, the IRS says the insurance won’t be considered established for your business and you will not qualify for the deduction. The tax code allows the partnership (LLC) to deduct its guaranteed payments.

Is Medicare a good or bad insurance?

That’s the bad news.

Which line of Schedule 1 is self employed health insurance?

The business deduction produces the maximum tax benefit. The self-employed health insurance deduction on line 29 of Schedule 1 of your Form 1040 produces the second-best benefit. The itemized deduction is either useless or produces the third-best benefit.

What percentage of training is deduction?

Interestingly, if you feed your employees during a training program, your deduction is only 50 percent. Make sure you know the rules that give you the 100 percent deduction for employee entertainment. The IRS says that the following types of entertainment qualify for the 100 percent employee entertainment tax deduction:

Do you need to itemize health insurance?

You don’t need to itemize deductions to get the tax-saving benefit from this above-the-line self-employed health insurance deduction. According to IRS Publication 535 (Business Expenses), the health insurance coverage must be established or considered to be established for your business as per the following explanations.

Can you deduct Medicare premiums if you are married?

you have a high income, and. you’re married and both you and your spouse are paying premiums. Fortunately, the premiums can potentially help your tax situation. The dollar benefit of Medicare tax deductions depends greatly on where you can deduct the premiums: The business deduction produces the maximum tax benefit.

What line on 1040 is Medicare tax deduction?

The self-employed health insurance deduction on line 29 of Schedule 1 of your Form 1040 produces the second-best benefit.

Do you need to itemize health insurance?

You don’t need to itemize deductions to get the tax-saving benefit from this above-the-line self-employed health insurance deduction. According to IRS Publication 535 (Business Expenses), the health insurance coverage must be established or considered to be established for your business as per the following explanations.

Can you pay Medicare premiums on W-2?

You can pay the premiums yourself, or the S corporation can pay them and report the premium amounts on your Form W-2 as additional taxable wages. But if the policy is in your name and you pay the premiums yourself as you would for your Medicare coverage, the IRS says the S corporation must reimburse you and report the premium amounts on your Form ...

Can a S corporation reimburse a spouse for Medicare?

In guidance, the IRS makes it clear that the S corporation and the partnership can reimburse to the shareholder-employee the spouse’s Medicare payments, and that reimbursement establishes the insurance in the business’s name.

Number 1: The Business Deduction

You flat out get the best dollar benefit from your Medicare and supplemental insurance premiums when you can deduct them as business deductions. You can make this happen when:

Second Best: Self-Employed Health Insurance Deduction

If you are self-employed as a sole proprietor, an LLC member treated as a sole proprietor for tax purposes, a partner, an LLC member treated as a partner for tax purposes, or an S corporation shareholder-employee, you can potentially claim an above-the-line deduction for your health insurance premiums—including Medicare premiums.

How to Deduct Medicare as a Business Expense if you are a Sole Proprietor

If you are a sole proprietor or an LLC member treated as a sole proprietor for tax purposes who file Schedule C, a health insurance policy can be in the name of your business or in your own name. Premiums you pay for Medicare health insurance in your name can be used to figure the above-the-line deduction for self-employed health insurance.

How to Deduct Medicare as a Business Expense if you are a Partner

If you are a partner or an LLC member treated as a partner for tax purposes, a health insurance policy can be either in the name of the partnership (LLC) or in your own name.

How to Deduct Medicare as a Business Expense if you are an S Corporation Shareholder-Employee

If you are a shareholder-employee who owns more than 2 percent of the S corporation, a health insurance policy can be either in the name of the S corporation or in your own name. You can pay the premiums yourself, or the S corporation can pay them and report the premium amounts on your Form W-2 as additional taxable wages.

How much is Medicare Part B?

Medicare Part B premiums are about $100 per month, so this deduction can really add up. This comes as unexpected good news because, before 2010, the IRS said that Medicare premiums were not deductible under the self-employed health insurance deduction. Then, in 2010, the IRS said that only premiums for Medicare Part B were deductible.

How to amend your taxes if you are a sole proprietor?

If, like most small business owners, you are a sole proprietor, you amend your income tax return by filing IRS Form 1040X, Amended U.S. Individual Income Tax Return. When you file Form 1040X to obtain a refund of taxes you've already paid, it is called a "claim for refund.". Talk to a Tax Attorney.

How long can you file an amended Medicare tax return?

You can file an amended return up to three years after the date you filed your original return for the year (April 15 or October 15 if you obtained an extension to file).

Is Medicare premium deductible?

But now the IRS says that premiums for all forms of Medicare are deductible (Parts A, B, C, and D). You can use this deduction only if you own a business as a sole proprietor, partner in a partnership, limited liability company member, or S corporation shareholder who owns more than 2% of the company stock.

Can you deduct health insurance from a retirement plan?

Amounts paid for health insurance coverage from retirement plan distributions that were non taxable because you are a retired public safety officer can’t be used to figure the deduction. The deduction cannot exceed the self-employed person’s earned income – after expenses.

Is Medicare deductible for self employed?

Is this really true? A. Yes. In 2012, the IRS ruled that Medicare insurance premiums can be counted. Under the ruling, Medicare premiums covering the self-employed individual – as well as his or her spouse, dependents, and under-age-27 children – are deductible.

What happens if you don't have minimum essential coverage?

A statement that if the employee is not covered under minimum essential coverage, the employee may be subject to the mandatory penalty and the QSEHRA reimbursements could be taxable. [Note: the mandatory penalty for failure to be covered under minimum essential coverage expired after December 31, 2018.]

What factors determine reasonable compensation?

Some factors in determining reasonable compensation: Training and experience. Duties and responsibilities. Time and effort devoted to the business. Dividend history. Payments to non-shareholder employees. Timing and manner of paying bonuses to key people. What comparable businesses pay for similar services.

Can a corporation buy health insurance in its own name?

Therefore, if the shareholder was the sole employee of the corporation, then the shareholder has to purchase health insurance in his own name.

Is health insurance deductible on W-2?

Health and accident insurance premiums paid on behalf of a greater than 2- percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employee's Form W-2, subject to income tax withholding.

Can QSEHRA be used with group health insurance?

The reimbursement is made after the employee incurs a medical expense and submits documentation. A QSEHRA cannot work in conjunction with a group health insurance plan. A QSEHRA will not violate the ACA coverage mandates if certain key requirements are met. To establish a QSEHRA, the employer must: