You’ll get Medicare automatically if you’re already receiving Social Security retirement or SSDI

Social Security Disability Insurance

Social Security Disability Insurance is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide income supplements to people who are physically restricted in their ability to be employed because of a notable disability. SSD can be supplied on either a temporary or permanent basis, usually directly correlated to …

The SSDI program pays benefits to you and certain family members if you are “insured.” This means that you worked long enough – and recently enough - and paid Social Security taxes on your earnings.

Can I get Medicare without claiming social security?

Dear Approaching: You can do just as you wish – you can enroll in Medicare at age 65 without claiming Social Security until you are 70. If you wait until you are 70 to claim Social Security your benefit amount will be nearly 31% higher than it would be at your full retirement age of 66 + 2 months.

Is Medicare mandatory if I am receiving Social Security?

Medicare Part A, hospital insurance, is mandatory for those who receive Social Security, and may have an impact on existing health coverage. A person who does not participate in Medicare Part A must forego all Social Security retirement benefits and repay any benefits already received. Medicare Part B, medical insurance, is an optional benefit. Failing to enroll will not jeopardize Social Security benefits.

Should you enroll in Medicare before you retire?

- Social Security and Medicare Are Separate Decisions. ...

- Some People Are Automatically Enrolled in Medicare. ...

- Sign Up for Medicare On Time. ...

- Beneficiaries Who Work Can Avoid the Late Enrollment Penalty. ...

- Signing Up After You Missed the Initial Enrollment Period. ...

- Be Prepared to Get a Medicare Bill. ...

Do people on SSI usually get Medicare too?

Those who qualify for Supplemental Security Income (SSI) are eligible for Medicaid, while those who receive Social Security Disability Insurance (SSD or SSDI) qualify for Medicare. However, SSD recipients won’t receive medical benefits from Medicare until two years after their application has been approved. Those who receive SSI don’t have to wait before receiving Medicaid.

Can you get both Social Security and Medicare?

SOCIAL SECURITY, MEDICAID AND MEDICARE Medicare is linked to entitlement to Social Security benefits. It is possible to get both Medicare and Medicaid. States pay the Medicare premiums for people who receive SSI benefits if they are also eligible for Medicaid.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Does Medicare automatically start with Social Security?

People who aren't yet collecting Social Security, or aren't eligible for Social Security Retirement, aren't automatically enrolled into Medicare. They must sign up by contacting Social Security.

How does Social Security affect Medicare?

Social Security and Medicare are distinct programs serving older and disabled Americans, but they have an important commonality: Social Security handles enrollment for Medicare Part A (hospital insurance) and Part B (medical insurance).

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How much is deducted from Social Security each month for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.

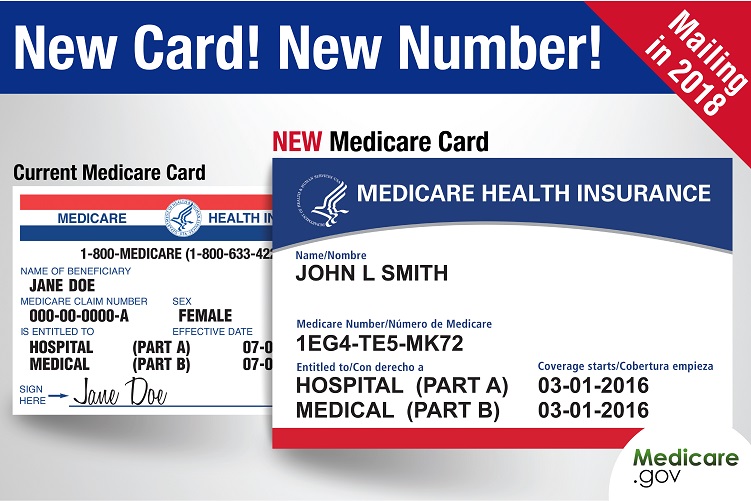

Do you automatically get a Medicare card when you turn 65?

You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Is my Social Security account the same as my Medicare account?

A: They're not the same thing, but they do have many similarities, and most older Americans receive benefits simultaneously from both programs. Social Security, which was enacted in 1935, is a government-run income benefit for retirees who have worked – and paid Social Security taxes – for at least ten years.

How long do you have to be on Social Security to get Medicare?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. You have Lou Gehrig's disease. Once you qualify for Medicare, you are automatically enrolled in Medicare Part A. You can then choose to enroll in other parts of the program or to delay enrollment.

What age do you have to be to qualify for Medicare?

Meet the work credit requirement (or have a spouse that meets this requirement) You might also be eligible for Medicare if you are under age 65 and meet one of the following conditions: You have a disability.

What is Medicare 2021?

Updated July 16, 2021. Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA (Federal Insurance Contributions Act) taxes during their working years. Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older.

Why does Social Security change?

The value of Social Security benefits you are eligible for can change due to factors such as divorce, having a child, or the death of a spouse. If your life circumstances are different than when you started taking Social Security benefits, notify the Social Security Administration to ensure you are receiving the correct benefit.

How old do you have to be to get Social Security?

If you are eligible for Social Security, your family members may also be eligible to receive some benefit if they are a: Spouse or former spouse age 62 or older. Spouse younger than 62 if taking care of a child who is younger than age 16 or with disabilities.

Can family members receive Social Security?

Family members can only receive these payments if you are eligible and have already filed for retirement benefits. 4. Deciding when and how to file for Social Security benefits (whether they are your own or your spousal benefit) should be a strategic piece of a prepared older person's retirement planning. The value of Social Security benefits you ...

Does Medicare cover older people?

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62. Even if you are eligible to start receiving benefits, you do not have to start taking them. ...

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

What is Social Security?

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration (SSA). You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

How long do you have to wait to get Medicare if you don't need it?

Therefore, if you don’t need the income from those benefits right away, you could conceivably sign up for Medicare at 65 and then wait another five years before filing for Social Security. There are also scenarios where it might pay to get on Social Security before enrolling in Medicare.

How old do you have to be to get Social Security?

Depending on your year of birth, that age will fall out somewhere between 66 and 67.

What happens if you wait too long to sign up for Medicare?

If you wait too long to sign up for Medicare Part B, you’ll face a 10 percent increase in your Part B premiums for every year-long period you were eligible to enroll but didn’t. There are also financial implications associated with waiting too long to sign up for a Part D drug plan.

When does Medicare start?

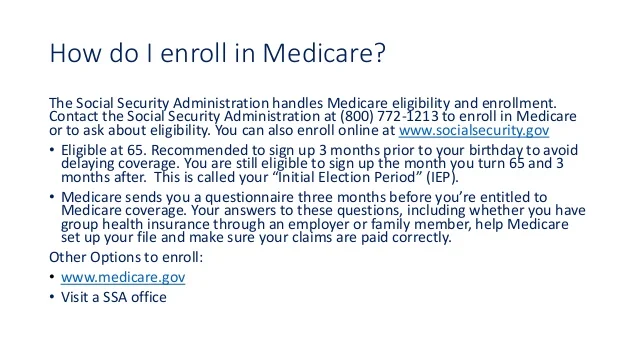

Your initial enrollment period for Medicare begins three months before the month of your 65th birthday , and ends three months after the month you turn 65.

When do you get a special enrollment period?

That said, if you’re still working and have coverage under a group health plan during the seven-month period surrounding your 65th birthday, you’ll get a special enrollment period that begins when you separate from your employer or your group coverage ends.

Is Medicare insurance cheap?

Remember, health coverage under Medicare doesn’t necessarily come cheap. Between premiums, deductibles, and coinsurance, you might find that your out-of-pocket costs are substantially lower under a group health plan, in which case it pays to stick with it as long as you can.

Do seniors rely on Medicare?

A: Millions of seniors rely on Medicare for health benefits in retirement, and depend on Social Security as a key income source. But while the two programs are interrelated, participation in one doesn’t necessarily hinge on being signed up for the other.

What happens if you don't enroll in Medicare Part A?

Medicare Part B, medical insurance, is an optional benefit. Failing to enroll will not jeopardize Social Security benefits.

Do I have to take Medicare if I have Social Security?

Do I have to take Medicare if I receive Social Security? For various reasons, there are some who choose to put off Medicare enrollment when they turn 65. If they also delay Social Security benefits, there will be no problem. However, if they get Social Security but do not enroll in Medicare Part A, there can be problems.

How long do you have to sign up for Medicare if you don't sign up?

Here’s why you need to be on top of your deadline: If you don’t sign up during those seven months , you may be subject to a permanent surcharge once you do enroll. You’ll find more information on sign-up periods in Medicare publications on enrolling in Part B and Part D.

What is the FRA age for Medicare?

Keep in mind. The Medicare eligibility age of 65 no longer coincides with Social Security’s full retirement age (FRA) — the age when you qualify for 100 percent of the Social Security benefit calculated from your lifetime earnings. FRA was long set at 65 but it is gradually going up . For people born in 1955, it is 66 years and 2 months;

How long is Medicare for a person born in 1955?

For people born in 1955, it is 66 years and 2 months; it settles at 67 for people born in 1960 or later. Even if you don’t qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

Does Social Security automatically sign you up for Medicare at 65?

But you should be aware of the enrollment deadlines, as Social Security will not sign you up automatically at 65 for “traditional Medicare” — Part A (hospitalization) and Part B (health insurance) — as it typically does for people already collecting Social Security benefits.

Can you deny Medicare if you have a preexisting condition?

Your Part D provider cannot deny coverage even if you are in poor health or have a preexisting condition. You can choose between paying Medicare directly or having Part D costs deducted from your Social Security payment.