Do you automatically get Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you don't enroll in Medicare Part A at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

Does Medicare automatically sign you up for Part A?

You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

Is Medicare optional at 65?

At age 65, or if you have certain disabilities, you become eligible for health coverage through various parts of the Medicare program. While Medicare isn't necessarily mandatory, it is automatically offered in some situations and may take some effort to opt out of.

Can I delay Medicare Part A?

However, if you have to pay a premium for Part A, you can delay Part A until you (or your spouse) stop working or lose that employer coverage. You will NOT pay a penalty for delaying Part A, as long as you enroll within 8 months of losing your coverage or stopping work (whichever happens first).

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

When should I sign up for Medicare Part B if I am still working?

You can wait until you stop working (or lose your health insurance, if that happens first) to sign up for Part B, and you won't pay a late enrollment penalty.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

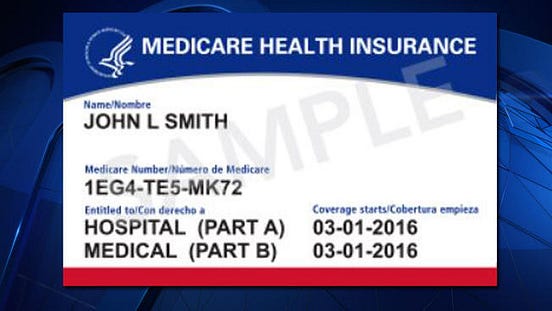

Will Medicare automatically send me a Medicare card?

Once you're signed up for Medicare, we'll mail you your Medicare card in your welcome packet. You can also log into (or create) your secure Medicare account to print your official Medicare card. I didn't get my Medicare card in the mail. View the Medicare card if you get benefits from the Railroad Retirement Board.

How do I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

Can you have Medicare and employer insurance at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Do you have to have Medicare Part B?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Do You Have to Sign up For Medicare if You Are Still Working?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Can I Get Social Security and Not Sign up for Medicare?

Yes and no. Medicare Part B is optional. If you’re automatically enrolled in Medicare Part A, you will be automatically enrolled in Part B and then given the option of opting out. You may still continue to receive your Social Security benefits without having Part B.

What happens if you fail to enroll in Medicare?

If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Is Medicare a secondary plan?

Medicare would be secondary. If you were to have both Medicare and group coverage, your Medicare would supplement your group plan and may reduce some health spending. However, that might only be important to you if you have some health care spending going on and you just want more robust overall coverage.

Can you delay Medicare if you retire?

Many people enroll in Part A and delay Parts B and D until they retire. However, you may not want to delay Medicare.

Can you enroll in Medicare if you never enroll?

With that said, if you were to never enroll in Medicare, you wouldn’t end up paying those penalties. However, lasting your entire life without ever needing to sign up for Medicare is unlikely.

Is it mandatory to sign up for Medicare Part A?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage. So…the straightest answer I can give you is yes and no.

How long do you have to work to get Medicare Part A?

If by the time you reach 65 you’ve worked a total of approximately 10 years over your career, you’re entitled to premium-free Medicare Part A, which pays for in-patient hospital charges and more.

What happens if you overlook Medicare enrollment rules?

Medicare processes and rules are complex and rife with exceptions; if you overlook something in the enrollment rules, you may pay a high price in terms of both penalties and gaps in coverage. So you should consult with Medicare and with the benefits administrator for your employer coverage — before you enroll or decide to delay enrollment.

How many employees do you have to have to have Medicare Part B?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part B, which will be your primary insurance. If you have an HSA and want to keep contributing: If you have an HSA ...

What is Medicare Part A?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part A, which will be your primary insurance. “Primary” means that Medicare pays first, and then the employer insurance kicks in ...

How long do you have to keep HSA contributions?

Stop making contributions to your HSA at least six months before you sign up for Part B. And you’ll want to sign up for Medicare at least a month before you stop work ...

Does Medicare Part A cover my employer?

Because in some cases, Medicare Part A may cover what your employer plan does not. But as with so many aspects of Medicare, there are caveats, exceptions and potential pitfalls. If the employer has 20 or more employees: If your or your spouse's employer has 20 or more employees and a group health plan, you don't have to sign up for Medicare ...

Is Medicare cheaper than group health insurance?

If your employer (or your spouse’s employer) requires you to pay a large portion of the premium on your group health insurance, you may find Medicare cheaper and the coverage adequate. So compare your current coverage and out-of-pocket expenses — including premiums, deductibles, copays and coinsurance — with your costs and benefits under Medicare, which may also pay some expenses not covered by your group plan.

What happens if you don't sign up for Medicare?

Therefore, if you are required to sign up for Medicare but don’t, you’ll essentially be left with little or no health coverage.

How long do you have to sign up for Medicare?

At that point, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare without risking late penalties. If the employer has 20 or more employees, the law stipulates that those 65 and older (and their spouses) must be offered exactly the same health benefits that are offered to younger employees ...

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.